How the wealth effect is driving the U.S. economy

The Sandbox Daily (1.28.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

wealth effect from rising stock and housing prices

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +1.59% | S&P 500 +0.92% | Dow +0.31% | Russell 2000 +0.21%

FIXED INCOME: Barclays Agg Bond -0.03% | High Yield -0.04% | 2yr UST 4.197% | 10yr UST 4.534%

COMMODITIES: Brent Crude +0.65% to $77.58/barrel. Gold +1.21% to $2,771.5/oz.

BITCOIN: -0.41% to $101,220

US DOLLAR INDEX: +0.53% to 107.910

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: -8.32% to 16.41

Quote of the day

- Douglas Boneparth in News You Can’t Use

Wealth effect: rising stock and housing prices are fueling consumer spending

A big part around the underestimation of economic growth this cycle can be attributable to the wealth effect.

Per Ned Davis Research, every 1% increase in household net worth translates into a 0.4% year-over-year rise in consumption one year later.

The two largest contributors to a person’s net worth are their home and their financial assets, which are both hovering at/around all-time highs.

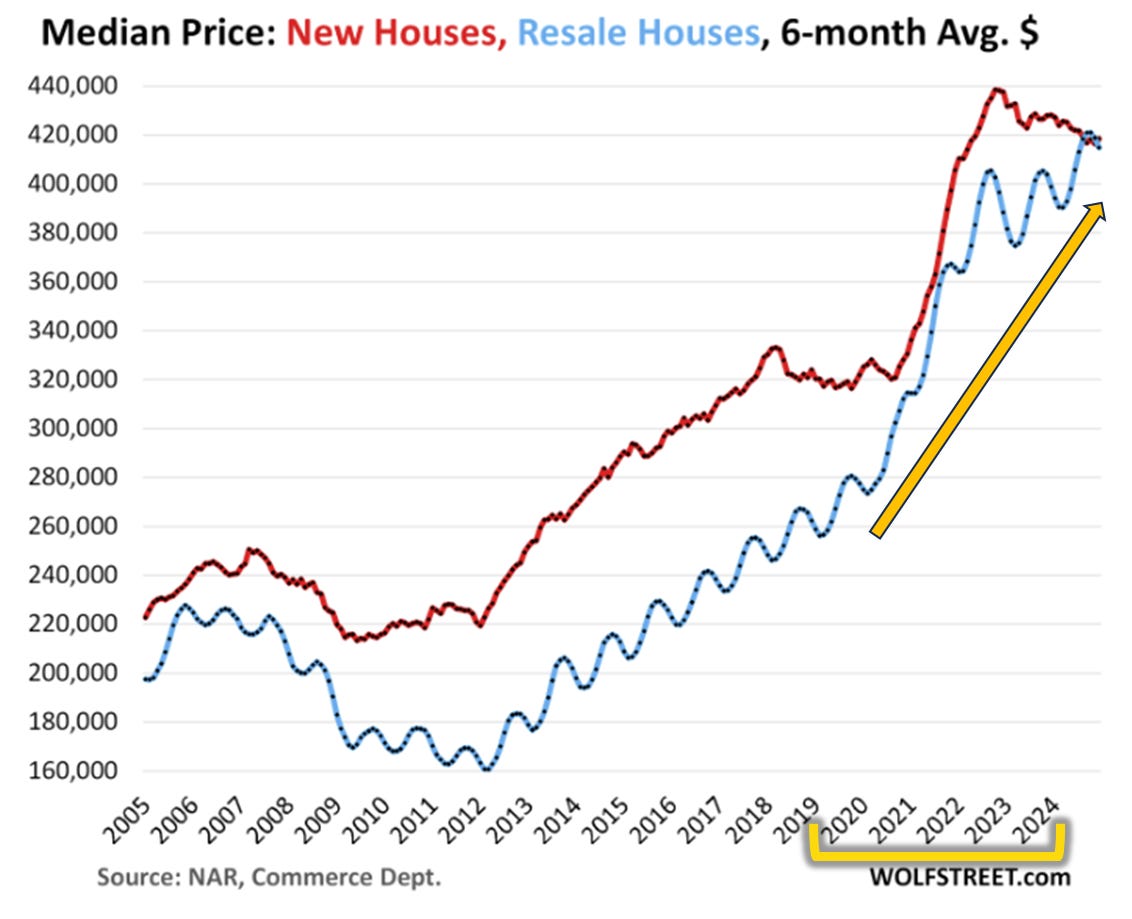

While housing prices have cooled from their blistering pace of +20% YoY growth in 2020-2022, they have remained firm despite the standstill in home sales.

After all, why move to a new home with a 7% mortgage when you can stay put with a 3% rate?

As for financial assets, the S&P 500 posted back-to-back +20% gains in 2023 and 2024 for only the fifth time since 1927.

That matters when households hold a record 36% of their investable assets in stocks – highest on record.

So, while the economists, dubious investors, and the voting public expressed their concern over the economy the past few years, it did not translate into skepticism toward the U.S. stock market.

The Federal Reserve last released their Survey of Consumer Finances report detailing U.S. household net worth as of December 2022, which is produced every three years.

At the time, the median net worth for the typical U.S. household had grown 37% to $192,900 after inflation from 2019 to 2022, the highest level on record. It was the biggest increase over a three-year period in the history of the data set.

Should the housing and equity markets hold firm in 2025, imagine the additional household gains we will see by year’s end on the next iteration of the Fed’s consumer finances survey?!

Remember, households do not always sell assets to fund spending. They often just save less.

We know the vast majority of excess savings from the pandemic has been depleted. We also know the U.S. personal savings rate has stabilized around 4-5%, which remains below the pre-pandemic trend of 5-8%.

The wealth effect refers to the tendency of consumers to increase spending patterns when their personal net worth rises, even if their income itself is relatively flat. This can play out across a multitude of angles.

Like most things in personal fuh-nance, human psychology has a massive impact on a person’s assuredness to continue swiping their Amex. When asset values rise, consumers feel wealthier – thereby boosting confidence in their own financial stability. This increased optimism leads to higher discretionary spending on goods and services, as people anticipate continued financial security for the future to come. Our self-control filter over immediate satisfaction, also known as delayed gratification, is one thing that human beings have never mastered well.

Rising asset values improve consumers’ borrowing capacity since higher home equity or investment portfolio values can serve as collateral for loans. This allows consumers to take on more debt for large purchases, such as a second residence, new cars, and luxury items. Credit is the great multiplier of a capitalistic society.

Finally, when net wealth increases, individuals generally save less for the future, believing their assets will continue appreciating and provide the necessary cushion in the event of an emergency. As a result, they redirect money from their savings goals toward their consumption habits, boosting demand in the local economy.

Together, these factors give rise to a positive feedback loop: as consumer spending rises, businesses earn more revenue, employment grows, and economic activity rises – further reinforcing confidence and spending.

Sources: Ned Davis Research, Wolf Street, Federal Reserve, St. Louis Fed

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: