Investing at all-time highs, and 🧁 weekend sprinkles 🧁

The Sandbox Daily (4.12.2024)

Welcome, Sandbox friends.

It’s Masters weekend in Augusta, GA. Lots of big names atop the leaderboard and Tiger is staying for the weekend – what’s not to like??!? AND, find me a more beautiful setting than Amen Corner and the Hogan bridge crossing over Rae’s Creek on 12.

Today’s Daily discusses:

investing at all-time highs

weekend sprinkles

Let’s dig in.

Markets in review

EQUITIES: Dow -1.24% | S&P 500 -1.46% | Nasdaq 100 -1.66% | Russell 2000 -1.93%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield -0.05% | 2yr UST 4.892% | 10yr UST 4.518%

COMMODITIES: Brent Crude +0.57% to $90.25/barrel. Gold -0.57% to $2,359.1/oz.

BITCOIN: -4.67% to $67,378

US DOLLAR INDEX: +0.71% to 106.031

CBOE EQUITY PUT/CALL RATIO: 0.72

VIX: +16.10% to 17.31

Quote of the day

“If you want something done, ask a busy person to do it.”

- Laura Ingalls Wilder, American writer

Investing at all-time highs

With major benchmarks and various sector ETFs printing new all-time highs after the brutal 2022 bear market, many investors express a certain anxiety or discomfort holding their positions while prices reside at fresh new highs.

This is the precise intersection of traditional finance (TF) and behavioral finance (BF).

So far in 2024, the S&P 500 index has achieved 22 new all-time highs despite many investors pooh-poohing this economy.

What many investors fail to realize though – until they look at a long-term chart – is that the stock market is often trading at or near all-time highs with some regularity.

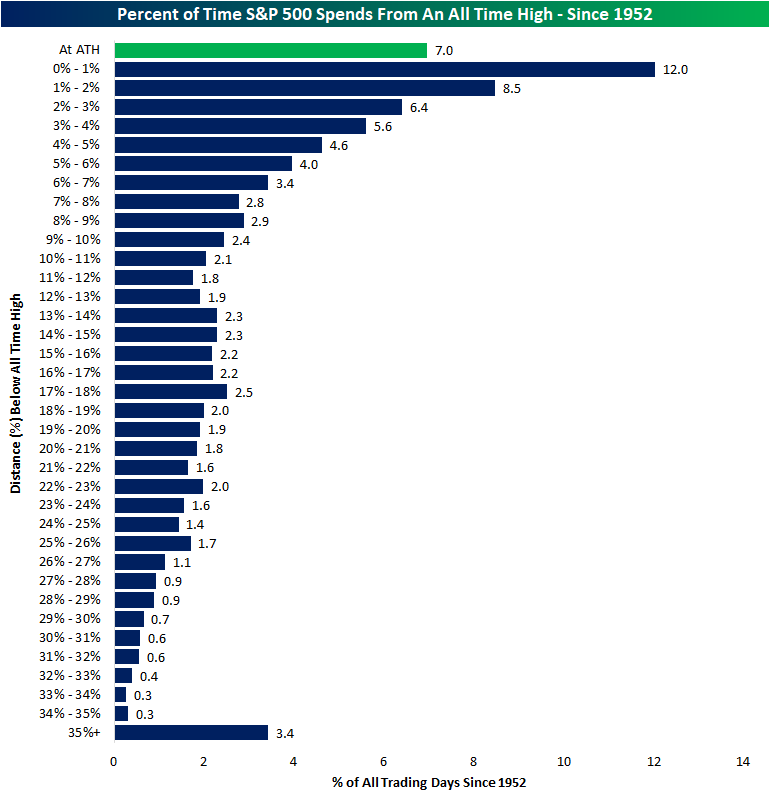

Below is a breakdown showing the percentage of time that the S&P 500 has traded within various ranges of an all-time high since 1952.

As you can see, the S&P 500 trades within 5% of all-time highs 44% of the time.

Within 10% of ATHs? 59.6% of the time.

In fact, even after a strong run in 2023 and early 2024, the market can definitely continue to stretch its legs in 2024 and beyond – using history as a guide.

Over the last 50+ years, had you invested in the S&P 500 at an all-time high, your investment would have been higher a year later 73% of the time with a median return of 12.1%. This is in line with historical market averages – whether we are at all-time highs or not.

Here’s the chart I keep coming back to:

New highs are not scary.

In fact, quite the contrary. Forward returns on average are in your favor.

Source: Bespoke Investment Group, J.P Morgan, A Wealth of Common Sense, Clearnomics

Weekend sprinkles

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Books

Nick Maggiulli – Just Keep Buying (Amazon)

Blogs

TKer – Even strong stock market years can get very stressful (Sam Ro)

Potomac Fund Management – Not so Fast: The pitfalls of buffer ETFs (Tyler Lovingood)

Carson Group – Is it time to worry about inflation again? (Sonu Varghese)

Grindstone Intelligence – The Monday morning grind (Austin Harrison)

Andreessen Horowitz – Why AI will save the world (Marc Andreessen)

Movies

Rad – Cru Jones and Bart Taylor, also featuring that actress from Full House (IMDB)

Land of Bad – Russell Crowe, Liam Hemsworth (IMDB)

Music

Harry Styles – Cinema (Spotify, Apple Music)

Deadmau5 feat. Pharrell Williams – Pomegranate (Spotify, Apple Music)

Kid Cudi feat. Ty Dolla $ign – Willing to Trust (Spotify, Apple Music)

Calum Scott – Dancing On My Own, Tiësto Remix (Spotify, Apple Music)

Jason Aldean – Let Your Boys Be Country (Spotify, Apple Music)

Social Media

Josh Brown’s take – perfectly on point – on inflation (Instagram)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.