Good entry points are difficult to find, plus time in the market, central bank flows, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (7.3.2024)

Welcome, Sandbox friends.

The S&P 500 and Nasdaq Composite wrapped up the holiday-shortened session at record closing levels, Hurricane Beryl roars toward Jamaica and the Cayman Islands after becoming the earliest-ever Atlantic hurricane to intensify to Category 5 wind speeds (165 mph), and Tesla’s stock is back to flat on the year after falling as much as -42.8% back on April 22nd.

Quick programming note before we get started:

U.S. markets will be closed on Thursday, July 4th in observance of Independence Day, while Friday, July 5th is a vacation day! As such, The Sandbox Daily will be back with regularly scheduled programming on Monday, 7/8.

Today’s Daily discusses:

good entry points are difficult to find

time is your friend

central Bank flows & liquidity

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.87% | S&P 500 +0.51% | Russell 2000 +0.14% | Dow -0.06%

FIXED INCOME: Barclays Agg Bond +0.54% | High Yield +0.35% | 2yr UST 4.706% | 10yr UST 4.354%

COMMODITIES: Brent Crude +1.10% to $87.19/barrel. Gold +1.30% to $2,363.8/oz.

BITCOIN: -3.57% to $59,634

US DOLLAR INDEX: -0.35% to 105.353

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: +0.50% to 12.09

Quote of the day

“There’s two buttons I never like to hit, alright? And that’s panic and snooze.”

- Ted Lasso

Good entry points are difficult to find

As we enter the second half of the year, one common question we are seeing these days is: when is the right time to invest cash on the sidelines?

The last few years have been an unusual market environment, to say the least. Most notably, a rising rate environment and sticky inflationary pressures have not brought on recession the way econometric models and history would suggest. With elevated valuations, concentrated equity returns, increased focus on political risks from numerous elections around the globe, and a slowing Chinese economy, stock markets have continued to climb the wall of worry higher with many indexes hovering at/around all-time highs.

Many investors are reviewing their portfolios at the halfway mark wondering if their portfolio is positioned correctly heading into the 2nd half of the year. Others are sitting on excess cash waiting for the opportunity to catch equities on a pullback. These halftime report card assessments and questions are perfectly normal.

The obstacle many investors cannot overcome is waiting to buy-the-dip, because it just hasn’t happened yet. See below.

Source: Goldman Sachs Global Investment Research

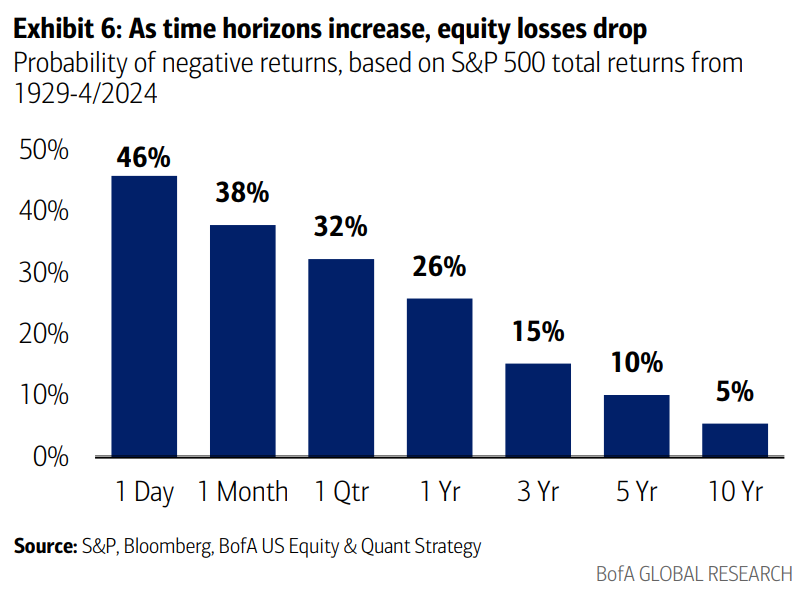

Time is your friend

The probability of losing money in the S&P 500 on any given day is a little worse than a coin-flip (46%), but that probability of loss declines by half over 1-year periods (26%) and by magnitudes over 5-year (10%) and 10-year periods (5%).

Source: Bank of America Global Research

Central Bank flows & liquidity

After a decade+ of Quantitative Easing (QE), the global bond supply/demand balance has shifted.

J.P. Morgan projects net bond sales by G4 central banks (U.S, Euro Area, United Kingdom, Japan) of ~$1.3T in 2024, roughly $240B more versus 2023.

The only other post-GFC period where G4 central bank balance sheets were also reduced was in 2019, when the Federal Reserve actively reversed its Quantitative Easing by selling its securities holdings back to the market.

Source: J.P. Morgan Markets

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

A Wealth of Common Sense – How I Invest My Own Money (Ben Carlson)

All Star Charts – Right Analysis, Wrong Result (Sean McLaughlin)

Cautiously Optimistic – Is a summer storm coming? (Callie Cox)

Podcasts

Bloomberg Odd Lots – Why Tom Lee Thinks We Could See S&P 15,000 by 2030 (Spotify, Apple Podcasts)

Anthony Pompliano – 4 Mind-Blowing Reasons Why Homes Are Unaffordable with Lance Lambert (Spotify, Apple Podcasts)

The Compound and Friends – If I Ran the Fed with Professor Jeremy Siegel and Wisdom Tree CIO Jeremy Schwartz (Spotify, Apple Podcasts, YouTube)

New Hampshire Public Radio – Bear Brook: A True Crime Story (Spotify, Apple Podcasts)

Movies

The Wave – Kristoffer Joner, Ane Dahl Torp (IMDB, YouTube)

Music

Chromeo – Slumming It (Spotify, Apple Music)

Post Malone – Motley Crue (Spotify, Apple Music)

Books

Kyla Scanlon – In This Economy? (Amazon)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.