Inflation's bumpy ride to 2%, plus bankruptcies, forward P/E at 20x, and credit standards

The Sandbox Daily (2.13.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

inflation’s bumpy ride to 2%

bankruptcies slow its pace in January

market multiple up over 20x

credit standards remain elevated

Let’s dig in.

Markets in review

EQUITIES: Dow -1.35% | S&P 500 -1.37% | Nasdaq 100 -1.58% | Russell 2000 -3.96%

FIXED INCOME: Barclays Agg Bond -0.92% | High Yield -0.80% | 2yr UST 4.671% | 10yr UST 4.326%

COMMODITIES: Brent Crude +0.89% to $82.73/barrel. Gold -1.32% to $2,006.2/oz.

BITCOIN: -0.92% to $49,536

US DOLLAR INDEX: +0.67% to 104.871

CBOE EQUITY PUT/CALL RATIO: 0.55

VIX: +13.78% to 15.85

Quote of the day

“It’s not the strongest species that survive, nor the most intelligent, but the most responsive to change.”

- Charles Darwin

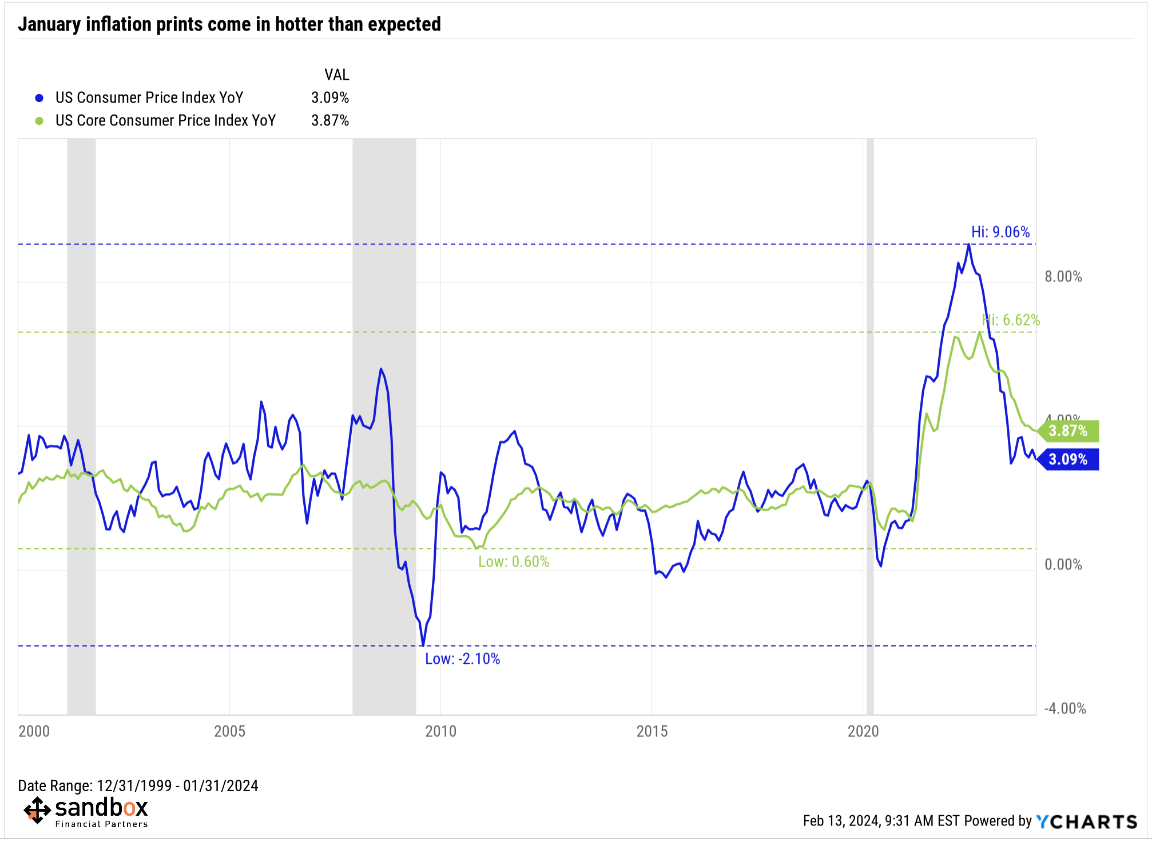

Inflation’s bumpy ride: January CPI report comes in hotter than expected

January’s Consumer Price Index (CPI) report released this morning had the potential to boost market expectations of Fed rate cuts or scale them back. It did the latter.

What’s becoming clear crystal clear to Lieutenant Daniel Kaffee, Colonel Nathan Jessup, and the rest of investors is the path of softening price pressures – what’s known as disinflation – remains choppy and protracted, with certain categories proving stickier than most had anticipated. In other words, the path towards inflation normalization is not a straight line down from 9% to 2%.

January’s CPI print surprised to the upside, largely driven by persistent shelter price growth. Here are the key numbers:

The stickiness in the data continues to largely reside within the Shelter category, as you can see in the green bars below.

While the large majority of categories contributing to inflation have receded, housing has not.

Housing accounted for more than HALF of inflation in January. Shelter CPI increased 0.6%, the most in 11 months.

This is in line with its 12-month average, but roughly double the monthly price growth prior to the pandemic.

Remember, official rent and owners’ equivalent rent – the main sub buckets within the Shelter category – generally lag spot market price rents by a year, but are taking a while to “catch down” to now-tame real-world rents.

So, if you remove this lagging Shelter category, inflation is already below the Fed’s desired 2% target.

So, what are the bottom line takeaways from today?

Growth may be too strong to achieve that last mile of disinflation, going from 3% to 2%. It will require the Fed to remain higher-for-longer to wring that last 1% of inflation out of the system. As such, it is becoming increasingly more likely that the 1st move on rate cuts comes over the summer, not March or May as expected just a few weeks ago – the market is repricing those odds quickly.

Today’s CPI print and the subsequent reaction in stocks is yet another demonstration of how equities are trading at the mercy of interest rates. Expect this behavior to persist, on both dovish and hawkish data releases, going forward.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Piper Sandler, Bloomberg, Wall Street Journal, CME Group, Sonu Varghese, Austin Harrison, A Few Good Men

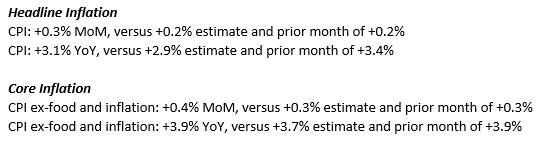

Bankruptcies slow its pace in January

The pace of U.S. corporate bankruptcy filings decelerated at the start of the new year.

After a year in which we saw the highest number of bankruptcies since 2010, this is welcome news.

S&P Global Market Intelligence recorded 36 bankruptcy filings in January – as the economy continues to digest higher interest rates and tighter financial conditions.

The filings seem to be concentrated around more capital-intensive industries, the same three that saw the most bankruptcy filings in 2023.

No surprise, there.

Source: S&P Global Market Intelligence

Market multiple up over 20x

The forward 12-month P/E ratio for the S&P 500 is 20.3x, the 1st time over 20x in two years and is now 1 standard deviation expensive (19.8x).

This P/E ratio is above the 5-year average (18.9x) and above the 10-year average (17.7x). The longer-term 25-year average is 16.4x.

What is driving the rise in the forward 12-month P/E ratio?

On October 27, the forward 12-month P/E ratio was 17.0x, as the price of the index hit its lowest value after a 3-month broader market decline. Since October 27, the price of the S&P 500 has increased by 21.4%, while the forward 12-month EPS estimate has increased by just 2.0%. Thus, the increase in the “P” has been the main driver of the increase in the P/E ratio over the past few months.

At the sector level, 8 sectors had forward 12-month P/E ratios that exceeded their 25-year averages.

Source: FactSet, J.P. Morgan Guide to the Markets

Credit standards remain elevated

The Fed’s Senior Loan Officer Opinion Survey (SLOOS), released last week, shows that consumer credit standards are consistently tighter than pre-Covid levels and fits the expectation that delinquency rates should normalize as interest rates recede over the coming 12 months.

Remember, rising consumer delinquency and default rates mostly reflect normalization from very low levels in recent years, higher interest rates, and riskier lending (from loan vintages early in the pandemic), not poor household finances.

Source: Goldman Sachs Global Investment Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

jam-packed summary, awesome visual analysis, only wednesday and i already know this is the post of the week, probably month even. so appreciated!