Inflation knocking at the Fed’s doorstep, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (5.30.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

inflation knocking at the Fed’s doorstep

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +0.13% | Russell 2000 +0.01% | S&P 500 -0.01% | Nasdaq 100 -0.11%

FIXED INCOME: Barclays Agg Bond +0.25% | High Yield +0.09% | 2yr UST 3.90% | 10yr UST 4.40%

COMMODITIES: Brent Crude -0.39% to $63.90/barrel. Gold -0.79% to $3,317.5/oz.

BITCOIN: -1.23% to $104,630

US DOLLAR INDEX: +0.11% to 99.389

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: -3.18% to 18.57

Quote of the day

“This above all: to thine own self be true.”

- William Shakespeare, Hamlet

Inflation knocking at the Fed’s doorstep

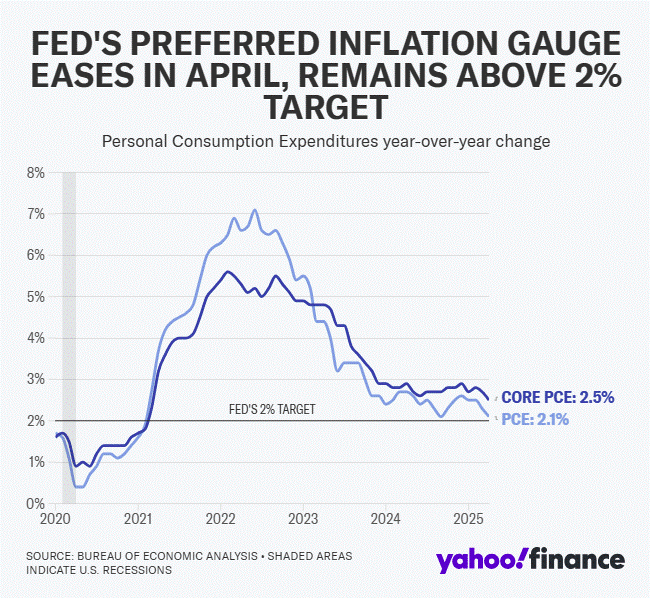

This morning, we received the Fed’s preferred measure on inflation, the Personal Consumption Expenditures (PCE) Price Index.

The good news is continued moderation in price changes, with the headline number showing just 2.1% growth year-on-year for April.

This report came in line as expected, with no surprises for a monthly surge in inflation. The audience caught the preview mid-month when the Consumer Price Index (CPI) came in soft as well.

The data offers a snapshot of the U.S. economy during a month when the Trump administration surprised investors announcing universal and reciprocal tariffs that roiled markets and caused outright panic.

Objectively speaking, both headline and core inflation rates are knocking on the doorstep of the Fed’s stated target of the 2% mandate.

The path of disinflation is complete, or is it…

Where is this one-time structural shift higher in inflation that economists are ringing alarm bells over?

The easy answer is it’s too early to detect any meaningful impact from tariffs.

The more likely answer is nuanced. Perhaps companies built up inventories enough where much of the higher cost won’t be passed to the consumer. Maybe other companies are absorbing the higher upstream costs in their margins. Do companies feel they have the pricing power to increase prices in a soft and uncertain consumer environment without jeopardizing demand?

Whatever the case may be, we aren’t seeing prices heating up. Yet...

Today we also received updated data on income and spending to shed further light on the consumer.

Wages rose by +0.8% in April, while consumer spending increased +0.2%. Higher incomes is welcome news for Americans, but softer spending doesn’t help growth unless those wages are spent.

As the personal savings rate ticks higher, consumers cutting back is a warning sign that caution is permeating into the collective consciousness. This jives with the various consumer sentiment surveys throughout 2025 that show historic levels of uncertainty and nervousness about the economy.

The Fed’s reaction function likely doesn’t shift with these new data points. The inflationary shock from the pandemic seems to have dissipated, but caution is warranted over growing risks to the consumer.

Downside risks to the economy are rising, especially after another chaotic week of tariff headlines – which have now spilled over to the legal system and courts.

Ultimately, this will push the Fed to resume policy easing via interest rate cuts, but will it be too late?

Sources: Yahoo Finance, Charlie Bilello, Bloomberg

Weekend sprinkles

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

OptimistiCallie – Five Mind-Blowing Market Facts (Callie Cox)

Yield to Maturity – The First $100,000 (Clifford Cornell)

Morningstar – How Healthy is the US Economy? Here’s What the Top Economic Indicators Say. (Margaret Giles)

Morgan Stanley – Drawdowns and Recoveries: Base Rates for Bottoms and Bounces (Michael Mauboussin and Dan Callahan)

TCW – When the Market Outgrows the Index (David Vick, CFA)

Podcasts

What’s Next For Markets w/ Michael Kantrowitz – Unpacking the Current State of Market Multiples (YouTube, Spotify, Apple Podcasts)

The Compound and Friends w/ Jens Nordvig – Why Initial Jobless Claims Could Blow Up the Stock Market (YouTube, Spotify, Apple Podcasts)

a16z w/ Rick Rubin – Vibe Coding is the Punk Rock of Software (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

Sirens – Julianne Moore, Meghann Fahy, Kevin Bacon (Netflix, IMDB, YouTube)

Music

Arctic Monkeys – Don’t Sit Down ‘Cause I’ve Moved Your Chair (YouTube, Spotify, Apple Music)

Books

Sahil Bloom – The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life (Amazon)

Fun

TACO Trump (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)