Hard data shows the U.S. economy still in solid place 💪

The Sandbox Daily (5.29.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

hard data shows the U.S. economy still in solid place

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 +0.40% | Russell 2000 +0.34% | Dow +0.28% | Nasdaq 100 +0.21%

FIXED INCOME: Barclays Agg Bond +0.37% | High Yield +0.15% | 2yr UST 3.941% | 10yr UST 4.421%

COMMODITIES: Brent Crude -1.12% to $64.18/barrel. Gold +0.56% to $3,341.1/oz.

BITCOIN: -1.10% to $106,155

US DOLLAR INDEX: -0.53% to 99.347

CBOE TOTAL PUT/CALL RATIO: 0.81

VIX: -0.67% to 19.18

Quote of the day

“We don’t see things as they are, we see things as we are.”

- Anais Nin

Hard data shows the U.S. economy still in solid place

After an endless parade of downgrades to both earnings estimates and economic growth, it’s no surprise that fear, uncertainty, and doubt are overtaking the collective consciousness of investors.

The market is trying to navigate a growing mountain of risks posed by on-then-off-and-on-again tariffs, what was an effective embargo on China, immigration and deportations, DOGE cuts, geopolitics, and many other considerations.

At least over the near term, these risks have put upward pressure on inflation and downward pressure on growth and employment. Specific to the Fed’s mandates, the twin goals of maximum employment and price stability are under tremendous pressure.

The U.S. economy is resilient, yes. But, after roughly four months under the 47 administration, the U.S. economy is dodging blows from every angle in the same way Neo fights off Agent Smith and his henchmen in The Matrix.

Stay nimble and keep your head on a swivel !

Although soft data (think surveys and estimates) usually leads the hard data (i.e. actual reported data), the soft data is often prone to exaggeration in both directions.

The Fed has explicitly stated it will wait for the hard data before acting, a wait-and-see approach which by definition means it will be late if interest rate cuts are needed. Powell has said umpteen times that the Fed is in a good position, and the committee can afford to be patient and wait for greater clarity.

So, what is the data showing us right now?

Surprisingly, tremendous resilience.

The most recent string of economic data, combined with a u-turn in consumer confidence among American households, shows a silver lining for the U.S. economy.

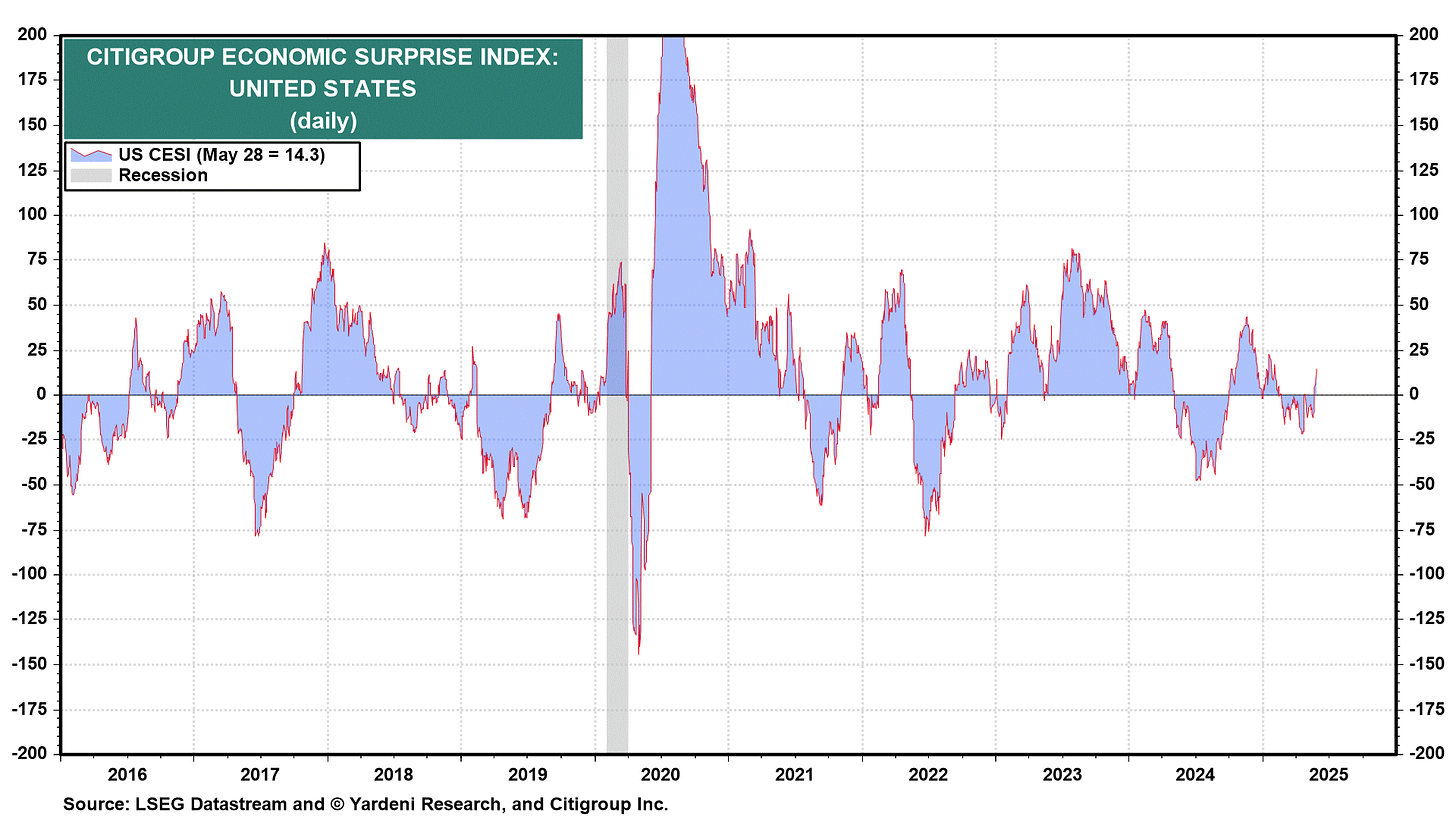

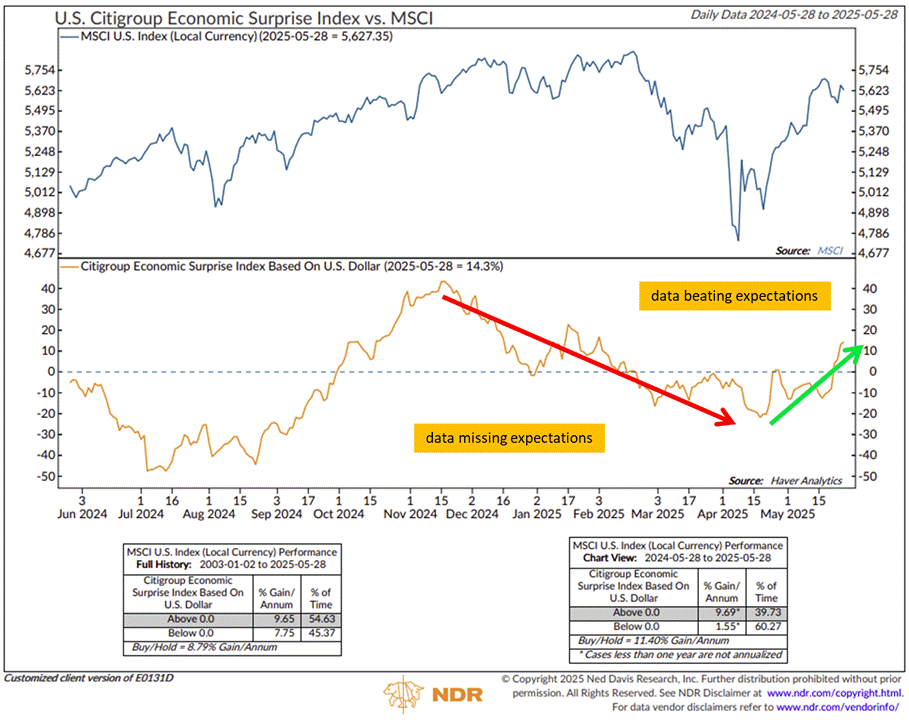

The U.S. Citigroup Economic Surprise Index – a widely followed indicator that provides a quick-and-dirty snapshot of how the economy is faring against expectations – has just risen above the zero line and flipped outright positive for the first time since February.

Surprise indexes show how economic data (yes, all of it) compares with consensus analyst expectations. Higher numbers mean data has been better than expected; lower numbers, worse.

The chart below would indicate our economy is holding up under the weight of tremendous uncertainty.

When you zoom into just the recent data, the improvement in the hard data is without question.

What’s driving the data?

On the positive front, the labor market is holding firm (albeit the rise in continuing claims is worth flagging), while input costs like energy and metals are down. Credit conditions remain favorable for both households and businesses, although higher-for-longer could eventually lead to a day of reckoning. Momentum around AI remains robust as Nvidia reaffirmed last night during its earnings release. Retail continues to buy the dip hand over fist.

On the negative front, trade and economic policy uncertainty? Forget about it. Tariffs are likely going to lead to a one-time structural shift higher on prices, either weighing on corporate margins or the consumer’s wallet (or worse, both). High mortgage rates and low affordability weigh on the housing market. Ongoing confusion will ultimately slow investment and global trade.

Like most things in life, the scales show it’s a mix of some good and some bad.

So, despite some better-than-feared data, are we out of the woods? No.

Can this ship rotate starboard side quickly and slip into recession? Maybe.

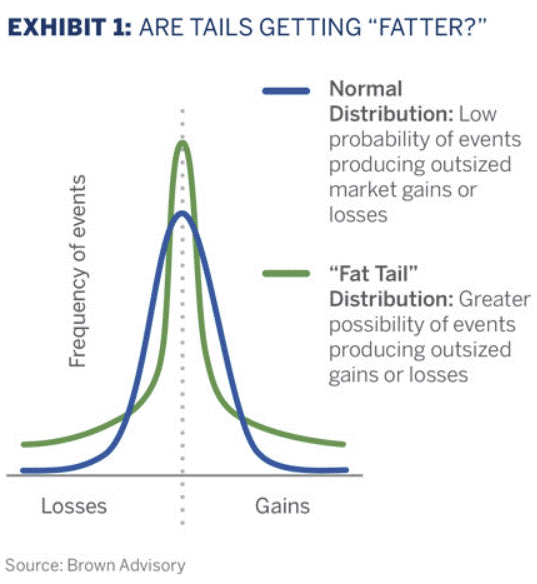

One thing I am certain of as we approach the mid-point of the year is the range of outcomes is widespread, something statisticians call kurtosis where the probability distribution of extreme values (both higher and lower than average) occur more frequently.

But, for now, it is unwise to undermine the strength and resilience of the American economy (and consumer).

Sources: The Matrix, Yardeni Research, Ned Davis Research, Brown Advisory

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)