Is the Fed done, plus lousy QQQ breadth, 2024 Treasury issuance, and a visit with Charles Payne

The Sandbox Daily (10.16.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

is the Fed done hiking rates?

strange market: QQQ up, breadth is not

23% increase in Treasury auction sizes coming 2024

Let’s dig in.

Markets in review

EQUITIES: Russell 2000 +1.59% | Nasdaq 100 +1.18% | S&P 500 +1.06% | Dow +0.93%

FIXED INCOME: Barclays Agg Bond -0.56% | High Yield -0.03% | 2yr UST 5.101% | 10yr UST 4.712%

COMMODITIES: Brent Crude -0.76% to $90.20/barrel. Gold -0.33% to $1,921.1/oz.

BITCOIN: +4.76% to $28,336

US DOLLAR INDEX: -0.41% to 106.209

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: -10.92% to 17.21

Quote of the day

“It may take some hard work. But the more you say no to the things that don’t matter, the more you can say yes to the things that do.”

- Ryan Holiday, The Daily Stoic

Is the Fed done hiking rates?

This afternoon, I joined Charles Payne on Fox Business to talk through several topics on investor’s minds – and specifically, the one question burning on everyone’s mind: is the Fed done hiking rates?

Maybe, maybe not.

I barely know what my kids are thinking when one hits the other over the head with a golf club. How am I supposed to know what every member of the Federal Open Markets Committee (FOMC) is thinking?

Using a weight of the evidence approach, I would suggest the highest probability outcome is the Fed is done for the following five reasons:

The recent unrelenting push higher in yields is the market’s way of doing the Fed’s dirty work (green arrow in chart below at 4.595%), effectively tightening financial conditions worthy of that final 25 basis point hike the Committee sought 1-2 months ago.

The Fed has accomplished A LOT of tightening to date and has publicly acknowledged as much.

Exhibit A: besides the late 1970s cycle, the current interest rate hiking cycle is the fastest and highest on record, delivering 525 basis points across 11 meetings from March 2022 to July 2023

Exhibit B: balance sheet normalization via Quantitative Tightening ($95 billion/month in U.S. Treasury and MBS runoff)

the Fed does not have much history to compare the downstream effects of this level of policy tightening

Disinflation has been, presently is, and will continue to be the trend for some time going forward. The vast majority of categories have shown prices come down, while the Shelter category (1/3 of the CPI basket) remains elevated yet severely lags the much lower and much more high frequency data. Here is the CPI basket without housing at the Fed’s 2% stated target at:

The economy – resilient beyond reason – is at long-term trend growth. 4 consecutive quarters of GDP hovering around 2-2.5% coupled with a labor market that is averaging 266k net jobs gained over the last year (and wage gains coming off the boil) does not suggest we’re at imminent risk of overheating, at least for now.

Markets have priced in the risk of a policy error. We know the Fed’s past track record isn’t perfect when executing their monetary policy tools.

People like lists. While many many more considerations could be argued, these five carry the most significance in our view.

More with Charles below:

Source: Making Money with Charles Payne, FS Insight, Dwyer Strategy, St Louis Fed, Bloomberg, All Star Charts

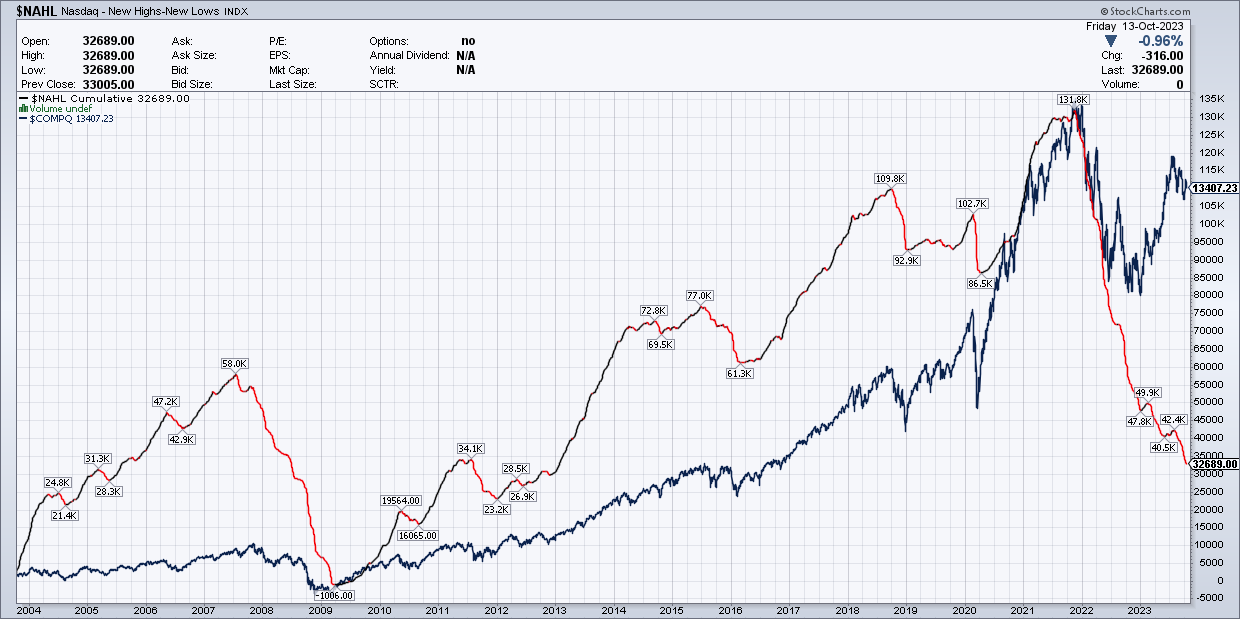

Strange market: indexes up, breadth is not

It is not traditional bull market behavior to see the index averages push higher while so few companies participate in experiencing new 52-week high prices simultaneously.

Here is the Nasdaq index (price in dark blue) with an overlay showing the number of companies achieving new 52-week highs. The divergence beginning in late 2022 is particularly troubling.

Source: Austin Hankwitz

23% increase in Treasury auction sizes coming 2024

A forecast coming from the Treasury Borrowing Advisory Committee’s projects that U.S. Treasury auction sizes will increase on average 23% in 2024 across the yield curve. That’s a lot of borrowing, folks.

This dramatic growth in the supply of the risk-free asset – at a time when the yield is in excess of 5% for the 1st time in what feels like forever – is pulling capital away from other fixed income assets and, to a lesser extent, risk assets.

Source: Torsten Slok

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

great spot on Charles !