Inflation's final descent, plus peak interest rates, Apple's racket, Dollar falls/stocks surge, and Q4 estimates

The Sandbox Daily (11.14.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

inflation’s final descent

history indicates the peak rate during Fed tightening cycles is rather brief

Apple’s racket on mobile search

Dollar rolls over, stocks rip / historic day for small-caps

revising Q4 estimates lower

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +5.44% | Nasdaq 100 +2.13% | S&P 500 +1.91% | Dow +1.43%

FIXED INCOME: Barclays Agg Bond +1.26% | High Yield +1.01% | 2yr UST 4.834% | 10yr UST 4.453%

COMMODITIES: Brent Crude -0.11% to $82.43/barrel. Gold +0.85% to $1,966.7/oz.

BITCOIN: -3.04% to $35,451

US DOLLAR INDEX: -1.46% to 104.089

CBOE EQUITY PUT/CALL RATIO: 0.88

VIX: -4.07% to 14.16

Quote of the day

“An irrational drop in price makes a stock cheaper. A rational drop in price makes it more expensive.”

- Gautam Baid, The Joys of Compounding

Inflation’s final descent

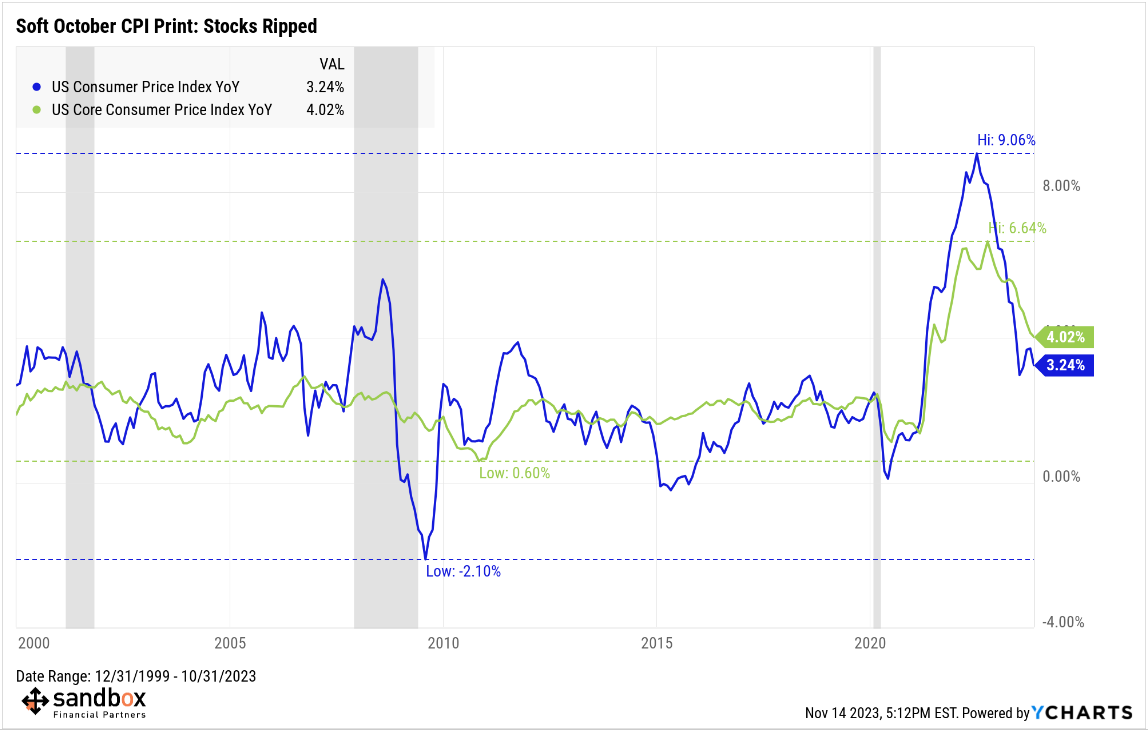

Inflation has fallen sharply from its pandemic peak and is in progress of its final descent.

Both headline and core CPI inflation eased in October, coming in slightly below expectations.

Headline CPI moderated to 3.2% YoY from 3.7% in the prior month, while core CPI (ex-food and energy) ticked down to 4.0% YoY from 4.1%.

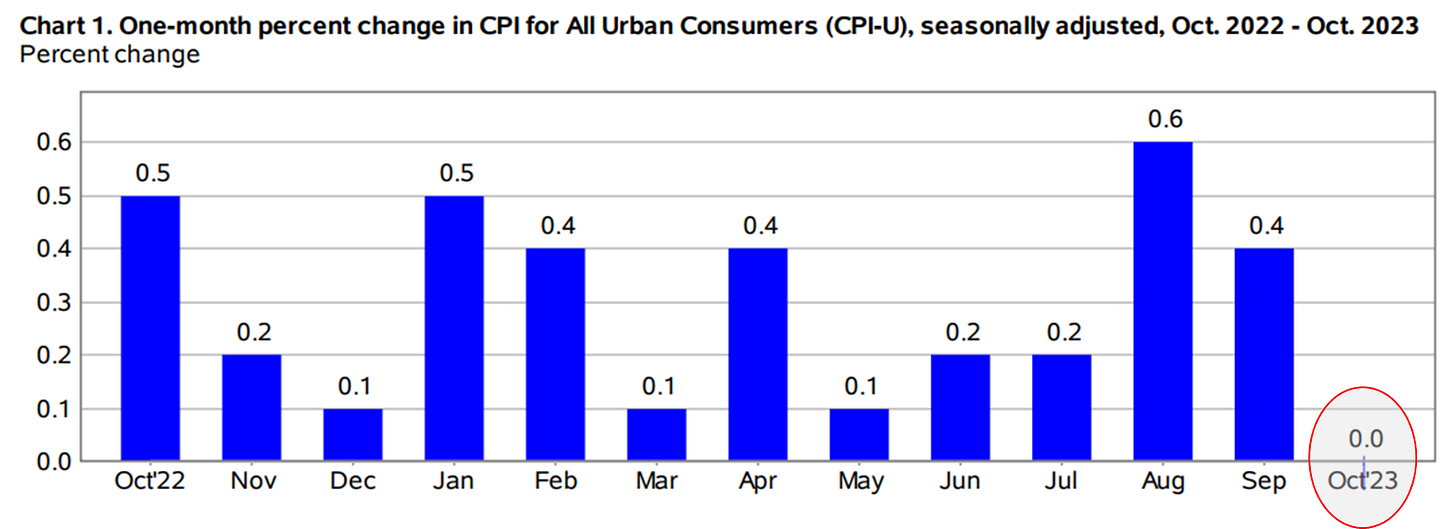

The monthly change in headline CPI was flat, the lowest month-over-month change since July 2022.

To be clear, this doesn’t mean prices are falling, rather they are going up at a much more moderate and reaasonable pace in aggregate.

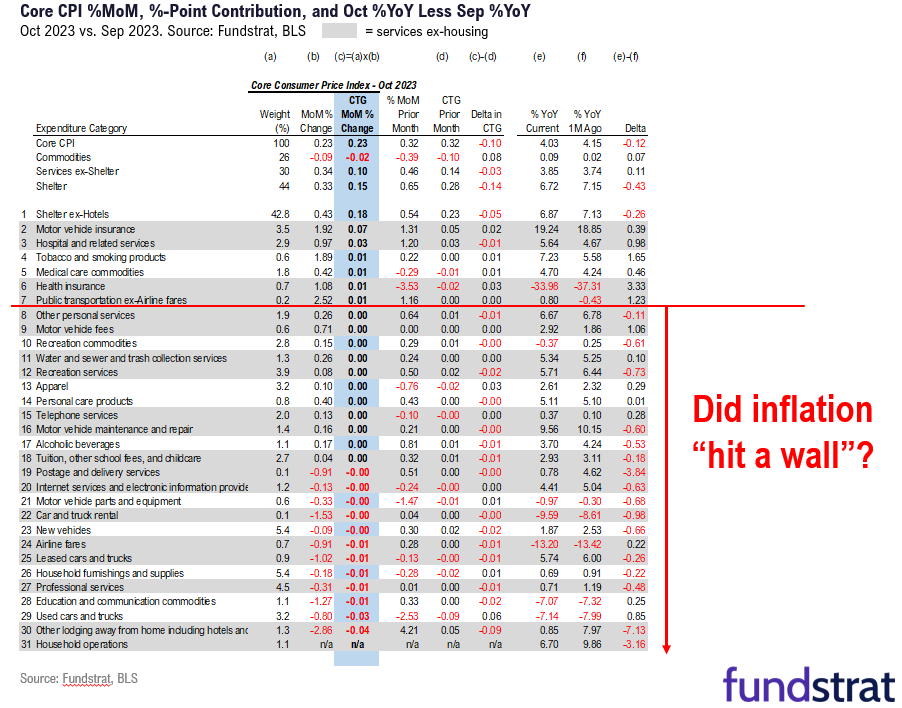

Drilling down, the bigger story seems to be that inflation could be hitting a wall. Just 7 of 31 Core CPI components saw a rise in October. Also key, the shelter fever seems to be breaking.

This is contradictory to the mainstream narrative and should drive a change in the Fed’s view of the “stickiness” of inflation.

Although inflation is making progress toward the Fed’s mandate of the 2.0% target, some underlying price pressures remain. Looking forward, perhaps most encouraging is that further disinflation remains in the pipeline from the rebalancing across the auto, housing, and labor markets.

On balance, this inflation report makes further rate hikes entirely unwarranted but still supports restrictive Fed policy.

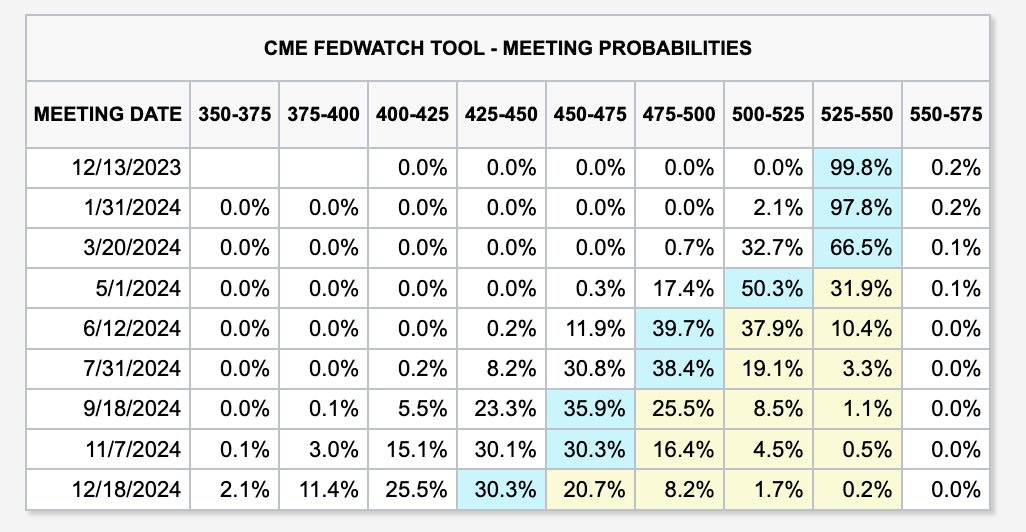

The market now shows a 0% change of additional rate hikes, with rate cuts beginning in May 2024.

And with yields crashing and investors bearishly positioned, stocks ripped to the upside today.

Source: U.S. Bureau of Labor Statistics, Ned Davis Research, Bloomberg, FS Insight, CME FedWatch Tool

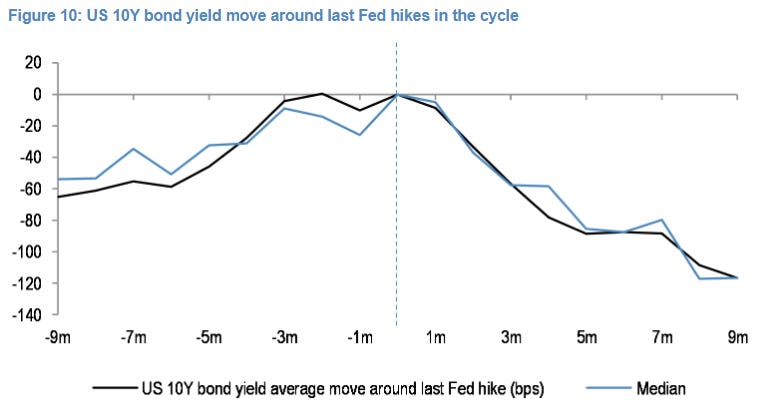

Yields down following final hike (July 2023) aligns with history

Looking at the past eight Fed tightening cycles, bond yields were down each time by an average of 100 bps roughly 8 months following the final rate hike, irrespective of whether the recession or the soft landing followed.

Reviewing these past cycles shows that bond yields always fell rather quickly following that final hike, down over 50 bps after 3 months and 100 bps after 8 months – meaning, the peak for interest rates in the cycle is rather fleeting.

The last hike of this cycle was at the end of July, so we are roughly 4 months (“4M”) in the table listed below.

Of course, each cycle is unique and presents its own opportunities and risks so calibrating the appropriate level of interest rates to balance each is difficult.

Source: J.P. Morgan

Apple’s racket on mobile search

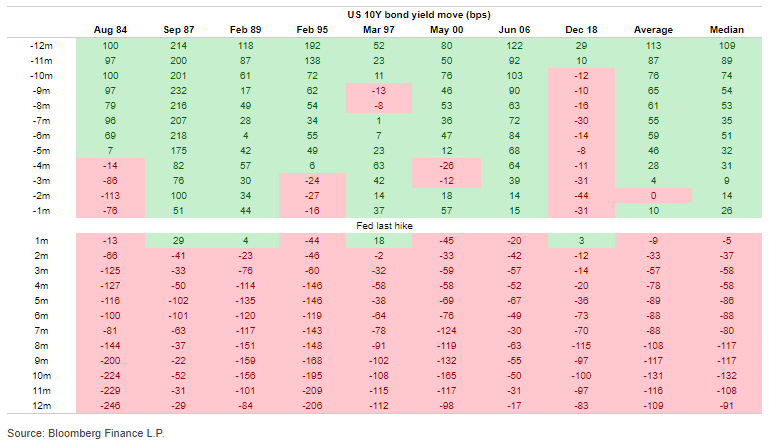

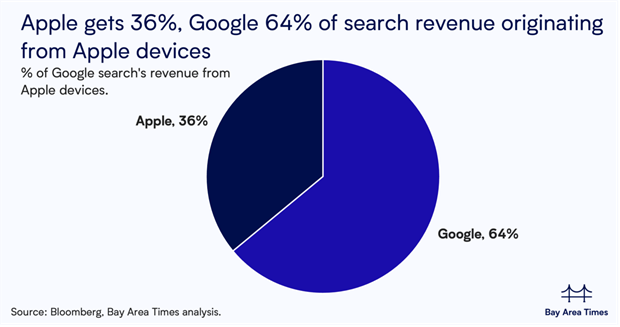

Google pays Apple 36% (!!!!!!!!) of the revenue it earns from search advertising made through the Safari browser, per testimony from a University of Chicago professor.

The companies have had a partnership since 2002 that keeps Google as the default search engine in Apple’s mobile web browser, Safari. But that partnership comes with a hefty pricetag for Google.

The number was supposed to be confidential, but an expert witness testified about it during Google's defense in its D.C. antitrust trial.

Source: Bay Area Times

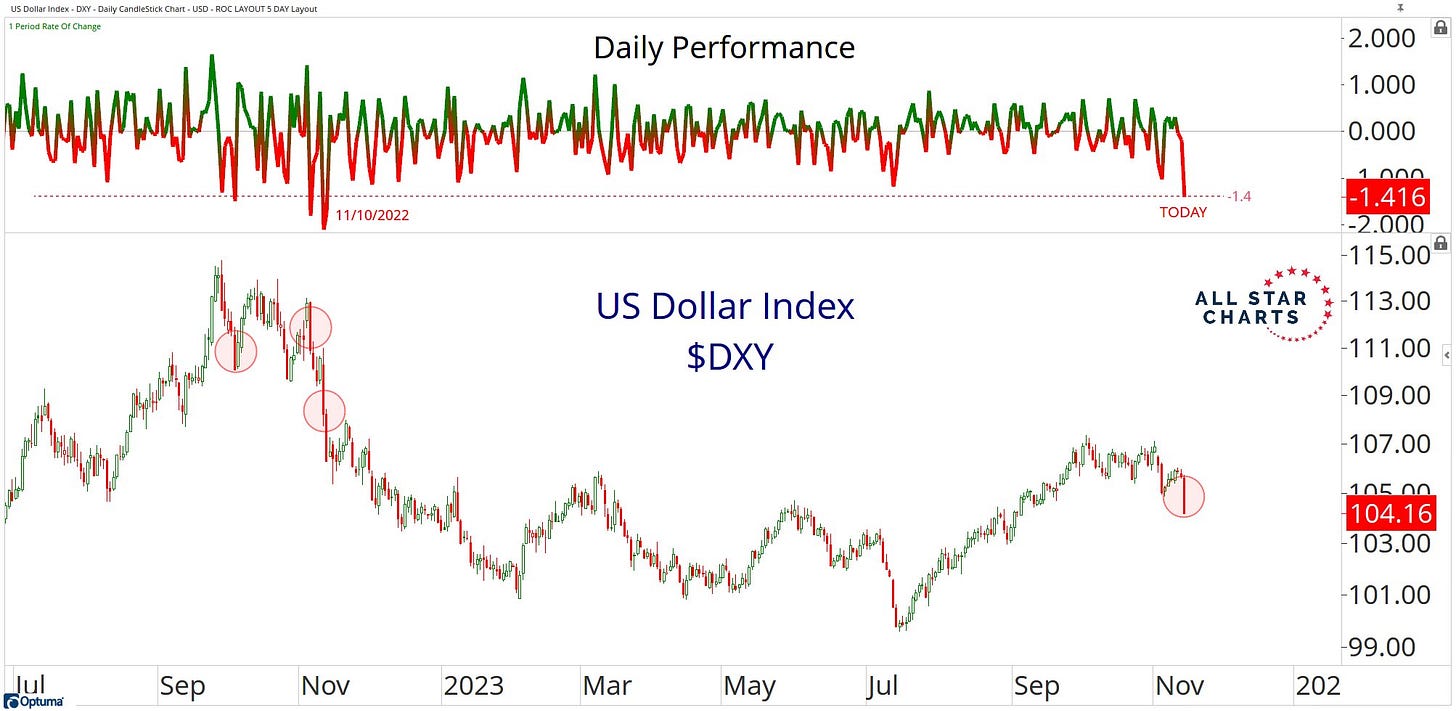

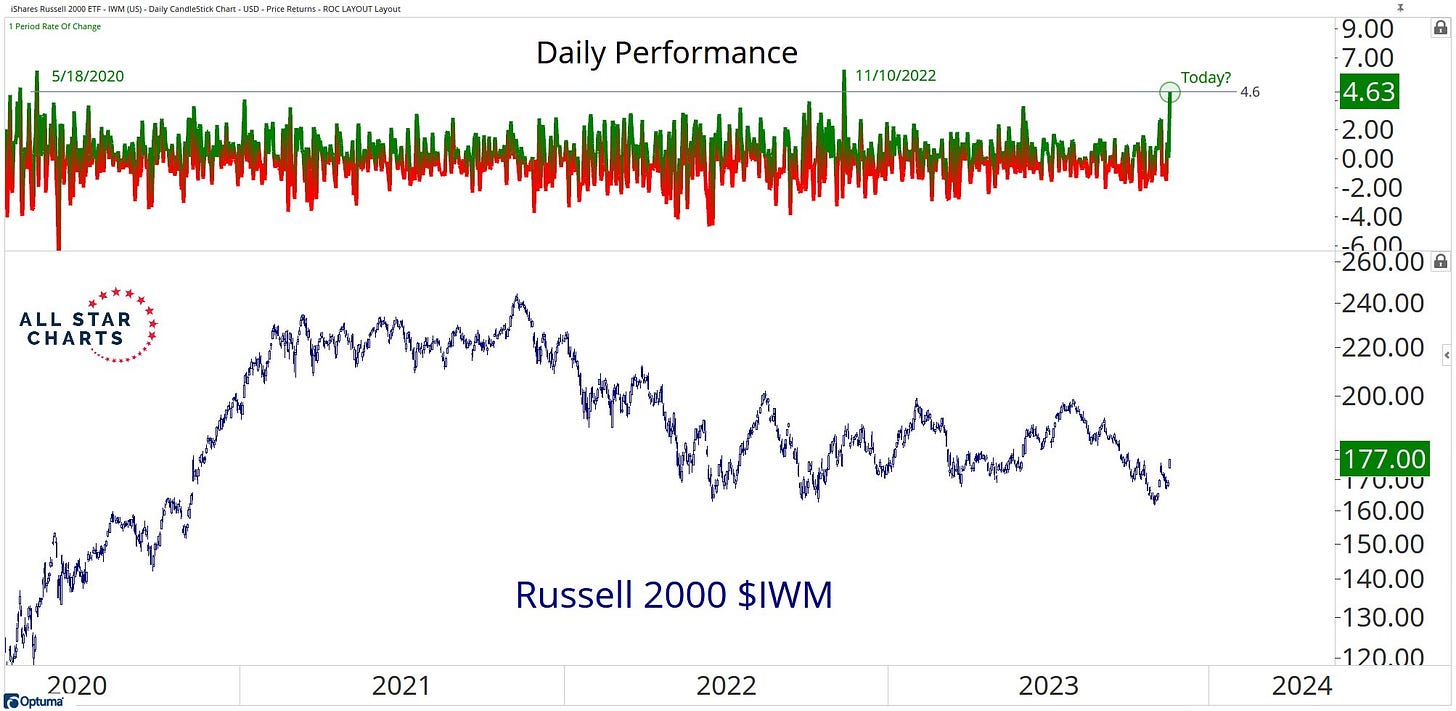

Dollar rolls over, stocks rip / historic day for small-caps

The U.S. dollar suffered its worst day in a year.

And how did stocks respond?

A wall of green. LOTS of it.

But, no area of the market had a more acute response than small-caps, which have had a difficult 2023 – see last week’s deep dive here.

Today’s +5.44% face-ripping rally was notable, with the Russell 2000 logging its single best trading session since last November and 2nd best since the COVID-19 bottom.*

*Note: this IWM 0.00%↑ chart was an intra-day chart only showing a +4.63% move

Source: FinViz, Steve Strazza

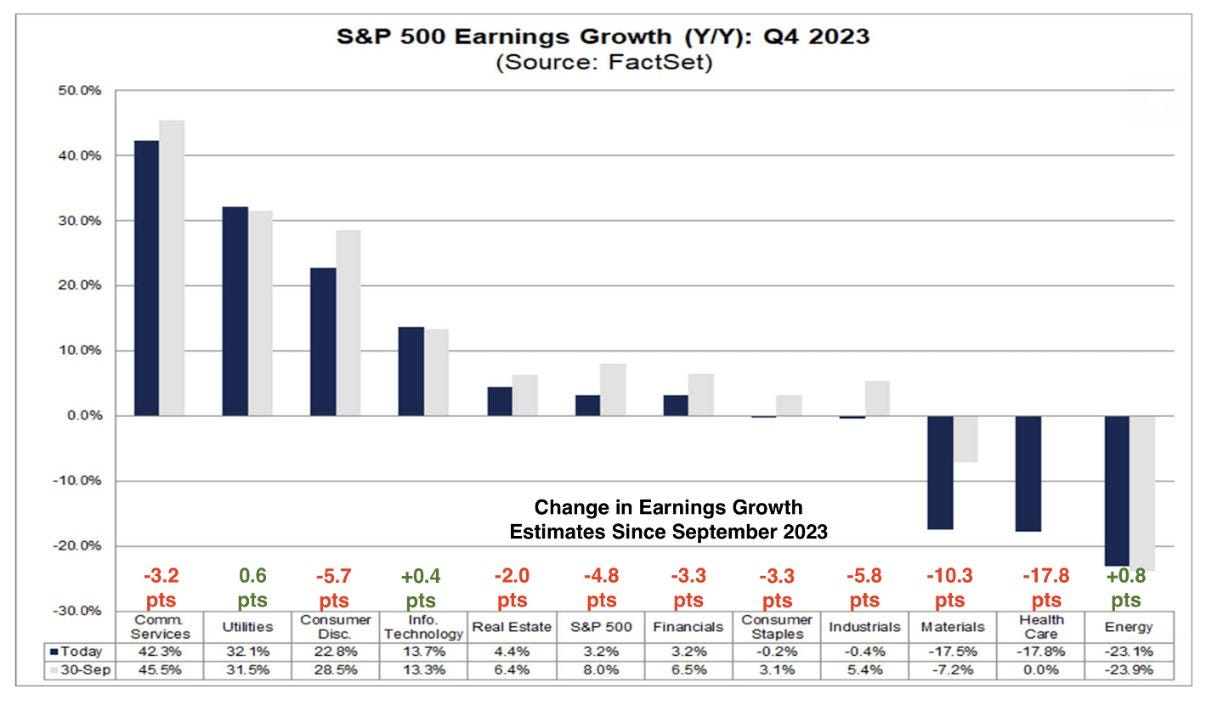

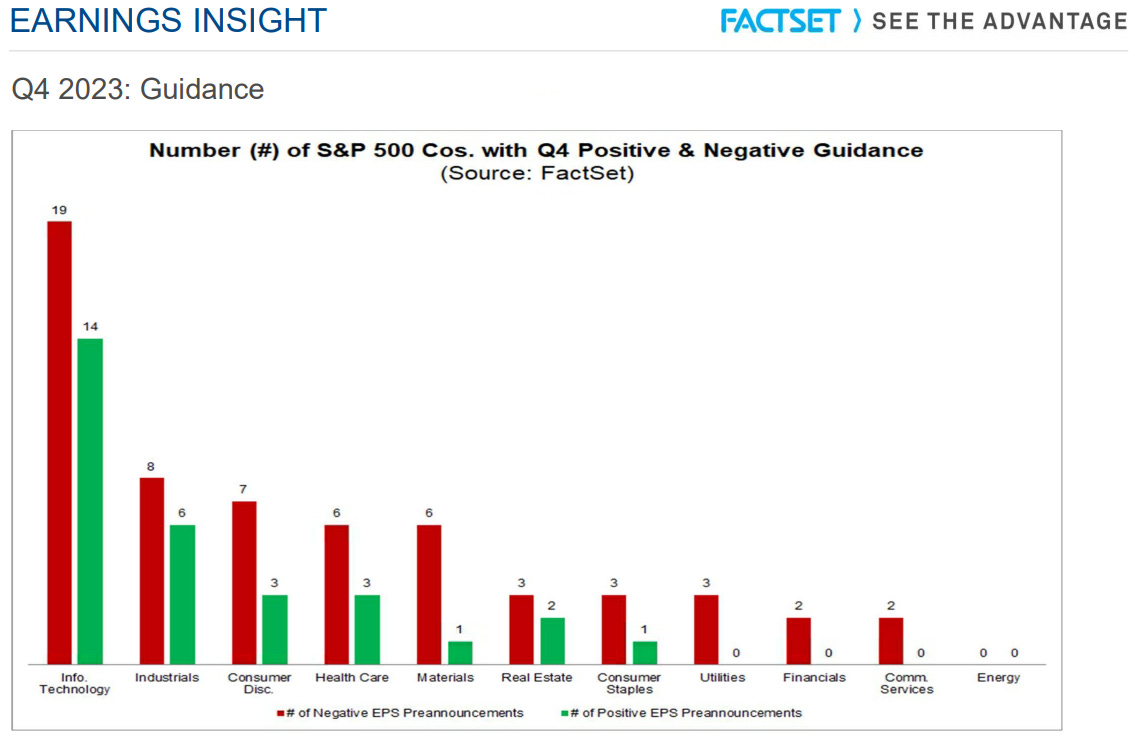

Revising Q4 estimates lower

Q4 earnings estimates are coming down for most S&P 500 sectors.

Analysts are revising their expectations lower in response to CEOs across America that continue expressing a cautious near-term outlook.

Energy, Utilities, and Technology are the only exceptions.

These downward EPS revisions from analysts align with the Q4 earnings guidance from C-Suite America where more companies have issued negative EPS guidance (59) than positive (30).

Source: FactSet

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.