History is favorable this time of year, plus oil's slide and 2024's economic strength

The Sandbox Daily (9.30.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

history is favorable this time of year

look to China to reverse oil’s slide

where is the stress?

Let’s dig in.

Markets in review

EQUITIES: S&P 500 +0.42% | Nasdaq 100 +0.26% | Russell 2000 +0.24% | Dow +0.04%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.07% | 2yr UST 3.645% | 10yr UST 3.787%

COMMODITIES: Brent Crude -0.29% to $71.76/barrel. Gold -0.49% to $2,655.1/oz.

BITCOIN: -3.17% to $63,746

US DOLLAR INDEX: +0.38% to 100.765

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -1.36% to 16.73

Quote of the day

“Sometimes you have to play a long time to be able to play like yourself.”

- Miles Davis

History is favorable this time of year

After the seasonally weak market period of August and September, typical seasonal headwinds could shift into tailwinds as stocks have historically gained ground in the 4th quarter – starting with October.

October’s average gain since 1950 for the S&P 500 index is +0.96%, positive 60% of the time. It’s also the 3rd and 4th best performing month over the past 10 and 20 years, respectively.

In fact, the October-November two-month period is historically one of the strongest periods on the calendar over any time frame.

And when you review the 4-year Presidential Election cycles going back to 1950, the upcoming period shows history favors more strength – see the blue box below.

The average gain for the 4th quarter of an election year is +2.5%, positive 83% of the time.

At risk of stating the obvious, it’s important to remember that only price pays. These seasonal charts are just a roadmap for how humans have behaved historically.

We use these tools to put the environment into context, similar to sentiment or positioning data.

Source: LPL Research, Ryan Detrick

Look to China to reverse oil’s slide

Crude oil prices peaked at $95 a barrel roughly one year ago. More recently, they were as high as $85 in July.

Today, prices are roughly $70 and testing long-term support.

With rising geopolitical tensions in the Middle East, why have oil prices fallen so much?

Much of the weakness can be attributable to softer demand from China.

Here is the International Energy Agency (IEA) in their most recent September monthly report:

And yet, the tides could be changing.

The immediate response from commodities – and, in turn, oil – was quite constructive to China’s recently announced stimulus measures, which has the potential to positively impact the demand side of the equation.

Crude prices have been weak historically when most China data has been disappointing, which has been the case for most of their covid-19 reopening.

If the stimulus measures lead to more positive economic output, China could become less of a headwind for crude oil.

Offsetting the potential boost in Chinese demand is rising supply from the Organization of Petroleum Exporting Countries (OPEC) and its allied nations, especially if de facto leader Saudi Arabia decides to ramp up production into year-end.

Source: All Star Charts, International Energy Agency (IEA), Ned Davis Research

Where is the stress?

Liquidity is abundant, the stock market is making one all-time high after another, and credit spreads are tight.

After two years of a strong run for the bulls, it’s prudent to look closely for signs of credit distress across the economy – but nothing glaringly stands out.

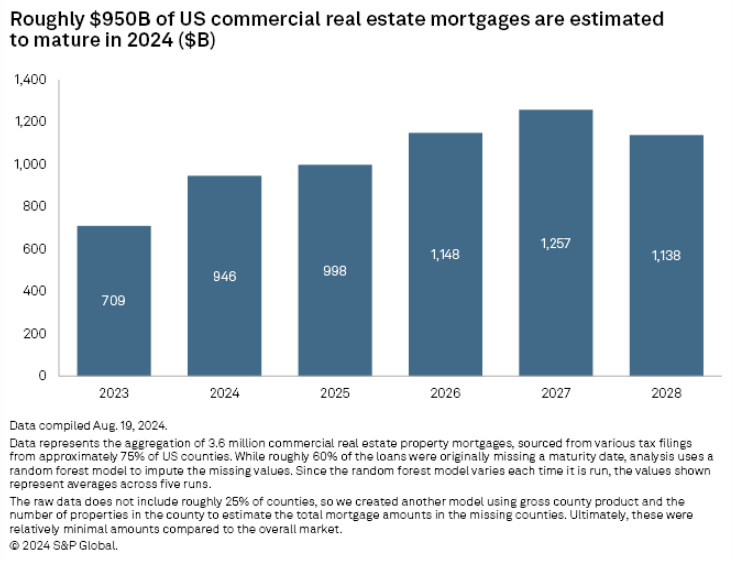

Commercial real estate loans bear watching, but that house of cards may not be as threatening as some fear.

After two years of highly restrictive monetary policy and a slowdown in credit creation, the Financial Conditions Index – a scorecard using market-based indicators to understand if the economy is tighter or looser than normal – shows the current environment is back to the levels from early 2022, a time when the Federal Reserve’s benchmark interest rate was near zero that nourished rallies in assets like non-fungible tokens (NFTs), non-profitable tech companies (hello Cathie Wood), and meme stocks.

And while household finances for the lower deciles of the income distribution are not as comfortable as they were two years ago, aggregate debt ratios remain in comfortable ranges.

Meanwhile, manufacturing and residential housing have been two of the most acutely impacted corners of the economy, but with the tour de force of global synchronous easing that’s taking shape in 2024 and 2025, many expect a mid-cycle revival contributing to economy activity.

Like most things, confidence underpins much of the activity, capital allocation decisions, and risk management throughout a credit cycle – and there is scant evidence pointing towards contraction.

What does bear watching is the easing cycle ahead of us has no close historical precedent. Central banks typically reduce rates when they need to support the economy through some sort of stress event. Cutting rates to secure a soft landing will create unique challenges for both deciding and communicating changes to policy.

Source: S&P Global, RSM, Brookings Institute, The Daily Shot

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: