Investing lessons from Benjamin Graham, plus crude oil vs. energy stocks, Big Tech, Broadway theatre, and Hawaii's Mauna Loa volcano

The Sandbox Daily (11.29.2022)

Welcome, Sandbox friends.

Today’s Daily discusses the pearls of wisdom from famed value investor Benjamin Graham, the growing divergence between Oil and Energy stocks, the struggles of Big Tech, Broadway theatre spending is back, and Hawaii's Mauna Loa volcano erupts.

Trading in today’s afternoon session was light due to the World Cup match between the United States and Iran at 2pm. People are in rapture with this global event!

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.31% | Dow +0.01% | S&P 500 -0.16% | Nasdaq 100 -0.73%

FIXED INCOME: Barclays Agg Bond -0.36% | High Yield +0.43% | 2yr UST 4.481% | 10yr UST 3.750%

COMMODITIES: Brent Crude +0.61% to $83.70/barrel. Gold +0.32% to $1,763.7/oz.

BITCOIN: +1.51% to $16,462

US DOLLAR INDEX: +0.24% to 106.803

CBOE EQUITY PUT/CALL RATIO: 0.76

VIX: -1.44% to 21.89

20 lessons from the father of value investing

Benjamin Graham was an influential investor whose research in securities laid the framework for in-depth fundamental valuation used in stock analysis today by many investors. He wrote two of the seminal texts in neoclassical investing: Security Analysis and The Intelligent Investor.

Here are 20 investment tips from The Intelligent Investor:

Source: Compounding Quality

Crude has given up almost all gains YTD, energy sector still +60%

Crude oil posted its lowest weekly close of 2022 on Friday of last week, with West Texas Intermediate ending at $77/bbl. Then, with drastic COVID-related lockdowns hitting major Chinese urban centers over the weekend, U.S. oil prices briefly fell even more yesterday, as investors braced for a further slowdown in China's economy and thus global economic growth.

Earlier this year, the world seemed at risk of running dangerously short of oil and gas due to Russia's attack on Ukraine – creating major shocks to the global economy. In June, U.S. gasoline prices topped $5/gallon for the first time; now they're a bit higher than $3.50. And U.S. crude oil was more than $120/barrel in June, prompting a series of releases from the U.S. Strategic Petroleum Reserve; now they're almost 40% less, touching sub-$74 levels yesterday. So, oil prices are back to pre-war levels and prices at the pump are falling.

But none of these developments have seemed to impact energy stocks, which are up a remarkable +60% YTD and going in the complete opposite direction in recent months. The divergence between Oil and Energy stocks is obvious – many are wondering how long this will continue.

Crude oil prices are key inputs into the giant machine that is the U.S. economy, touching both products that are directly petroleum-related — such as chemicals, plastics, fertilizers and fuels — and indirectly impacting a broader swath of the economy through the costs of manufacturing, transportation and heating. High oil prices are thought to depress the supply of goods by raising the cost of producing them, worsening inflation and weighing on real economic growth. All else equal, the nearly 40% drop in crude oil prices should help the U.S. economy.

Source: Beat the Bench

Big tech out of favor

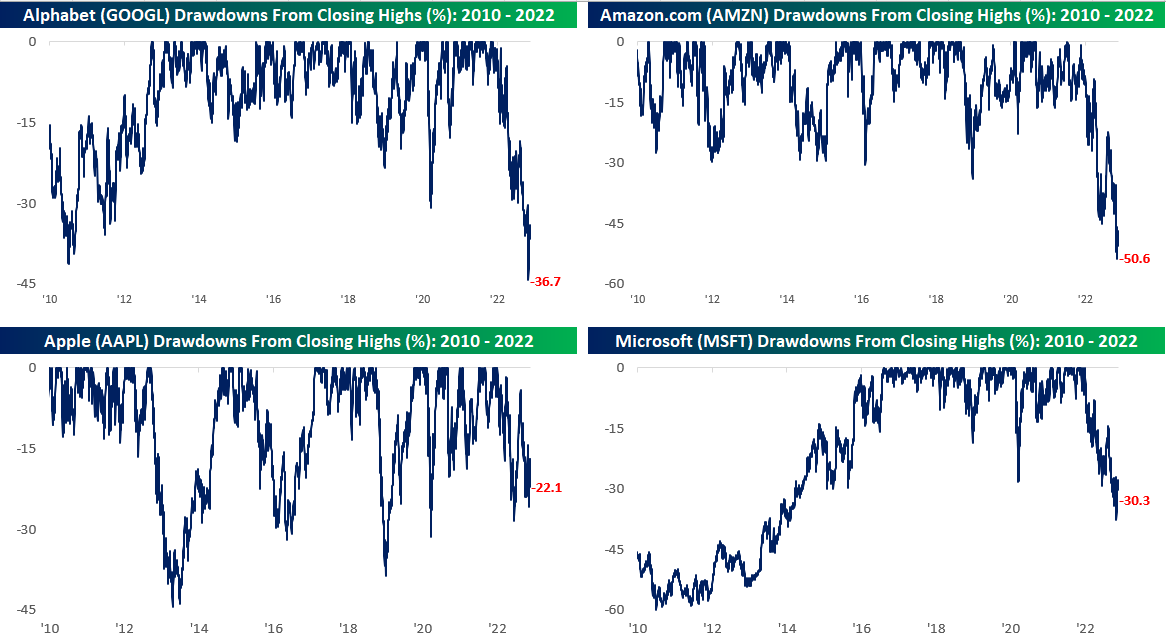

With the flare-up of protests in China sparking concerns about production disruptions at Foxconn factories, shares of Apple (AAPL) are once again down 20% from their all-time closing high.

With that move, all four of the mega-cap “MAGA” stocks – Microsoft (MSFT), Apple (AAPL), Alphabet aka Google (GOOGL), and Amazon.com (AMZN) – are now down at least 20% from their all-time closing highs. Along with AAPL's 22% drawdown, the three others have seen declines in excess of 30% with AMZN down over 50% from its record high.

For years, mega-caps were credited with driving the broader market gains as they handily outperformed other large-caps and their smaller market-cap peers. In 2022, we have seen the opposite trend play out as mega caps are still seeing larger moves, but to the downside instead of to the upside. While all four of the largest stocks in the S&P 500 are down at least 20% from their highs, it's quite a juxtaposition with the S&P 500 which is down 'only' 17.8%.

Source: Bespoke Investment Group

Broadway theater spending is back

In another (anecdotal) sign of consumer strength, people are heading back to the theatre district for their favorite show!

In mid-October, we learned that U.S. retail sales rose in October by +1.3%, while the consensus had only expected an increase of +0.9%. This helps to confirm the narrative that the U.S. consumer is still quite strong. In fact, in the last few months, the theatre district has seen a notable uptick in the number of people going to Broadway shows. Similar consumer services and experiences, such as concerts and sporting events, are also seeing parallels of increased demand.

An important driver of this trend is that job and wage growth remain strong and household savings remain intact, for now.

Source: Apollo Global Management, The Daily Shot

Hawaii’s Mauna Loa, the world’s largest active volcano, erupts

Hawaii's Mauna Loa volcano began erupting Sunday evening for the first time since 1984, following a recent spike of earthquakes in the area and the culmination of months of elevated tectonic activity. Portions of the island were under an ashfall advisory yesterday, which has since been canceled. Check out this time lapse video of the eruption from inside the crater:

The volcano is the biggest of five that make up the Big Island of Hawaii and is the largest active volcano in the world, rising more than 13,000 feet above sea level.

Several webcams are positioned near the summit to capture this event in real time:

https://www.usgs.gov/volcanoes/mauna-loa/webcams

As of this writing, the lava had migrated out of the summit area to a rift zone on the volcano’s northeast flank, but is not threatening any downslope communities. If lava were to break out of some rift zones, it could rush down quickly due to the volcano's steep slopes.

Source: U.S. Geological Survey

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.

Great post Blake. I enjoyed being reminded of Graham's wisdom-I am partial to #4. Good planning will help keep you on track.