Inflation expectations, plus bank lending, market indigestion, short-term rates, and DCA

The Sandbox Daily (3.16.2023)

Welcome, Sandbox friends.

One year ago today – March 16th, 2022 – the Federal Reserve announced their 1st rate hike of the current cycle, taking the Fed Funds Rate from 0.00–0.25% to 0.25–0.50%. It appears the market and the tightening of financial conditions are finally experiencing those “long and variable lags.”

Today’s Daily discusses:

bull steepener shows a win on inflation

lending from small- and mid-sized banks

digesting market indigestion

bank rates lagging money market funds

dollar-cost averaging as a rules-based investment philosophy

Let’s set aside March Madness for a few minutes and dig in.

Markets in review

EQUITIES: Nasdaq 100 +2.69% | S&P 500 +1.76% | Russell 2000 +1.45% | Dow +1.17%

FIXED INCOME: Barclays Agg Bond -0.39% | High Yield +0.65% | 2yr UST 4.168% | 10yr UST 3.585%

COMMODITIES: Brent Crude +1.23% to $74.60/barrel. Gold -0.37% to $1,924.1/oz.

BITCOIN: +1.57% to $24,756

US DOLLAR INDEX: -0.21% to 104.423

CBOE EQUITY PUT/CALL RATIO: 0.80

VIX: -12.05% to 22.99

Quote of the day

“Good advice rarely changes, while markets change constantly. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good.”

-Jason Zweig

Bull steepener shows a win on inflation

Interest rates have been on the move over the last two weeks as the market digests hawkish commentary from the Federal Reserve and multiple bank failures causing fears of contagion risk. One major development in rates markets is the potential “un-inverting” of the yield curve.

A “bull steepener” is a change in the yield curve caused by short-term interest rates falling faster than long-term rates, resulting in a higher spread between the two interest rates. Most people associate the 2-year U.S. Treasury as the short-term rate in this example and the 10-year U.S. Treasury as the long-term rate.

Here is a bull steepener in real time, showing the inverted yield is becoming less inverted as short-term rates fall at a faster clip than the long end of the curve:

So, the big question becomes: did inflation break or is a recession coming?

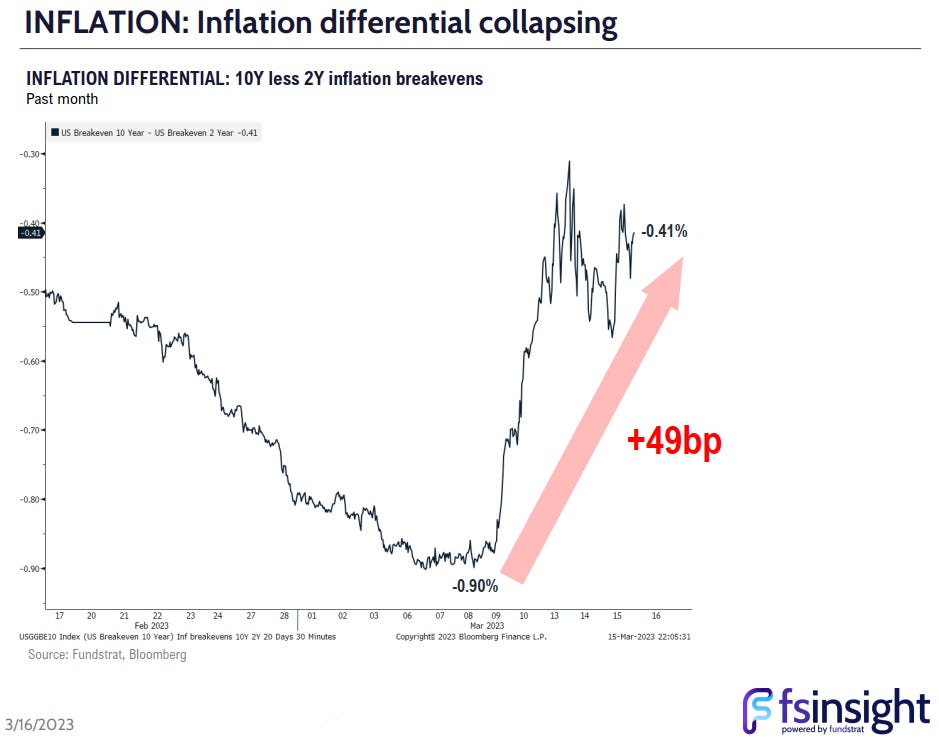

Well, if you study market-based measures of inflation using inflation-breakeven rates (the difference between a U.S. Treasury and a U.S. Treasury Inflation Protected Security bond of the equivalent duration), it appears the market is expecting a collapse in inflation over the next two years (2 year inflation expectations have dropped at nearly 3x the magnitude versus 10 year inflation expectations).

Over the last week (March 9 – March 16), the bond market’s interpretation suggests the Fed has won / is winning the war on inflation.

To be clear, the Fed is a long way from their stated goal of the 2% long-term neutral policy rate of inflation. However, the monetary policy tightening cycle over the last year is showing sufficient evidence that disinflation appears to be taking hold.

Source: FS Insight

What’s all the fuss with small- and mid-sized banks

U.S. policymakers have taken aggressive steps to shore up the financial system, but concerns about stress at some banks persists. Ongoing pressure could cause smaller banks to become more conservative about lending in order to preserve liquidity in case they need to meet depositor withdrawals, and a tightening in lending standards could weigh on aggregate demand.

The issue? Small- and medium-sized banks play a very important role in credit creation across the U.S. economy. Banks with less than $250 billion in assets account for roughly 60% of residential real estate lending and 80% of commercial real estate lending.

The macroeconomic impact of a pullback in lending will remain highly uncertain until the extent of the stress on the banking system becomes clear.

Source: Goldman Sachs Global Investment Research

Digesting market indigestion

Hawkish Federal Reserve and European Central Bank? ✔️

Multiple banks failing? ✔️

Recession worries? ✔️

Markets volatile? ✔️

Geopolitics worrying everybody and their mother? ✔️

Yet some measures that people track for coincident indicators of financial stress remain contained. If there was real panic in the market, you would expect stress in junk bonds, senior loans, investment grade bonds, and the VIX – yet we’re not seeing fractures in any of those measures yet.

The Fed has never explicitly defined “sufficiently restrictive” but bank failures, negative YoY M2 money supply growth, draining bank reserves, tighter lending standards, banks holding $620 billion dollars of losses in their held-to-maturity (HTM) and available-for-securities (AFS) investment portfolios, $95 billion dollars of balance sheet runoff per month (Quantitative Tightening), 7-8% mortgage rates, and historically low investor sentiment all seem to suggest the market is experiencing a tightening of financial and credit conditions.

Source: The Irrelevant Investor

Banks slow to catch up to money market funds

The spread between what money markets are offering and what traditional checking and savings accounts are offering is laughable. No wonder money is leaving checking and savings accounts at the bank for an attractive interest rate in Money Market Funds.

Banks will have to play catch up and pay up to their customers/savers, or else risk watching these deposits leaver for better returns elsewhere.

After all, there-are-reasonable-alternatives (TARA) has replaced the there-is-no-alternative (TINA) mantra of the 2010s.

Source: Ned Davis Research, JPMorgan, iCapital

Rules-based investing

Dollar-cost averaging over long time horizons effectively makes market timing irrelevant.

As they often say, “time in the market” is more important than “timing the market.”

Dollar-cost averaging prevents procrastination, minimizes regret (by using a rules-based investing philosophy), avoids market timing, and removes emotion from your financial plan. While it may be tempting to try waiting for the perfect time to invest – especially in a volatile market – remember the low probability of finding the right entry point and the (high) cost of waiting prevents you from even beginning your financial journey.

As Nick Maggiulli eloquently said, Just Keep Buying.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.