Historical context of current market cycle, plus corporate tax rates, housing affordability, and the bond slump

The Sandbox Daily (4.8.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

where in the cycle is Carmen Sandiego?

U.S. corporate tax rates

housing affordability

ongoing slump in bonds

Let’s dig in.

Solar Eclipse 2024

The kids were PUMPED !

Markets in review

EQUITIES: Russell 2000 +0.50% | Dow -0.03% | S&P 500 -0.04% | Nasdaq 100 -0.05%

FIXED INCOME: Barclays Agg Bond -0.09% | High Yield +0.23% | 2yr UST 4.795% | 10yr UST 4.422%

COMMODITIES: Brent Crude -0.75% to $90.49/barrel. Gold +0.51% to $2,357.4/oz.

BITCOIN: +3.74% to $71,647

US DOLLAR INDEX: -0.14% to 104.151

CBOE EQUITY PUT/CALL RATIO: 0.71

VIX: -5.24% to 15.19

Quote of the day

The three stages of career development are:

I want to be in the meeting.

I want to run the meeting.

I want to avoid meetings.

- Jay Ferro, Angel Investor

Where in the cycle is Carmen Sandiego?

Now that we are 18 months into this bull market cycle and up +45% from the October 2022 low, many investors are asking how much is left in the tank. How long can this broadening bull continue?

As the chart below shows, cyclical bull markets can be as modest as 40% or as robust as 100%+, lasting from a few months to several years. In fact, over the past 100 years, the median bull market has produced a gain of 90% spanning roughly 30 months in duration.

By that measure, there should be some life left for this cycle.

Stated differently, we can view these cyclical bull markets over time as a clock.

If 12:00 is the start of the cycle, compared to the longest cycles in history, it’s only around 3:00pm right now.

Source: Jurrien Timmer

U.S. corporate tax rates are now more competitive

Today’s statutory corporate tax rate is low compared to historical levels.

Prior to 2017, the United States had the highest corporate tax rate among OECD countries at 35%. The Tax Cuts and Jobs Act legislative bill passed in 2017 lowered the corporate rate to 21%, placing the U.S. in the lower half of OECD countries.

Of course, the effective tax rate that corporations pay is typically far lower than the statutory rate due to a labyrinth of tax breaks and deductions. Naturally, this is a politically complex topic.

On the one hand, corporations are maximizing their tax efficiency based on the existing tax code, which ultimately is good for employees, shareholders, and the overall economy. On the other hand, this can be viewed as corporations “not paying their fair share,” especially when they are highly profitable, buying back shares and keeping cash overseas.

This is one motivation for the 15% Corporate Alternative Minimum Tax (CAMT) for companies with roughly $1 billion in profits included in the 2022 Inflation Reduction Act.

Regardless, the statutory corporate tax rate has been at this level or higher for the past 80ish years (i.e. the post world war environment) during which markets have performed extremely well due to business cycle expansions. Thus, while taxes affect individuals and business owners, it’s important to not overreact when it comes to investment strategies.

Source: Clearnomics, Bloomberg, FA Magazine

Housing affordability is a major problem

Many homebuyers have been priced out of the market due to soaring home prices and high interest rates.

The graphic below shows the dwindling supply of affordable U.S. homes.

In 2023, only 16% of homes were affordable* in America, falling from 21% in 2022.

* An affordable listing defined by Redfin is one with a monthly mortgage payment no more than 30% of the median monthly income of that county.

Source: Visual Capitalist

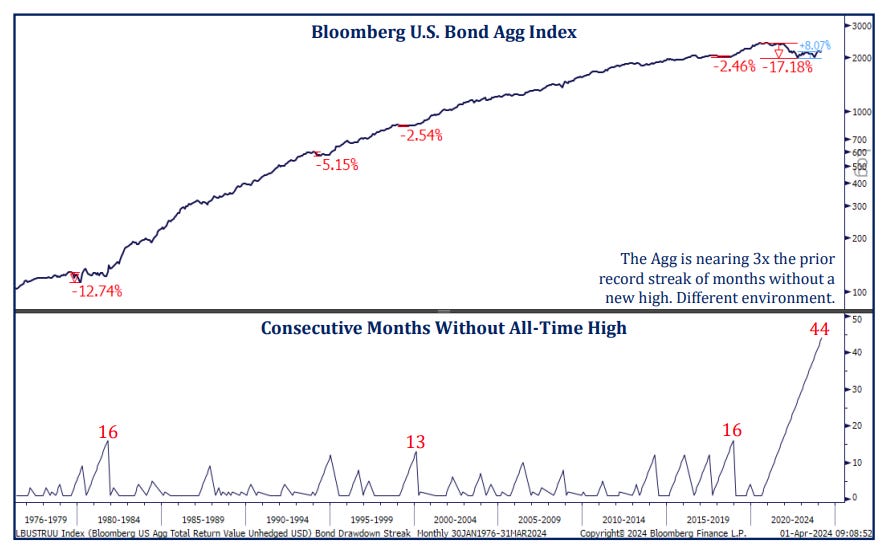

Bond slump continues

Bonds have had a tough go of it – that’s what happens when central banks hike interest rates at the fastest and highest clip in decades, maybe ever (depending on geographic region).

Before 2022, the worst bond rout in the history of the Bloomberg U.S. Aggregate Bond Index was -3%. Then the Mike Tyson uppercut of 2022 hit bonds in right in the mouth, returning -13%.

Up until 2021-2022, bonds had never endured back-to-back calendar year losses. Well, that changed too.

After regaining some of their mojo in 2023, the push higher in yields in 2024 is causing another slump in bond land.

The highly-tracked bond index is now 44-months removed from its last all-time high, approaching 3x the prior record of 16-months.

Source: J.P. Morgan Guide to the Markets, Todd Sohn

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Cloudy up here in Toronto - didn't see a damn thing!

🌘