High-income earners are stressed, plus credit market revival and job openings

The Sandbox Daily (7.2.2024)

Welcome, Sandbox friends.

The S&P 500 index closed above 5,500 for 1st time in its history, Fed Chair Powell says the data suggests inflation is back on a downward path, and the Drug Enforcement Agency has labeled Citigroup the favorite bank for money launderers.

Today’s Daily discusses:

even high-income earners are stressed about their finances

once fallen angels, now rising stars

job openings unexpectedly rise

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.01% | S&P 500 +0.62% | Dow +0.41% | Russell 2000 +0.19%

FIXED INCOME: Barclays Agg Bond +0.33% | High Yield +0.27% | 2yr UST 4.749% | 10yr UST 4.436%

COMMODITIES: Brent Crude -0.03% to $86.57/barrel. Gold -0.01% to $2,338.6/oz.

BITCOIN: -1.48% to $62,044

US DOLLAR INDEX: -0.20% to 105.694

CBOE EQUITY PUT/CALL RATIO: 0.56

VIX: -1.55% to 12.03

Quote of the day

“Living with uncertainty becomes easier once we accept that the magic certainty button doesn’t exist. It’s not real, so don’t bother looking or hoping for it.”

- Carl Richards, The Behavior Gap

Even high-income earners are stressed about their finances

Americans are feeling the pressure of the rapid and cumulative cost of living increases in the past few years, and even high earners – those earning six figures – are feeling increasingly concerned about their ability to make ends meet, according to a recent Fed survey.

That’s why even wealthier Americans are cutting back on discretionary spending, including eating out and entertainment, or opt for cheaper store brands – “trading down” – when shopping retail or groceries.

The Fed survey found that nearly a third (30.8%) of those earning $100k-$150k per year are concerned about their finances in the short term (the next 0-6 months). This is up from 21.3% just one year ago, indicating that the cost-of-living increase is really starting to take hold. Similar results apply for the $150k+ cohort, as well.

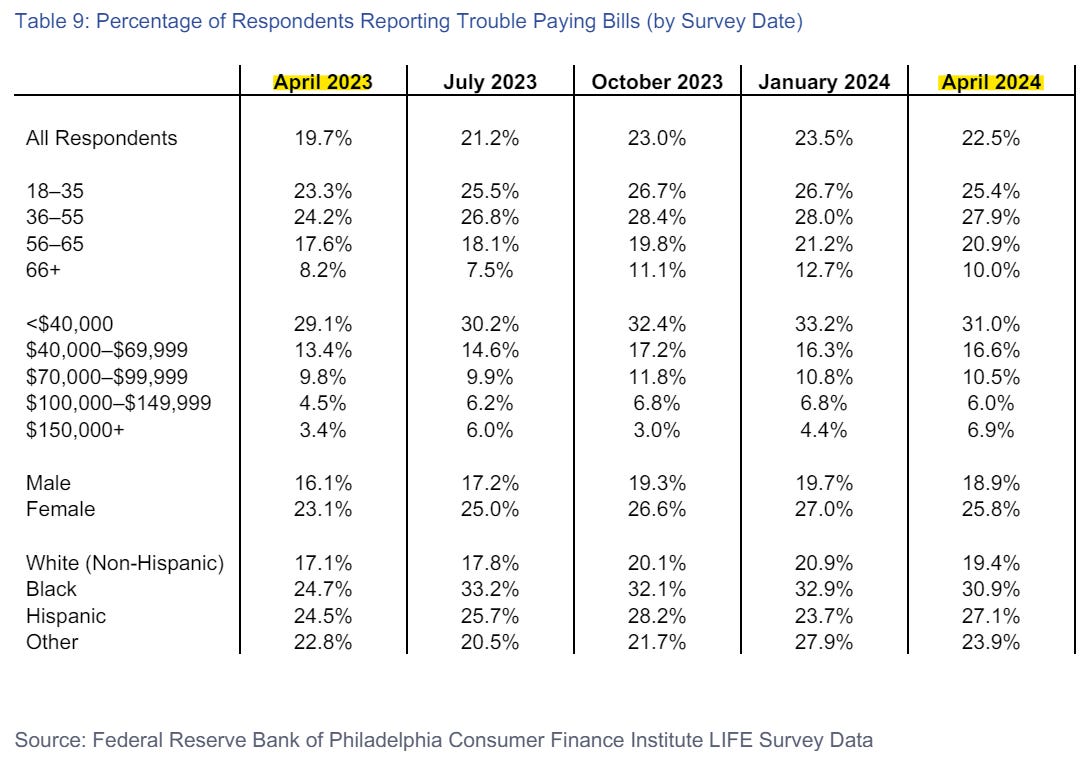

What about Americans worried about paying bills immediately due?

Versus this time last year… higher across every age bracket, every income cohort, for both males and females, and across all ethnicities. See below.

Let’s be clear, if Americans struggle to make ends meet, that’s a problem, and it doesn’t matter if they bring home a high or low income.

For the past year or two, many lower-income households have felt these effects more acutely, while higher-income households absorbed these price shocks a bit better. Perhaps the inflation chickens are coming home to roost now, which does not bode well for America’s core economic growth engine – consumer spending.

Source: Federal Reserve Bank of Philadelphia

Once fallen angels, now rising stars

The COVID-19 pandemic created widespread financial uncertainty, unleashing an unprecedented wave of corporate borrowers being downgraded by the major credit rating agencies from Investment Grade to High Yield – or those issues called “fallen angels.”

By Goldman’s count, roughly $230 billion in outstanding debt was downgraded from Investment Grade to High Yield in 2020.

Since then, ratings momentum has been positive as many of these so-called “fallen angels” have recovered financially. From 2021 to 2024, over $350 billion in notional has been upgraded from High Yield to Investment Grate (“rising stars”), dwarfing the $75 billion in notional outstanding downgraded during the same time frame.

The revival in credit markets is a positive in many ways, as contagion from defaults risks have diminished, lenders avoid painful writedowns, and borrowers patiently await blue skies ahead as C-Suites manage through a difficult higher-for-longer environment.

Source: Goldman Sachs Global Investment Research

Job openings unexpectedly rise

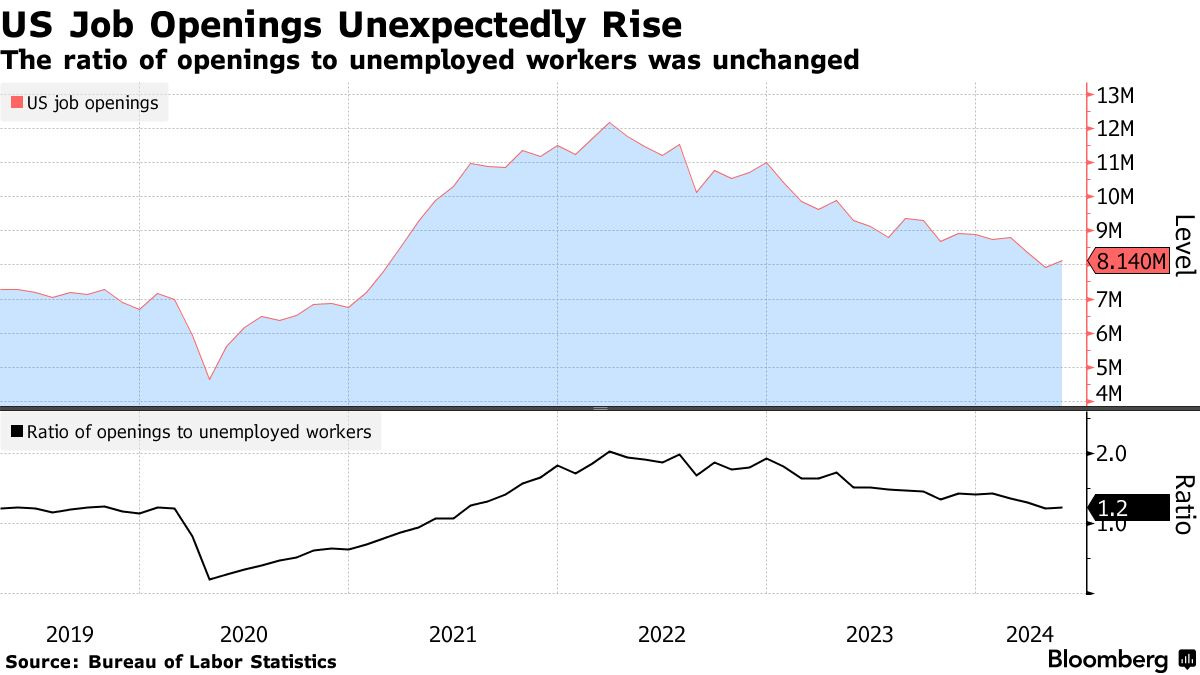

Each month, we turn to the Labor Department's Job Openings and Labor Turnover Survey (JOLTS) to understand the ebbs and flows of what's really happening among businesses and their workers.

Job openings across America increased slightly to 8.14 million in May (+2.8%) from April’s downwardly revised 7.92 million reading, its 1st increase in 3 months and higher than economists expected.

Job openings are down -13% from one year ago and down -33.2% from the peak level in March 2022.

The number of job openings has steadily declined since hitting the cyclical peak of 12.18 million vacancies in March 2022 when the Federal Reserve initiated its tightening cycle, but the number of job openings still remains ~25% higher than the 5-year period average pre-COVID.

The other key metric in today’s report, the ratio of job-openings-to-unemployed-Americans, was unchanged from the prior month at 1.2 – well below the cycle peak of 2.03 and more or less in line with the general pre-pandemic levels and the 1.23 level in February 2020.

In simpler terms, this means there are 8.14 million job openings and 6.65 million unemployed workers.

Elsewhere, the Quits Rate was largely unchanged in May at 2.2% – where it has been for the past 7 months and basically in line with its pre-pandemic level. The peak of this cycle topped at 3.0%. See chart below.

This reflects reduced labor turnover and less worker confidence in their job prospects. It also implies a continued squeeze of the pay premium of job switchers over job stayers, which should contribute to overall wage growth moderation in the near-term.

The Fed is closely watching the progress of labor demand/supply rebalancing, and today’s report shows the labor market has certainly continued to move toward better balance. It suggests that the Fed can hold monetary policy steady for now, allowing higher-for-longer interest rates to squeeze inflation without causing a recession.

Importantly, these monthly JOLTS reports illustrate the kind of cooling that the Federal Reserve would like to see, with demand for workers slowing through fewer openings rather than outright job losses.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, Advisor Perspectives

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.