IPO market, plus Warren Buffett estate instructions, U.S. trade partners, CEO confidence, and credit spreads

The Sandbox Daily (2.8.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

IPO market set to reopen?

estate instructions for Warren Buffett’s wife

U.S. buys more from Mexico than China for 1st time in two decades

CEO confidence improves

corporate spreads are historically tight

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.50% | Nasdaq 100 +0.16% | Dow +0.13% | S&P 500 +0.06%

FIXED INCOME: Barclays Agg Bond -0.31% | High Yield -0.05% | 2yr UST 4.458% | 10yr UST 4.154%

COMMODITIES: Brent Crude +3.24% to $81.78/barrel. Gold -0.13% to $2,049.1/oz.

BITCOIN: +2.23% to $45,357

US DOLLAR INDEX: +0.08% to 104.144

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -0.31% to 12.79

Quote of the day

“To borrow a baseball analogy, your batting average matters a lot less than your slugging percentage. It's not how many of your picks are right... it's how much money you make when you're right versus how much you lose when you're wrong.”

- Whitney Tilson, Empire Financial Research

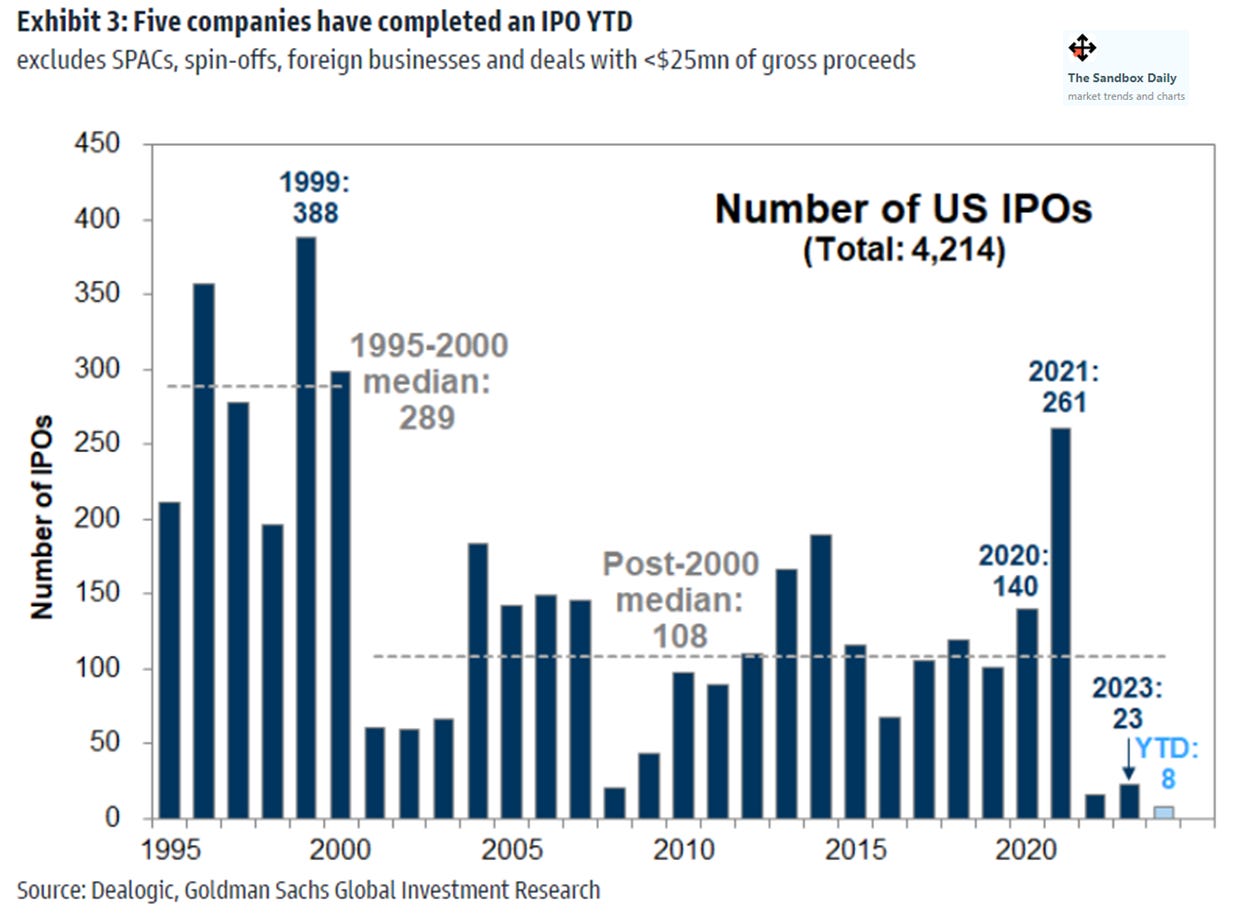

IPO market set to reopen?

Signs of life in the Initial Public Offering (IPO) market are spurring investor optimism that more companies will decide to go public this year and next.

Not only are companies and sellers looking at the markets more actively and broadly, but potential shareholders are also engaging in more active discussions with companies that are likely to go public. Venture Capitalists also need more movement/exits from older portfolio companies to make room for younger portfolio companies and investment into new projects and/or capital raises.

This is welcome news after two years where the IPO market has been nothing but tumbleweeds blowing across the desert sands.

Excluding SPACs and spin-offs, there have been 10 initial offerings completed on U.S. exchanges in 2024 with greater than $25 million of gross proceeds, 8 of which were U.S.-headquartered offerings. These 8 U.S.-based IPOs raised a total of $1.9 billion in gross proceeds. This pace of IPO activity, if sustained, would surpass the levels from 2022 and 2023.

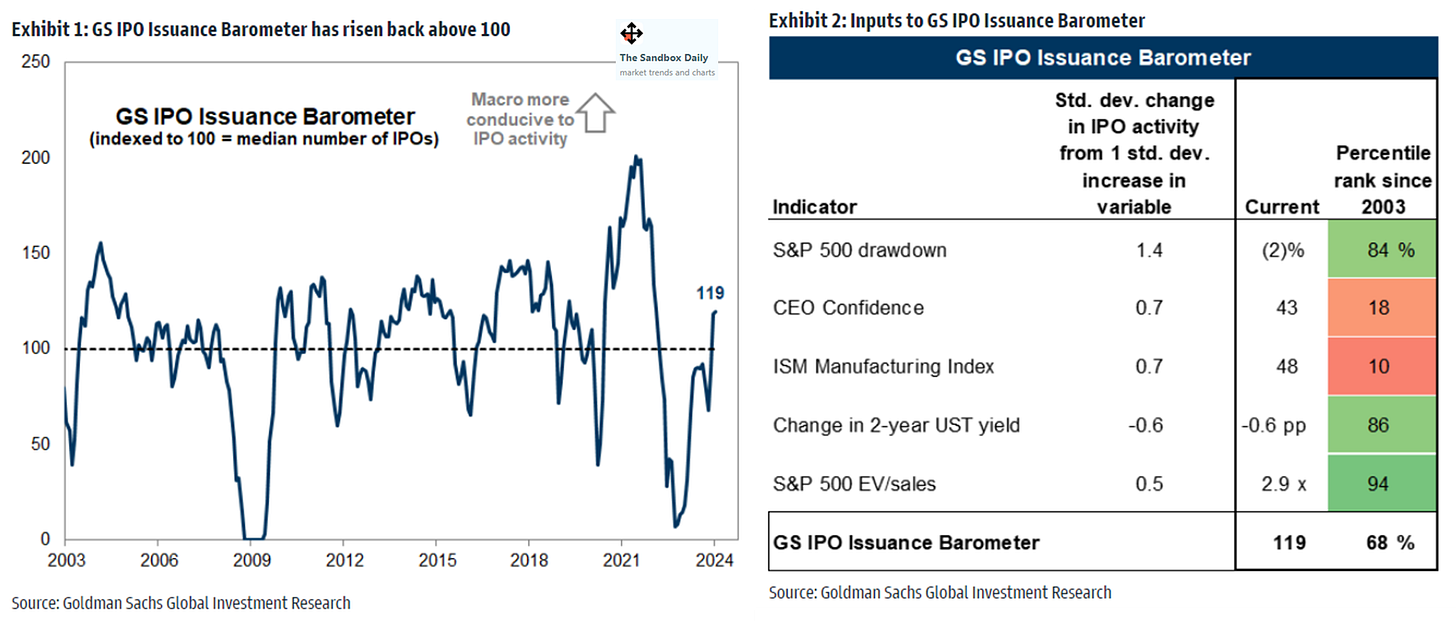

Goldman Sachs’ proprietary IPO Issuance Barometer rose to its highest level since February 2022. This index gauges how conducive the macro environment is for IPOs.

It is based on 5 components: S&P 500 drawdown, as measured by how far the index trades from its trailing 52-week high, CEO confidence, ISM Manufacturing Index, 6-month change in the nominal 2-year Treasury note yield, and S&P 500 trailing EV/sales.

Current economic strength, some recent easing in yields, and more robust valuations should lead to the market conditions ripe for more IPOs to come to market in the coming months and quarters.

Source: Goldman Sachs Global Investment Research

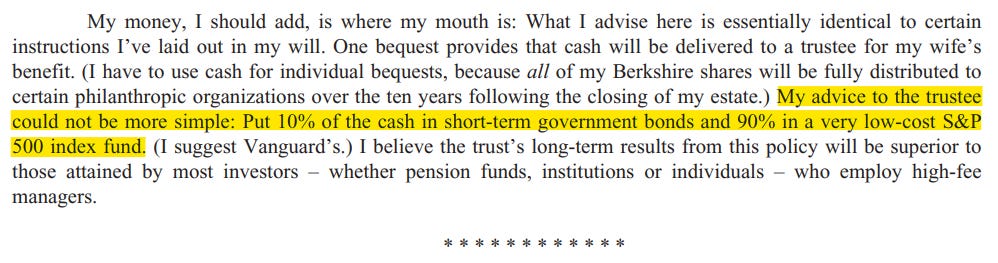

Estate instructions for Warren Buffett’s wife

In Berkshire Hathaway’s 2013 annual report, Warren Buffett included a brief discussion of his own family's finances.

The CEO of Berkshire explained that he had established a trust for his wife's benefit. These were the simple instructions that he had provided to the trustee:

"Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund."

That was it.

Despite Warren Buffett being one of the wealthiest people in the world (that helps, to be sure), the portfolio he recommended was remarkably simple – no actively-managed funds, no hedge funds, no private equity, or any other seemingly sophisticated investments.

Buffett's view is that it really doesn't need to be any more complex than that.

Source: Berkshire Hathaway

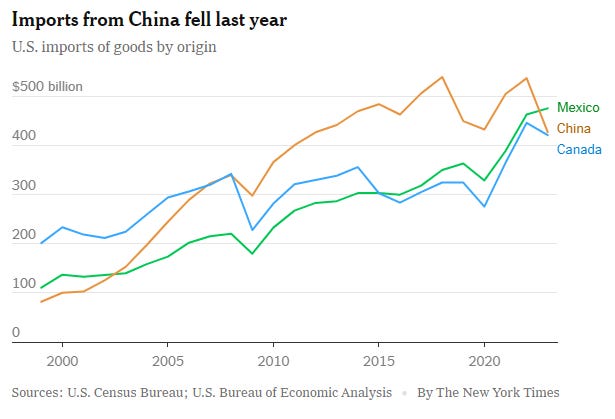

U.S. buys more from Mexico than China for 1st time in two decades

Mexico was the biggest trade partner of the United States in 2023 and the biggest source of the country's imports – ahead of China – for the 1st time in two decades.

Trade with Mexico – both imports and exports – totaled close to $800 billion last year as efforts to source closer to home and reduce dependence on China are ongoing in the United States and other Western countries.

The U.S. has also strengthened trade relationships with our neighbor to the North. Canada is currently the country's top 2 trade partner.

China was the biggest trade partner to the United States between 2015 and 2018, but Mexico and Canada pulled ahead at the height of the U.S.-China trade war in 2019.

Source: New York Times, Statista

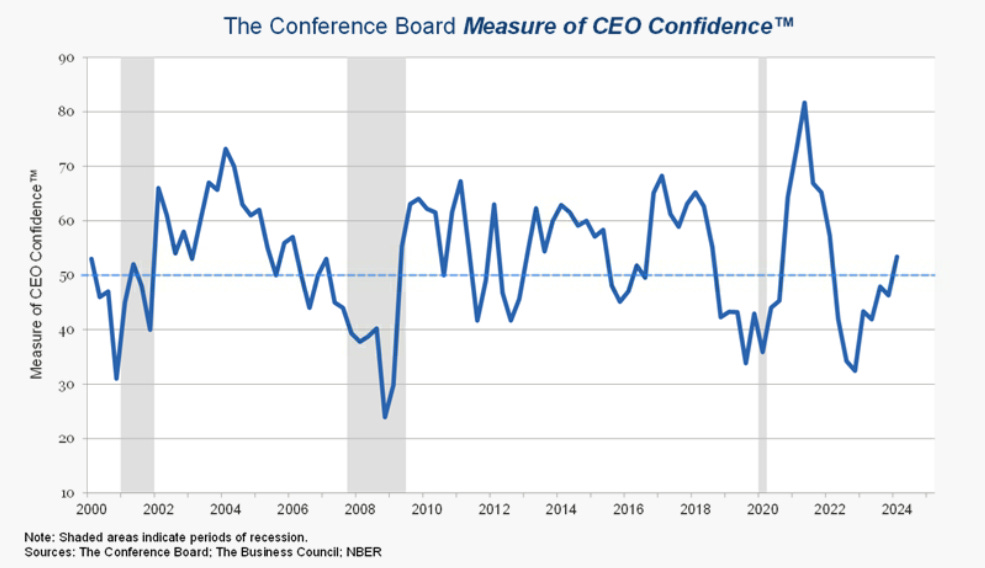

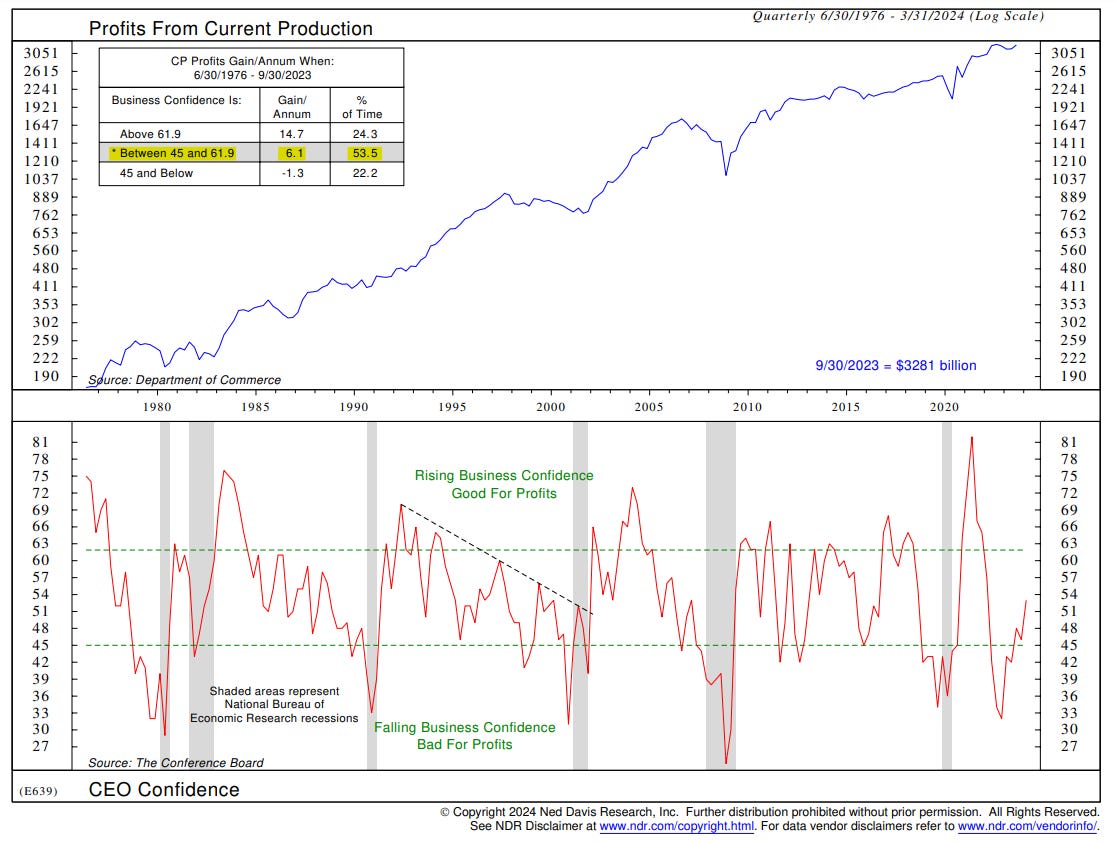

CEO confidence improves

Stock markets at all-time highs, declining inflation, and historically low unemployment are driving confidence higher.

The Conference Board’s CEO Confidence Index rose 7 points in Q1 to 53, above 50 for the 1st time in 2 years, indicating growing optimism among executives.

Both current conditions and expectations for the year ahead improved. CEOs had a net positive assessment not only of the broad macro economy but also of conditions in their own industries. The increase in confidence implies a potential pickup in capex in 2024 and bodes well for corporate profit growth.

Yet, despite the more positive economic outlook, hiring plans for the next 12 months declined. The share of CEOs who plan to lay off workers jumped from 13% to 23%, while those who plan to grow their workforce slipped from 38% to 35%. The report attributed this net decline in hiring plans to letting up of labor hoarding that characterized most of last year. It suggests a moderation in labor demand and easing in labor market conditions in 2024.

In special questions, CEOs identified political uncertainty ahead of the U.S. presidential election as their main challenge this year. Global downside risks included the spread of current wars, deglobalization, and U.S.-China tensions. Upside risks included falling inflation, Fed rate cuts, and a resolution to current geopolitical conflicts.

Source: The Conference Board, Ned Davis Research

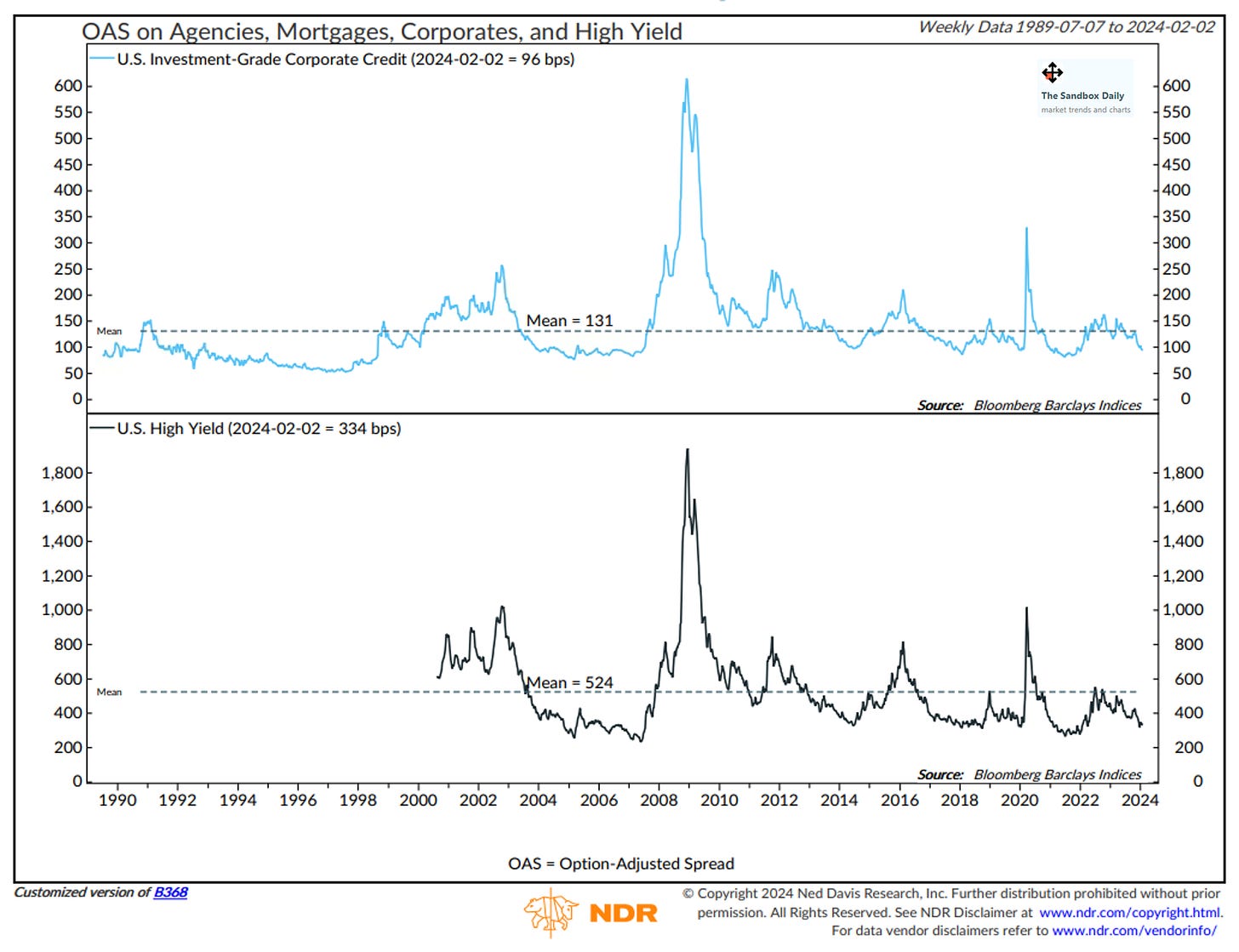

Corporate spreads are historically tight

Corporate credit spreads are historically tight as default risk has diminished and the economy grows above-trend.

The Investment Grade option-adjusted spread (OAS) is currently around 95 bps, well below its mean of 131 bps since 1990. The all-time low was 52 bps in August 1997, while the pandemic low was 81 bps in July 2021.

Meanwhile, the High Yield OAS is currently around 330 bps, well below its mean of 524 bps since August 2000. The record low was 234 bps in May 2007, while the pandemic low was 266 bps.

Source: Ned Davis Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.