In private markets, manager selection matters

The Sandbox Daily (10.29.2025)

Welcome, Sandbox friends.

I had a ton of fun dropping by the New York Stock Exchange this morning to discuss year-end expectations, big tech, and credit with Nicole Petallides on the Opening Bell.

Onwards…

Today’s Daily discusses:

in private markets, manager selection matters

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.41% | S&P 500 0.00% | Dow -0.16% | Russell 2000 -0.87%

FIXED INCOME: Barclays Agg Bond -0.47% | High Yield -0.31% | 2yr UST 3.596% | 10yr UST 4.076%

COMMODITIES: Brent Crude +0.62% to $64.80/barrel. Gold -1.02% to $3,942.3/oz.

BITCOIN: -1.32% to $111,532

US DOLLAR INDEX: +0.49% to 99.152

CBOE TOTAL PUT/CALL RATIO: 0.74

VIX: +3.05% to 16.92

Quote of the day

“Always be stronger than you need to be. Always leave room for the unexpected.”

- James Clear

Manager selection matters

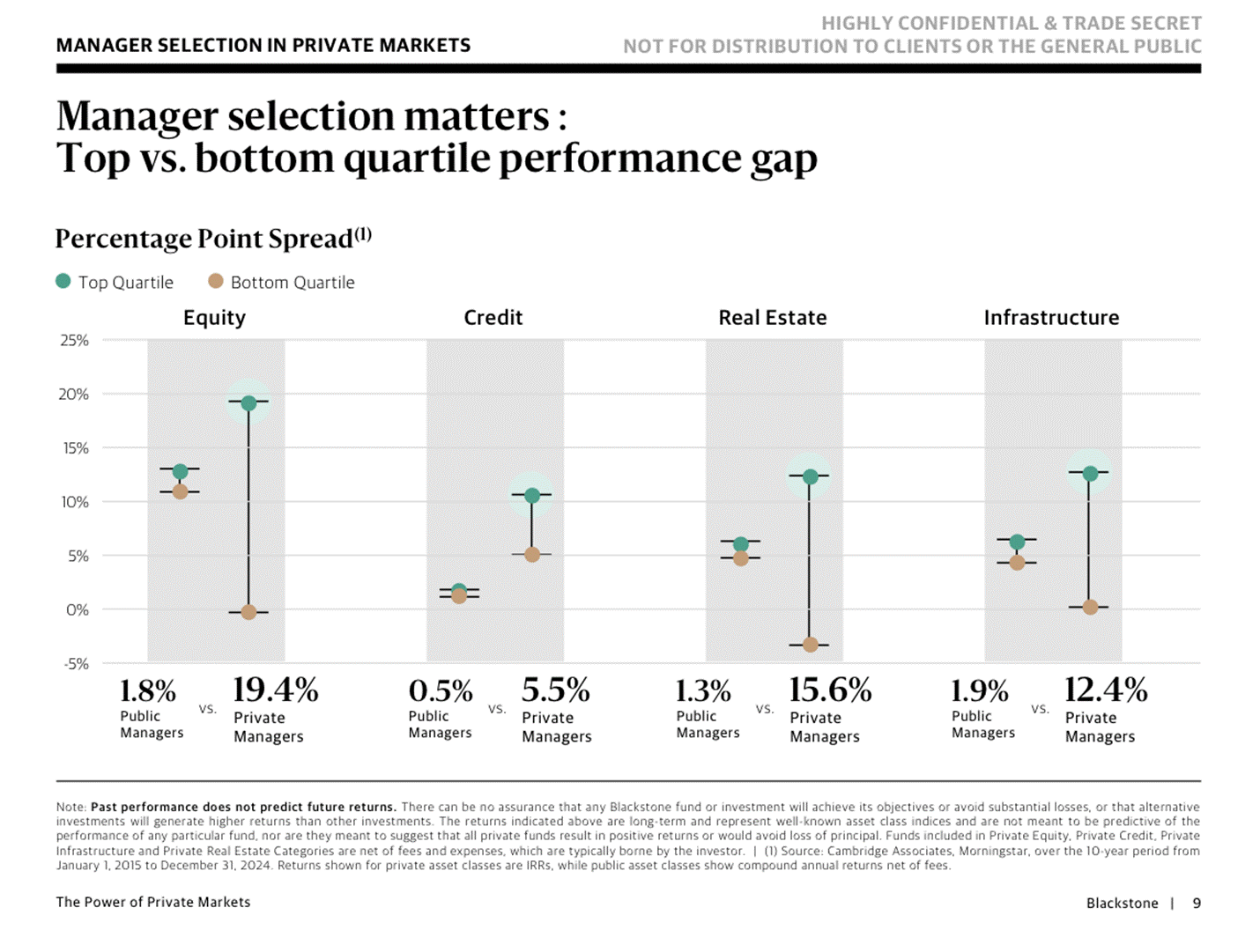

Manager selection plays a central role in private market investing, given the significantly wider dispersion of returns for private asset managers as compared to public managers.

This is illustrated in the Blackstone chart below, which shows the range of outcomes across managers that investors have experienced – in both public markets and private markets. As you can clearly see, the range is much, much wider for private assets (dumbbells, right side) than for public assets (dumbbells, left side).

The significant dispersion in results – which is measured here by the gap between the top and bottom quartiles of performance – underscores that the rewards to effective manager selection are high in private markets.

The key drivers of performance for private assets have evolved over time, but deal sourcing/access, scale, underwriting quality, risk management, and operational value creation are some of the driving factors that contribute to higher outcomes.

Source: Blackstone

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Awesome Blake