Investors remain cautious, plus leading indicators soft again, Fed balance sheet, streaming prices, and Thanksgiving travel

The Sandbox Daily (11.20.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

cautious outlook

leading economic indicators continue to indicate weakness ahead

evolution of Fed balance sheet runoff

streaming price increases demonstrate inflation in real time

TSA expects this holiday travel season to be busiest ever

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 +1.19% | S&P 500 +0.74% | Dow +0.58% | Russell 2000 +0.52%

FIXED INCOME: Barclays Agg Bond +0.16% | High Yield +0.11% | 2yr UST 4.917% | 10yr UST 4.424%

COMMODITIES: Brent Crude +1.86% to $82.11/barrel. Gold -0.26% to $1,979.6/oz.

BITCOIN: +1.46% to $37,421

US DOLLAR INDEX: -0.41% to 103.493

CBOE EQUITY PUT/CALL RATIO: 0.54

VIX: -2.83% to 13.41

Quote of the day

“Every great money manager I've ever met, all they want to talk about is their mistakes. There's a great humility there.”

- Stan Druckenmiller

Cautious outlook

Investors across both institutional and retail pools are skeptical over the next 12 months.

A Fundstrat poll from last week across these two buckets shows roughly half of respondents only see 5-10% upside in 2024.

This 5-10% return expectation makes intuitive sense because we know that stocks average 7-10% per year over the long haul.

Yet, Ryan Detrick astutely notes that “going all the way back to 1950, we found there were only four years that stocks gained between 8% and 10% on the year.”

So, the empirical data shows us the average year in the stock market rarely produces the “average” return.

In fact, since 1900 (123 years), calendar-year stock returns exhibit something statisticians call “kurtosis,” or fat-tailed distributions where there’s a more-than-likely chance of generating large returns (positive or negative) than mild returns.

While the historical data demonstrates a 5-10% year is a low probability outcome, the expectation of investors (and sell-side analysts) has the tendency to gravitate towards this cautious bogey.

Source: FS Insight, Ryan Detrick

Leading economic indicators continue to indicate weakness ahead

While a number of recent economic indicators show a diminishing risk of recession in the near-term, the Conference Board’s Leading Economic Index (LEI) suggests the sky is not all clear.

The leading indicators sank -0.8% in October. The latest drop was led by weaker consumer outlook for business conditions, a decline in manufacturing new orders, and tighter credit conditions.

The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major global economies. Many economists and investors track this measure closely.

The majority of LEI components have deteriorated over the past six months, pointing to persistent weakness in activity.

October’s decline marked the 19th consecutive decline in a row. As shown below, declines of this magnitude – of which there aren’t many – have always been associated with recession.

The LEI has been signaling recession for some time but one hasn’t materialized – similar to other common recession markers like the inverted yield curve and oil shocks. The Conference Board still expects a “very short recession” in 2024.

It’s possible that the LEI components – which favor manufacturing, credit, and consumer sentiment – could be underestimating the strength of this economy in light of excess savings, a tight labor market, and a high share of consumer locked into sub-4% 30-year fixed rate mortgages.

While no forecasting system is perfect, this one has a pretty good track record.

Source: The Conference Board, Ned Davis Research, EPB Research

Evolution of balance sheet runoff

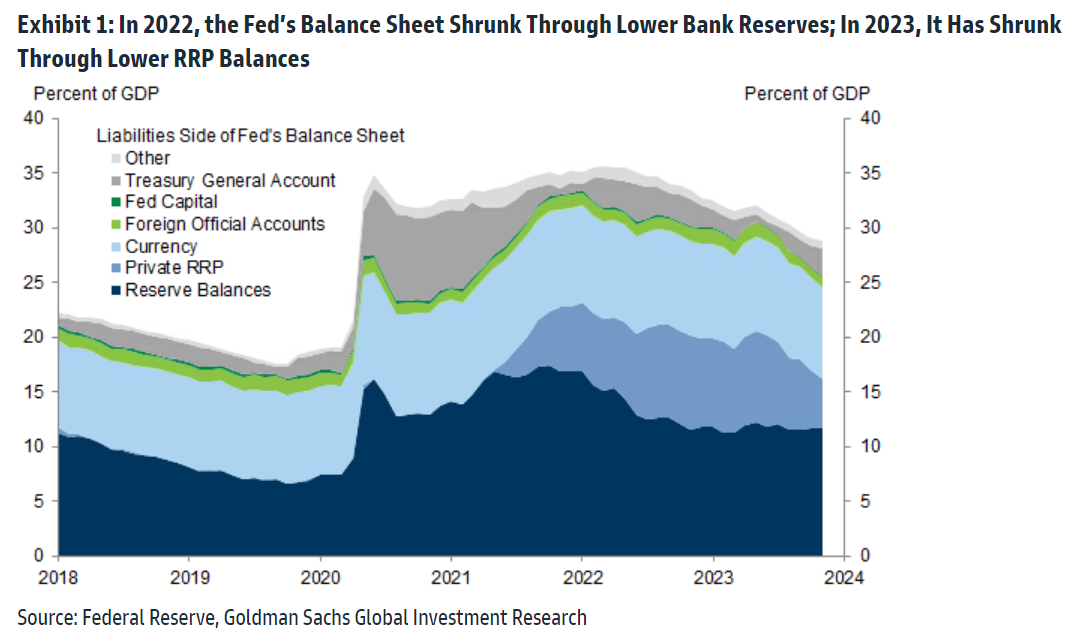

Since last year, the Fed’s balance sheet has shrunk by $1.2tn to $7.8tn, and balance sheet runoff has proceeded smoothly so far.

As the Federal Reserve lets securities roll of its balance sheet, the stock of Treasury and MBS debt it used to hold needs to be absorbed by the private sector. Private savers absorb this debt by drawing on bank deposits and money market fund balances. In response, banks and money market funds reduce their holdings at the Fed, putting downward pressure on bank reserves and balances at the Fed’s Reverse Repo (RRP) Facility.

The chart below breaks down the evolution of the liability side of the Fed’s balance sheet.

In 2022, the bulk of the reduction in the Fed’s balance sheet came from a decline in bank reserves, which fell from $4.3tn in 2021, or around 19% of bank assets, to around $3.1tn in December 2022, or 13.5% of bank assets. At the same time, the Fed’s Reverse Repo Facility (RRP) – where intermediaries like money market funds can deposit excess liquidity if market rates fall below the RRP rate set by the Fed – actually increased in 2022, as the rapid rise in the Fed Funds Rate led depositors toward money market funds in search for more attractive yields and a decline in outstanding Treasury bills pushed money markets toward the RRP facility.

In contrast, reserve balances have been relatively flat in 2023, and the Fed’s liabilities declined largely because of lower RRP use. RRP balances declined by over $1.5tn to $936bn this year, as increased Treasury bill issuance and higher demand for funding by banks pushed money market funds away from the facility.

Source: Goldman Sachs Global Investment Research

Streaming price increases demonstrate erosion of purchasing power in real time

Last month, it was Netflix.

The streaming giant hiked the monthly price of its basic plan from $10 to $12 and its premium plan from $20 to $23, while its $7 ad-supported tier remains unchanged. Netflix last raised prices in January 2022.

Next month, it will be Apple’s turn.

The largest company by market cap is raising the prices of several services, most notably Apple TV+ which moves from $6.99 to $9.99 per month. Apple last raised prices in October 2022 as the streaming platforms continue to push higher prices along to their customers.

Chances are, you are like my family and have a subscription to at least one streaming service, if not several.

With each increase, it’s just been a couple dollars here and a few there, so it’s easy to shrug off in the moment. However, both Netflix and Apple have nearly doubled off their original price points – and because these are monthly payments – the dollars surely add up over time!

In normal times, inflation eats away at purchasing power silently until you look back and assess the damage. In current times, it's easier to feel the pinch in real-time because it’s happened everywhere all at the same time.

TSA expects this holiday travel season to be busiest ever

The Transportation Security Administration (TSA) expects to screen 30 million passengers this holiday season – from November 17 through November 28 – the most ever. The Sunday after Thanksgiving is expected to be the busiest day during that period with an estimated 2.9 million passengers taking to the skies.

“We expect this holiday season to be our busiest ever. In 2023, we have already seen 7 of the top 10 busiest travel days in TSA’s history,” said TSA Administrator David Pekoske.

This might be a good sign for the airline industry, which has been struggling since the pandemic.

Meanwhile, AAA is also projecting some big numbers – estimating 55.37 million travelers will head 50 miles or more from home over the Thanksgiving holiday travel period.

This year’s Thanksgiving forecast is an increase of 2.3% over last year and would mark the 3rd-highest Thanksgiving forecast since AAA began tracking holiday travel in 2000, behind only 2005 and 2019.

Source: Transportation Security Administration, CNBC

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.