IMF declares victory over inflation/warns of tepid growth, plus bond market spooking investors, U.S. election odds, and CFA exam results

The Sandbox Daily (10.22.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

IMF releases final economic report of 2024

bond market sends stocks into retreat

U.S. election nears, race remains too close to call

CFA exam results

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +0.11% | Dow -0.02% | S&P 500 -0.05% | Russell 2000 -0.37%

FIXED INCOME: Barclays Agg Bond +0.02% | High Yield -0.14% | 2yr UST 4.032% | 10yr UST 4.208%

COMMODITIES: Brent Crude +1.67% to $75.53/barrel. Gold +0.89% to $2,763.2/oz.

BITCOIN: -0.65% to $67,413

US DOLLAR INDEX: +0.07% to 104.085

CBOE EQUITY PUT/CALL RATIO: 0.49

VIX: -0.93% to 18.20

Quote of the day

“In three words I can sum up everything I've learned about life: it goes on.”

- Robert Frost, American Poet

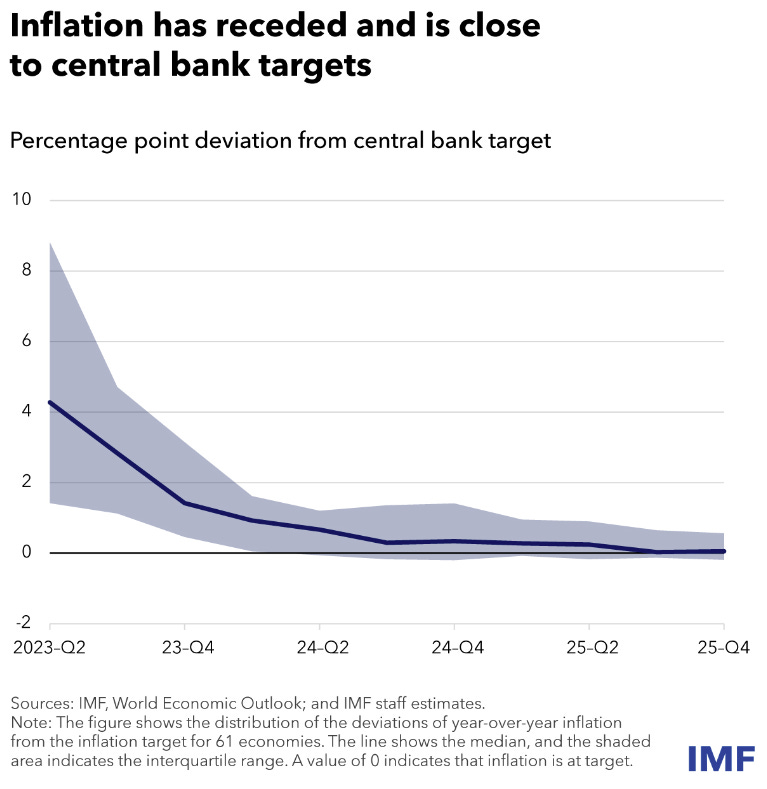

IMF declares victory over inflation, warns of tepid growth

The International Monetary Fund released their final World Economic Outlook quarterly report for 2024, and the global agency’s findings had a bit of something for everyone.

The good news?

The global economy managed to avoid falling into a recession despite a synchronized effort by the world’s central banks to raise interest rates to their highest levels in decades in efforts to overcome the rapid rise in inflation.

The bad news?

The latest outlook reports stable but underwhelming global growth, with the balance of risks tilted to the downside – namely, escalating violence in the Middle East, the prospect of a new round of trade wars, and global financial conditions having tightened dramatically.

“Inflation is almost back to central bank targets in many countries, and we’ve done this without a global slowdown or a global recession,” said IMF chief economist Pierre-Olivier Gourinchas.

In the United States, projected growth for 2024 has been revised upward to 2.8% – which is 0.2% higher than the July forecast – on account of stronger outturns in consumption and nonresidential investment.

Source: International Monetary Fund, Associated Press

Bond market sends stocks into retreat

The MOVE Index is warning of gathering storm clouds on the horizon, as bond market implied volatility has surged nearly 45% since September 26.

The CBOE Volatility Index (“VIX”) measures the level of risk associated with the stock market over the next 30 days, while the bond market’s version – the ICE Bank of America MOVE Index (MOVE) – tracks expected volatility in the Treasury market over the same time frame.

Notably, the MOVE Index just jumped to the highest levels of the year, indicating investor anxiety about possible market disruptions. Aside from the usual risks – investor indigestion over the economic outlook, monetary policy direction, geopolitics, etc. – the latest parabolic swing higher is most likely attributable to uncertainty over the U.S. election outcome.

Prior instances of a surging MOVE Index have been accompanied by stock market wobbles.

The options-based predictor is signaling a move in Treasury yields roughly 3x (18 bps) its normal one-month periodic average daily move (6 bps) immediately following the election.

Source: Bloomberg

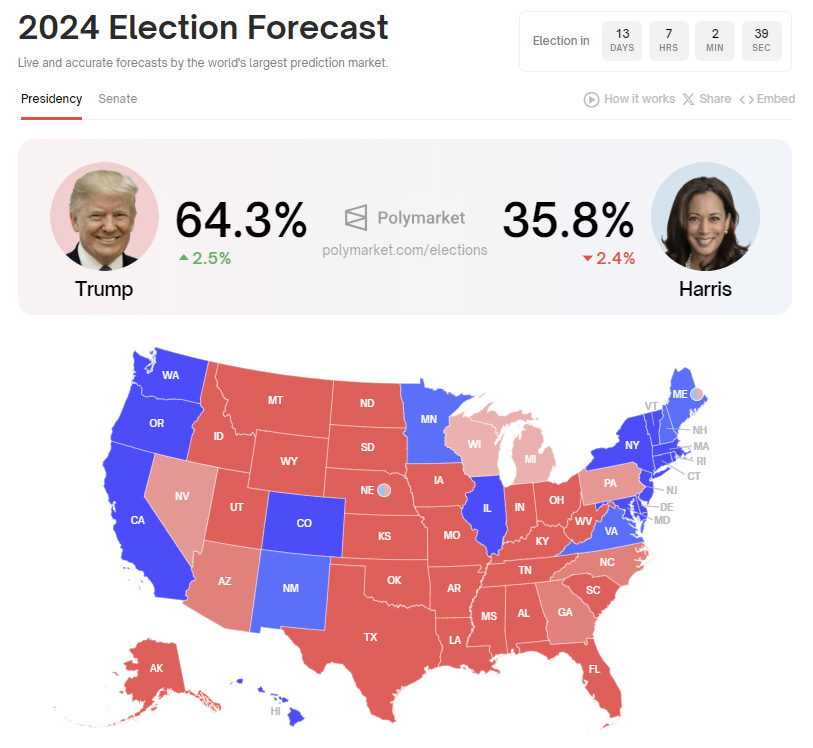

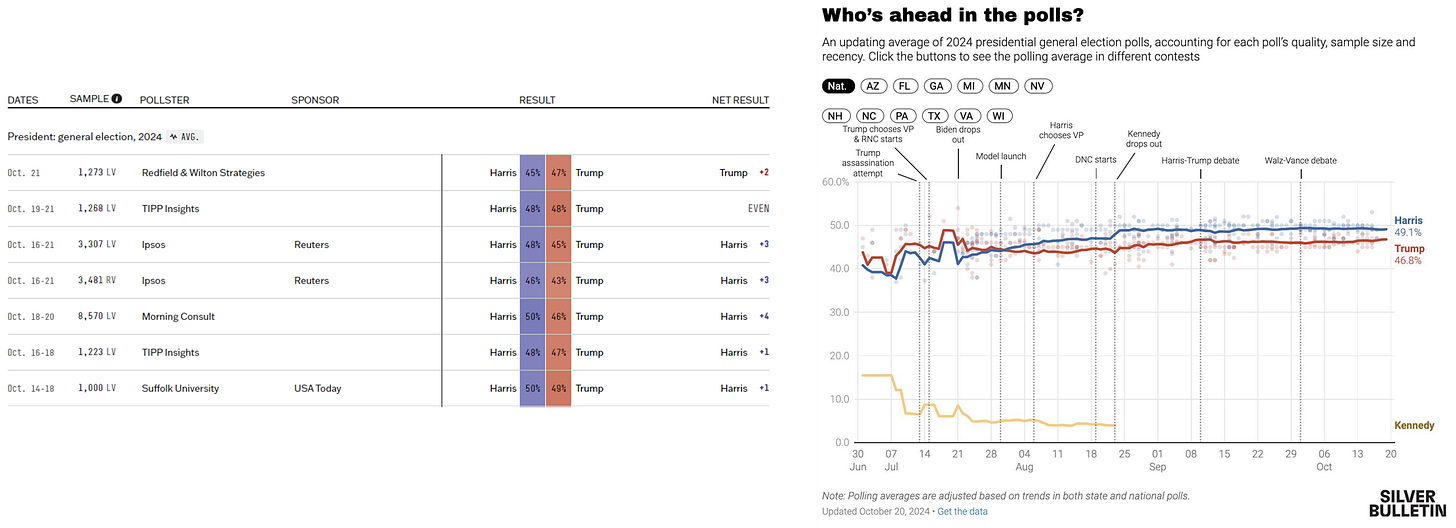

Election nears, Presidential race remains too close to call

With two weeks until election day, recent polling shows a slight shift in favor of former President Trump.

Here is the latest forecast from Polymarket, a blockchain-based betting market.

Others polls, however, are reporting an extremely tight race in which either candidate could win.

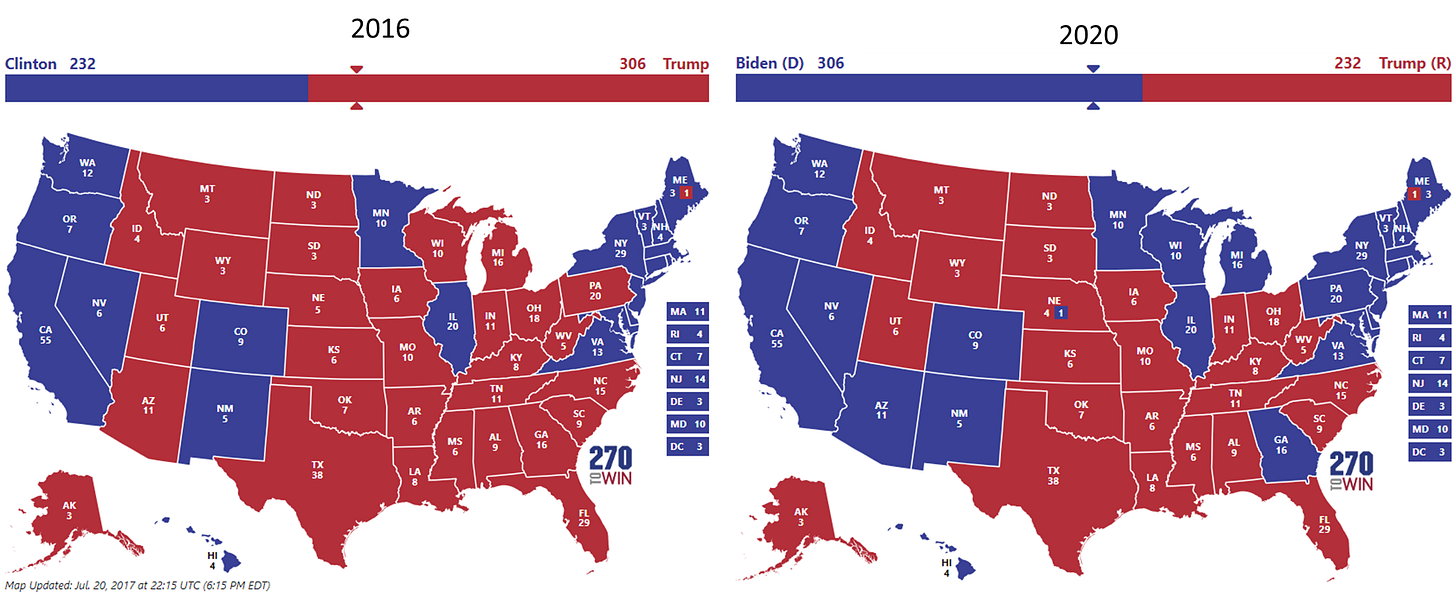

While the vast majority of polling data that makes national headlines represent the meaningless national popular vote numbers, policy strategists are quick to remind us that individual state polls are the superior way of sizing up the race.

Vice President Harris needs to hold all the swing states that President Biden won in 2020 with slim margins of victory; those key battleground states include Pennsylvania, Michigan, and Wisconsin. If Harris can win those three states that Trump carried in 2016 but Biden flipped in 2020, Harris would have the minimum number of 270 Electoral votes. Alternatively, a Trump victory in any one of these states would lessen the probability of a Democratic victory. As such, both candidates are investing most of their time and money in the closing days on these swing states.

Two important points to consider with two weeks until election day.

One, polling is not as accurate as past election cycles.

Second, national polls have little value as the United States elects its President with 50 different races that form the Electoral College.

Source: Polymarket, FiveThirtyEight, Nate Silver, 270 To Win

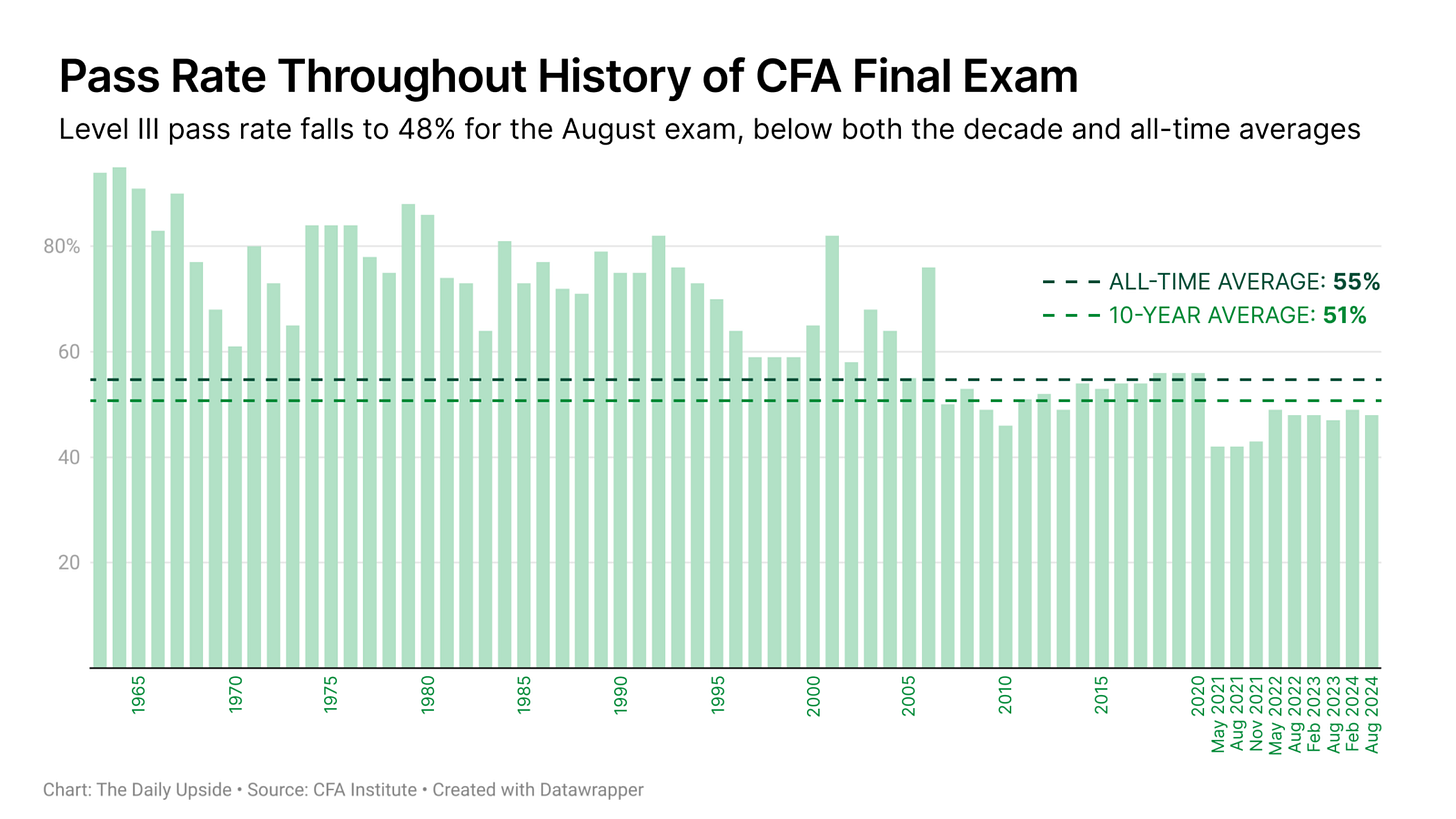

Passing the CFA exam is notoriously difficult. Congratulations are in order !

The pass rate for the third and final level of the Chartered Financial Analyst (CFA) designation was 48% for the August 2024 exam, which is below the all-time average pass rate (55%) but basically aligned with post-pandemic averages. 16,947 people sat for the most recent Level III exam across nearly 500 testing centers around the world. The Level II pass rate came in at 47%, while Level I at 44%. The CFA Institute has been administering exams since 1963.

People pursue the Chartered Financial Analyst (CFA) designation to enhance their credibility and expertise in financial analysis and the investment management business. The CFA charter is globally recognized and widely respected among its peers, offering career advancement opportunities in finance, investment banking, and asset management. Earning the CFA can demonstrate a high level of competence and commitment, helping individuals stand out in a competitive industry.

The program's rigorous curriculum focuses on a wide range of financial topics, including: ethical and professional standards, quantitative methods, economics, financial statement analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

As a proud CFA charterholder myself, I can attest to the high degree of technical difficulty and overbearing time commitment that the CFA exam requires of its prospective applicants. Congrats to all who passed !

Source: CFA Institute, The Daily Upside

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: