Investor whiplash, plus the move in yields, GDP revision, U.S. dollar slide, and retiring The Reformed Broker

The Sandbox Daily (11.29.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

investor whiplash

major move in yields

3rd quarter GDP figure revised… higher?

U.S. dollar’s slide

Let’s dig in

Markets in review

EQUITIES: Russell 2000 +0.61% | Dow +0.04% | S&P 500 -0.09% | Nasdaq 100 -0.14%

FIXED INCOME: Barclays Agg Bond +0.49% | High Yield +0.54% | 2yr UST 4.645% | 10yr UST 4.259%

COMMODITIES: Brent Crude +1.49% to $82.90/barrel. Gold +0.18% to $2,065.5/oz.

BITCOIN: -0.19% to $37,820

US DOLLAR INDEX: +0.07% to 102.822

CBOE EQUITY PUT/CALL RATIO: 0.79

VIX: +2.29% to 12.98

Quote of the day

“I don’t care how 'optimized' our models are or how much math we have behind them – if we can’t keep our clients in them, what’s the difference? A fantastic portfolio that our clients can’t stick to is worthless, we may as well be throwing darts at ETFs.”

- Josh Brown, Ritholtz Wealth Management in The Challenge

* Publisher’s note: Today, we learned that Josh Brown is retiring the consummate financial blog, The Reformed Broker, in a beautifully written post titled This is the End. Josh has provided countless, amazing insights over the years to millions of readers – providing refreshingly honest takes all along the way. When that e-mail notification hit my inbox, I couldn’t wait to hit that embedded hyperlink and see what Josh was cooking up. It was a privilege to shake your hand and tell all of that to you directly at Future Proof. Should you be reading this post – from me and countless others – THANK YOU. Best wishes on the next leg of your journey.

Investor whiplash

The divergence between growth and value persists.

Again.

The Vanguard Growth ETF (VUG) is up +40% year-to-date, while its counterpart Vanguard Value ETF (VTV) is up +1%.

After a brief moment in the sun during 2022, growth has firmly regained the torch.

For investors, we call this style whiplash.

Source: YCharts

Major move in yields

It appears much of the rational for the Federal Reserve skipping a November rate hike has dissipated.

Let’s back up. The updated, expanded reference from tighter “credit” to “financial and credit” conditions in the 2nd paragraph of the November FOMC statement largely rested on the sharp increase in U.S. Treasury term premiums from the day before the September meeting (9/19) to the eve of the last FOMC announcement (10/31).

Since then, term premiums have unwound much of the increase – 65 of 112 bps at the farthest horizon – on net through yesterday, to be precise. Furthermore, the drop in term premiums appears to be a global phenomenon, with the largest declines here in the U.S.

So, why the rally? Interesting to note how when yields shot up relentlessly, the narrative was all about the United States Treasury’s unsustainable and gratuitous debt load, with new-found economists from the cheap seats affixed on routine events such as refunding announcements and Treasury auctions.

Now? Amid this recent substantial rally, we don’t hear anything about the improved fiscal position of this great country. If anything, the situation is incrementally, infinitesimally worse – if at all.

Perhaps other factors have played a role, including the recent deterioration of the hedging value in the U.S. dollar. Even so, there’s rarely a single “tell” that does all the lifting in a fulsome explanation, not to mention the persistent market noise that persists at all times.

Source: Federal Reserve, Piper Sandler

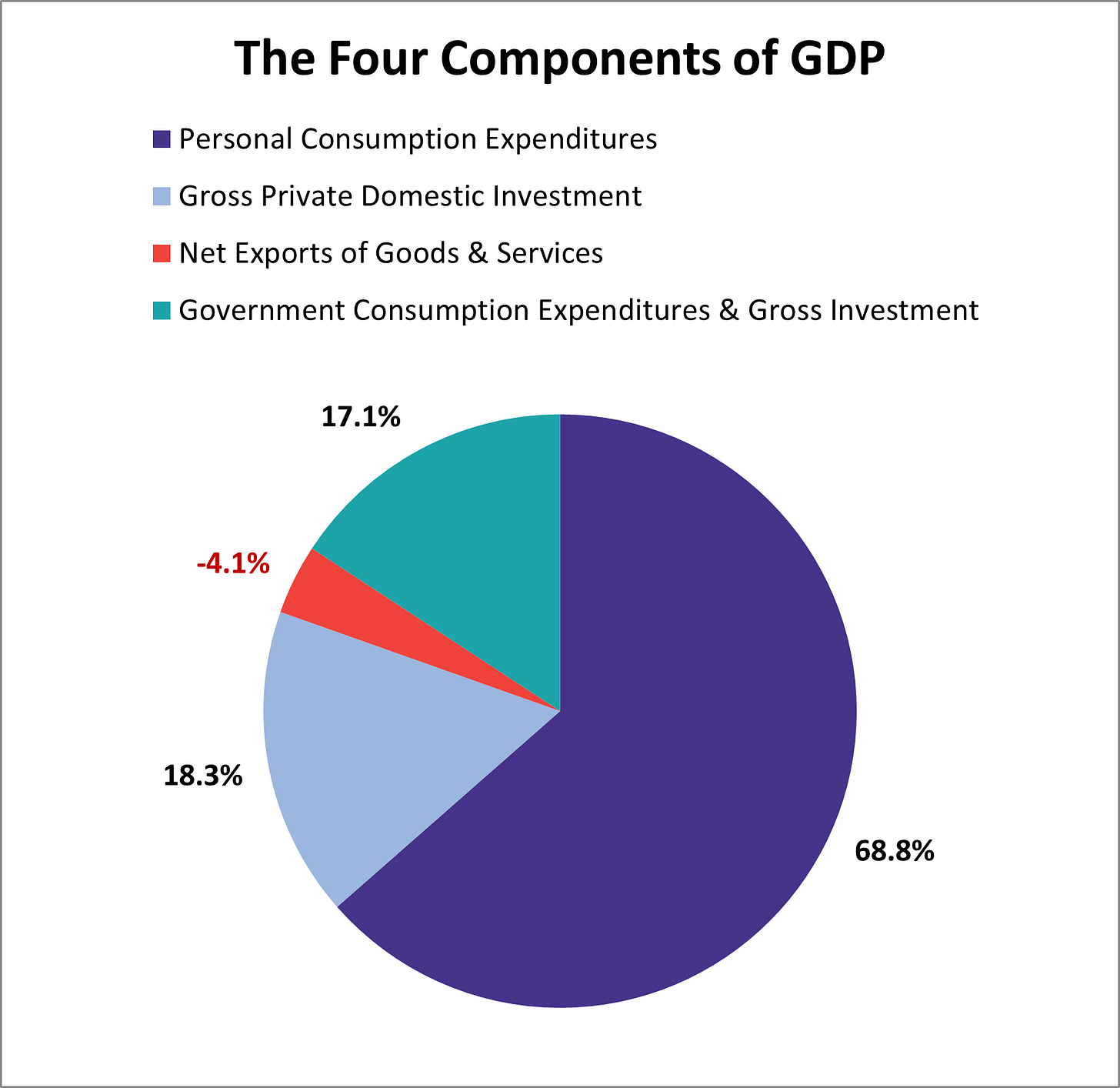

3rd quarter GDP figure revised… higher?

This morning’s revised estimate for 3rd quarter U.S. GDP growth was full of surprises – and oddly also made many investors, economists, and talking pundits angry that the economy keeps growing despite their public calls to the contrary.

Revisions pushed headline growth from 4.9% to 5.2% annualized, but we must look beneath the headlines for important breadcrumbs.

Consumer spending was revised down from 4.0% to 3.6% annualized. Consumer data is often revised downward as the economy downshifts, which we witnessed in the latest GDP report. Looking ahead, we should likely expect to see less support from consumer spending.

The reason we obsess about consumer spending is because of its critical importance for economic growth in the United States.

And here’s the evolution of that consumer spending piece as a share of GDP over time, which is just a smidge beneath the series peak reached in the 2nd quarter of 2022:

Meanwhile, government spending and inventories – both measures revised higher – will likely subtract from Q4 growth in some natural giveback.

In addition to weaker consumer spending, markets are digesting Fed governor Christopher Waller’s apparent pivot, as he commented yesterday that the Fed could hold rates steady at the upcoming meeting. If inflation safely returns to 2-3% level, he acknowledged the Fed should ease the policy rate to avoid throttling economic activity more than necessary. Investors know that Waller had been the most hawkish of Fed officials, so this is market-moving guidance. Treasury yields and the U.S. dollar both fell on the news.

On balance, the strong momentum last quarter reflects the remarkable resilience of the U.S. economy amid high interest rates and tight bank lending standards which have yet to meaningfully restrain aggregate demand.

Source: Ned Davis Research, Bloomberg, Advisor Perspectives

Dollar slides

The dollar is down big this month, putting in its worst performance in a year.

The dollar index is down 3.6% through November 28, the sharpest monthly slide since last November's 5% drop.

We should not forget the extraordinary streak of weekly gains from July to September that wreaked havoc on equity and commodity prices alike.

Now, the dollar is steadily slipping – losing key technical levels along the way.

The downside move gained strength on November 14th when we learned of “inflation’s final descent” on the day of the soft October CPI print, causing the Dollar to (massively) undercut a key Fibonacci level from the entire range of the cycle’s peak-to-trough price action – a significant technical development.

The decline in the greenback — as measured by the U.S. dollar index — is a reflection of growing certainty in financial markets that the Federal Reserve has basically vanquished inflation and peak rates for the cycle are likely in.

And for those readers not sure of the dollar’s importance for markets, here’s a chart of major index performance across a variety of asset classes since the U.S. dollar peaked on October 3rd:

Source: Axios, Grindstone Intelligence, J.C. Parets

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Great stuff Blake!