Is your portfolio missing crypto? Why 10–40% crypto could be the new normal.

The Sandbox Daily (8.27.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

crypto: breaking the 60/40 mold

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +0.64% | Dow +0.32% | S&P 500 +0.24% | Nasdaq 100 +0.17%

FIXED INCOME: Barclays Agg Bond +0.10% | High Yield +0.12% | 2yr UST 3.621% | 10yr UST 4.238%

COMMODITIES: Brent Crude -1.44% to $67.81/barrel. Gold +0.45% to $3,448.3/oz.

BITCOIN: +0.81% to $112,075

US DOLLAR INDEX: -0.01% to 98.224

CBOE TOTAL PUT/CALL RATIO: 0.89

VIX: +1.57% to 14.85

Quote of the day

“The story of mankind is in you. The vast experience, the deep-rooted fears, anxieties, sorrow, pleasure, and all the beliefs that man has accommodated throughout the millennia. You are that book.”

- Jiddu Krishnamurti

Rethinking portfolios: Edelman’s bold call

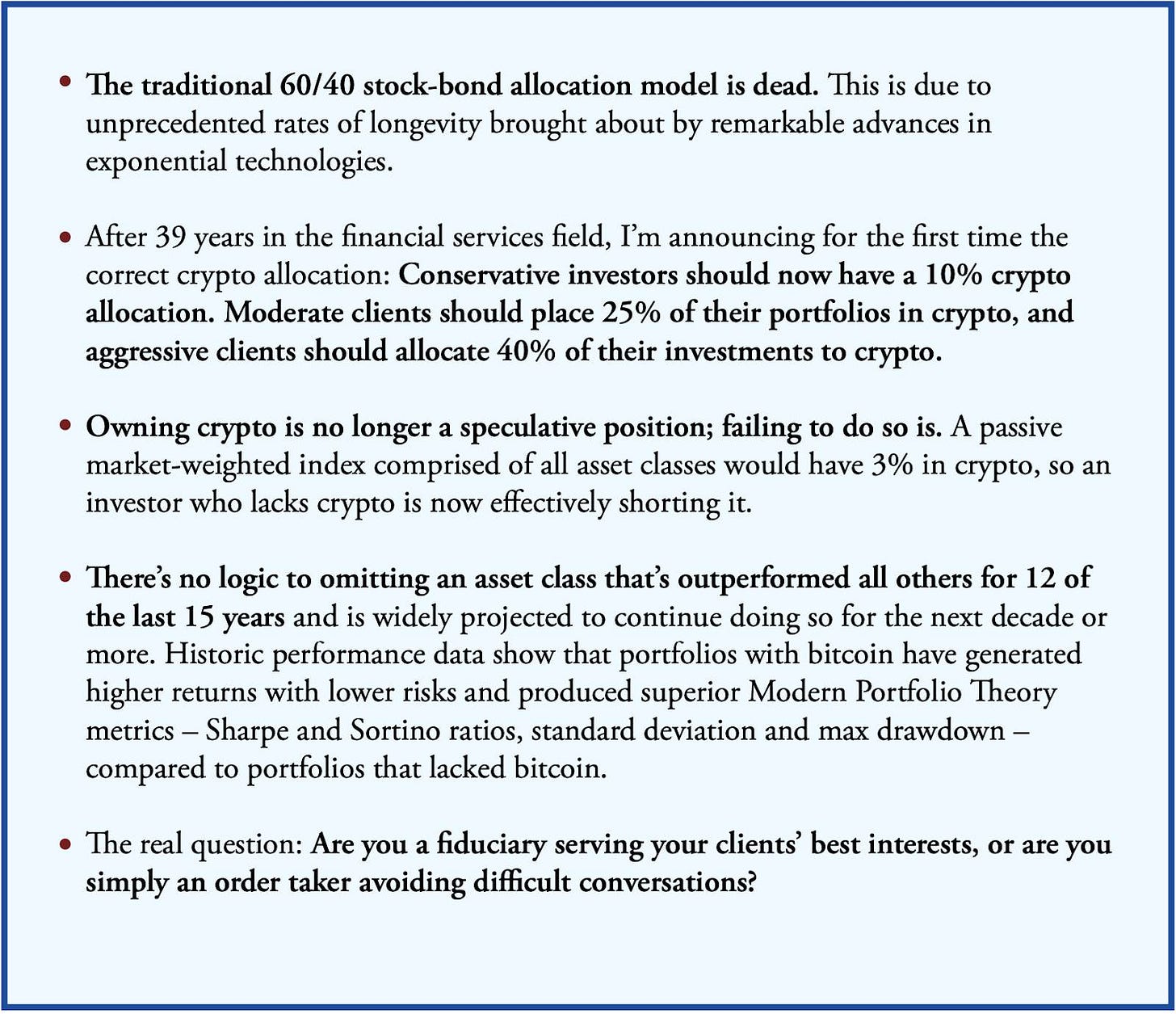

Earlier this summer, legendary financial advisor Ric Edelman delivered one of the boldest calls of his career: a 10% crypto allocation in portfolios for conservative investors, a 25% allocation for moderate investors, and 40% for aggressive investors. No, that’s not a typo.

For context, just a few years ago, Edelman advocated for a 1% allocation to crypto, while most mainstream advisors today recommend less than 5%.

This dramatic shift isn’t just a change in numbers.

It’s a signal that the conversation around crypto is moving from niche speculation to mainstream portfolio consideration.

Edelman’s very public call (see graphic below) forces investors to confront a question few had been asking until just recently: how big of a role should digital assets play in a modern portfolio?

Edelman isn’t just a crypto enthusiast. When he speaks, the financial world listens.

One of the most respected voices in wealth management, Edelman has built a reputation for foresight and clarity. He co-founded Edelman Financial Engines, which manages nearly $300 billion in assets, and created the Digital Assets Council of Financial Professionals (DACFP) to educate advisors on digital assets.

Two major forces underpin Edelman’s new allocation guidance:

Longevity: Today’s investors are expected to live much longer than previous generations. The classic 60/40 portfolio – 60% stocks, 40% bonds – was built for a time when clients retired at 65 and died at 85. That’s no longer the case. Edelman argues that “living to 100 means 60 is the new 30,” and portfolios must last far longer, demanding higher-returning and more growth-oriented assets.

Technological Disruption – From blockchain to biotech breakthroughs like CRISPR, Edelman believes the 21st century will be defined by technologies that can radically shift wealth creation. Tom Lee has stated the same for the legacy banking infrastructure, calling for banks to trade like high growth tech stocks once adoption is in place. Digital assets, particularly crypto, are at the heart of this transformation, offering investors exposure to these high-growth trends across banking, real estate, collectibles like art, equities, and more.

This combination is why Edelman considers the traditional 60/40 portfolio obsolete, advocating instead for portfolios that blend stocks and bonds with crypto.

Institutions agree that crypto is no longer an experimental asset. As always, watch what they do, not what they say.

To wit:

Spot Bitcoin ETFs now manage billions

Custody solutions from Fidelity, Coinbase, and others have solved the cold storage challenge

More than 1,800 public companies hold Bitcoin in their treasury

And soon, crypto will find its way into 401(k) plans – potentially unlocking $9 trillion in retirement capital

Regulatory clarity and political support have further legitimized crypto, making it a mainstream investment.

And adding crypto can improve classical portfolio metrics.

Bitcoin, and other digital assets, tend to be uncorrelated with stocks, bonds, and commodities, thus enhancing diversification.

Studies have shown that portfolios including crypto can achieve higher returns with improved Sharpe ratios, reducing overall risk while boosting growth potential.

While Edelman’s 10-40% recommendation is bold, it isn’t universally accepted.

The potential for higher returns comes with higher volatility, and retail investors can be prone to panic-selling during market downturns. Behavioral risks remain a major consideration.

That said, for younger investors with long horizons, or those seeking diversification beyond traditional equities and bonds, Edelman’s guidance may be compelling. New investors or those with a lower risk tolerance might consider starting at 5%, scaling up as comfort and understanding grow.

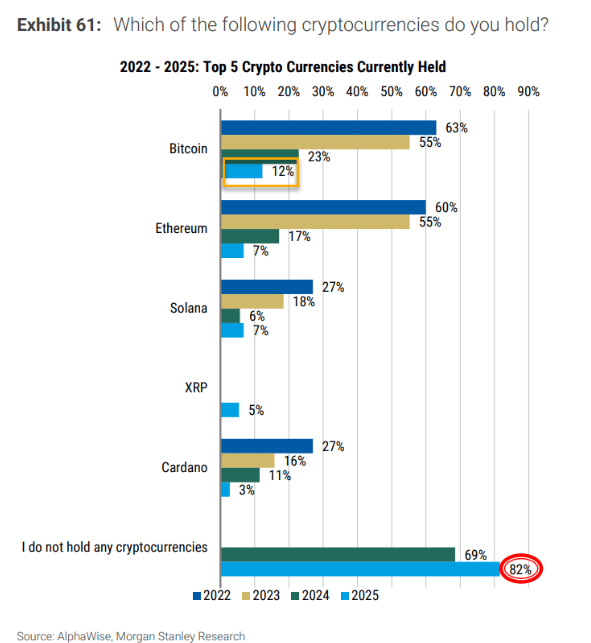

While the crypto landscape has matured by leaps and bounds in just the last few years, market penetration still shows tremendous potential for increased adoption:

One thing is undeniable: Rick Edelman is shifting the Overton Window for mainstream investing. What once seemed outrageous – a 10%, 25%, or even 40% allocation to crypto – is now a serious portfolio consideration.

His call encourages investors to think differently about risk, longevity, and growth.

That said, the advice is not a one-size-fits-all prescription. Investors should:

Tailor crypto allocations to their risk tolerance and goals

Stay informed about infrastructure, custody, and regulatory developments

Consider crypto as part of a broader portfolio strategy, not a speculative gamble

Sources: Digital Assets Council of Financial Professionals, Coinbase, VanEck, CoinDesk, Bitwise, CNBC

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Crypto is all the rage —and picking up steam with the grift of the trump family.

There are many reasons why this sentiment driven meme is imaginary in its long term ‘value’ or eventual ghost of value. If you’ve invested in this one-of-a-kind several years ago and with a little luck (possibly a lot) you can escape with a nice stack of green backs.

But, ultimately, as anything more than mad/house money it will end badly for most.

As have all historically observed Ponzi phenomena.