Gold all-time highs, plus March seasonality, net new highs, target-date funds, and rates vs. inflation

The Sandbox Daily (3.5.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

all-time highs for gold

seasonality favors March

a new high in new highs

prominent hedge fund manager sounds the alarm on target-date funds

one simple chart (rates vs. inflation)

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -0.99% | S&P 500 -1.02% | Dow -1.04% | Nasdaq 100 -1.80%

FIXED INCOME: Barclays Agg Bond +0.54% | High Yield -0.08% | 2yr UST 4.556% | 10yr UST 4.145%

COMMODITIES: Brent Crude -0.93% to $82.03/barrel. Gold +0.53% to $2,137.6/oz.

BITCOIN: -6.47% to $64,029

US DOLLAR INDEX: -0.06% to 103.771

CBOE EQUITY PUT/CALL RATIO: 0.64

VIX: +7.19% to 14.46

Quote of the day

“For most investors, our most reliable edge lies in a series of virtues that seem painfully out of fashion these days: patience, humility and diligence.”

- The Mutual Fund Observer

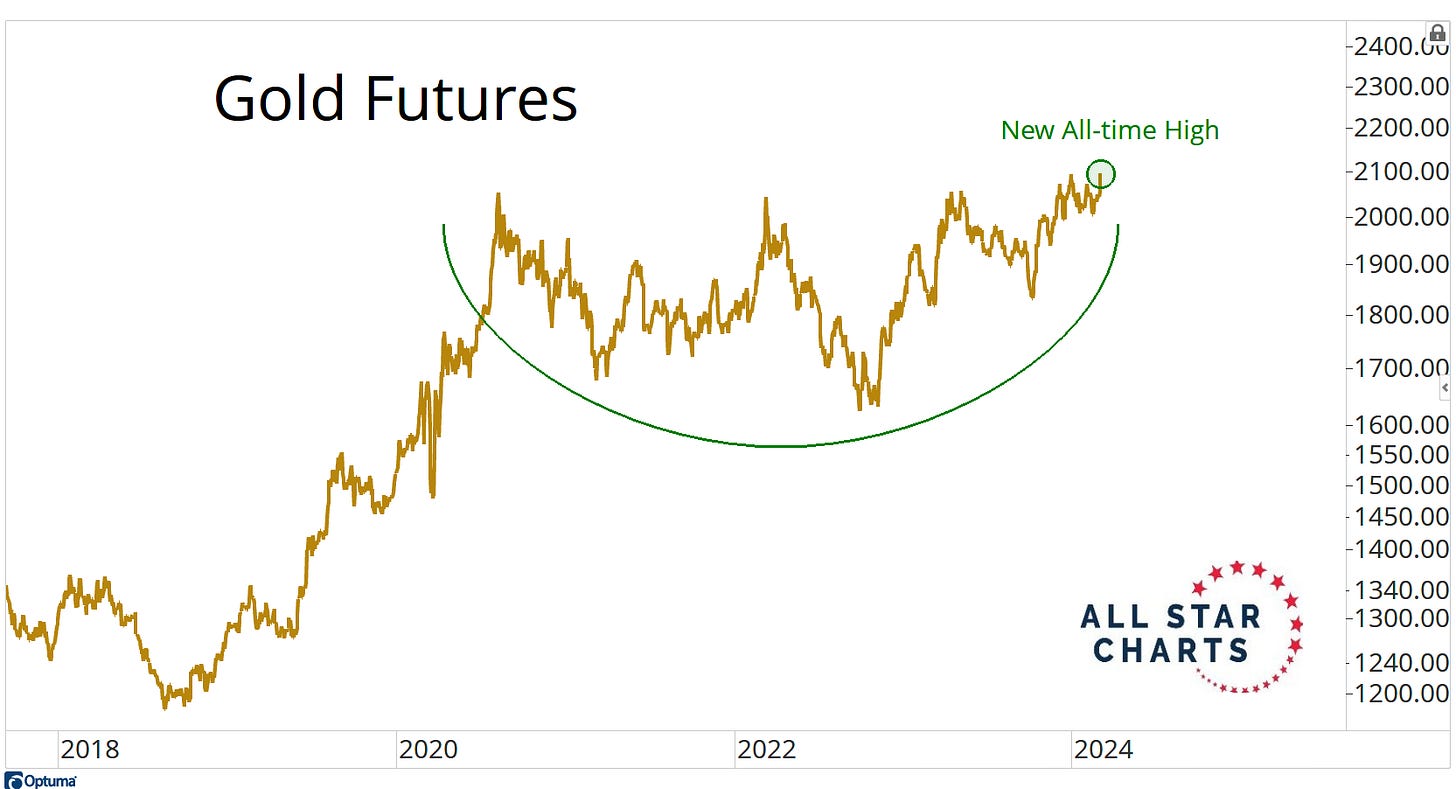

New all-time highs for gold

Never in history has Gold closed at a higher price than it did yesterday, having successfully completed a multi-year base that sets up the next move higher.

Gold has performed well despite lack of investor enthusiasm (Peter Schiff notwithstanding), higher real yields, and a strong U.S. dollar – in part due to surging demand from central banks. It now has upside on the expectation that the Fed will start cutting interest rates this year.

Also noteworthy, the price of gold is rising even as U.S. ETF assets invested in the underlying commodity keeps falling:

Source: All Star Charts, The Daily Shot

Seasonality favors March

Historically, as we move into spring, March and April are two of the better months for the S&P 500 index.

Since 1950 (yellow bars below), the S&P 500 has gained +1.1% in March, while April was up +1.5% – although those returns aren’t quite as strong during Election years like 2024. Even including the 12% drop in 2020 when the arrival of COVID-19 gripped markets, March is still positive on average over the past 10 years (green bars).

After 4 consecutive positive months off the October 2023 lows, investors are looking toward the historically strong seasonal periods in March and April to continue the rally.

Source: Ryan Detrick, CMT (Carson Group)

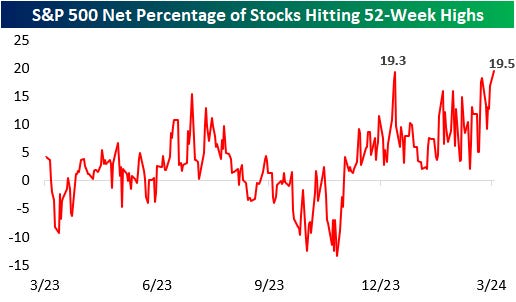

A new high in new highs

With all the talk about only a handful of stocks driving the stock market's performance, it may be surprising to see that yesterday, a net 19.5% of S&P 500 index constituents hit new 52-week highs – the highest reading since May 2021.

As shown below, we've now seen more new 52-week highs than 52-week lows on each of the last 85 trading days.

Source: Bespoke Investment Group

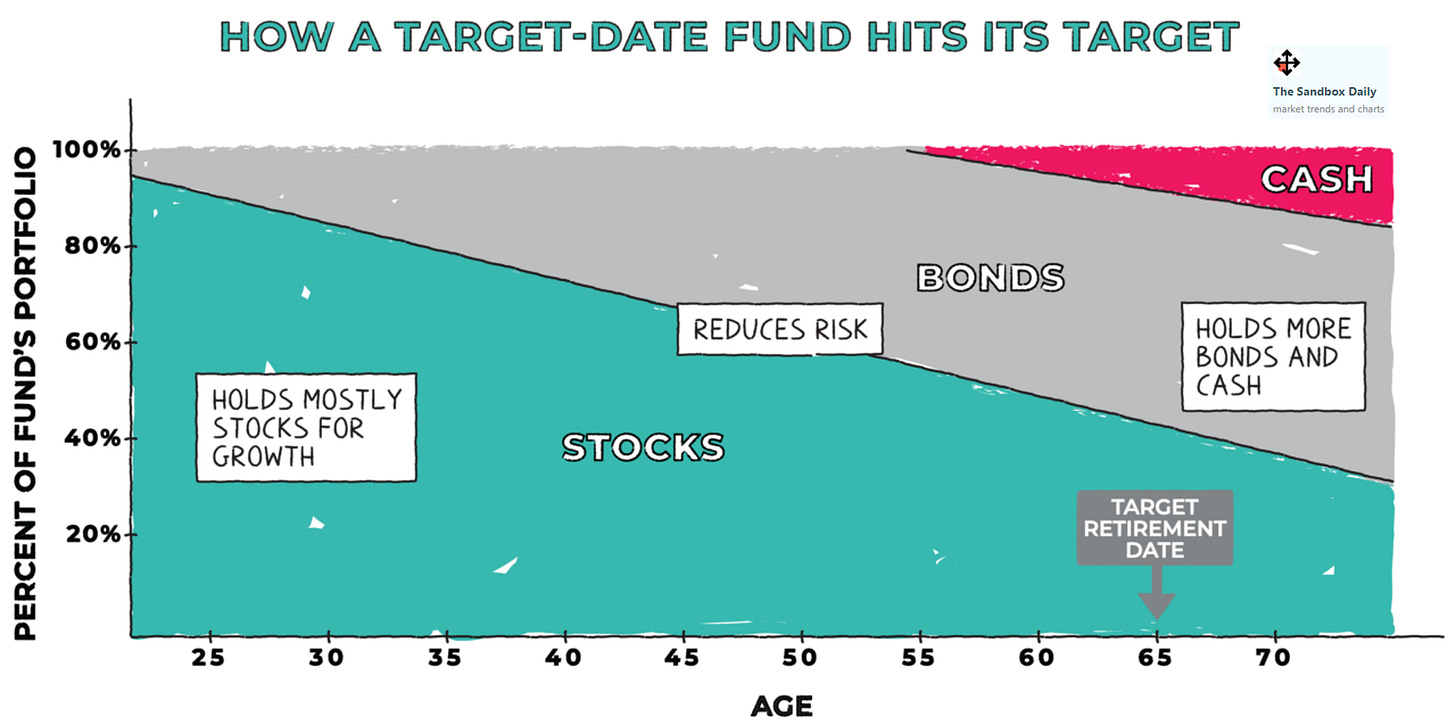

A prominent hedge fund manager sounds the alarm on target-date funds

One of the most significant financial innovations over the past few decades has been the rise of target-date funds, with assets under management rising from less than $8 billion in 2000 to roughly $3.3 trillion today.

The growth of target-date funds was facilitated by the Pension Protection Act of 2006, which qualifies both target-date funds and balanced funds as default options in defined-contribution retirement savings plans.

As a result, many 401(k) plans and other retirement plans now offer target-date funds as a default option for participants because they help providers meet their fiduciary obligations: providing participants with a diversified and appropriate investment vehicle for their retirement needs.

Pick a general retirement or liquidity-need date and you are set!

While TDF’s offer many benefits for investors – simplicity, low cost, broad diversification, systematic rebalances, and de-risking over time (see graphic below) – these investment vehicles aren’t without their drawbacks.

Enter Greenlight Capital hedge fund manager, David Einhorn, who raises a warning flag about the vast sums of passive capital pools “plowing into stocks and bonds with regard to only price, not value.” For years, concerns have been rising about the concentration, money flows, and momentum directed at the market by these passive vehicles.

The “set it and forget it” principle of TDFs is both its blessing and curse: most investors (and the underlying funds itself) rarely adjust their allocations, buying stocks and bonds and whatever other financial asset irrespective of valuation, market fundamentals, or technical structure.

In fact, they become susceptible when air pockets and drawdowns inevitably strike, specifically when a handful of fully valued tech stocks are driving markets higher.

Source: Wall Street Journal, Vanguard, LSEG, LA Wealth Management, We Study Markets

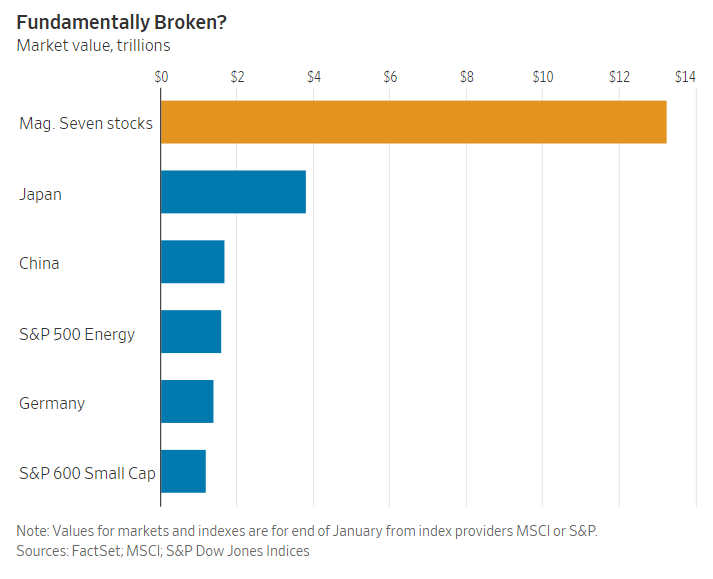

One simple chart

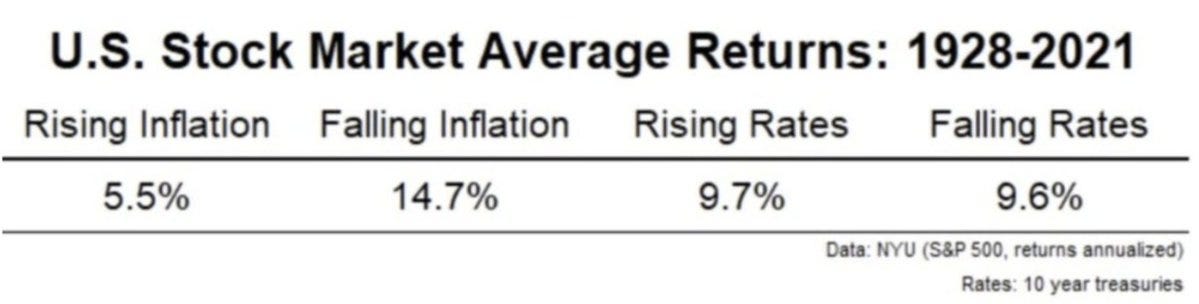

Since 1928, S&P 500 calendar year returns have had no differential whether interest rates were rising or falling.

What does materially impact market returns is whether inflation is rising or falling.

Source: Seth Golden

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.