How the Trump trade impacts long-term investors, plus 2025 earnings and rate cuts

The Sandbox Daily (11.12.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

how the Trump trade impacts long-term investors

twin drivers to 2025 earnings

Fed Funds rate cut bets fall sharply after election

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.17% | S&P 500 -0.29% | Dow -0.86% | Russell 2000 -1.77%

FIXED INCOME: Barclays Agg Bond -0.58% | High Yield -0.40% | 2yr UST 4.342% | 10yr UST 4.429%

COMMODITIES: Brent Crude -0.11% to $71.75/barrel. Gold -0.41% to $2,606.9/oz.

BITCOIN: +0.47% to $88,486

US DOLLAR INDEX: +0.36% to 105.918

CBOE EQUITY PUT/CALL RATIO: 0.74

VIX: -1.74% to 14.71

Quote of the day

“Experience is what you got when you didn't get what you wanted.”

- Randy Pausch

How the Trump trade impacts long-term investors

While the political world will focus on the election for some time, financial markets have already shifted their attention to the next administration’s policies, Federal Reserve rate cuts, and the underlying economy.

Putting politics aside, chances are that the next administration will inherit strong economic tailwinds.

While it’s clear that voters struggled with inflation over the past few years, rising prices were the result of both supply chain disruptions during the pandemic and the significant government stimulus that followed. These shocks to the system have faded as inflation has fallen back toward 2%, prompting the Fed to cut rates, which supports the economy.

At the same time, the bull market rally since late 2022 means that valuations across an array of asset classes are well above average, suggesting that many investments are no longer as attractive. The post-election rally in recent days has only pushed valuations higher. The price-to-earnings of the S&P 500, for instance, is nearing post-pandemic highs and is only a few points away from its historic dot-com bubble peak.

In uncertain situations, a north star that can guide investors is valuations.

In the long run, there is nothing more correlated with returns than whether the market is cheap or expensive compared to measures such as corporate earnings. While valuations are not market timing tools – stocks can run well above fundamentals in the short run – they do tell us how to set expectations that reflect long-term trends.

Today, market enthusiasm is the result of the “Trump trade,” which refers to investments that benefit from the expected policies of the next administration. This includes lower individual and corporate taxes, tariffs, light regulation, and deficit spending in areas such as infrastructure.

That platform helped propel markets for a time after the 2016 election due to optimism in financial markets, the strengthening of the U.S. dollar, and higher bond yields as investors anticipated pro-growth economic policies.

As the famous investor Benjamin Graham observed, "in the short run, the market is a voting machine but in the long run, it is a weighing machine." This is relevant today because many of the investments with stretched valuations, including tech stocks and cryptocurrencies, are especially prone to booms and busts. When things go well, it seems foolish in hindsight to focus on valuations and earnings. However, the reason to do so is exactly because it is difficult to predict the exact winners.

Elevated valuations have often corresponded to lower or even negative longer run returns. This occurs if those valuations take place later in the business cycle just before a crash.

The hope is that this time is different, and the economy continues to grow steadily. But even in that scenario, markets that are rallying ahead of fundamentals could mean that returns are “pulled forward.”

Source: Sandbox Financial Partners, Clearnomics

Twin drivers to 2025 earnings

Bank of America estimates that cutting the statutory U.S. corporate income tax rate to 15% from its current 21% could add nearly $100 billion to earnings... next year.

So, while Q3 corporate earnings are handily beating the street’s estimates, the 2025 figures – which many estimate are too rosy and they aren’t necessarily wrong – could be look low depending how tax cuts (upward risk to growth estimates) and offsetting tariff executive orders (downside risks) play out.

Goldman Sachs forecasts S&P 500 EPS growth of 11% in 2025 and another 7% in 2026.

Source: Goldman Sachs Global Investment Research

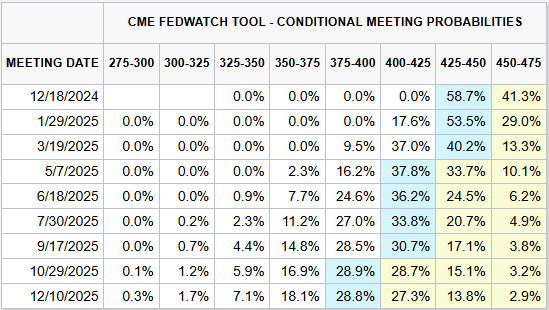

Fed Funds rate cut bets fall sharply after election

Transport manufacturers front loading orders ahead of potential tariffs, better funding conditions from junk bonds, and a pro-business climate for M&A transactions are just a few examples of the post-Trump trade downstream effects.

Economic stimulus via tax cuts, new tariffs, immigrant deportations, and less fiscal guardrails are leading to slower projections of future disinflation.

Accordingly, the bond market now believes only two-to-three rate cuts come to pass over the next twelve months, versus a range of four-six cuts prior to Election Day.

Source: CME Fed Watch Tool

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: