Inflation's bumpy ride to 2%, plus record U.S. oil production, market breadth, global shipping, and LT inflation expectations

The Sandbox Daily (3.12.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

inflation’s bumpy ride

record U.S. oil output

market breadth continues to expand

global shipping disruptions from Red Sea attacks

long-term inflation expectations rise

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.49% | S&P 500 +1.12% | Dow +0.61% | Russell 2000 -0.02%

FIXED INCOME: Barclays Agg Bond -0.25% | High Yield +0.09% | 2yr UST 4.588% | 10yr UST 4.153%

COMMODITIES: Brent Crude -0.17% to $82.07/barrel. Gold -1.19% to $2,162.5/oz.

BITCOIN: -1.89% to $71,143

US DOLLAR INDEX: +0.07% to 102.939

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: -9.07% to 13.84

Quote of the day

“It may take some hard work. But the more you say no to the things that don’t matter, the more you can say yes to the things that do.”

- Ryan Holiday, The Daily Stoic

Inflation’s bumpy ride: February CPI report comes in hotter than expected

The center of attention for this week’s eco data was today’s February consumer price index (CPI) report. It showed progress on the “final mile” for bringing down inflationary pressures is not budging as fast as the Fed would like.

February’s CPI print came in a little warmer than expected, driven by higher energy and rent prices. Here are the key numbers:

The stickiness in the data continues to largely reside within the Shelter category, as you can see in the darker green bars below.

While the large majority of categories contributing to inflation have receded, housing has not.

Housing accounted for more than HALF of inflation in February. +0.4% is in line with its 12-month average, but roughly double the monthly price growth prior to the pandemic, which was sub-0.3% per month.

Remember, the Shelter component of official CPI is very out of step (strong) with what actual rents in the market are doing today (falling/steady) – due to lags in the collection and reporting of data – which is holding all CPI measures artificially higher.

So, if you remove the stale data from housing, inflation is already below the Fed’s desired 2% target.

What has caught my attention is the process of disinflation seems to have stalled out. Not good.

Looking at the chart below, it is clear that inflation essentially stopped going down 8 months ago. That stickiness may require the Fed to remain higher-for-longer, or perhaps hike rates further, to wring that last 1% of inflation out of the system. One of the largest risks to the market in 2H24 is a rate cut hike, a scenario not priced into markets at the moment.

While the Federal Reserve’s preferred measure of inflation is the core personal consumption expenditures (PCE) index, the CPI is the next best thing. It certainly factors into Wall Street’s thinking about the Fed’s next move on interest rates.

Although market expectations still favor the next easing cycle to begin in June, the risk is of later and/or fewer rate cuts than currently priced in, if inflation pressures persist.

What’s become clear to investors is the path of softening price pressures – what’s known as disinflation – remains choppy and protracted, with certain categories proving stickier than most had anticipated. In other words, the path towards inflation normalization is not a straight line down from 9% to 2%.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Piper Sandler, Bloomberg, CME Group, Sonu Varghese, Ph.D., Austin Harrison, CMT

Record U.S. oil output

According to the U.S. Energy Information Administration (EIA), the U.S. produced more crude oil last year than any nation at any time. Ever.

Crude oil production in the United States averaged a staggering 12.9 million barrels per day in 2023 and reached a high in December of 13.3 million bpd – 10% above its December 2022 level.

Together, the United States, Russia, and Saudi Arabia accounted for 40% (32.8 million bpd) of global oil production in 2023.

These 3 countries have produced more oil than any others since 1971, although the top spot has shifted among them over the past 5 decades.

Source: U.S. Energy Information Administration, Sonu Varghese, Ph. D.

Market breadth continues to expand

There was a period earlier this year where breadth in the market was narrowing in terms of the percentage of stocks trading above their 50-day moving averages (DMA).

However, as seen in the chart below, the last few weeks have seen a notable upswing.

After bottoming out at less than 52% on February 13th, there’s been a steady increase in the percentage of stocks trading above their 50-DMA with yesterday’s level reaching just under 80% (79.5%). It’s still below the 90%+ levels we saw a few months ago, but 80% is a healthy number.

Source: Bespoke Investment Group

Global shipping disruptions from Red Sea attacks

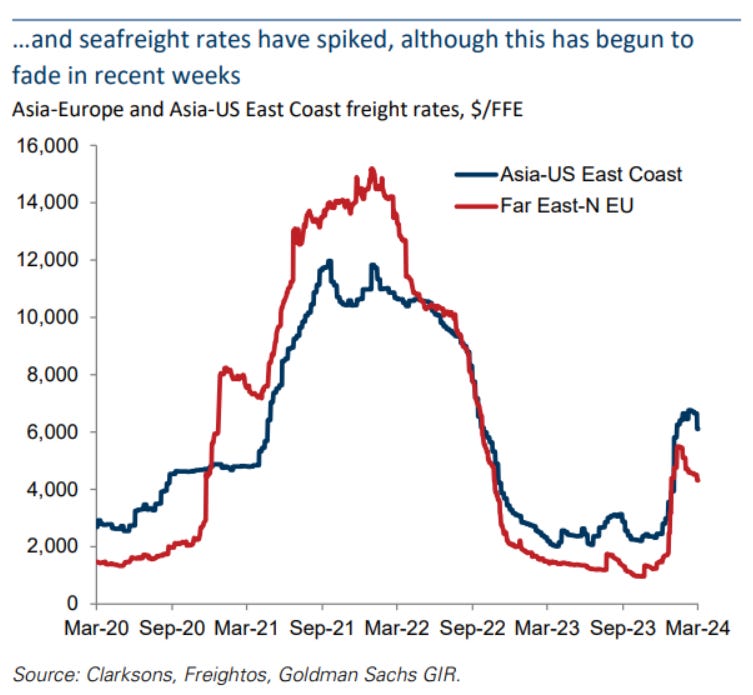

One of the biggest maritime disruptions in history is happening right now in the Red Sea due to the Iran-backed Houthi rebel attacks on commercial ships. What are the implications of this disruption for global commerce?

Roughly 10% of global oil and 30% of the world’s containers flow through the Red Sea, and it serves as the principal trade route between Europe and Asia. Most shipping is now re-routing around Africa’s Cape of Good Hope, which is adding significant time and cost to journeys and taking a substantial amount of logistics capacity out of play.

Container transits through the Suez Canal are down over 80% YoY.

This has caused seafreight rates to spike, container costs to rise, and shipping times to lengthen.

Source: Goldman Sachs Global Investment Research

Long-term inflation expectations rise

A recent Fed survey showed that consumers increasingly doubt the Federal Reserve can achieve its inflation goals anytime soon.

The outlook for the next 12 months remains unchanged but expectations rose 0.3% to 2.7% at the 3-yr range. Similarly, the 5-yr outlook jumped even more, up 0.4% to 2.9%.

These numbers stand ahead of the Fed's 2% target, which the agency has struggled to achieve – especially over the last 8 months as the "final mile" progress has stalled.

Source: Federal Reserve Bank of New York

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

👏