Hedge funds play catch up, plus Arm files IPO paperwork, leadership from semis, and global breadth deteriorates

The Sandbox Daily (8.23.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

hedge funds play catch up

SoftBank’s Arm files IPO registration statement

looking to semis for leadership

global breadth deterioration

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.60% | S&P 500 +1.10% | Russell 2000 +1.04% | Dow +0.54%

FIXED INCOME: Barclays Agg Bond +0.96% | High Yield +0.81% | 2yr UST 4.982% | 10yr UST 4.198%

COMMODITIES: Brent Crude -1.39% to $82.86/barrel. Gold +1.02% to $1,945.6/oz.

BITCOIN: +3.34% to $26,651

US DOLLAR INDEX: -0.17% to 103.388

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: -5.83% to 15.98

Quote of the day

“It may seem counterintuitive, but if you have something in your portfolio that you’re complaining about, it’s a good sign you’ve built a diversified portfolio.”

- Carl Richards, The Behavior Gap

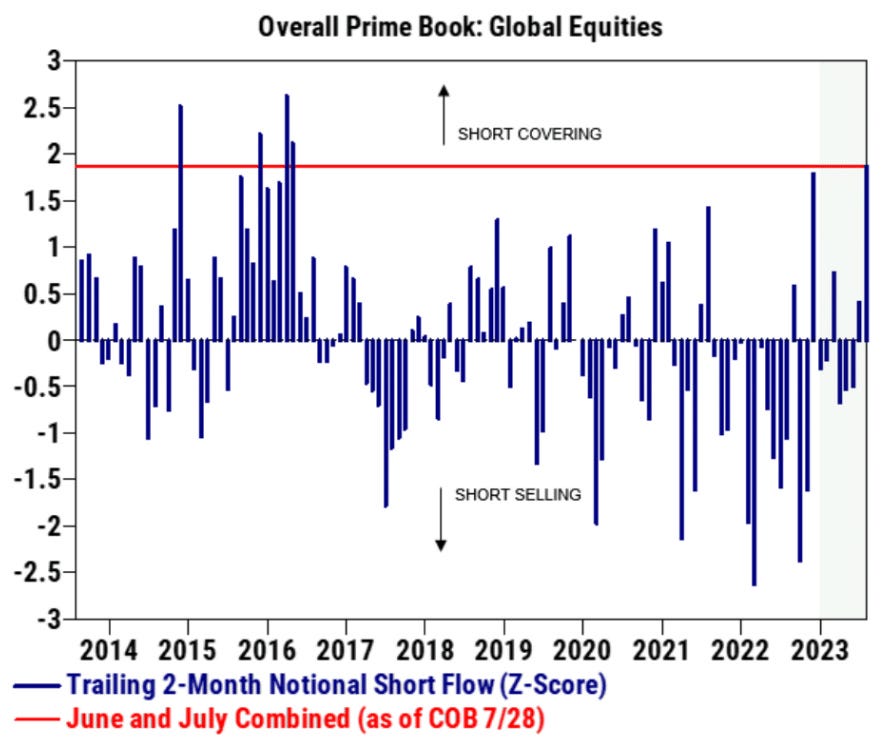

Hedge funds play catch up

Betting against U.S. stocks, specifically growth stocks, has gone poorly for Wall Street’s speculators.

Strong year-to-date gains among a large basket of stocks, specifically over June and July, led to hedge funds closing out short positions at the fastest pace in years, according to Goldman Sachs’ prime brokerage unit.

The cumulative dollar amount of short covering by hedge funds in June and July combined was the largest over a 2-month period since 2016.

Hedge funds came into 2023 with relatively low leverage, or borrowed money, compared to recent years after cutting risk for most of 2022 in anticipation of a recession. But, after missing out on some of the market’s surprise rally this year, they added significant leverage in an attempt to catch up and juice returns.

More recently, hedge fund leverage has been volatile; gross exposures remain close to record highs while net leverage remains constrained.

Source: Goldman Sachs Global Investment Research

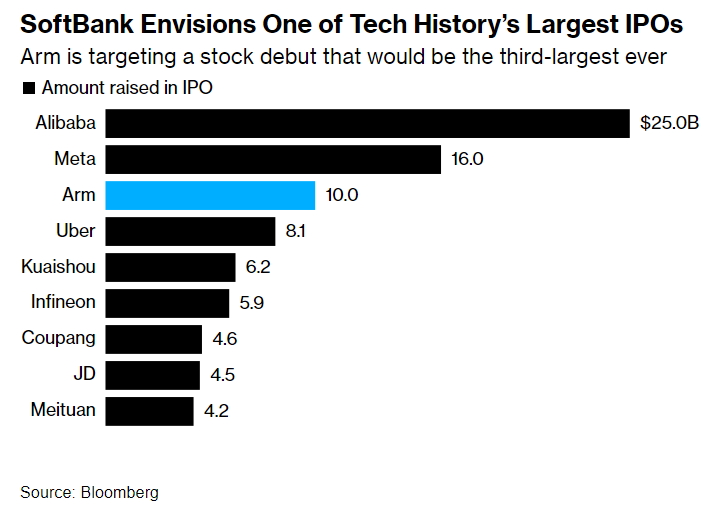

SoftBank’s Arm files IPO registration statement

Earlier this week, Arm Holdings Ltd. filed its F-1 registration statement ahead of its planned initial public offering (IPO) on the Nasdaq under the ticker “ARM.”

The firm’s stock market debut will be the 1st major test for the IPO market in years as the company looks to raise $10 billion at a $60-70B valuation, which would mark the 3rd largest tech IPO ever.

Arm’s chip designs are found in nearly all the world’s smartphones – some estimates say as high as 99% of all devices – including Apple iPhones and most Android devices. Arm sells the blueprints needed to design microprocessors and then licenses technology known as instruction sets that dictate how software programs communicate with those chips.

The lofty valuation’s being discussed are not for the faint of heart. With $2.68 billion in revenue, Arm would IPO at roughly 22-26x price-to-sales, elevated but comparable to most of its peer group. The AI chips market is red hot right now, as compared to the 2.5x P/S multiple for the S&P 500 index.

There is one complication, however – the company’s labyrinthine relationship with China, its 2nd largest market. 24.5% of Arm’s revenue comes from an independent entity it does not control – called Arm China – but nonetheless relies on to access China’s massive smartphone market. Arm China has the exclusive rights to distribute Arm’s technology in the country. Bloomberg estimated that Arm’s registration statement spent more than 3,500 words to explain the risks it faces in China.

On a brighter note, a successful launch for Arm could lead to a reboot of the startup IPO market which has significantly slowed down since the record blitz back in 2020-2021.

Source: SEC, Bloomberg, Stock Analysis, Yahoo Finance, Multpl

Looking to semis for leadership

Speaking of semis, the semiconductor industry is a valuable proxy for assessing the health of the global economy and equity markets worldwide.

The importance of these companies cannot be overstated, as they produce the technology that drives the world economy. When semiconductors are trending higher, it tends to indicate that the market and overall economy are in good shape.

The chart below shows the VanEck Semiconductor ETF (SMH), still up +47% year-to-date despite a near 10% decline in August:

After testing a key polarity level last week (#2 above), SMH has turned higher this week – avoiding a potential breakdown sequence should semis have lost that critical level.

The next level of interest, $159-$161, represents the 2021 highs and July 2023 highs (#1 above); a move above would represent a potential breakout and be bullish for equities. Given Nvidia Corp (NVDA) represents 20% of SMH, expect SMH to continue pushing higher after tonight’s earnings report sent Nvidia to new all-time highs in after-hours trading.

Source: Kimble Charting Solutions, VanEck

Global breadth deterioration

Per Hi Mount Research:

The percentage of markets above their 50-day average (blue line below) has dropped to the lowest level since March, while the percentage above their 200-day average (orange line) is at the lowest level of the year.

The lack of expansion in new highs leaves the market more vulnerable to downside moves should the selling pressures in August persist.

Source: Hi Mount Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.