Happy Bitcoin Pizza Day, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (5.22.2025)

Welcome, Sandbox friends.

Quick publisher’s note before we begin today: Monday is Memorial Day, so The Sandbox Daily will be taking a short break in observance of the holiday, returning to your inbox on Tuesday, May 27th with our regularly scheduled programming.

A special thank you to all the brave men and women who have served or are currently serving – we honor you this weekend.

Today’s Daily discusses:

Bitcoin Pizza Day!

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.15% | Dow 0.00% | S&P 500 -0.04% | Russell 2000 -0.05%

FIXED INCOME: Barclays Agg Bond +0.29% | High Yield +0.20% | 2yr UST 3.999% | 10yr UST 4.545%

COMMODITIES: Brent Crude -1.14% to $64.17/barrel. Gold -0.61% to $3,293.2/oz.

BITCOIN: +2.69% to $111,320

US DOLLAR INDEX: +0.36% to 99.918

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: -2.83% to 20.28

Quote of the day

“We assume that the more arguments we give, the better our case. In reality, our weakest arguments dilute the strongest. Generally, you’ll only be as convincing as your worst point, so instead of making as many arguments as you can, make only the best.”

- Gurwinder Bhogal, Writer and Computer Scientist

Bitcoin Pizza Day!

Bitcoin Pizza Day is here and what a fitting tribute: a new all-time high.

Fifteen years ago, on May 22, 2010, a hungry programmer and bitcoin enthusiast named Laszlo Hanyecz paid for two Papa John’s pizzas with 10,000 bitcoin, becoming the first recognized bitcoin transaction – now celebrated the world over as “Bitcoin Pizza Day.”

Unfortunately for Laszlo, bitcoin is up over 25,000% since May 2010 and those 10,000 BTC are worth the equivalent of $1.1B today.

Intraday trading lifted the price of bitcoin to the $111,000 range.

The milestone of new all-time highs in bitcoin’s price comes amid growing adoption from corporations, positive regulatory developments, and improving global economic conditions that have created the perfect storm for bitcoin's ascent.

Here are some recent developments that highlight the surge in bitcoin’s price and interest:

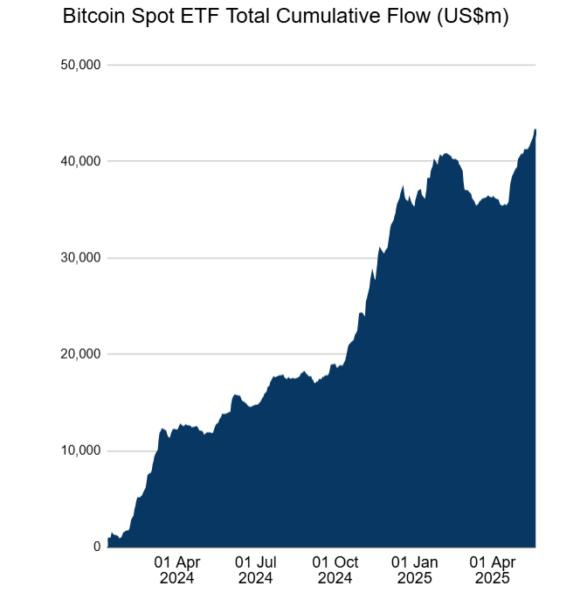

Spot bitcoin ETFs

Since the United States approved spot bitcoin ETFs in January 2024, institutional and retail adoption has surged. Major asset managers like BlackRock and Fidelity have continued to attract steady inflows through both individual purchases and model-based allocations. These ETFs have created a new, regulated gateway for traditional investors to access bitcoin, increasing demand while reducing circulating supply.

2024 bitcoin halving

The fourth bitcoin halving occurred in April 2024, reducing the block reward from 6.25 BTC to 3.125 BTC. This reduces the new supply of bitcoin entering circulation, reinforcing the supply-side scarcity narrative and often catalyzing upward price momentum in the following months.

Regulatory change

Since President Donald Trump returned to the White House in 2025, the U.S. has undergone a significant regulatory shift toward a more crypto-friendly environment. This transformation includes the establishment of a national Bitcoin Strategic Reserve, a digital asset working group led by "Crypto Czar" David Sacks, working groups for comprehensive regulatory frameworks to provide clarity and support for the crypto industry, and a concerted push for deregulation to foster innovation.

Macro environment

Many narratives have been peddled by bitcoin maximalists: decentralized asset, digital gold, store of value, safe haven, inflation hedge, etc etc. In 2025, its global economic and political uncertainties. Will it stick? Maybe, maybe not. But, for now, buyers are in control and narratives follow price.

At the time of Laszlo’s Papa John’s purchase in 2010, bitcoin was only a small development among tech enthusiasts and nerds.

Today, bitcoin has become the fifth largest asset in the world with a $2.1T market cap, overtaking Amazon earlier this week. To surpass gold in market cap and officially earn the title of digital gold, bitcoin has ~$20T to go.

Institutional interest in bitcoin has reached unprecedented levels, providing substantial support for the rally in the face of incredible uncertainty in 2025.

U.S.-listed spot bitcoin ETFs have attracted approximately $4.2 billion in May alone, with inflows recorded on nearly every trading day this month. These investment vehicles have now accumulated over $40 billion in total assets, demonstrating the growing confidence of institutional investors in bitcoin as a legitimate asset class.

Commodity or currency?

Regulated or decentralized?

Safe haven or risk asset?

There have been many questions, doubts and uncertainties, and bumps (very very big bumps) along its journey, but bitcoin’s capacity to survive has to be the starting point when thinking about its success.

As Dylan Grice of Societe Generale once said: “Thriving is great. Prospering isn’t bad either. But neither mean much if you’re unable to survive.”

Sources: CNBC, All Star Charts, CoinDesk, Seeking Alpha

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

Enter the Labyrinth – Moving Beyond Words (Frederik Gieschen)

Verdad – Innovation and Stock Market Bubbles (Brian Chingono)

A Wealth of Common Sense - Financial Advice That Doesn’t Work Anymore (Ben Carlson)

Flow Financial Planning – Build Some More Room For Error into Your Finances (Meg Bartelt)

J.P. Morgan – Back to Our Regularly Scheduled Programming (Michael Cembalest)

The Ringer – The Impossible Mission of Ending a Franchise Like ‘Mission: Impossible’ (Adam Nayman)

Podcasts

Ezra Klein – We Have to Really ReThink the Purpose of Education (Spotify, Apple Podcasts)

a16z – What Is an AI Agent? (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Four Seasons – Tina Fey, Steve Carell, Will Forte (Netflix, IMDB, YouTube)

Music

Donda – True Love (Spotify, Apple Music, YouTube)

Books

Sahil Bloom – The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life (Amazon)

Fun

Cooper Alan – Red Hot Chili Peppers Mashup (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)