Jackson Hole, global markets await Fed Chair Powell's speech and THE most important chart for investors

The Sandbox Daily (8.24.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

bond market not buying what the Fed is selling

the single most important chart for investors?

sentiment and positioning have both quickly reversed course

the people have spoken: 4-day workweeks

Let’s dig in.

Markets in review

EQUITIES: Dow -1.08% | Russell 2000 -1.27% | S&P 500 -1.35% | Nasdaq 100 -2.19%

FIXED INCOME: Barclays Agg Bond -0.23% | High Yield -0.55% | 2yr UST 5.025% | 10yr UST 4.239%

COMMODITIES: Brent Crude -0.10% to $83.13/barrel. Gold -0.17% to $1,944.8/oz.

BITCOIN: -2.37% to $26,035

US DOLLAR INDEX: +0.55% to 103.992

CBOE EQUITY PUT/CALL RATIO: 0.89

VIX: +7.63% to 17.20

Quote of the day

“Five years is not a very long time. You see crazy things over five years. Of course, it often feels like a lifetime to actually live through it. The long haul is a really long time. It sometimes feels like several lifetimes to actually live through it.”

- Cliff Asness, AQR Capital Management, Efficient Frontier “Theory” for the Long Run

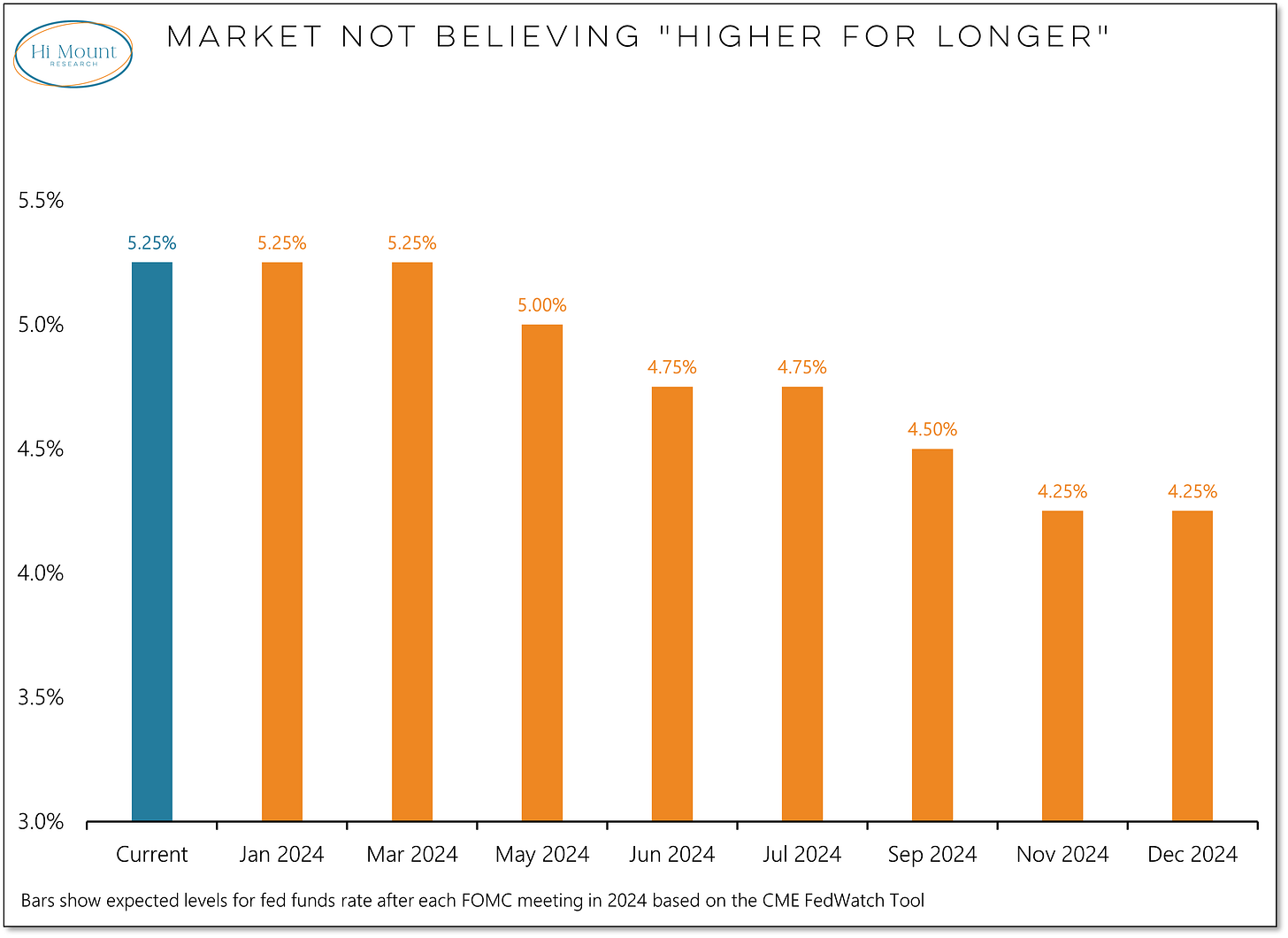

Bond market not buying what the Fed is selling

The entire investing world is waiting with bated breath for Federal Reserve Chairman Jerome Powell’s Friday keynote speech at 10:05am ET during the Kansas City Fed Symposium in Jackson Hole, Wyoming.

What’s the state of play?

The Federal Reserve keeps talking tough on inflation and says monetary policy must remain sufficiently restrictive for now. Regarding interest rates, that means higher-for-longer.

The bond market, however – wrong for the entire last year – remains skeptical of the Fed’s intentions. Fed Funds Futures are currently pricing in 4 hikes across the 8 calendar meetings in 2024.

Outside of individual rate decisions, this conference is traditionally one of the most prominent global central banking events of the year, and markets watch closely to gain insights on policy themes for the rest of the year and beyond.

Last year’s speech didn’t go so well for risk assets when Jerome Powell warned that interest rate hikes would “bring some pain” to American households and businesses.

In response to Chair Powell’s Jackson Hole remarks, the Dow Jones index lost over 1,000 points that day and a total of 4,000 points along its way to the bottom about a month later. All the major averages lost nearly 10% or more – ouch!

Will history repeat itself?

Source: Hi Mount Research, Kansas City Fed

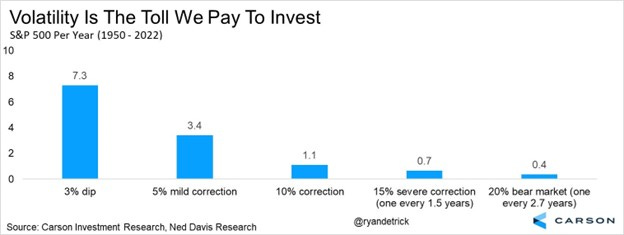

The most important chart for investors

As investors in stocks, volatility is the price you pay to achieve long-term capital appreciation.

Sometimes the ride isn’t always the easiest, nor the most fun, but that patience to endure difficult markets allows investors to avoid making costly mistakes at the worst time.

Setting the right expectations when investing in public equities is critically important to your success. In that vein, here is what you should expect on average from the S&P 500:

each year sees more than seven different 3% dips

5% stocks corrections occur three times per year

we experience a 10% correction about once a year on average

a 15% major correction happens every year-and-a-half

20% bear markets happen about every three years

Do yourself a favor and save this chart for perpetuity. When the next market drawdown comes, you will be mentally ready for it.

Source: Ryan Detrick

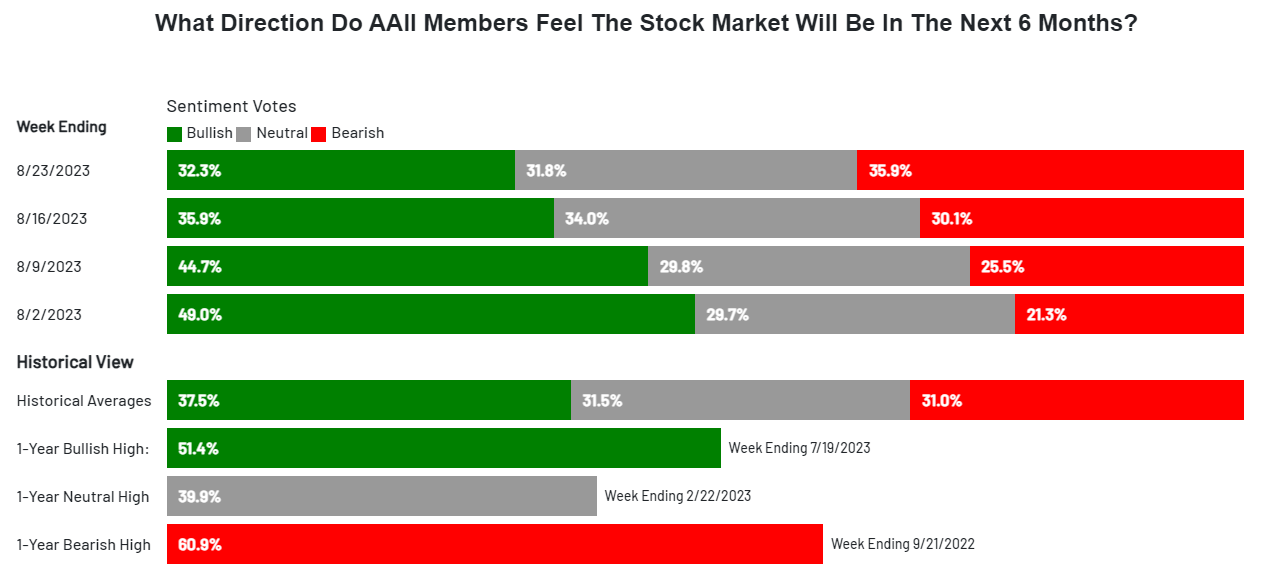

Sentiment and positioning have both quickly reversed course

The sharp move higher in both yields and the U.S. dollar index over the last month or so have been widely cited drags on risk sentiment and positioning as the market once again reassesses Fed policy and outlook.

Bullish retail sentiment declined for the 3rd consecutive week, driving bearish sentiment (red line below) above bullish (green line) for the 1st time since June 2nd. The two lines have quickly reversed their year-to-date moves.

The latest weekly survey from the American Association of Individual Investors (AAII) reported Bullish sentiment was 32.3%, with Neutral investors at 31.8% and Bearish sentiment at 35.9%.

The current Bullish sentiment reading of 32.3% is firmly off the 52-week high of 51.4% we just established back on July 19th.

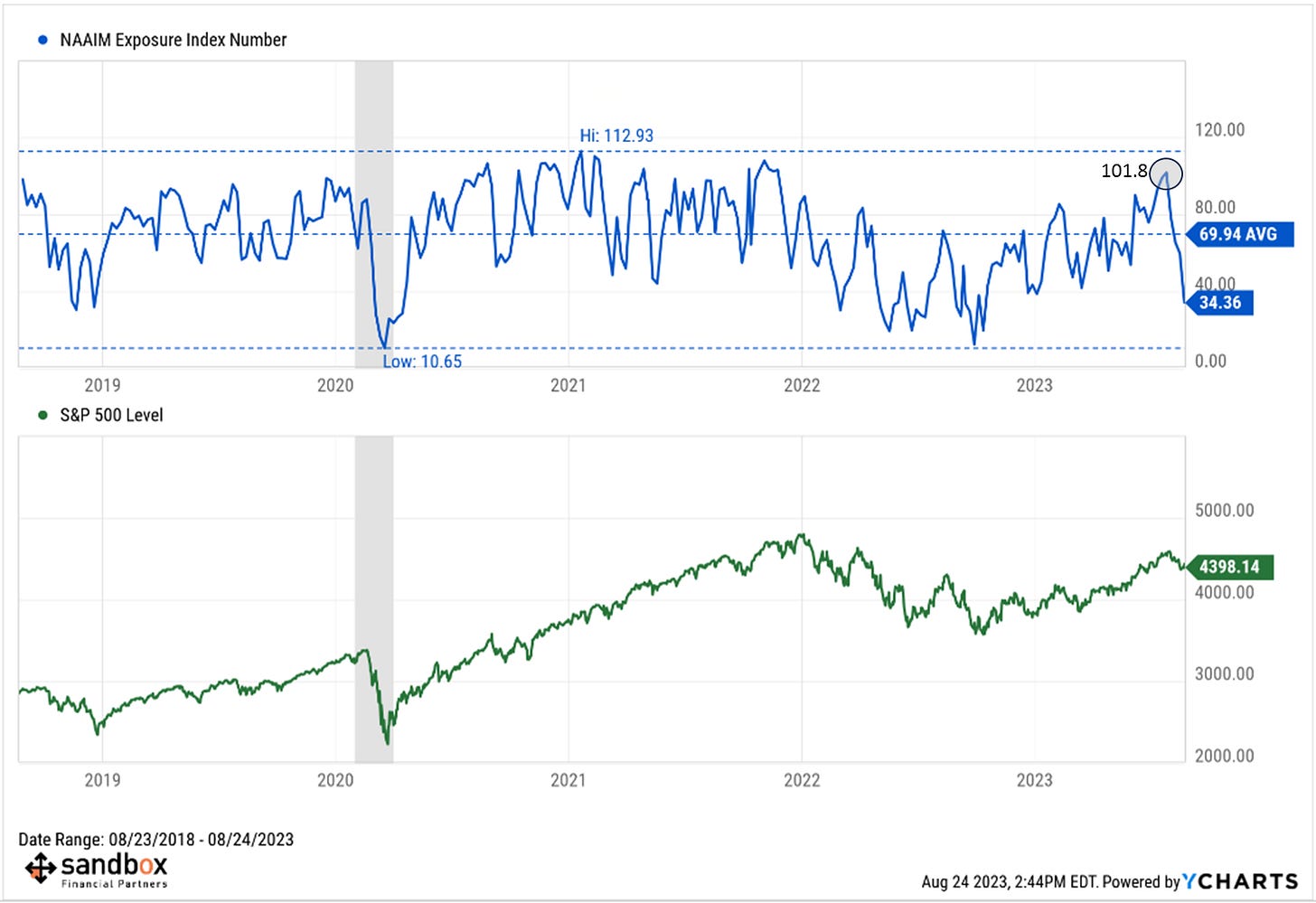

Meanwhile, positioning has also collapsed at the same time.

The National Association of Active Investment Managers (NAAIM) Exposure Index is down to 34.4 – its lowest reading of 2023 – and firmly off the recent cycle peak of 101.8 on July 26th.

The NAAIM report shows the collective professional money manager’s weekly average exposure to equities (scaled from -200% which is leveraged short to +200% which is fully levered long).

The index had been steadily climbing higher this year since the March mini banking crisis – meaning investment managers were adding risk (i.e. legging longer into their equity positions) – however the recent lightening of positions shows risk appetite has been dashed for now.

Source: American Association of Individual Investors, Dwyer Strategy, National Association of Active Investment Managers

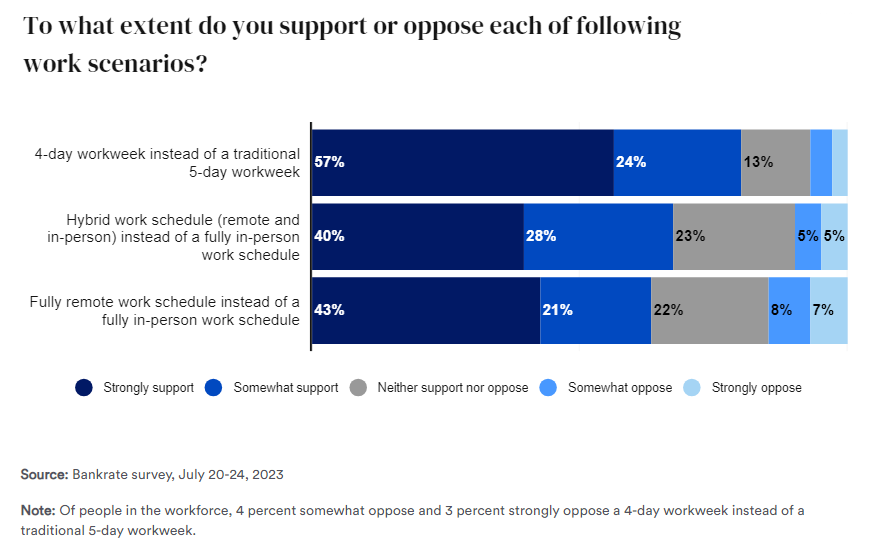

The people have spoken: 4-day workweeks

Workers are over the classic 5-day workweek.

A shorter workweek is becoming an increasingly popular idea, with a recent Bankrate survey revealing that 81% of full-time workers and job seekers would prefer fewer days on the clock and the longer weekend.

Employers across the United States have had to adapt to a changing labor market with fewer job seekers, higher salary expectations, and intensifying demand for flexible schedules. In addition to the rise of remote and hybrid work, 4-day workweeks aren’t far behind in the workers’ preferences.

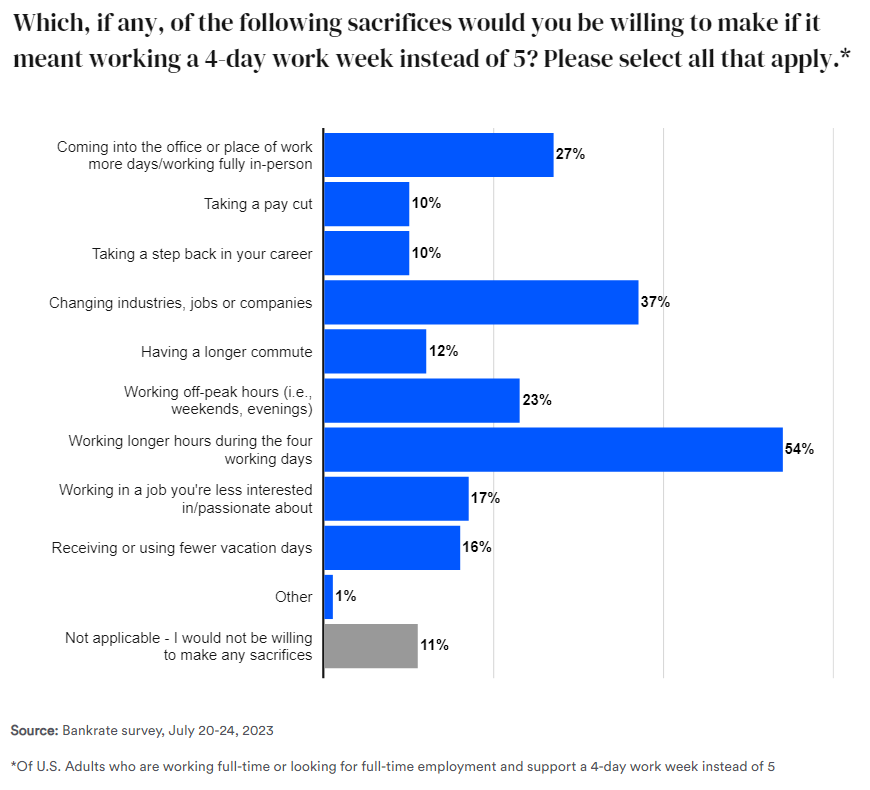

Workers understand there is no free lunch, so 89% of proponents said they’re prepared to make sacrifices in other areas to ensure a shorter work week:

54% would stretch their daily hours, ensuring the same output in a shorter week

37% would consider switching jobs or industries to a position that offers four-day weeks

27% would wind down hybrid schedules, or even give up remote work entirely

This underscores an evolving sentiment among employees that a work-life balance might require more than traditional job perks. Hybrid and remote work have already become the new normal. Is the 4-day workweek next up?

Source: Bankrate

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.