Government shutdowns affect economic reporting, leaving investors and economists in the dark

The Sandbox Daily (10.1.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

government shutdown leaves investors without key jobs report

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.49% | S&P 500 +0.34% | Russell 2000 +0.24% | Dow +0.09%

FIXED INCOME: Barclays Agg Bond +0.26% | High Yield +0.19% | 2yr UST 3.537% | 10yr UST 4.101%

COMMODITIES: Brent Crude -0.71% to $65.56/barrel. Gold +0.42% to $3,889.5/oz.

BITCOIN: +2.79% to $117,356

US DOLLAR INDEX: -0.02% to 97.754

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: +0.06% to 16.29

Quote of the day

“The wound is the place where the light enters you.”

- Rumi, Sufi Poet

Government shutdown leaves investors without key jobs report

Well, it’s here. The U.S. federal government officially shut down at midnight after a deadlocked Congress failed to pass a budget for the next fiscal year, the funding agreement that’s needed to allocate the actual dollars across different departments and agencies.

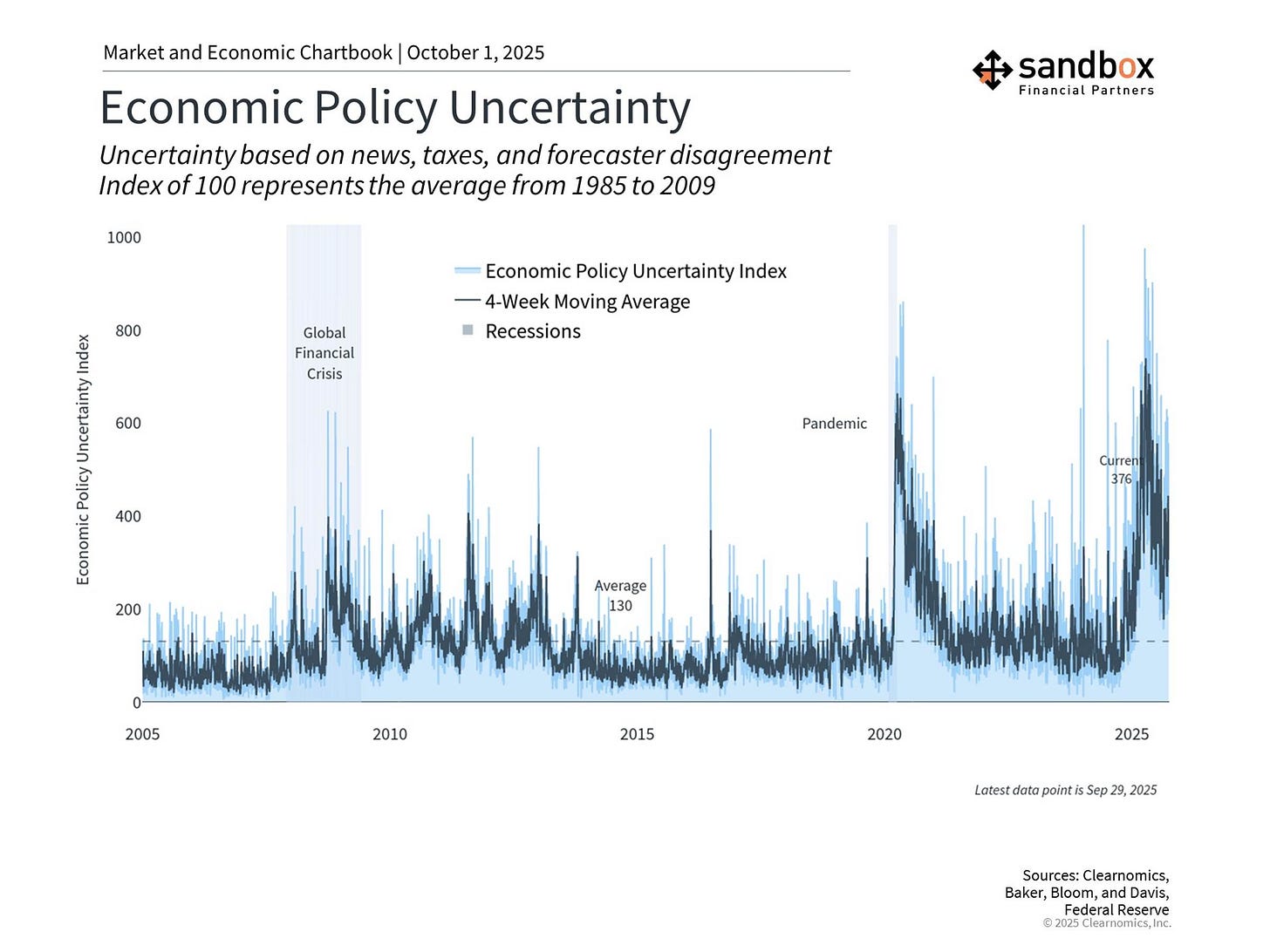

This adds to a year in which government policies around trade, taxes, immigration, and more have created uncertainty for the economy and markets.

Government shutdowns have occurred regularly over the years under presidents of both parties, with minimal long-term impact on financial markets.

The reason is straightforward: shutdowns are temporary disruptions that don’t change underlying economic fundamentals.

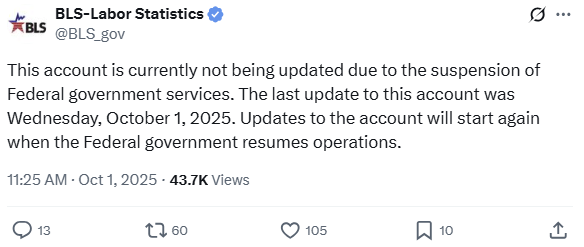

The disruptive nature of this particular shutdown – outside of course the very unfortunate prospect of furloughs and reductions in force across the federal workforce – will reveal itself on Friday, the day we are supposed to receive the all-important Bureau of Labor Statistics’ nonfarm payrolls report for September.

The monthly jobs report, along with scores of other official economic data, is on hiatus until further notice.

At the recent September meeting, Fed Chair Powell stated the FOMC committee now favors the employment side of their mandate over any near-term inflation risks, so the October rate cut decision becomes a lot more ambiguous without the crucial September jobs report.

In its place, we have the ADP private payrolls report released this morning as a placeholder – which garners additional focus to gauge the current state of the labor market.

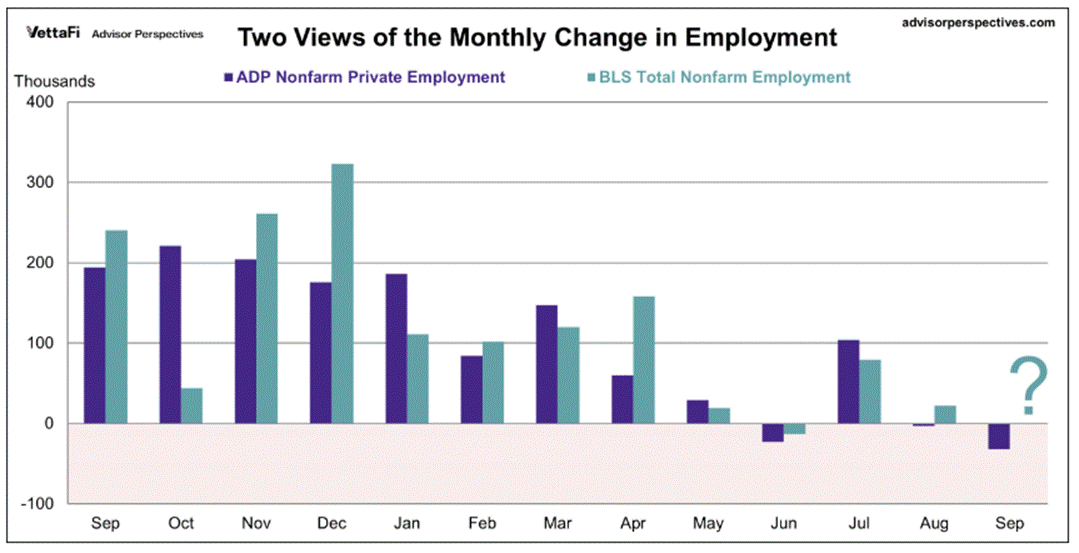

ADP private payrolls fell -32,000 in September, contrary to expectations of a +50,000 increase. What’s more, the prior month (August) was revised down by 57,000 to -3,000 now.

So, for those keeping score at home, ADP payrolls have declined in three of the past four months, while the 12-month average is running at its lowest level since 2021.

In plain English, the labor market is weakening in front of our very eyes – confirming the jobs data reported from other sources.

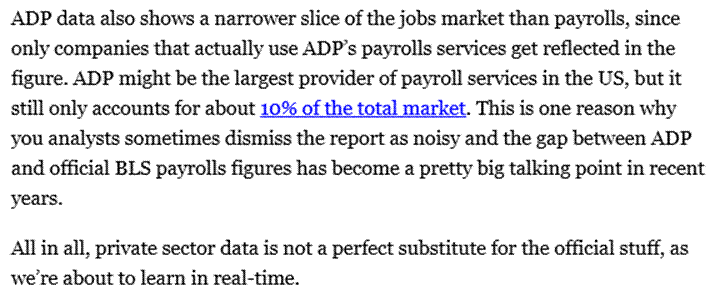

And yet, we must remind ourselves the private payrolls data from vendor ADP only tells a part of the story, though.

Here’s Tracy Alloway:

For now, we must take the ADP jobs data at face value and what it means for the market’s expectations for further interest rate cuts this year.

Declining ADP payrolls, along with weakness across other labor market indicators such as JOLTS and ISM employment indexes, justifies the resumption of Fed rate cuts last month and explains why the committee cuts rates again at their October meeting.

Bottom line: government shutdowns may dominate headlines, create challenges for federal workers, and disrupt important services, but they have historically had minimal impact on financial markets.

Investors should continue to focus on their financial plans rather than daily events in Washington.

Sources: Clearnomics, ADP, Advisor Perspectives, Bloomberg, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)