Israel, Iran tensions boil over, plus 🧁 weekend sprinkles 🧁

The Sandbox Daily (6.13.2025)

Welcome, Sandbox friends.

Happy Friday the 13th !

Today’s Daily discusses:

Israel, Iran tensions boil over

🧁 weekend sprinkles 🧁

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 -1.13% | Nasdaq 100 -1.29% | Dow -1.79% | Russell 2000 -1.85%

FIXED INCOME: Barclays Agg Bond -0.36% | High Yield -0.30% | 2yr UST 3.951% | 10yr UST 4.407%

COMMODITIES: Brent Crude +7.40% to $74.49/barrel. Gold +1.48% to $3,452.6/oz.

BITCOIN: -0.67% to $105,548

US DOLLAR INDEX: +0.22% to 98.138

CBOE TOTAL PUT/CALL RATIO: 0.87

VIX: +15.54% to 20.82

Quote of the day

“Don’t call me lucky. I’ve failed more times than you tried.”

- Unknown

Israel, Iran tensions boil over

The escalating conflict in the Middle East is sure to dominate headlines over the coming days and weeks as Israel and Iran exchange offensive attacks.

While the human consequences from war are of top concern, it's important for investors at home to understand markets have endured these tragic events before.

The situation is still developing and can change quickly, but here are some key things to keep in mind:

Israel’s attack and Iran's retaliation come after unsuccessful discussions between the United State and Iran over reducing Iran’s nuclear capabilities. Perhaps the biggest concern among investors is whether this conflict will escalate further. This is occurring even as the Israel-Gaza war rages on.

It's imperative to keep these conflicts in perspective. While serious from a geopolitical perspective, these events are generally not a reason to react with our portfolios. This has been true over the past several years and across history. While markets may demonstrate a "flight-to-safety pattern" over days or weeks, markets have also been resilient over longer time frames. Look to add to core positions on dips.

Oil markets were immediately impacted with the price of Brent crude surging over 7% following the attack. While regional conflicts do not necessarily affect the broader market, oil prices can act as a transmission mechanism. Higher oil prices affect consumers and businesses all around the world, so disruptions to supply and demand can affect the global economy. That said, the jump in oil only brings prices back to where they were as recently as April.

Some "safe haven" assets strengthened, with gold prices, the Swiss franc, and the U.S. dollar all gaining as investors sought refuge from geopolitical uncertainty. This is consistent with historical patterns during periods of heightened Middle East tensions. The exception is Treasury yields which have increased, suggesting investors are not flocking to these bonds.

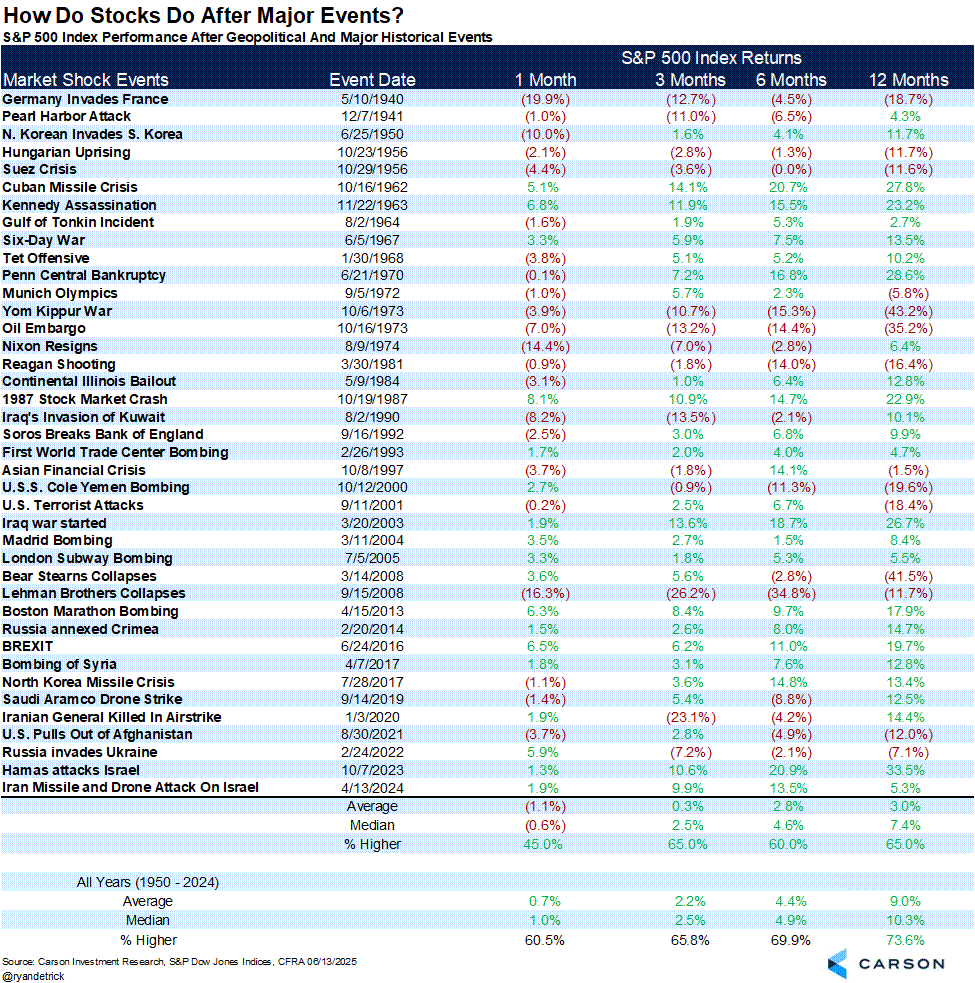

Referencing the table below illustrates how markets have navigated various global conflicts over time.

It shows that while short-term volatility is common during uncertain periods, especially over one-month time frames, markets have historically maintained their upward trajectory over intermediate and longer-term time periods – despite major disruptions like war, financial crises, or energy shocks over the last 100 years.

While geopolitical events will create near-term market gyrations, staying on target and committed to your plan rather than overreact to short-term market noise remains the most prudent approach to building wealth over time.

Source: Ryan Detrick

🧁 Weekend sprinkles 🧁

Here are the ideas, sights, and sounds that caught my attention this week – perfect for quiet time over the weekend.

Blogs

We’re Gonna Get Those Bastards – We All Need to be Loved (Jared Dillian)

Discipline Funds – The Myth of F$ck You Money (Cullen Roche)

A Wealth of Common Sense – The Upside of Gratitude (Ben Carlson)

Podcasts

Motley Fool Money – J.L. Collins, Achieving Financial Independence (Spotify, Apple Podcasts)

Invest Like the Best with Patrick O’Shaughnessy – Bill Gurley: The Gift and The Curse of Staying Private (YouTube, Spotify, Apple Podcasts)

Movies/TV Shows

The Studio – Seth Rogen, Catherine O’Hara, Ike Barinholtz (Apple TV, IMDB, YouTube)

Music

Hard-Fi – Fire in the House (Spotify, Apple Music, YouTube)

Books

Sahil Bloom – The 5 Types of Wealth: A Transformative Guide to Design Your Dream Life (Amazon)

Fun

Ashton Hall – Another One (Instagram)

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)