Here comes Santa Claus, right down Santa Clause lane 🎅🎄

The Sandbox Daily (12.22.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

the Santa Claus Rally is here

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.16% | S&P 500 +0.64% | Dow +0.47% | Nasdaq 100 +0.46%

FIXED INCOME: Barclays Agg Bond -0.04% | High Yield +0.09% | 2yr UST 3.505% | 10yr UST 4.163%

COMMODITIES: Brent Crude +2.53% to $62.01/barrel. Gold +2.07% to $4,478.2/oz.

BITCOIN: +0.08% to $88,326

US DOLLAR INDEX: -0.31% to 98.289

CBOE TOTAL PUT/CALL RATIO: 0.85

VIX: -5.57% to 14.08

Quote of the day

“Better to be slapped with the truth than kissed with a lie.”

- Russian Proverb

Here comes Santa Claus, right down Santa Clause lane

Investors have had to contend with plenty of noise in 2025, yet for U.S. stock owners, it’s been another banner year of performance following back-to-back +20% returns in 2023 and 2024.

Stocks now enter the final stretch of the year hoping for a little Christmas magic from Santa.

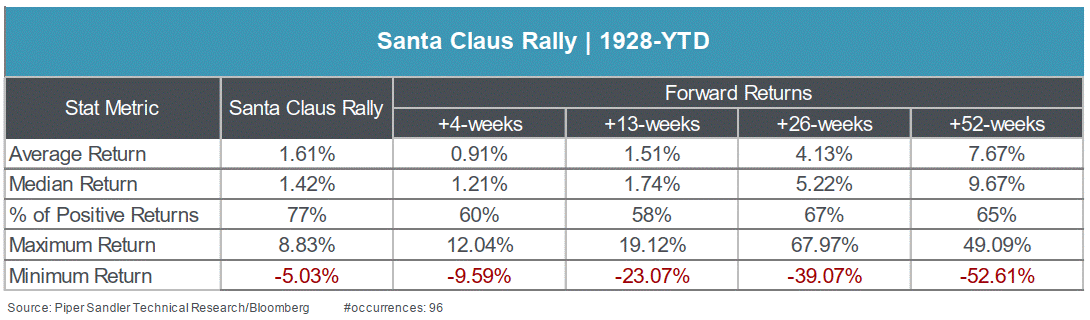

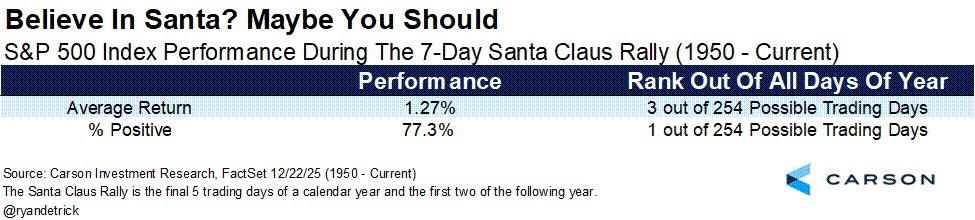

Yale Hirsch introduced the ‘Santa Claus rally’ observation in the early 1970s via his Stock Trader’s Almanac. The “Santa Claus rally” refers to the S&P 500’s tendency to rise during the last five trading days of a calendar year and the first two trading sessions of the new year.

This year, the Santa Claus Rally runs from December 24th to January 5th.

The S&P 500 has generated average returns of +1.6% over the 7-day trading period – compared to only a +0.2% average return for all rolling seven-day returns – closing higher 77% of the time.

That’s good for the third best 7-day period of the whole year (since 1950).

However, Santa does make mistakes from time to time. As Yale Hirsch famously stated: “If Santa should fail to call, the Bears will come to Broad & Wall.”

For those who aren’t familiar, the New York Stock Exchange is located in downtown Manhattan at the corner of Broad Street and Wall Street.

While it doesn’t happen often, failure for the jolly ol’ fellow to deliver the Santa Claus Rally to Broad & Wall can precede some difficult markets (particularly down Januarys) or times when stocks could be purchased at lower prices later in the year.

These seasonal buying patterns provide us with signals. Are stocks behaving as we expect them to? Or are stocks diverging from strength?

Should stocks do well – as expected – then ho hum carry on.

Should stocks stumble – especially in light of the recent tech trade sputtering into year-end – then we have something to talk about.

Your move, Santa !

Sources: LPL Financial, Piper Sandler, Ryan Detrick

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)