It's not just 7 stocks, plus active management, hikes-to-cuts, Grayscale outflows, and a stop at the NYSE

The Sandbox Daily (1.30.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

it’s not just 7 stocks

active manager performance

from hikes to cuts

Grayscale bitcoin outflows slowing

This afternoon we dropped by the New York Stock Exchange as a guest of J.P. Morgan and checked off a major bucket list item. This building has a tremendous amount of history and carries a certain vibrancy/energy that is difficult to put into words. I felt like a 7-year-old in the toy section at Target.

Now on to the content – let’s dig in.

Markets in review

EQUITIES: Dow +0.35% | S&P 500 -0.06% | Nasdaq 100 -0.68% | Russell 2000 -0.76%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield -0.13% | 2yr UST 4.322% | 10yr UST 4.022%

COMMODITIES: Brent Crude -0.33% to $82.60/barrel. Gold +0.13% to $2,053.7/oz.

BITCOIN: +0.88% to $42,745

US DOLLAR INDEX: +0.04% to 103.439

CBOE EQUITY PUT/CALL RATIO: 0.57

VIX: -2.13% to 13.31

Quote of the day

“Your ultimate success or failure will depend on your ability to ignore the worries of the world long enough to allow your investments to succeed.”

- Peter Lynch, Former PM of the Fidelity Magellan Fund

It’s not just 7 stocks

If it was just Technology driving this market, then how come the biggest bellwethers in both Financials and Industrials are making new all-time highs?

Source: All Star Charts

Active manager performance

Concentrated market leadership presents a high hurdle for active managers to outperform market cap-weighted benchmarks given the narrow opportunity set of winners tilted towards mega-cap companies.

In fact, active managers delivered one of their worst relative performances on record with only 23% of Large-Cap Core funds outperforming their cap-weighted benchmark this past year, down from 66% outperforming in 2022.

Often times investors expect to be compensated for taking active risk when deviating from passive index-tracking strategies. Outperformance by 10 or 25 bps does not quite move the needle, so investors often times set their sights on those bigger swings.

This next J.P. Morgan chart shows the percentage of active managers outperforming by 100 bps (1%) or 250 bps (2.50%) becomes increasingly smaller – the probability of picking these few true winners is such a low probability that it’s not worth the incremental risk.

Source: J.P. Morgan Markets

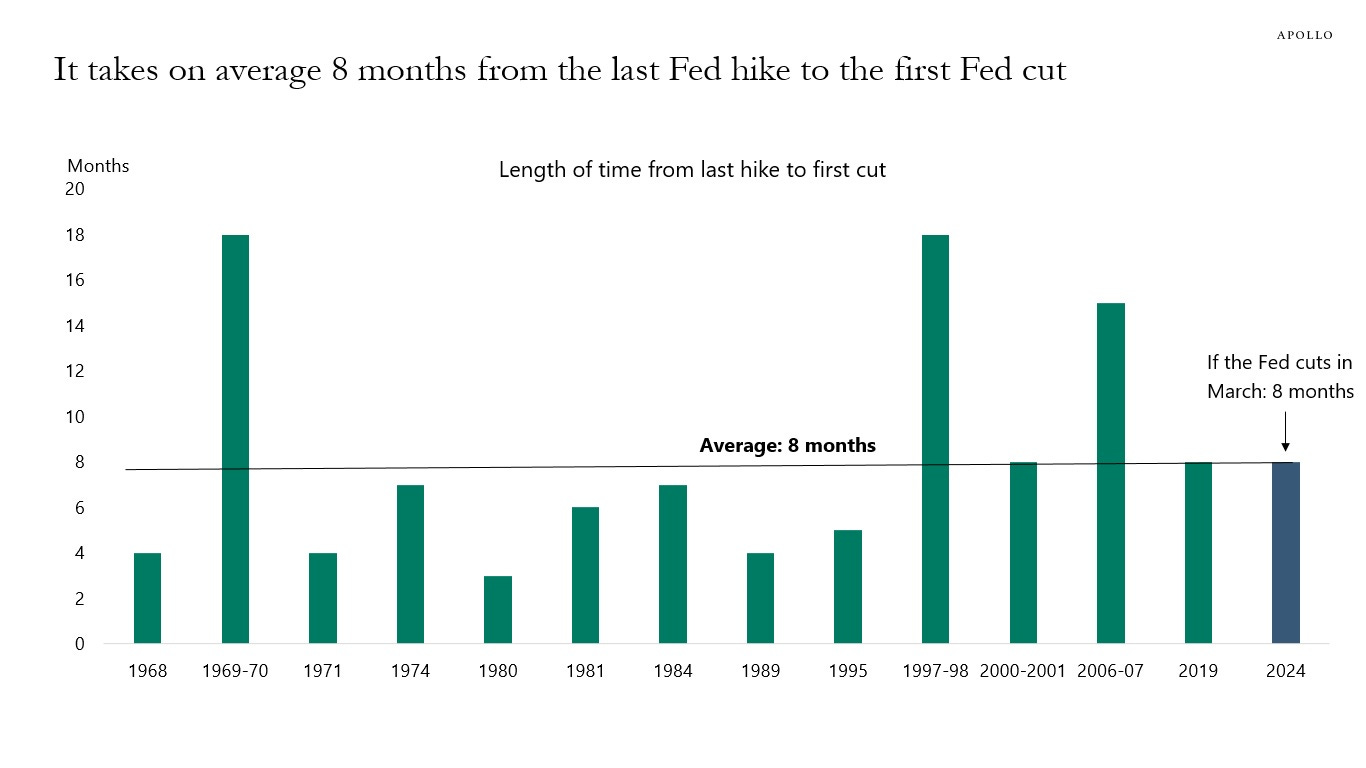

From hikes to cuts

Since 1950, the average length of time from the final rate hike of a tightening cycle to the first rate cut of an easing cycle is 8 months.

Assuming July 2023 was indeed the last rate hike of this cycle from the Federal Reserve, then the Fed should start cutting rate around March 2024 based on historical averages and precedent.

Source: Torsten Slok

GBTC outflows slowing

The Grayscale Bitcoin Trust (GBTC) – the legacy bitcoin behemoth struggling with redemptions after grossly mispricing its product – saw just $192 million in outflows yesterday, the lowest since the launch of all the spot Bitcoin ETFs. This resulted in the largest day of aggregate bitcoin ETF net inflows since the group launched two weeks ago.

Grayscale’s GBTC remains the largest Bitcoin ETF, with total assets under management (AUM) hovering around the $24 billion mark despite dropping from $28.6 billion before its conversion.

Source: Fundstrat

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.