Investors pay close attention to Value

The Sandbox Daily (6.28.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

pay attention to value

higher credit quality today

reviewing P/E multiples by region

resilient home prices rise for 3rd consecutive month

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +0.47% | Nasdaq 100 +0.12% | S&P 500 -0.04% | Dow -0.22%

FIXED INCOME: Barclays Agg Bond +0.30% | High Yield +0.58% | 2yr UST 4.712% | 10yr UST 3.714%

COMMODITIES: Brent Crude +1.77% to $73.54/barrel. Gold -0.38% to $1,916.5/oz.

BITCOIN: -1.92% to $30,067

US DOLLAR INDEX: +0.49% to 102.993

CBOE EQUITY PUT/CALL RATIO: 0.52

VIX: -2.26% to 13.43

Quote of the day

“Investing is a psychological game. A suboptimal strategy you can live with and execute is better than an optimal one you can't.”

- William Bernstein

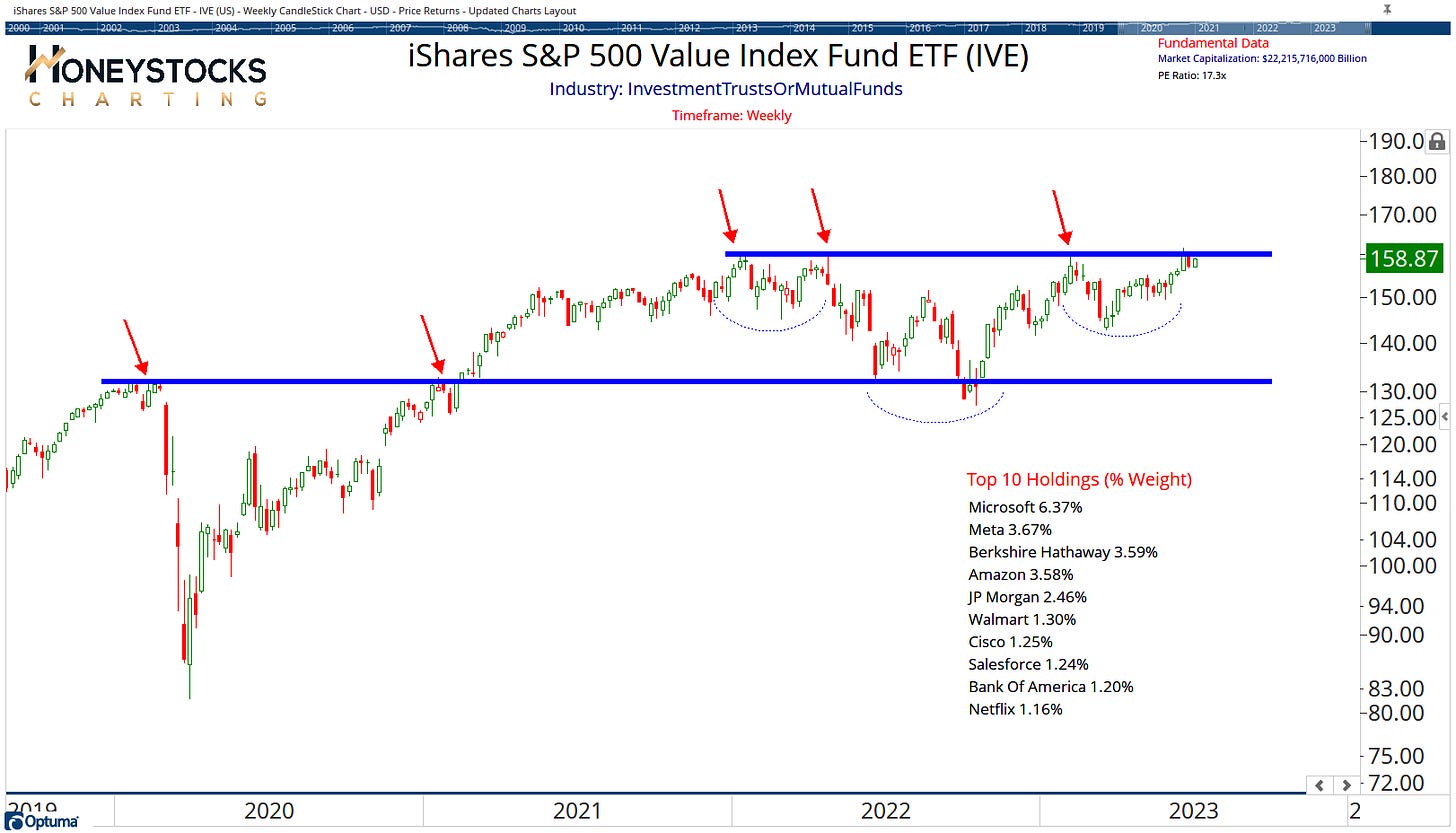

Pay close attention to Value

Bull markets are built when more stocks are going up than down. We know Growth is working this year; that’s all anyone seems to talk about.

But here is Value pushing up towards the top end of its range and pressing against all-time highs, testing overhead resistance for the 4th time since 2022. An inverse head and shoulders pattern while also sitting above both the 50- and 200-DMA – both bullish setups.

How many more times until supply (sellers) is absorbed by demand (buyers) and Value resolves higher back to trend?

What’s quite interesting is the top names in this iShares S&P 500 Value ETF (IVE). Sure looks a lot like Growth to me – MSFT, META, AMZN, CRM, NFLX. It’s important to know what you own and what’s driving performance.

Another item to address is how much longer these Value indexes and funds can continue holding onto these positions. These structures have rules and a screening process, while fund managers must invest according to the strategy and guidelines outlined in a prospectus. As these stocks reconstitute from “Growth” to Value,” look for lots of turnover in these names in the weeks and months ahead.

Source: Honeystocks Charting

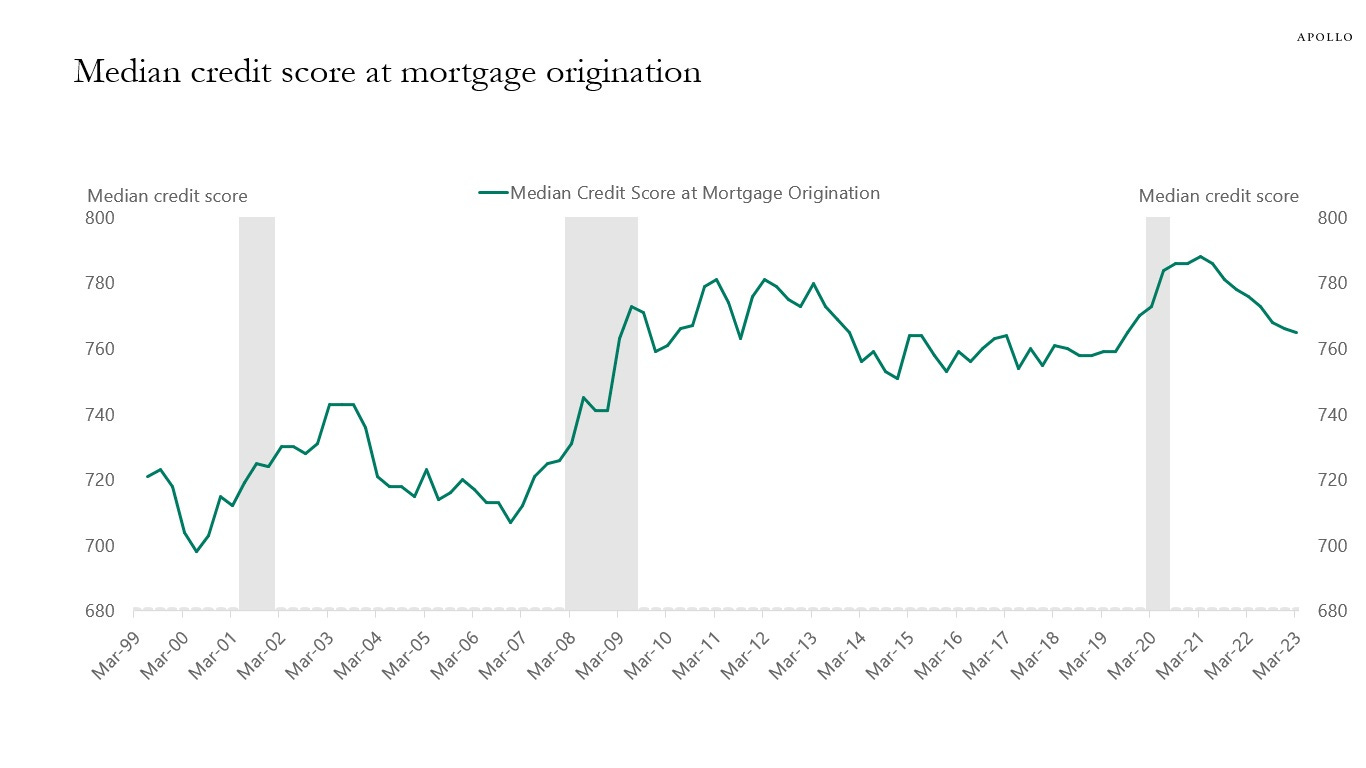

Higher credit quality today

The quality of mortgages (1st chart below) and auto loans (2nd chart) originated today is significantly higher than those originated before the Global Financial Crisis (GFC) in 2006.

Higher credit quality is a key narrative supporting the soft landing scenario because mounting job losses and a wave of defaults have yet to materialize.

Source: Apollo Global Management

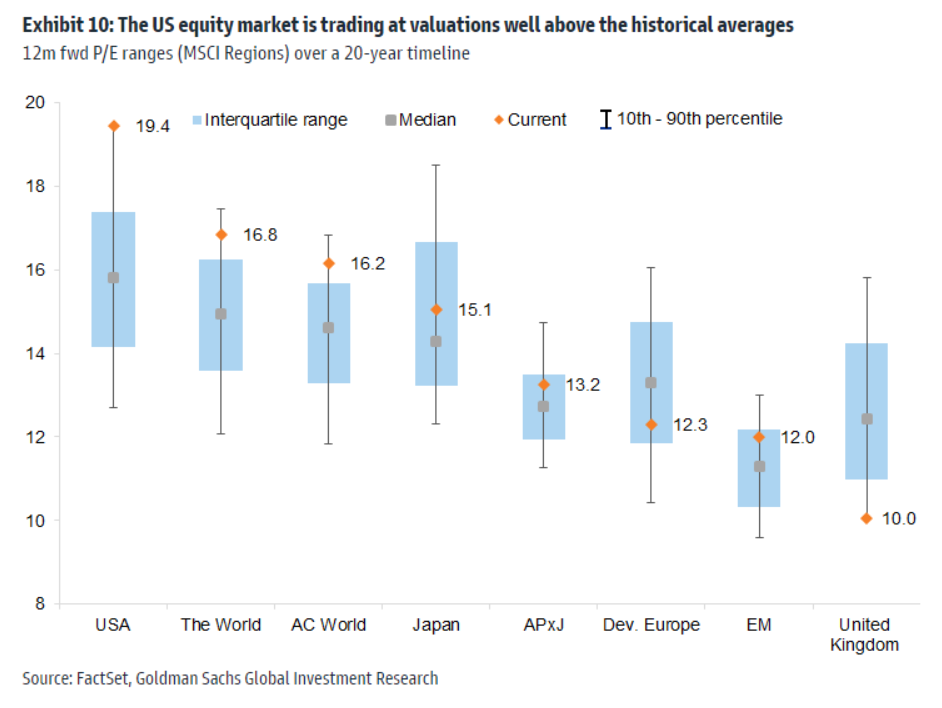

P/E equity multiples by region

When observing equity market multiples, the U.S. equity market in particular is trading at valuations well above the historical averages, and is now close to 20x forward consensus earnings (or even higher on lower earnings assumptions).

Other markets look cheaper, although in most cases they too have re-rated in recent weeks.

Source: Goldman Sachs Global Investment Research

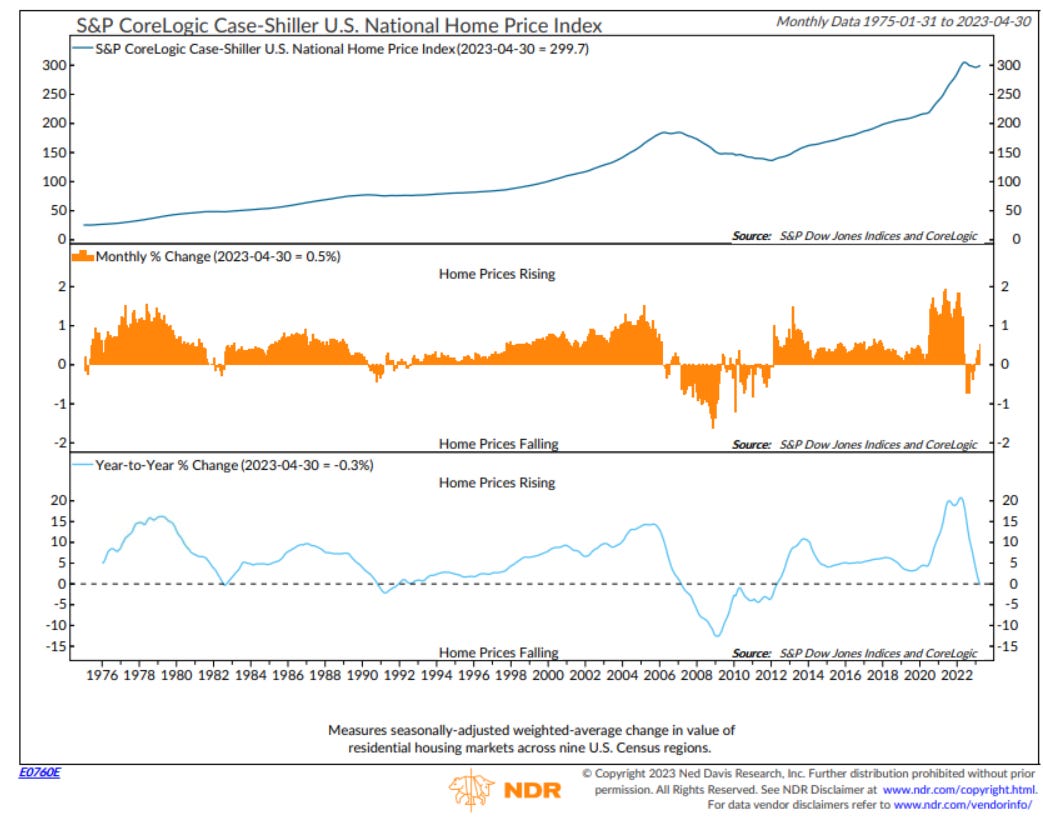

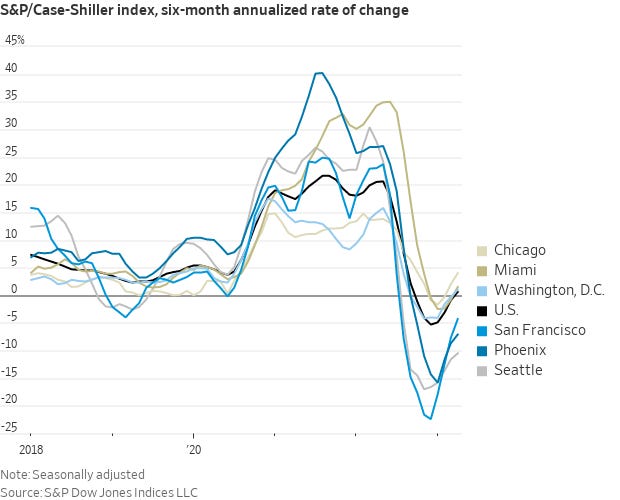

Resilient home prices rise for 3rd consecutive month

According to the Case-Shiller National Home Price index, home prices in the U.S. rose by +0.5% in April. That marks the 3rd consecutive month of increases and the largest gain since May 2022.

While prices are still down -0.3% YoY compared to April 2022, they are recovering steadily and are now just 2.4% below their June 2022 peak.

19 of the 20 major metro areas saw home price appreciation in April.

And if we look at prices using a shorter 6-month annualized basis, U.S. home prices have already hit a bottom and are rising again.

The housing market continues to prove resilient.

Source: S&P CoreLogic Case Shiller, Ned Davis Research, CNBC

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.