How the Fed’s rate cut impacts you, and Future Proof 2024 🌴🏄♂️

The Sandbox Daily (9.19.2024)

It’s good to be back!

I spent the last few days in Huntington Beach, California at an industry conference called Future Proof. The numbers were mind-blowing: 4,500 attendees, 30,000+ “breakthru” meetings, and over $20 trillion in AUM being represented. My friend JC Parets called it the “best conference in finance.” It is so inspiring to engage directly face-to-face with the highest-performing individuals across our industry – people wholly committed to their work and focused on building a brighter future. Whether its advisors sharing best practices, thought leaders opening the front door to their craft, or vendors presenting how their products and services can help you, there was something for everybody. You want to meet Dan Ives? He’s just walking around in a Hawaiian shirt and a pink flamingo colored jacket (ok, maybe that’s every day). Pick Tom Lee’s brain for 5 minutes? Go ahead and introduce yourself. Get an autographed copy of a national best seller - from the author herself??!? No problem. The wildly popular Animal Spirits pod did not disappoint, as they never do. The parties were fun, too; we’re human after all. The cherry on top? Third Eye Blind closed the whole thing down. The community and enthusiasm was off the charts, and I’m so fortunate for all the relationships I’ve built over the three years attending Future Proof. We’re putting together some fun stuff to share next week on The Sandbox Daily, so more to come on that front.

But, for now, it’s good to be back!

Welcome, Sandbox friends.

Today’s Daily discusses:

how the Fed’s decision impacts you

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.56% | Russell 2000 +2.10% | S&P 500 +1.70% | Dow 1.26%

FIXED INCOME: Barclays Agg Bond +0.01% | High Yield +0.30% | 2yr UST 3.588% | 10yr UST 3.719%

COMMODITIES: Brent Crude +1.56% to $74.80/barrel. Gold +0.60% to $2,614.1/oz.

BITCOIN: +5.82% to $63,201

US DOLLAR INDEX: +0.03% to 100.628

CBOE EQUITY PUT/CALL RATIO: 0.61

VIX: -10.42% to 16.33

Quote of the day

“Opportunities are grains of sand. They slide right past drooping fingers, but an active palm can gather whatever is within reach and shape it into a little castle. It is the act of engaging with the material that gives it shape.”

- James Clear

How the Fed’s decision impacts you

On Wednesday, the Federal Reserve reduced its key lending rate for the first time in four years by a half percentage point – double its more typical quarter percentage cut – lowering the Fed Funds Rate from a target range of 5.25% to 5.50% to a band of 4.75% to 5.00%.

The Fed Funds Rate – the rate at which commercial banks borrow and lend to each other – sets a base for what companies and liquidity providers charge people in the United States for both lending and savings products.

In fact, the highly anticipated move influences all sorts of consumer products for millions of people across the country – such as mortgages, credit cards, and saving rates.

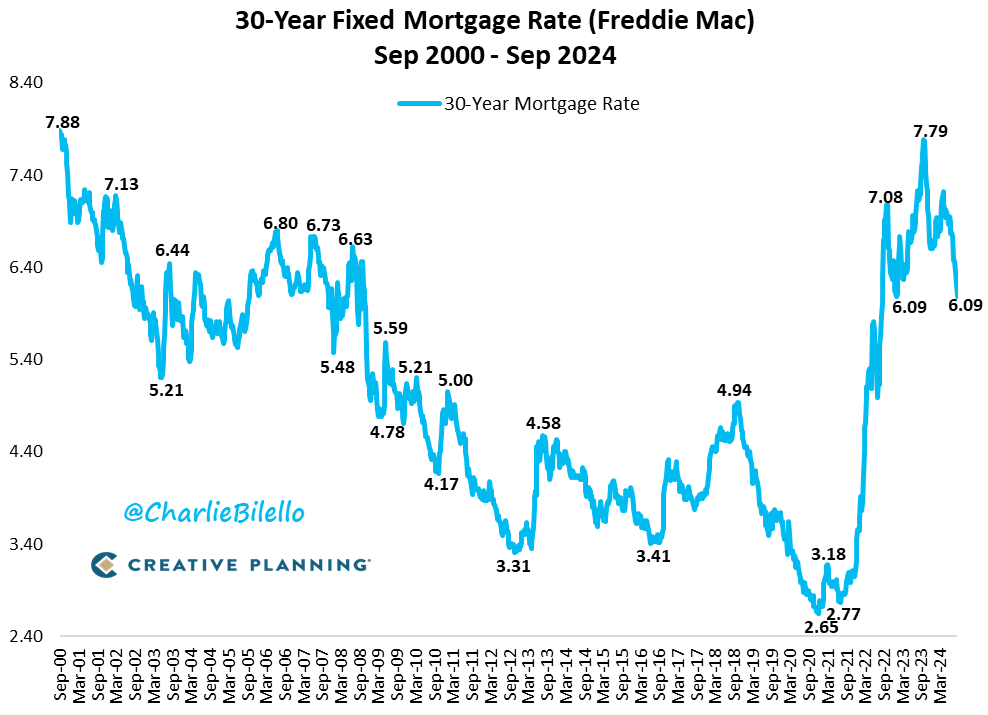

Mortgage rates have already come down in anticipation of the Fed’s decision, and they should continue its downward trend as the central bank further eases policy in the months ahead.

Fed Chair Jerome Powell noted himself that lower mortgage rates could help thaw the residential housing market that has been frozen for the better part of two years.

After all, roughly 75-80% of borrowers are paying a fixed mortgage rate of 5% or less – a full percentage point or more below the current prevailing rate.

The Fed’s rate cut won’t impact a large majority of existing homeowners at current levels, but it will help 1) homebuyers entering the market as financing rates coming down, 2) households with home loans tied to variable rates, and 3) the $380 billion in aggregate outstanding home equity lines of credit (HELOCs).

For many cohorts, affordability has been a real issue. Housing affordability in the post-pandemic era has been near its lowest level since the 1980s and is weighing mightily on home sales. A few rate cuts from the Fed should go a long way on this front.

Mortgages are the biggest consumer debt category at $12.52 trillion, but because the vast majority of outstanding stock is fixed-rate, many people may be looking for reprieve elsewhere.

Credit cards have entered the chat – where the outstanding stock in the United States is $1.14 trillion.

People who carry credit card balances have been crushed under the enormous weight of historically high rates, which makes it even harder to dig out from debt.

But, because credit card rates generally track the Fed Funds Rate, the initial cut should eventually trickle down and lead to lower APRs for those who carry balances. And yet, the bigger impacts will be felt in 2025 and beyond if the Fed continues to push down the cost of borrowing. The cumulative effect will be much more pronounced than any single rate cut.

Per WalletHub’s August Credit Card Landscape Report, the current average interest rate is 23.30% for new credit card offers and 22.76% for existing accounts. Ouch !

Other consumer-facing credit products will be impacted as well, including auto-loans and student loans.

But, what about the other side of the ledger? How will lower rates impact savers?

Here is Morningstar’s Director of Personal Finance, Christine Benz: “As attractive as yields on savings instruments have recently been, it’s wise not to hold too much in cash because these are short-term instruments and their yields are ephemeral. The really great yields that we’ve had recently may go lower.”

People who’ve enjoyed collecting risk-free, or nearly risk-free, yields on money markets and certificates of deposit (CDs) will likely see an immediate decline in savings. Some of this has already started to happen, but look for savings rates on these newly-in-vogue products to diminish their shine.

Also, expect some portion of the $6.2T in money market outstanding stock – cash “sitting on the sidelines” – to become highly motivated in the coming months and find its way into the market as yields come down.

In other words, say goodbye to “T-bill and chill” – the ultimate no-brainer for many savers over the last few years.

Sources: Federal Reserve, Charlie Bilello, Goldman Sachs Global Investment Research, New York Fed, Ned Davis Research, Associated Press, Wall Street Journal, Lisa Abramowicz, J.P. Morgan Markets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.