Investing through the highs and lows of the cycle

The Sandbox Daily (3.25.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

when in doubt, zoom out

Let’s dig in.

Blake

Markets in review

EQUITIES: Nasdaq 100 +0.53% | S&P 500 +0.16% | Dow +0.01% | Russell 2000 -0.66%

FIXED INCOME: Barclays Agg Bond +0.09% | High Yield -0.05% | 2yr UST 4.022% | 10yr UST 4.315%

COMMODITIES: Brent Crude +0.26% to $73.19/barrel. Gold +0.36% to $3,026.6/oz.

BITCOIN: -0.12% to $87,891

US DOLLAR INDEX: -0.05% to 104.208

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: -1.89% to 17.15

Quote of the day

“You cannot dream yourself into a character; you must hammer and forge yourself one.”

- James Anthony Froude

During difficult periods, zooming out helps

When it comes to financial planning and investment strategy, it's important to recognize what we can and cannot control.

We can control our own behavior, make thoughtful financial plans, and adjust our strategies as needed.

However, we cannot control the economic cycle, market movements, or policy decisions that impact the broader financial landscape.

Recognizing this distinction is so important and allows us to focus our attention and energy on the aspects of our financial lives where our decisions truly matter.

With some investors now worried about a possible recession and the stock market facing heightened uncertainty, this is a good time to review the fundamentals of business cycles and how they affect financial planning and investment strategy.

What is the business cycle?

Business cycles represent the broader economy’s movement through periods of growth and recession, measured by metrics like GDP, employment, industrial production, and many more (too many, in fact).

While the duration of a business cycle can vary significantly, they tend to occur over long periods, lasting 5-10 years on average.

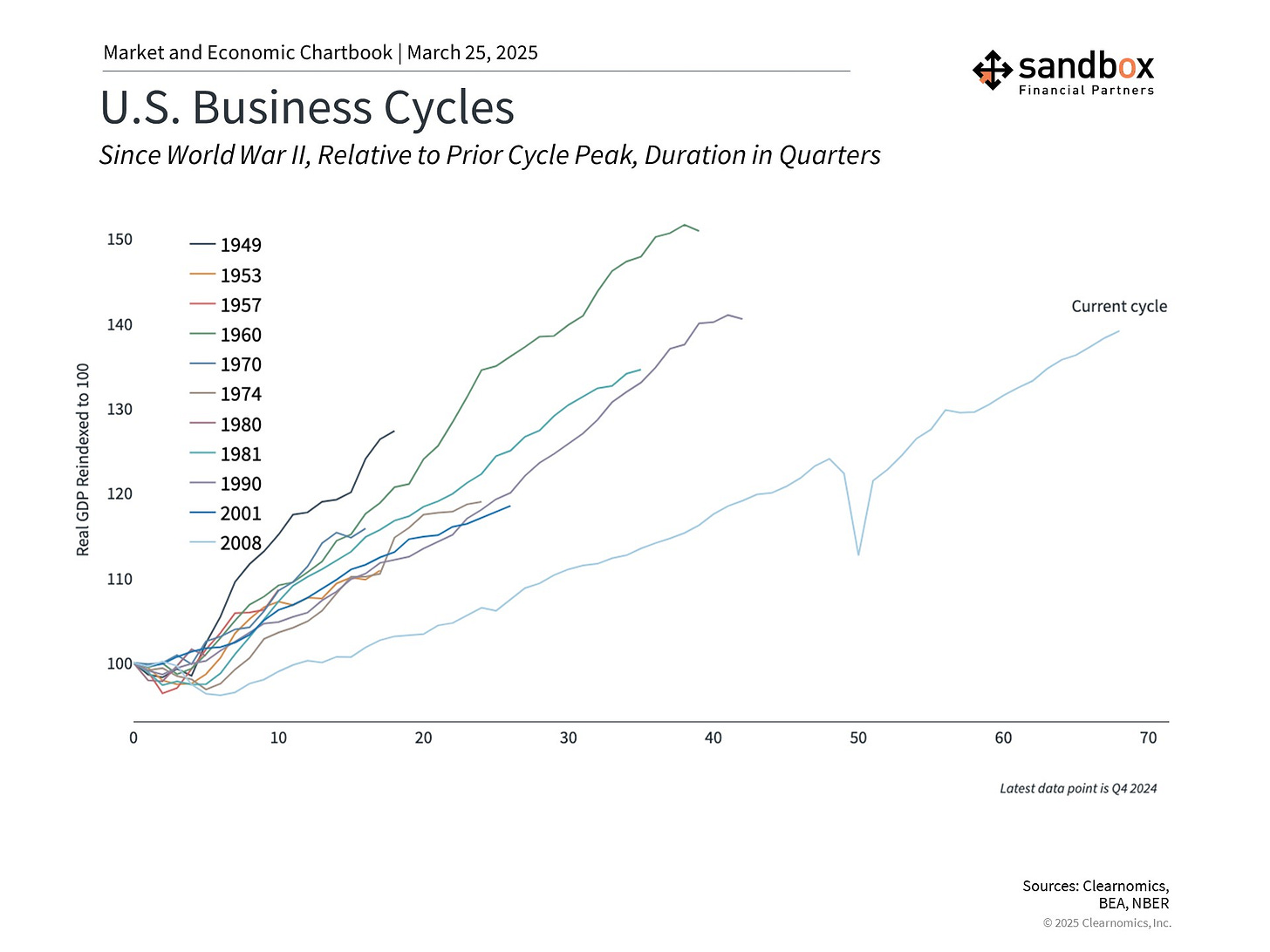

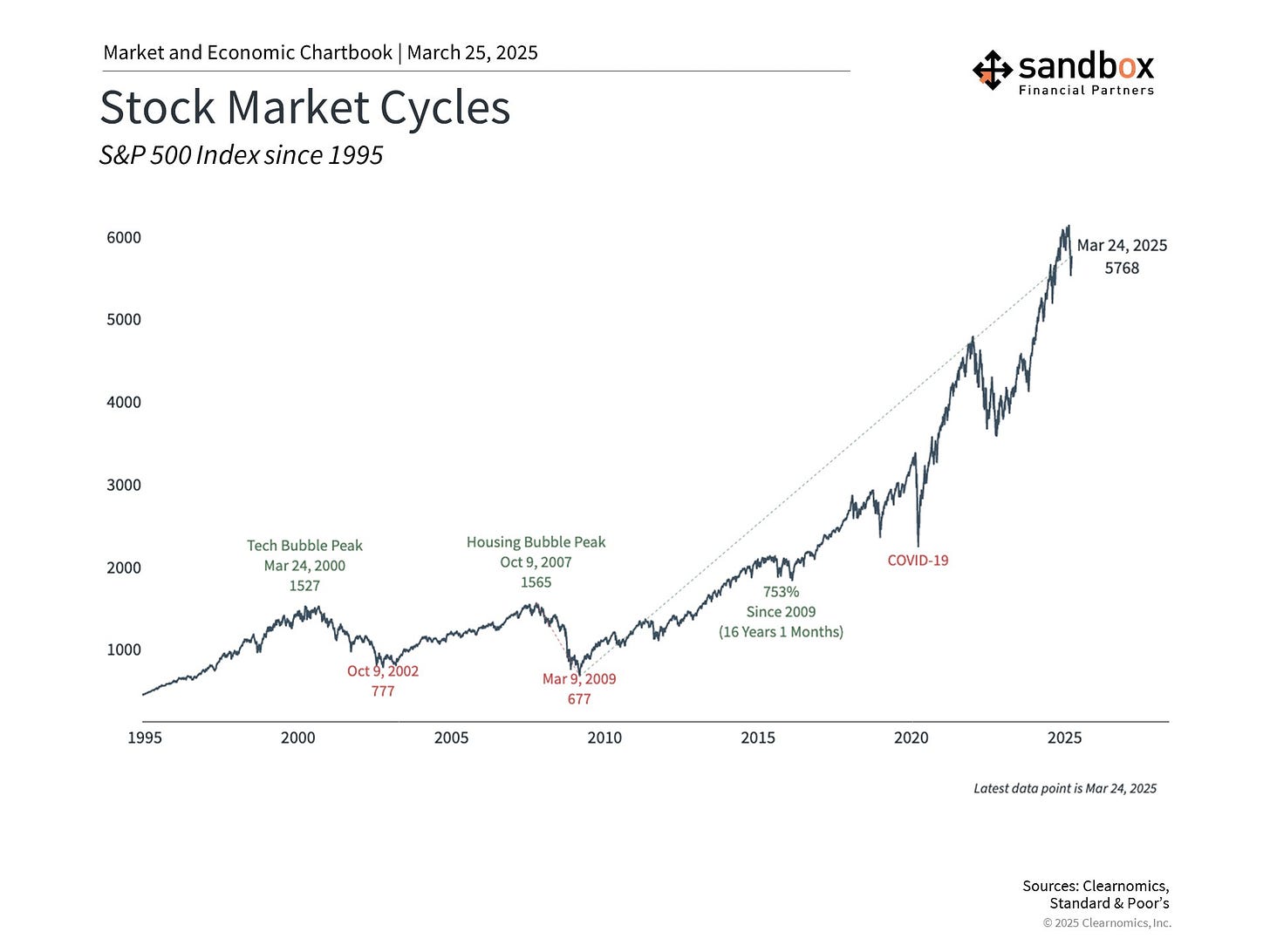

According to the National Bureau of Economic Research (NBER), there have been twelve recessions since World War II. In the last 25 years, we have experienced three: the 2001 dot-com bust, the 2008 global financial crisis, and the 2020 pandemic recession. Of course, there have been many more cases when investors and economists feared there might be a recession but one never materialized, 2023 being the most recent example.

Business cycles have also grown longer since the stagflationary period of the 1970s and early 1980s. The steady growth period until 2008 is often known as “The Great Moderation” – a period when the economy was strong, inflation was moderate, unemployment remained low, and the average cycle length was nearly nine years.

While each business cycle is unique, there are patterns that have emerged over time. In general, business cycles can be characterized by four distinct phases:

Expansion: During this phase, the economy grows as unemployment falls, consumer confidence rises, and business activity increases. GDP growth is positive, and companies often invest in new capacity.

Peak: This is the point where growth reaches its max. The economy is operating at or near full capacity, inflation may begin to rise, and signs of overheating might appear.

Contraction: During this phase economic activity slows, companies may reduce hiring or lay off workers, and GDP growth slows or becomes negative. Consumer spending typically decreases during this phase.

Trough: This is the lowest point of the cycle, where economic decline bottoms out before beginning to recover. Unemployment is typically at its highest, and business confidence is low.

Each phase may not be equal in length, and there are both situations where business cycles last longer than some expect and cases where cycles end abruptly.

For example, during the 1990s business cycle, the economy slowed sharply in 1995 without falling into a recession. The Fed was able to achieve a so-called “soft landing” by lowering inflation without negatively impacting economic growth.

In contrast, the 2008 global financial crisis resulted in a swift economic decline due to a rapid collapse in the financial sector. The same is true in 2020 when the nationwide shutdown resulted in a sharp decline in economic activity.

Trying to precisely time business cycles is notoriously difficult.

This is one reason economics is often referred to as an inexact science – it has a poor track record of predicting recessions, and often predicts ones that never occur. However, recognizing where we generally are in these cycles can help us make better financial decisions nonetheless.

Distinguishing between business and market cycles

Market cycles can be more volatile and occur more frequently than business cycles.

The stock market can experience multiple corrections within a single business cycle, including several short-term pullbacks each year, due to investor sentiment, liquidity conditions, and other factors beyond the economy.

This is because the market is anticipating the future while economic data is often backward-looking. Markets are certainly influenced by economic data, but news headlines, sentiment, and many other data points are also taken into consideration by investors. This means that markets can often overreact to short-term events.

Financial planning through cycles

Rather than attempting to time markets, investors can adopt different approaches to help.

The key is to ensure you stay on track with your financial goals throughout business and market cycles, easier said than done of course:

Maintain a long-term perspective. Short-term market movements often appear as mere blips when viewed over years and decades. They can sometimes be inaccurate indicators of the business cycle. For example, the 2022 stock market correction did not accurately predict an economic recession in 2023 as many economists called.

Portfolio rebalancing. Regular portfolio rebalancing enforces the discipline to “buy low and sell high” by reducing positions that have appreciated and adding to those that have underperformed. When appropriate, this systematic approach can help navigate market cycles without succumbing to emotional decision-making.

Adjust expectations by cycle phase. During late-cycle periods when valuations are stretched, future returns may be lower. Consider moderating return expectations during these phases rather than chasing higher yields through excessive risk-taking.

Have an emergency fund. Financial plans should take into account the fact that downturns are inevitable. Emergency funds covering 6-12 months of expenses provide crucial flexibility during contractionary periods, particularly if job security becomes a concern.

Portfolio resiliency across all phases of the business cycle

Constructing an appropriate portfolio remains the cornerstone of investing across business cycles, full stop.

Different asset classes can respond in unique ways to changing economic conditions.

For example, stocks typically benefit from economic expansions but struggle during contractions. In contrast, bonds can generate income during expansions and provide ballast during contractions.

The right portfolio differs for each person, balancing these asset classes according to your time horizon, risk tolerance, and financial goals.

A well-diversified portfolio will underperform the hottest asset class during any given time period, but it also avoids severe drawdowns along the way that derail financial plans.

Bottom line?

Market and business cycles are natural parts of the investing experience. Rather than trying to predict each turning point, history shows that it’s better to maintain a well-constructed portfolio that can weather all parts of the cycle.

Sources: CFA Institute, Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: