Investors hope for Santa Claus Rally as stocks lose steam, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (12.20.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

will Santa Claus come to Wall Street?

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +1.18% | S&P 500 +1.09% | Russell 2000 +0.94% | Nasdaq 100 +0.85%

FIXED INCOME: Barclays Agg Bond +0.27% | High Yield +0.63% | 2yr UST 4.314% | 10yr UST 4.528%

COMMODITIES: Brent Crude +0.07% to $72.93/barrel. Gold +1.36% to $2,643.6/oz.

BITCOIN: -1.74% to $95,796

US DOLLAR INDEX: -0.57% to 107.785

CBOE TOTAL PUT/CALL RATIO: 0.98

VIX: -23.79% to 18.36

Quote of the day

“Don't make a long-term decision based on a short-term emotion.”

- Unknown

This week’s Scrooge market, next week’s Santa Claus rally?

After a banner year for stocks around the world, December sure feels like we’re stumbling across the finish line.

For many, next week ushers in holiday cheer and the wonderful spirit of both Christmas and Hanukkah. For investors, many are wondering if the Santa Claus Rally will bring holiday cheer to their portfolios.

The “Santa Claus Rally” refers to the seasonal phenomenon where markets typically undergo a broad rally in stock prices during the final trading days of December and early days of January. The Santa Claus Rally is observed in many global markets, however it’s most commonly associated with U.S. stocks.

This period consists of the last five days of the year and the first two of the next year. Depending on when the holidays fall and the days of the week, the exact dates change every year.

In 2024, it starts December 24 and ends January 3.

The Santa Claus Rally garners headlines and attention across financial media due to the historically strong market returns during this relatively short timeframe.

Since 1950, the S&P 500 has generated average returns of +1.3% during the Santa Claus Rally period (and positive 78% of the time), compared to just a +0.2% average return for all rolling seven-day returns.

As the famed Yale Hirsch (founder of the Stock Trader’s Almanac) saying from 1972 goes: "If Santa should fail to call, the Bears will come to Broad & Wall."

For those who aren’t familiar, the New York Stock Exchange is located in downtown Manhattan at the corner of Broad Street and Wall Street.

Failure to have a Santa Claus Rally tends to precede some notable nasty markets (particularly down Januarys) or times when stocks could be purchased at lower prices later in the year.

Here’s a look at the SCR data since the turn of the millennium, courtesy of chart master Ryan Detrick:

Santa does make mistakes from time to time.

At risk of stating the obvious, the Santa Claus Rally should not be a reason to buy stocks should the jolly ol’ fellow come this year.

It’s also not a reason to sell stocks, either.

Similar to other seasonal patterns like the “First Five Days Indicator” or the “January Barometer,” these signals provide us information about the type of market environment we’re in.

Are stocks behaving as we expect them to? Or are stocks misbehaving?

Should stocks do well – as expected – then ho hum carry on. History says stocks should rally here, hence the name Santa Claus Rally.

Should stocks stumble – especially in light of the recent market indigestion in December – then we have something to talk about.

Your move, Santa.

Source: Ryan Detrick, LPL Financial, Almanac Trader

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

The White Coat Investor – The Big Holes in Your Financial Plan (Dr. Jim Dahle)

The Finance Buff – Retirees, a Rich Life Does Not Require Spending More Money (Harry Sit)

Money with Katie - Are We Finally Reaching Peak Awareness of Corporate Nonsense? (Katie Gatti Tassin)

New York Times – What Fed Rate Moves Mean for Your Finances (Tara Siegel Bernard and Ron Lieber)

OptimistiCallie – The 2025 OptimistiCallie Anti-Outlook (Callie Cox)

Discipline Funds – Three Things I Think I Think – Strategic Reserves, U.S. Market Capitalization, Invisible Independents (Cullen Roche)

Kyla’s Newsletter – Trust as the Next Great Commodity (Kyla Scanlon)

Of Dollars and Data – Do As I Say, Not As I Did (Nick Maggiulli)

Podcasts

The Compound and Friends feat. Nick Colas (DataTrek) – Cut Your Losses, Size up Your Winners (YouTube, Spotify, Apple Podcasts)

All In feat. Keith Rabois – Trump’s Cabinet, Google’s Quantum Chip, Apple’s iOS Flop, TikTok Ban, and State of VC (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Penguin – Colin Farrell, Cristin Milioti (IMDB, YouTube)

Music

Cooper Alan – Jesus Saves (Spotify, Apple Music, YouTube)

Books

Ryan Holiday – The Daily Dad: 366 Meditations on Parenting, Love, and Raising Great Kids (Amazon)

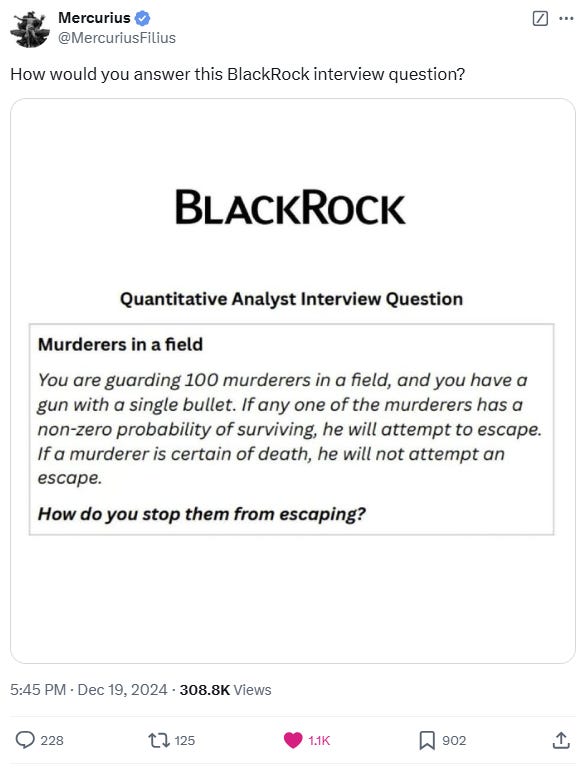

Tweet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: