Hedge fund positioning, plus market valuation, election year expectations, and a visit with Charles Payne on Fox Biz

The Sandbox Daily (5.23.2024)

Welcome, Sandbox friends.

This afternoon I joined Charles Payne on Fox Business for Making Money where we discussed investing in markets when indexes are at all-time highs and the recent quarterly earnings period. New York is always a fun place to visit!

Key takeaway?

Over the last 50 years when the S&P 500 index has been trading at all-time highs (like it is today), the market is higher 12 months later 73% of the time with a median return of +12.1%. New highs are not scary for investors. In fact, quite the contrary – especially when the Federal Reserve is turning dovish, the labor market continues to underpin this resilient economy, and corporate earnings are hooking higher.

Today’s Daily discusses:

trends from Q1 hedge fund positioning

is the “market” expensive?

presidential cycle: 4th year progression

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.44% | S&P 500 -0.74% | Dow -1.53% | Russell 2000 -1.60%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -0.35% | 2yr UST 4.941% | 10yr UST 4.477%

COMMODITIES: Brent Crude -0.67% to $81.35/barrel. Gold -2.63% to $2,352.2/oz.

BITCOIN: -2.47% to $67,658

US DOLLAR INDEX: +0.11% to 105.049

CBOE EQUITY PUT/CALL RATIO: 0.59

VIX: +3.91% to 12.77

Quote of the day

“Leaders get out in front and stay there by raising the standards by which they judge themselves—and by which they are willing to be judged.”

- Fred Smith, FedEx Founder

Hedge fund trend monitor

The Goldman Sachs U.S. Portfolio strategy team published their quarterly flagship publication Hedge Fund Trend Monitor, which analyzed 707 hedge funds with $2.7 trillion of gross equity positions ($1.8T long and $965B short) at the start of the 2nd quarter.

Two key takeaways?

Performance: The average U.S. long/short equity hedge fund has delivered a respectable +8% YTD return, boosted by the strong performance of popular stocks. Except for TSLA, the Magnificent 7 rank as the top 6 stocks on the Goldman Sachs list of the most popular long positions, which has returned +16% YTD. Mirroring a broadening equity market, hedge funds trimmed exposure to the mega-cap tech stocks to look for other alpha opportunities; Apple was the exception.

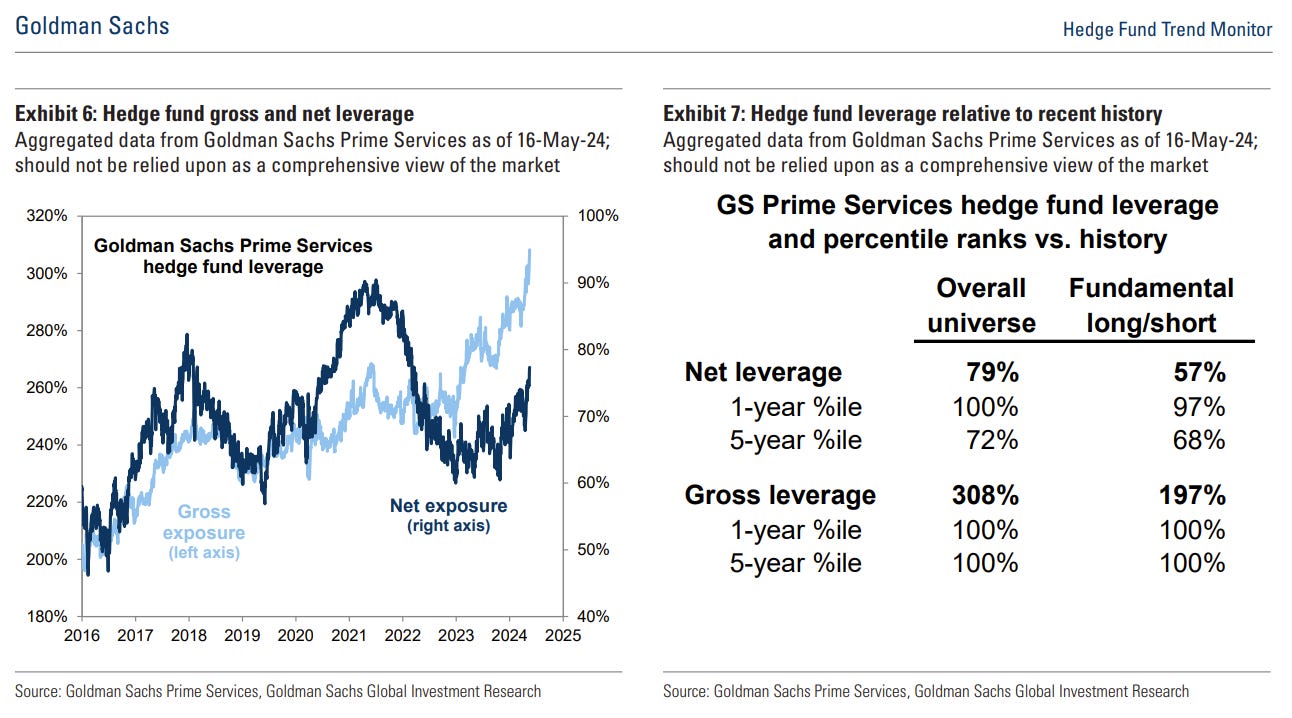

Leverage and Short Interest: Hedge funds increased net leverage modestly alongside the market rally while maintaining record gross leverage. Concentrated short positions have been particularly volatile recently, causing funds to rotate out of their favorite longs to cover shorts. However, the most recent short squeeze fell shy of the recent experiences in 2021 and December 2023. Short interest for the median S&P 500 stock remains very low at 1.8% of float.

Source: Goldman Sachs Global Investment Research

Is the “market” expensive?

The bulk of the equity performance last year came from multiple expansion.

So, are markets currently expensive from a valuation perspective?

Excluding a very select few Tech stocks (FANG), the market is trading at 16.9x forward earnings – in line with the 25-year average of… 16.9x.

Presidential cycle: 4th year progression

With the presidential election season heating up, there will no doubt be a flurry of daily headlines between now and election day on November 5th. A rematch between incumbent President Joe Biden and former President Donald Trump is all but set in stone.

As a lot can happen between now and November, it's natural for some investors to be concerned about the impact of politics on the stock market and economy. After all, the political climate has never felt more polarized not just due to elections, but also disagreements in Washington around the budget, immigration, foreign policy, and countless other measures. How can investors stay balanced during this year's presidential election?

In terms of market expectations for 2024, the historical annual progression of the 4th year in a presidential cycle suggests a likely consolidation during the 1st half of 2024 – fairly representative of what we’ve experienced YTD – before an acceleration in the back half of next year.

Historically, annual S&P 500 index returns have averaged +7.5% with a yearly maximum average drawdown of -15.0% during the 4th year of a Presidential cycle – both perfectly in line with long-term historical averages.

Below is a chart showing calendar year returns for the S&P 500 during all election years.

A red box represents all U.S. Presidential Election years since 1928; a yellow box shows all U.S. Presidential Elections years that occurred simultaneously during a U.S. recession.

The S&P 500 has been lower only four times during an election year, with two instances during a recession.

Diving deeper into the monthly seasonality trends with an election year shows that June through August have been strong historically, especially under Democrat leadership, while the months leading into the election (September to November) have been weaker.

History has been kind to these warmer months that are just on the horizon for all of us.

Rest assured, the economy will be a major hot button topic during the final push of campaign season. For most long-term investors though, it makes more sense to focus on fundamentals such as those related to the business cycle, rather than day-to-day splashy election headlines. Returns are far more correlated with cycles than presidential party and are often positive despite the party in power.

Source: Piper Sandler, Clearnomics

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.