Historical stock performance when the Fed cuts interest rates, plus asymmetric opportunities in bonds and central bank easing

The Sandbox Daily (7.18.2024)

Welcome, Sandbox friends.

The European Central Bank kept their key interest rate steady following the June cut, President Biden faces mounting pressures from inside his Democratic party to drop his re-election bid, and the Paris mayor Anne Hidalgo swims in the Seine River (illegal since 1923) to prove the water is safe for the upcoming Olympic games.

Today’s Daily discusses:

stock performance over the easing cycle

the impact of a 1% rise or fall in interest rates

central banks: moving closer to net accommodation

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.48% | S&P 500 -0.78% | Dow -1.29% | Russell 2000 -1.85%

FIXED INCOME: Barclays Agg Bond -0.27% | High Yield -0.20% | 2yr UST 4.462% | 10yr UST 4.185%

COMMODITIES: Brent Crude -0.68% to $84.53/barrel. Gold -1.03% to $2,431.2/oz.

BITCOIN: -0.72% to $63,677

US DOLLAR INDEX: +0.03% to 104.208

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: +10.01% to 15.93

Quote of the day

“You’ve got to find what you love. And that is as true for your work as it is for your lovers. Your work is going to fill a large part of your life, and the only way to be truly satisfied is to do what you believe is great work. And the only way to do great work is to love what you do. If you haven’t found it yet, keep looking. And don’t settle. As with all matters of the heart, you’ll know when you find it. And, like any great relationship, it just gets better and better as the years roll on. So keep looking. Don’t settle.”

- Steve Jobs, Apple CEO at the 2005 Stanford commencement speech

Stock performance over the easing cycle

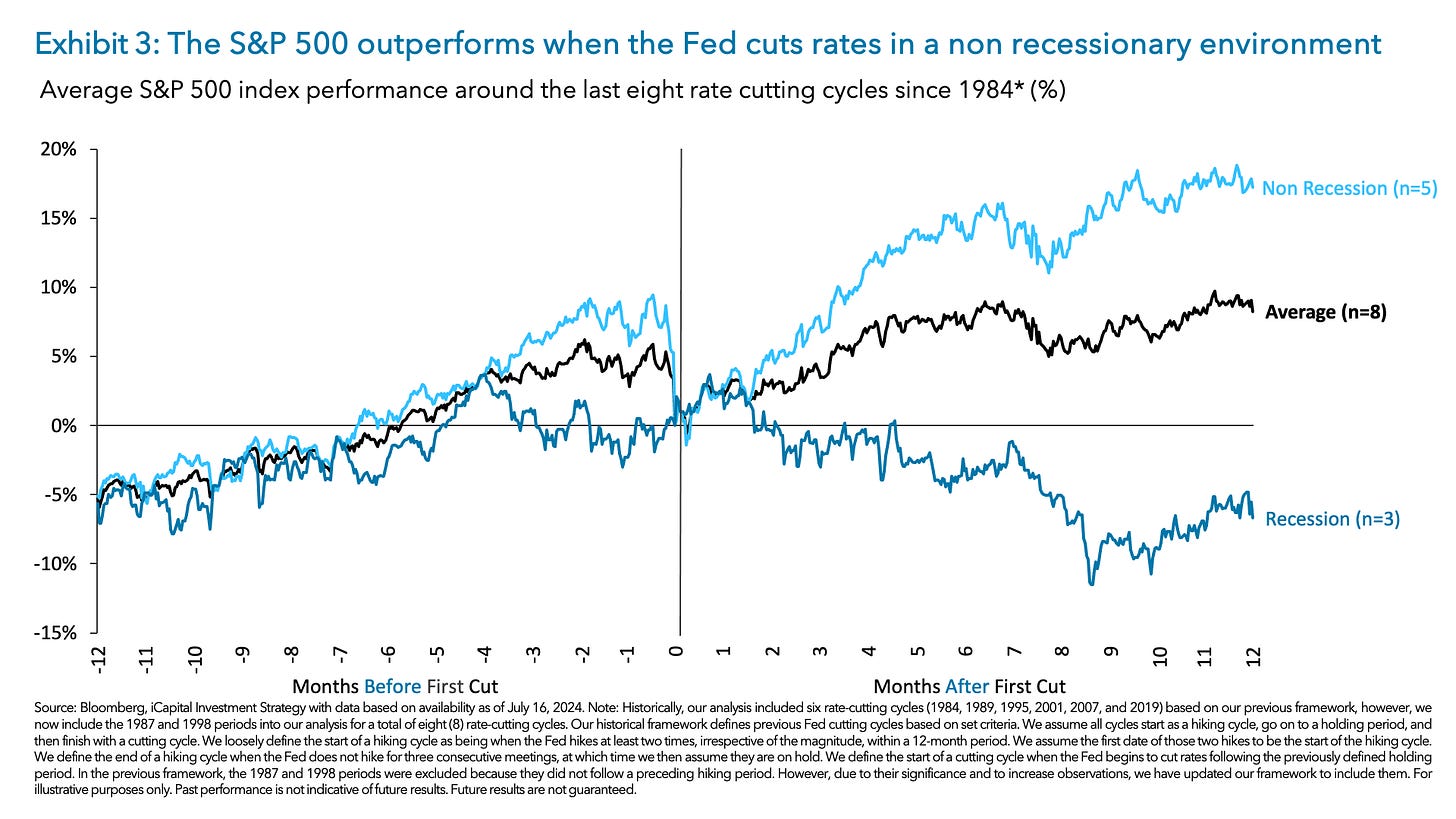

With the all-important Fed meeting on July 31, investors are reviewing what has happened to the stock market around 1st Fed rate cuts and during easing cycles – given the expectation that Fed Chair Jerome Powell will signal the 1st rate cut is coming in September.

Stocks, as represented by the S&P 500 index, have generally rallied in the 3-6 months leading up to the 1st rate cut, which makes intuitive sense because the market is a forward-looking discounting mechanism.

After a short period of consolidation around the interest rate policy change itself, stocks then tend to rally for 6-7 months with a mean gain of ~9-10%.

The key for the market and investor’s expectations will be the risk of recession.

Assuming the base case of no-recession plays out in 2024 and 2025, the market should continue to move higher – using historical analogs as a guide.

For our more data-driven readers, here is the underlying data over the past 12 easing cycles from start to finish.

Source: iCapital, Ned Davis Research

The impact of a 1% rise or fall in interest rates

When interest rates rise by 1%, bond prices tend to fall. The inverse is also correct; when interest rates fall by 1%, bond prices rise.

This inverse relationship between interest rates and bond prices is known as interest rate risk.

But these relationships are not exactly 1-to-1 – things like duration, convexity, and other nerdy input factors must be considered, but that’s for another discussion at a different time.

In the graphic below, J.P. Morgan captures this relationship between bond prices and interest rates in rather simple mathematical terms, showing the asymmetric movement in bond returns at these higher interest rate levels.

Assuming a parallel 1% move in interest rates higher and lower from current rates, here is how different sectors across fixed income would perform.

For example: a 1% rise in rates would cause Investment Grade Corporate bonds to fall -1.8%, while a 1% decline in rates would create a positive return of +12.2%.

This asymmetric risk/return for bonds is why so many bond managers are giddy about the forward prospects in credit and interest rate sensitive instruments.

Source: J.P. Morgan Guide to the Markets

Moving closer to net accommodation

Over the last several months, many major central banks have pivoted towards interest rates cuts – many doing so for the 1st time since the pandemic.

The share of the world’s central banks in easing cycles has now climbed to 41%, the highest since March 2022.

As shown in the cutout table in the chart below (see the blue arrow), when more than half of the world’s central banks are in easing cycles, it’s historically been a bullish condition for global equities. Equity gains are substantially higher and stronger when more banks are doing QE than not.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.