Hedge fund trends, plus cooling recession fears, U.S. dollar, cobalt, and recovering from losses

The Sandbox Daily (2.27.2023)

Welcome, Sandbox friends.

Today’s Daily discusses the hedge fund trends that Goldman Sachs is observing, recession fears coming off the boil, U.S. dollar strength regains the narrative, cobalt inputs powering the next wave of technology, and the gains required to offset losses.

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.74% | S&P 500 +0.31% | Russell 2000 +0.31% | Dow +0.22%

FIXED INCOME: Barclays Agg Bond +0.20% | High Yield +0.67% | 2yr UST 4.782% | 10yr UST 3.922%

COMMODITIES: Brent Crude -0.87% to $82.44/barrel. Gold +0.39% to $1,824.2/oz.

BITCOIN: -0.86% to $23,379

US DOLLAR INDEX: -0.52% to 104.672

CBOE EQUITY PUT/CALL RATIO: 0.82

VIX: -3.32% to 20.95

Quote of the day

“Volatility can prey on investors’ emotions, reducing the probability they'll do the right thing.”

-Howard Marks

Hedge fund trend monitor

The Goldman Sachs U.S. Portfolio strategy team published their Hedge Fund Trend Monitor report, which analyzed 758 hedge funds with $2.3 trillion of gross equity positions. The broad takeaways?

Leverage: Hedge fund leverage has rebounded alongside the equity market at the start of 2023. Hedge fund net leverage remains far below the record highs of mid-2021 but has rebounded from multi-year lows in the last several weeks as managers adjust their positioning and risk appetite.

Return dispersion: The average stock has become incrementally less macro-driven in recent months, signaling an improving environment for alpha generation. Fears of recession and elevated interest rate volatility helped create a particularly macro-driven market for much of 2022. Recently, however, company-specific factors have explained a growing portion of stock returns; rising return dispersion and falling stock correlations indicate an increasingly fertile environment for stock-pickers.

Top positions: Microsoft (MSFT) and Amazon (AMZN) remain the two most popular hedge fund long positions. Meta Platforms (META) rebounded to number three on the list after falling out of the top five last quarter for the first time since 2014. Tesla (TSLA) dropped off the list entirely. The following list contains the 50 stocks that appear most often among the top 10 holdings of fundamental hedge funds:

Source: Goldman Sachs Global Investment Research

Recession coming off the boil?

Per a recent Bank of America fund manager survey, recession odds peaked in November 2022 at 77% and have since declined to 24% this month, the lowest level since June 2022. Note prior peaks in recession fears coincided with the start of major bull markets in asset prices.

Source: Bank of America

U.S. dollar strength regains narrative

February is nearing its end and we’ve witnessed the return of a familiar foe: the U.S. Dollar.

By the middle of January, the U.S. Dollar Index was down by nearly 12% from its September peak. The move pushed the index below its 2016 and 2020 peaks for the first time in nearly a year – an encouraging development for equity market bulls, who watched Dollar strength wreak havoc on all risk assets in 2022. The downtrend continued as we moved into the 2nd month of the year, as February 1st brought with it new lows for the index.

Then the declines of 2023 were erased within just the first 3-4 trading sessions in February and the Dollar hasn’t looked back sense.

As market technicians often say, from failed moves come fast moves in the opposite direction. The U.S. Dollar Index was no exception. It's climbed 3% in February, on pace for its best month since September.

Source: Grindstone Intelligence

Cobalt inputs powering the next wave of technology

Cobalt has quickly become one of the most important natural resources, as it’s responsible for the batteries in our mobile phones, computers, and electric vehicles. Here is raw cobalt dug from the hammers and picks in an artisanal mine located in Kolwezi, Democratic Republic of the Congo (DRC).

Despite a history in which cobalt demand was traditionally dominated by industrial applications, new economy drivers such as lithium-ion batteries are pushing demand overwhelmingly into consumer applications. Part of this global adoption comes from government officials around the world calling for a transition to a greener economy, where regions such as the DRC are being transformed to accommodate the insatiable demand for this one raw – yet critically important – mineral.

Estimates are that the Democratic Republic of the Congo possesses 70% of the global cobalt supply. Cobalt, which is mainly produced as a byproduct of copper and nickel, was ignored for a long time in favor of those more in-demand minerals. But now, the world is turning to it for its essential role in lithium-ion batteries for phones and electric vehicles.

The issue many government officials and business leaders face is the deplorable working conditions that are forcing companies and countries to look at alternatives, as this shadow economy is often dangerous and rife with human rights violations. The Democratic Republic of Congo ranked 166 out of 180 countries on Transparency International's 2022 Corruption Perceptions Index (with a score of just 20 out of a possible 100). The road to cleaner energy is filled with many dirty jobs, often in emerging markets where regulation and law and order are severely lacking. As technology advances, our society will be forced to face the ethical issues associated with sourcing these valuable resources.

Source: Yahoo Finance, Crux Investor, Visual Capitalist, Statista

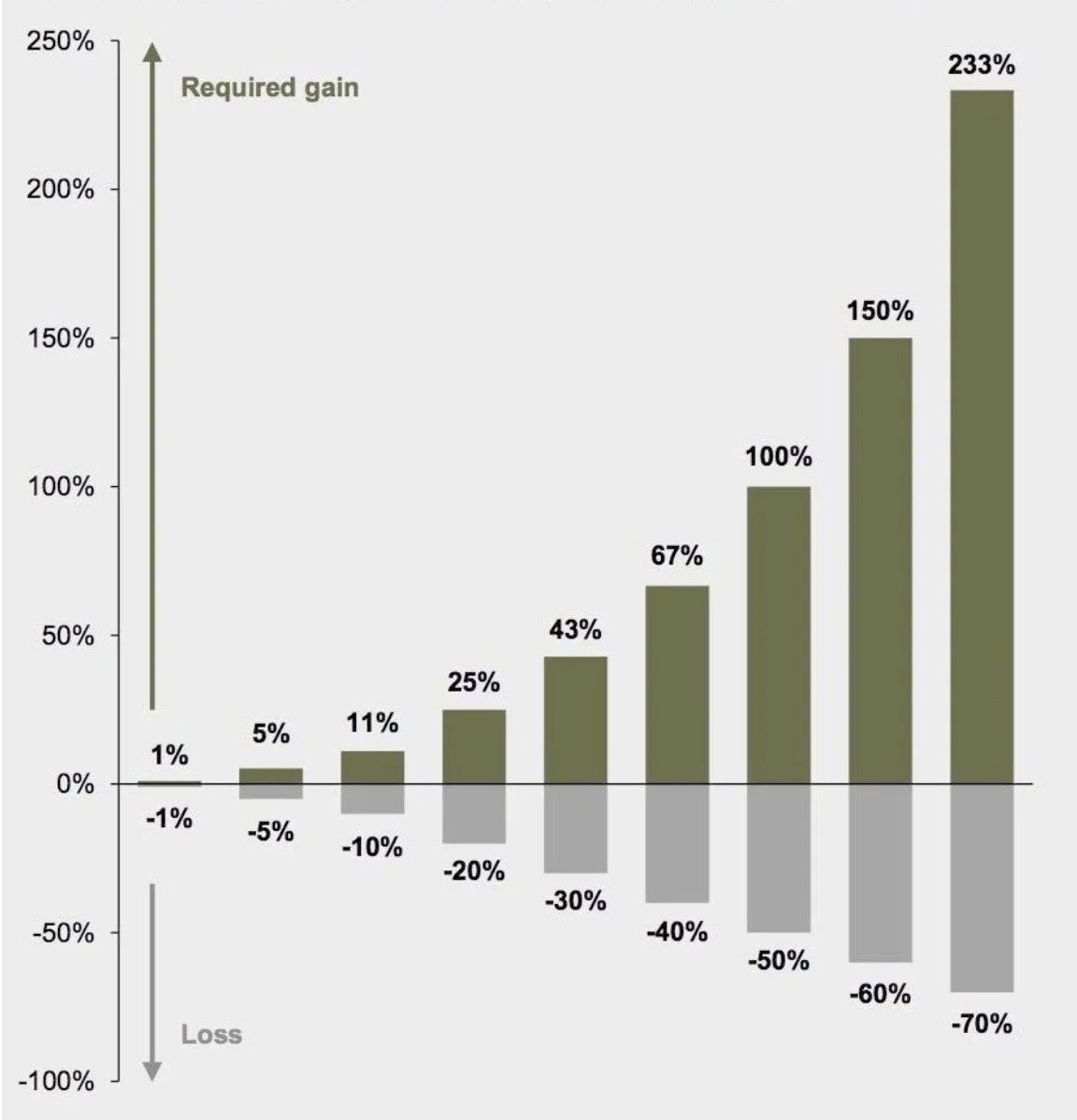

One simple graphic

Know when to cut your losses.

It is easier to recover from smaller declines than bigger declines.

As the magnitude of loss increases, it takes even more upside return just to get back to even on your invested position. This simple math illustration shows the importance of downside risk management.

Source: Sandbox Financial Partners

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.