Investors are suffering from whiplash, plus household debt, U.S. economic growth, and small-caps

The Sandbox Daily (7.23.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

investor whiplash

household debt as a share of household net worth

U.S. 2nd quarter economic growth (GDP) to report on Thursday

small-caps aren’t just about interest rates

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.02% | Dow -0.14% | S&P 500 -0.16% | Nasdaq 100 -0.35%

FIXED INCOME: Barclays Agg Bond -0.01% | High Yield +0.01% | 2yr UST 4.493% | 10yr UST 4.252%

COMMODITIES: Brent Crude -1.27% to $81.35/barrel. Gold +0.52% to $2,454.8/oz.

BITCOIN: -3.54% to $65,607

US DOLLAR INDEX: +0.13% to 104.453

CBOE EQUITY PUT/CALL RATIO: 0.68

VIX: -1.27% to 14.72

Quote of the day

“It is every man’s obligation to put back into the world at least the equivalent of what he takes out of it.”

- Albert Einstein

Investor whiplash

Rotation is the lifeblood of a bull market and this time is no different.

As interest rates drift lower, the market digests the soft June CPI report, and the frenetic U.S. presidential race grabs headlines one day after the next, the market has been internally repositioning itself over the last few weeks with extreme reversals taking place in many corners of the market – even if headline index performance has been relatively muted.

While trend-following hedge funds that are leveraged long in the names that have been working (big tech) and retail investors chase performance even higher, many investors have been under-allocated and perhaps even short the under-performing areas of the market like mid-caps and small-caps.

When both sides of the market have to be unwound quickly, you get extreme reversals and choppy price action that has many investors suffering from investor whiplash.

The baton handoff to the underloved and underowned areas of the market have gained significant momentum and caused a major rise in breadth expansion – something many investors have been asking for all year.

So, if you are wondering why all your stocks have changed trends or direction in the last few weeks, you aren’t the only one.

Welcome to the market rotation, which is the lifeblood of a bull market.

Source: Goldman Sachs Global Investment Research

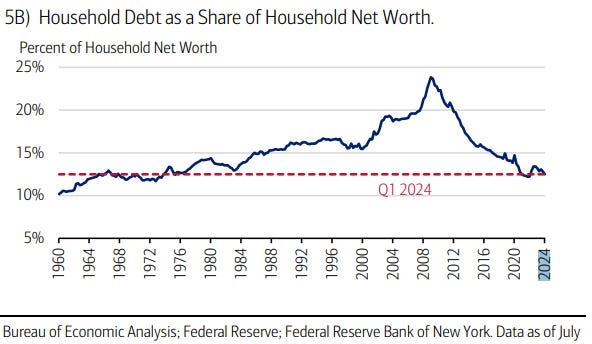

Household debt as a share of household net worth

It’s important to note that the share of household debt to net worth is near a 50-year low as home equity and investment portfolios have soared.

In fact, this measure is hovering around levels not seen since the mid-1970s.

The folks on tv will remind you credit card debt levels are higher, as well as delinquencies. However, so is net wealth – which the doomers often conveniently leave out.

Source: Mike Zaccardi, CFA CMT

U.S. 2nd quarter economic growth (GDP) to report on Thursday

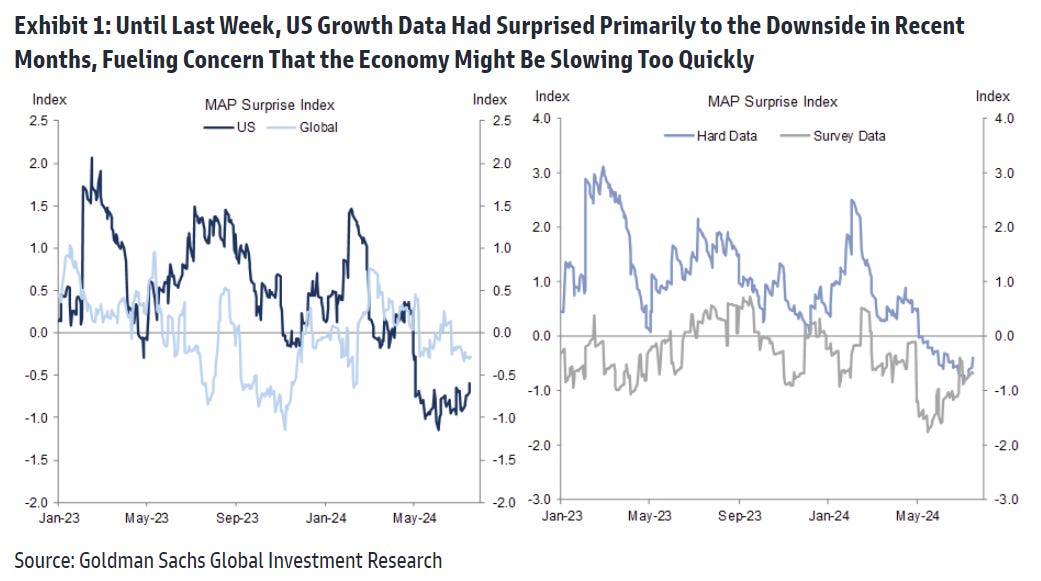

For much of 2024, economic activity data has surprised mainly to the downside, fueling concerns to many that the economy is slowing quickly.

The charts below show that Goldman Sachs’ surprise index has been negative for both the United States and global regions as actual results come in consistently below the street’s expectations.

But, last week’s strong Retail Sales and Industrial Production reports brought welcome relief.

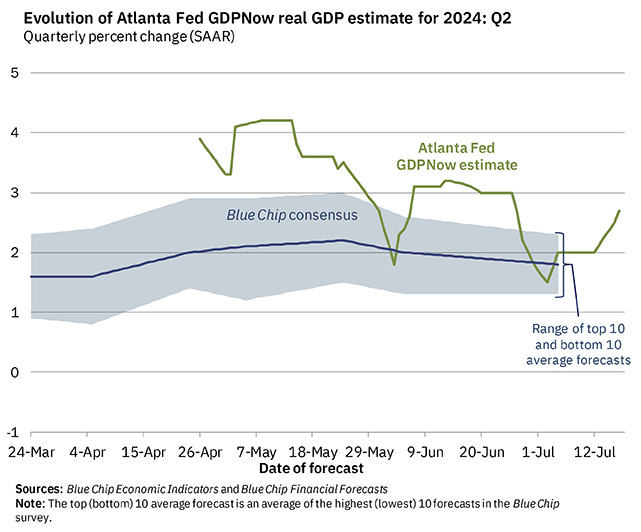

With the latest data in hand, the Atlanta Fed’s Q2 GDP growth “nowcast” is showing economic activity is recently expanding again, with the latest estimate at 2.7%.

On Thursday 7/25 this week, the market will get its 1st of three reports on U.S. Q2 GDP growth, with the street consensus looking for +1.9% growth during the 2nd quarter.

This upside surprise on growth in 2024 has been accompanied by a large decline in the consensus 12-month recession probability from 50% to ~25% since the start of the year as many of the growth risks that were most widely discussed in markets at the start of the year have come to look less threatening.

Source: Goldman Sachs Global Investment Research, Atlanta Fed

Small-caps aren’t just about interest rates

About those small-caps…

For small-cap stocks to outperform going forward, the group will have to put up earnings growth like its large-cap brethren.

Few investors will want to hold onto overvalued small-caps with little earnings growth and a ~1% dividend yield. These investors will hold with especially weak hands when one can earn 4-5% in a U.S. Treasury bond with no risk of capital loss and upside participation if interest rates move lower.

Source: Eric Wallerstein (Yardeni Research)

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.