Housing affordability, plus sector reclassifications, the inversion, and HY maturity schedule

The Sandbox Daily (3.7.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

housing affordability at lowest level in over a decade

assessing the March 17th GICS reclassification

a bond market recession signal is getting even louder

maturity schedule for High Yield credit

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 -1.11% | Nasdaq 100 -1.22% | S&P 500 -1.53% | Dow -1.72%

FIXED INCOME: Barclays Agg Bond -0.13% | High Yield -0.71% | 2yr UST 5.006% | 10yr UST 3.964%

COMMODITIES: Brent Crude -3.54% to $83.13/barrel. Gold -1.91% to $1,819.1/oz.

BITCOIN: -1.65% to $22,046

US DOLLAR INDEX: +1.22% to 105.627

CBOE EQUITY PUT/CALL RATIO: 0.67

VIX: +5.25% to 19.59

Quote of the day

“If you can't explain it to a six-year-old, you don't really understand it.”

-Albert Einstein

Housing affordability at lowest level in over a decade

Home prices are finally falling after hitting an all-time high in 2022, but ownership is still out of reach for many Americans.

The Atlanta Fed's Housing Affordability Monitor, which compares median home prices and other housing costs with median household income, shows that housing affordability is worse today than during the peak of the 2008 housing bubble. As of December month-end, the median American household would have to spend about 42.9% of their income to afford the median-priced house, according to the index.

Although down slightly from its cycle peak, that is near the highest share since 2006, when the median U.S. household had to spend about 42.0% of their income to afford the median-priced house.

It is also well above the 32.6% share just one year ago; at this rate, the typical American is paying about $607 more per month to own a median-priced home compared to last year.

The rapid decline in affordability stems from the highest mortgage rates in years and steep home prices.

Source: Federal Reserve Bank of Atlanta, Bloomberg, Charlie Bilello

Taking stock of the upcoming March 17th GICS reclassification

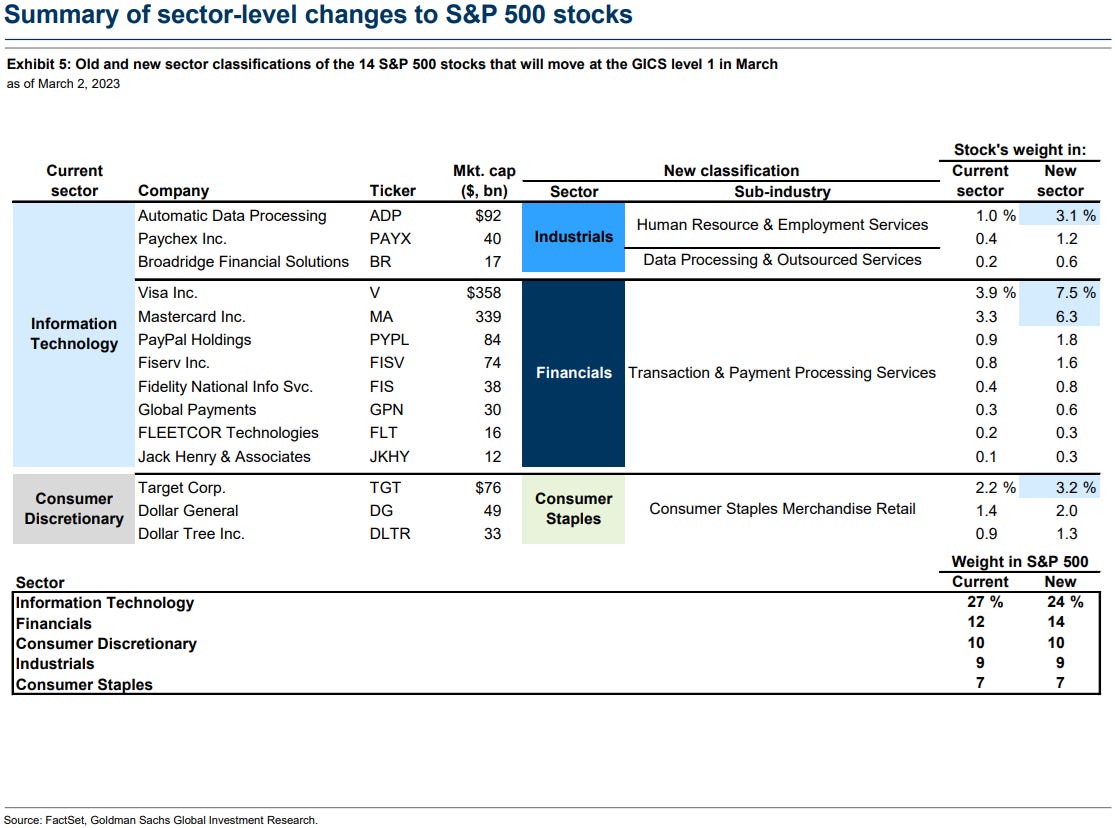

On March 17th, S&P Dow Jones and MSCI – large institutions that run many of the indexes we all know and trade – announced important changes to their Global Industry Classification Standard (GICS).

One major change will dissolve the “Data Processing & Outsourced Services” sub-group within the Information Technology sector and reallocate some of its constituents to Financials. The reclassification will add several growth stocks to the traditional value stocks in Financials. Visa Inc. (V), Mastercard Inc. (MA), and PayPal Holdings Inc. (PYPL), the three largest stocks affected, will comprise 16% of Financials cap and join a new sub-group entitled “Transaction and Payment Processing Services.”

The other significant GICS change are retailers that generate most of their revenue or earnings from staple items like food, household, and personal care products; those companies will be moved from Consumer Discretionary to Consumer Staples Sector. This will directly impact household names like Target Corp. (TGT), Dollar General (DG), and Dollar Tree Inc. (DLTR).

Three takeaways to consider:

The macro correlations of the sector will change modestly, but the sector will remain cyclical and positively correlated with rates.

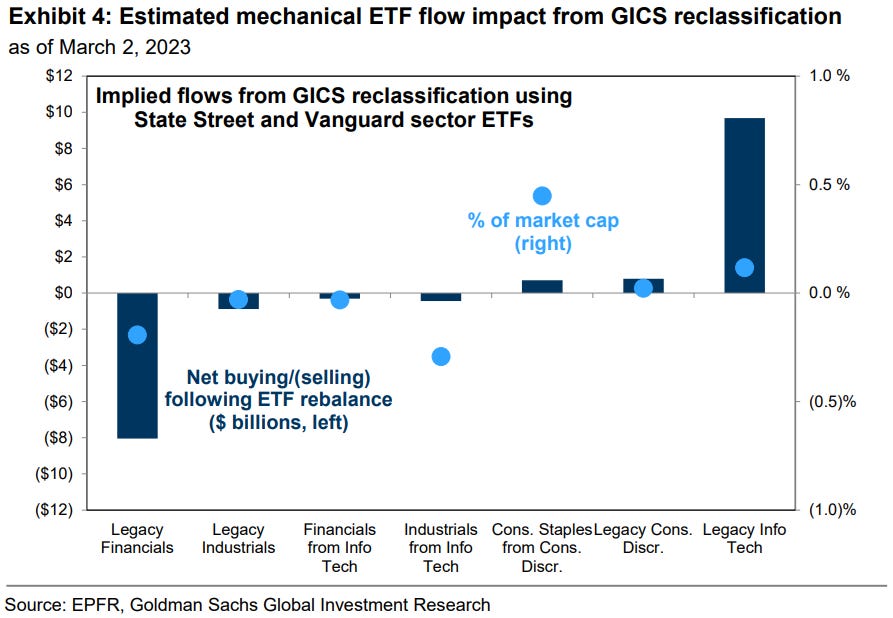

Implied mechanical net ETF flows for stocks across affected sectors would represent less than 1% of market cap (but still involve billions of dollars moving around the market).

Mutual funds would become more overweight Financials and more underweight Tech.

Source: Goldman Sachs Global Investment Research

A bond market recession signal is getting even louder

The 2-year U.S. Treasury yield topped 5% for the first time since 2007. The market’s reaction to today’s perceived hawkish testimony from Federal Reserve Chairman Jerome Powell pushed short-term interest rates even higher as the bond market prices in additional rate hikes in the short term.

This caused the 2-year Treasury note to trade at the widest yield differential above the 10-year note since September 18, 1981 – the curve is now inverted 100 basis points (or 1%).

This inversion of the yield curve often signals upcoming recessions (gray vertical bars below) and is evidence the bond market believes the economy will weaken and begin to shrink, forcing the Federal Reserve to cut interest rates.

Traditionally, in “normal” times, longer-dated bonds yield more than shorter-dated issues, partly owing to the risk associated with holding bonds over a longer duration (term premium) and partly because growth and inflation are projected to be higher over longer time horizons.

Source: Bloomberg, Barron’s Advisor, Bespoke Investment Group

High Yield credit maturity schedule

The record low yields of 2021 enabled companies to lock in low interest rates and push out bond maturities far into the future.

This is one reason that credit markets aren’t seeing distress and spread widening. In fact, after a brief and sharp rise last year, High Yield spreads over equivalent five-year government bonds – understanding the perceived credit risk priced by the bond market – are right back to a level that suggests healthy, normal, functioning markets.

The good news for more leveraged companies is the low yields in 2021 allowed them to lock in financing through 2025 and beyond. A significant wall of maturities for high yield credit won’t arrive until 2025.

Source: Wall Street Journal, Bloomberg

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.