Historic U.S. credit rating downgrade (or is it?), plus small-caps, BofA removes recession call, and ADP jobs report

The Sandbox Daily (8.2.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

Fitch downgrades U.S. credit rating, citing “erosion of governance”

small-caps the next leadership group?

Bank of America takes recession call off the table

ADP Payroll Report comes in hot

Let’s dig in.

Markets in review

EQUITIES: Dow -0.98% | Russell 2000 -1.37% | S&P 500 -1.38% | Nasdaq 100 -2.21%

FIXED INCOME: Barclays Agg Bond -0.24% | High Yield -0.43% | 2yr UST 4.883% | 10yr UST 4.086%

COMMODITIES: Brent Crude -1.72% to $83.45/barrel. Gold -0.39% to $1,971.1/oz.

BITCOIN: -0.23% to $29,112

US DOLLAR INDEX: +0.33% to 102.642

CBOE EQUITY PUT/CALL RATIO: 0.58

VIX: +15.51% to 16.09

Quote of the day

“What you are trying to do as an investor is that you are trying to exploit the fact that fewer things will happen than can happen.”

- Bill Miller, Legg Mason

Fitch downgrades U.S. credit rating from AAA to AA+

On Tuesday, Fitch Ratings service said it was lowering the United States country's issuer default rating (IDR) to 'AA+' from the highest score available of 'AAA'.

Here are the meat and potatoes from the agency’s statement that explain the decision:

This Fitch announcement brings back memories of the Standard & Poor's downgrade back in August 2011 over the same concerns of an incapable government. In the summer of 2011, the S&P 500 fell sharply only to recover into year-end and into 2012. So, in hindsight, while scary in the moment, the S&P downgrade caused short-term volatility but did not derail the structural strength in the underlying stock market.

Jared Bernstein, chairman of President Biden’s Council of Economic Advisers, used these words on CNBC this morning to describe the decision: cognitive dissonance, bizarre, inept, arbitrary, absurd, strange, puzzling.

Here is LPL Research’s take on the downgrade which puts a neat little bow on everything:

The rating agency warned two months ago that a downgrade was an option and, frankly, has been warning of a downgrade for years… While not necessarily wrong in its assessment, the rating downgrade will likely not have an impact on U.S. government debt or markets broadly.

Sure, the U.S. total debt load as a percentage of GDP is alarming and reaffirms Fitch’s assessment, but curing that issue is a multi-generational problem. Moreover, Fitch’s decision is not based on new information, nor does it reflect a difference in opinion with regards to the current U.S. debt policy.

Bottom line: the downgrade is unlikely to significantly impact the country's creditworthiness or reputation. Treasuries are still the world's highest quality, safe haven asset – the closest thing to “risk-free” available to the market – while the U.S. dollar is the dominant reserve currency. Demand for that is unlikely to change. The bond market’s muted reaction after the announcement confirms as much.

Source: Fitch Ratings, Reuters, UBS

Small caps the next leadership group?

Small-caps are back at a critical level of overhead supply for a 3rd time, having tested and failed at these price levels twice before – first in August 2022 when last year’s summer rally ran out of steam and again in February 2023.

This asset class has been effectively rangebound for 17 months, building a base off the pre-COVID highs.

Relative to the S&P 500 (SPY), the small-cap index (IWM) is holding support at a logical level (former lows of 2020) as the market looks to broaden out down the cap table from large companies to small companies.

If small caps are about to enter a fresh period of outperformance, this would be a logical place to start.

Just remember that a significant number of constituents in this index have negative earnings, a trend that has persisted and increased for decades.

So if your base case is a recession (more on that below), expect selling pressure to mount in this area of the market ahead of most others.

Source: Steve Strazza, Apollo Global Management

Bank of America no longer forecasting U.S. recession

Bank of America has joined the Federal Reserve in reversing its recession call amid growing optimism about the economic outlook.

Economists at the bank scrapped their forecast, stating that “recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the U.S. economy… Growth in economic activity over the past three quarters has averaged 2.3%, the unemployment rate has remained near all-time lows, and wage and price pressures are moving in the right direction, albeit gradually.”

Add Bank of America to the growing chorus that believe a “soft landing” is achievable.

Source: Bloomberg

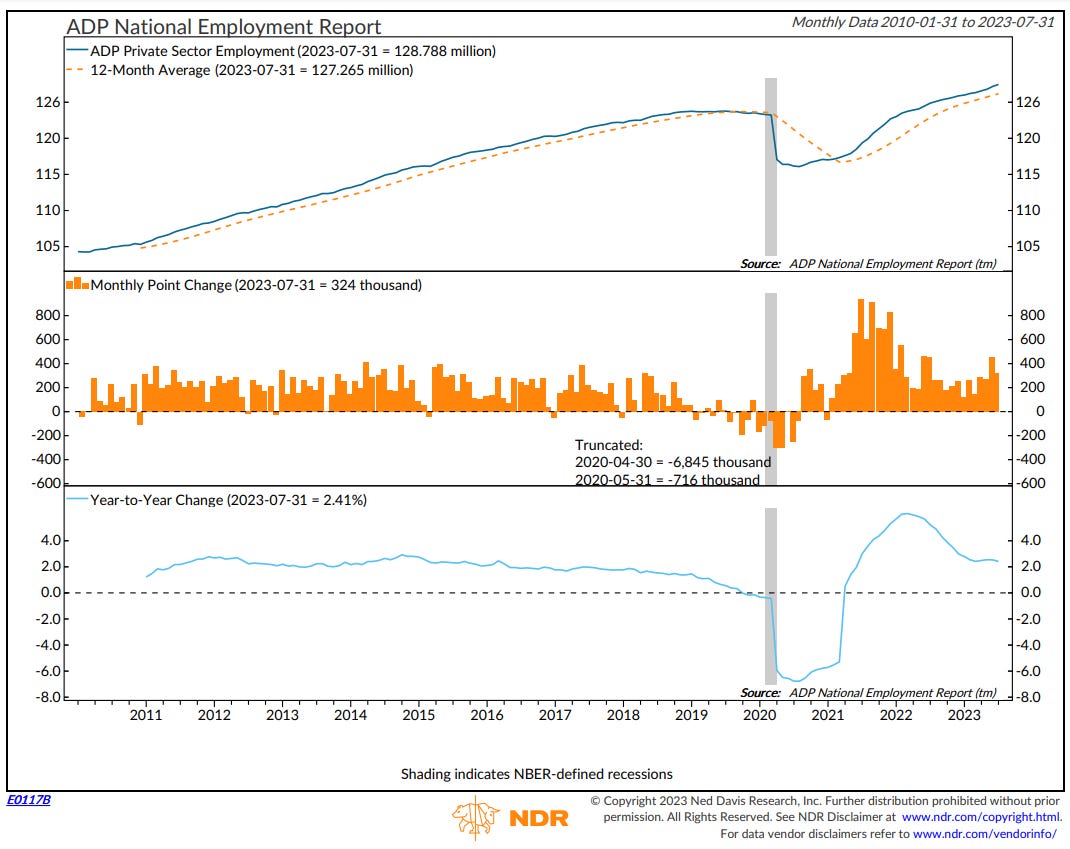

ADP National Employment Report comes in hot

The ADP National Employment Report (NER) showed that U.S. private employers increased payrolls by 324,000 in July (2nd biggest increase this year) and annual pay was up +6.2% year-over-year – just more evidence that the private sector job market remains hot.

The NER, part of a collaboration with the Stanford Digital Economy Lab, is built on the payroll transactions of more than 25 million U.S. workers.

Both the 3-month and 6-month average payroll gains continued to move up, with monthly job gains reaccelerating since the 1st quarter swoon– indicating trend improvement in job growth.

Markets came under some pressure after this jobs report blew away expectations (324k vs. 190k expected).

But is today’s ADP report thesis changing? No. In fact, keep in mind the ADP report had been reworked last year because the prior version often missed payrolls by such a sizable margin – so much so that Fundstrat’s Tom Lee has publicly stated that his prior firm’s economists (JPMorgan) labeled the ADP report a “random number generator.” Ouch!

Source: ADP Research Institute, Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice or as buy and sell recommendations. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.

Which end of day Gold price are you using??

Hi Blake,

I've been reading that the two consecutive quarters of negative GDP growth in Q1 and Q2 of 2022 do not necessarily indicate a recession. I understand that the labor market is tight, but I'm not sure how that relates to the definition of a recession. Could you please explain why two consecutive quarters of negative GDP growth do not always mean that we are in a recession?

Thanks,

Mike