January barometer flashes green, plus employment costs, Treasury refunding, stock drivers, and the month's performance

The Sandbox Daily (1.31.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

January barometer flashes green

important wage inflation measure continues to moderate

Treasury refunding announcement event risk clears without drama

what drives stock returns

January performance

Let’s dig in.

Markets in review

EQUITIES: Dow -0.82% | S&P 500 -1.61% | Nasdaq 100 -1.94% | Russell 2000 -2.45%

FIXED INCOME: Barclays Agg Bond +0.46% | High Yield -0.28% | 2yr UST 4.211% | 10yr UST 3.924%

COMMODITIES: Brent Crude -1.40% to $81.71/barrel. Gold +0.26% to $2,056.2/oz.

BITCOIN: -2.68% to $42,390

US DOLLAR INDEX: +0.17% to 103.568

CBOE EQUITY PUT/CALL RATIO: 0.66

VIX: +7.81% to 14.35

Quote of the day

“An investment in knowledge pays the best interest.”

- Benjamin Franklin

January barometer flashes green

January was a bit of a turbulent start to 2024 but we ended the month higher.

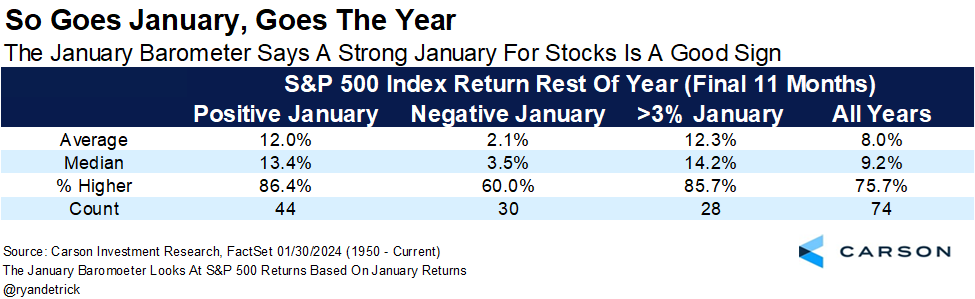

The January Barometer is often an early seasonal indicator of what’s to come for the remainder of the year. As the Wall Street saying goes: “As goes January, so goes the year.”

Historically speaking, when the 1st month is positive for stocks, the rest of the year is up +12.0% on average and higher 86.4% of the time.

And when that 1st month is lower? The stock market is up just +2.1% on average and higher 60% of the time. Big difference.

What’s more?

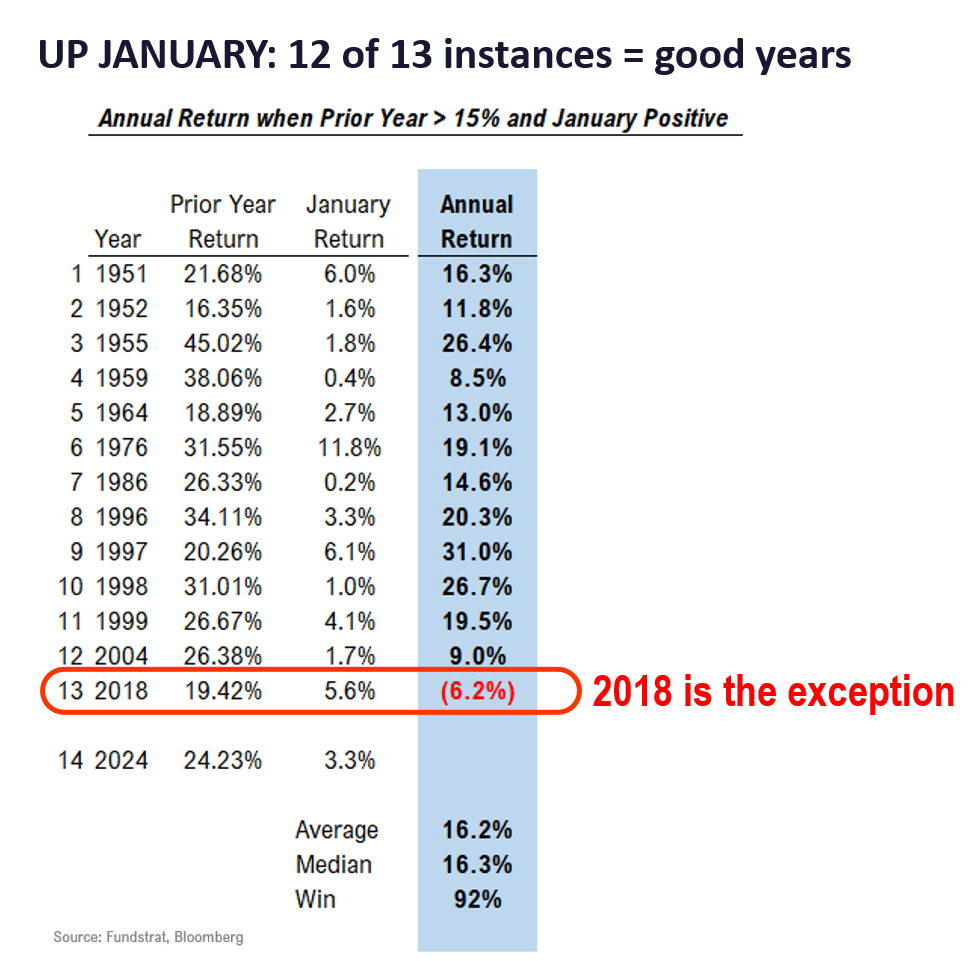

Since 1950, when the prior year’s S&P 500 index return is greater than +15% – like 2023 – and the next January’s monthly return is positive, the full year return averages +16.2% with a success rate of 92%.

Source: Ryan Detrick, CMT, Fundstrat

Important wage inflation measure continues to moderate

The Employment Cost Index (ECI), which measures the change in the hourly labor cost to employers over time, notches a smaller-than-expected gain, a fresh sign indicating that inflation pressures on business owners are at least leveling off. The ECI is the Fed’s preferred measure of labor costs.

The broader labor cost gauge rose by 0.9% in the 4th quarter, lower than the 1.0% expected consensus and marking the smallest gain since 2021. The index has stayed around the 1% level over several quarters, still elevated though above the 0.6%-0.8% range in the two years prior to the pandemic.

It’s a fresh report for markets that are looking for indications of a cooling labor market, which would give Federal Reserve officials the ammo needed to cut interest rates later this year.

Source: Ned Davis Research, Bloomberg

Treasury refunding announcement event risk clears without drama

The U.S. Treasury Department released its latest borrowing plan this week, a once-mundane event that lately has fueled market swings thanks to concerns about the federal budget deficit.

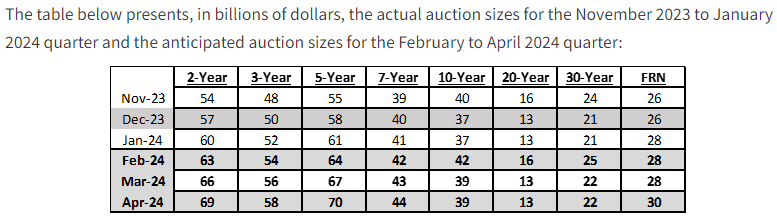

Each quarter, the Treasury’s so-called refunding announcement offers investors a breakdown of how the government will borrow money to make up for the gap between its revenue and its spending. Today we saw the Treasury continue to favor issuance on the short end of the curve.

In the press release, the U.S. Treasury said it will offer $121B in Treasury securities in next week’s auctions, up from $112B in the prior quarter. The refunding will include:

3-year notes in the amount of $54B, maturing February 2027

10-year notes in the amount of $42B, maturing February 2034

30- year bonds in the amount of $25B maturing February 2054

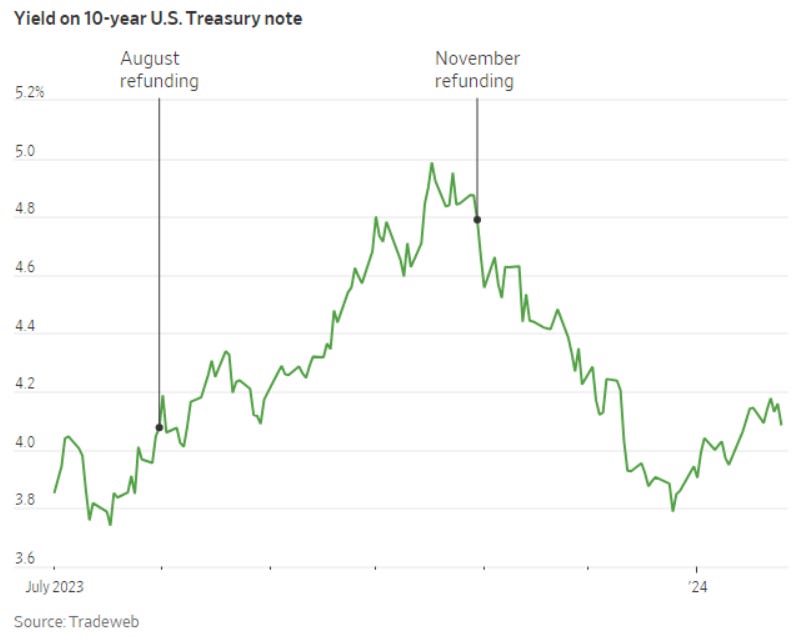

The dangers of these large budget deficits became apparent last August, when larger-than-anticipated borrowing needs drove Treasury officials to increase the size of longer-term debt auctions by more than investors expected. The announcement dealt a fresh blow to a market already under pressure from speculation that the Fed would keep interest rates higher for longer. The yield on the 10-year note touched 5% in late October for the 1st time in 16 years.

Investors got a 2nd surprise at the next refunding in November when the Treasury increased longer-term debt auctions by smaller amounts, leaning instead on short-term debt. That helped spur a reversal in longer-term yields, which set a floor on interest rates on everything from mortgages to corporate bonds.

Will this new refunding announcement lead to another major shift in the rate markets?

Source: U.S. Treasury, Bloomberg, Dwyer Strategy

What drives stock returns

With all the noise and competing narratives publicly available to us, it is often difficult to maintain discipline and perspective without getting too emotional about our investments. After all, we are human beings with real feelings and emotions. Sometimes we need to take a step back and remember what drives stock returns over different time horizons.

Source: Brian Feroldi

January performance

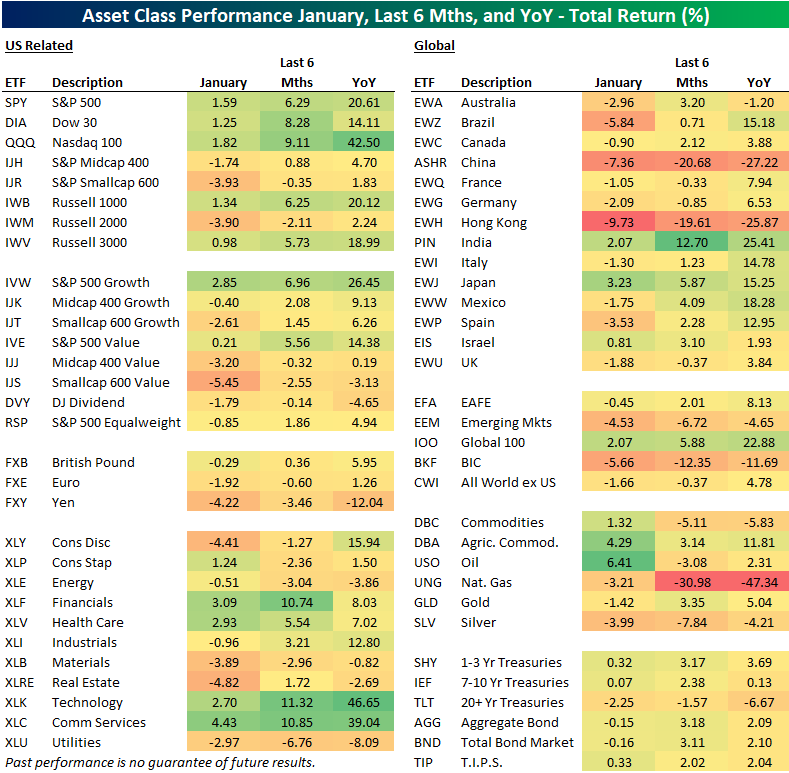

Below is an updated look at the asset class performance matrix for January:

Here’s a rundown of the S&P 500 index for January:

Index: +1.59%

Average Stock: -0.84%

221 Stocks Up

279 Stocks Down

Best performer: Juniper Networks (JNPR) +24.2%

Worst performer: Tesla (TSLA) -24.6%

Source: Bespoke Investment Group

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.