Hasta la vista, baby

The Sandbox Daily (6.25.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

one epic bounce

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.21% | S&P 500 0.00% | Dow -0.25% | Russell 2000 -1.16%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield -0.02% | 2yr UST 3.781% | 10yr UST 4.291%

COMMODITIES: Brent Crude +0.69% to $67.61/barrel. Gold +0.09% to $3,346.4/oz.

BITCOIN: +1.34% to $107,519

US DOLLAR INDEX: -0.14% to 97.719

CBOE TOTAL PUT/CALL RATIO: 0.90

VIX: -4.12% to 16.76

Quote of the day

“God isn't late. He's just not on your schedule.”

- Proverb

The market’s epic bounce

The S&P 500 index’s gain since the April 8 “Liberation Day” low is the strongest of similar 15-20% corrections since 1980.

Today, the S&P 500 is within 1% of its February 19 record high.

Whether the previous highs prove to be resistance, a place of consolidation, or a launching point for the next leg higher will likely depend on the trajectory of earnings, the economy, tariffs, inflation, and Fed policy.

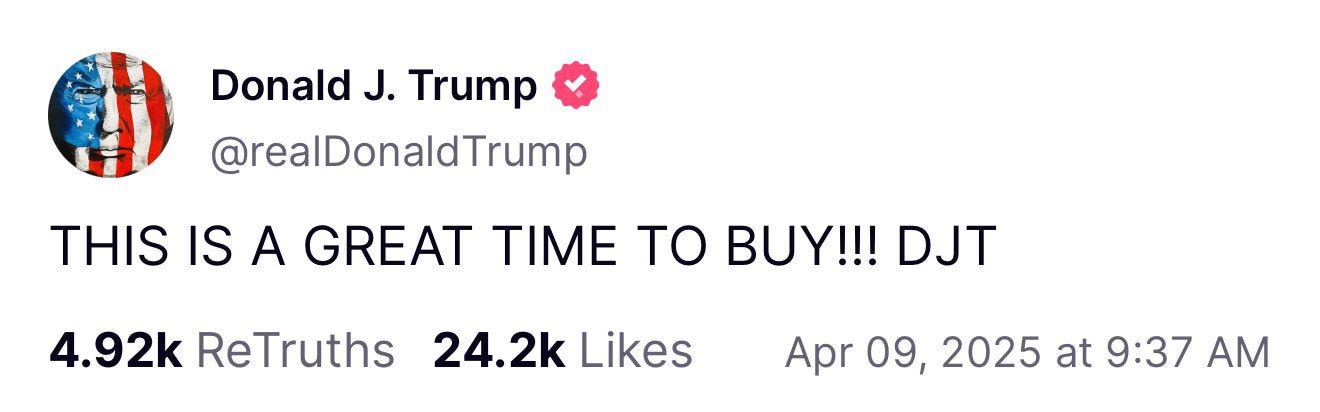

Or, maybe just a tweet from President Trump’s Truth Social, who knows.

The February-to-April waterfall decline was unique but not unprecedented.

The S&P 500 fell -18.9% on a closing basis, significant and decidedly terrifying but short of the 20% threshold that the history books will use to define cyclical bear markets.

Yet, after screening for similar historical analogs for S&P 500 corrections of 15-20%, there are six other instances since 1980 to compare the current bounce in equities.

None are as strong as this market’s v-shaped recover.

The S&P 500 has jumped 22.3% from April 8 through today, ranking it first amongst the combined seven cases. The rebounds after the 1980 and 2018 lows were the only others to exceed 18%.

Bottom line?

The rally over the past 2.5 months has been exceptionally strong.

Sources: Ned Davis Research, Bloomberg, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)