January: month in review

The Sandbox Daily (2.2.2026)

Welcome, Sandbox friends.

Today’s Daily discusses:

December: January market bites

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow +1.05% | Russell 2000 +1.02% | Nasdaq 100 +0.73% | S&P 500 +0.54%

FIXED INCOME: Barclays Agg Bond -0.12% | High Yield +0.06% | 2yr UST 3.576% | 10yr UST 4.281%

COMMODITIES: Brent Crude +2.03% to $66.39/barrel. Gold -1.34% to $4,681.8/oz.

BITCOIN: -6.89% to $78,278

US DOLLAR INDEX: +0.62% to 97.591

CBOE TOTAL PUT/CALL RATIO: 0.82

VIX: -6.31% to 16.34

Quote of the day

“Regardless of the event, you have three choices. Are you buying stocks, selling stocks, or holding stocks? Cuban Missile Crisis, ‘87 crash, 9/11, Lehman... it doesn’t matter. Those are still the same three choices you have.”

- Chris Verrone, Strategas Research

January: month in review

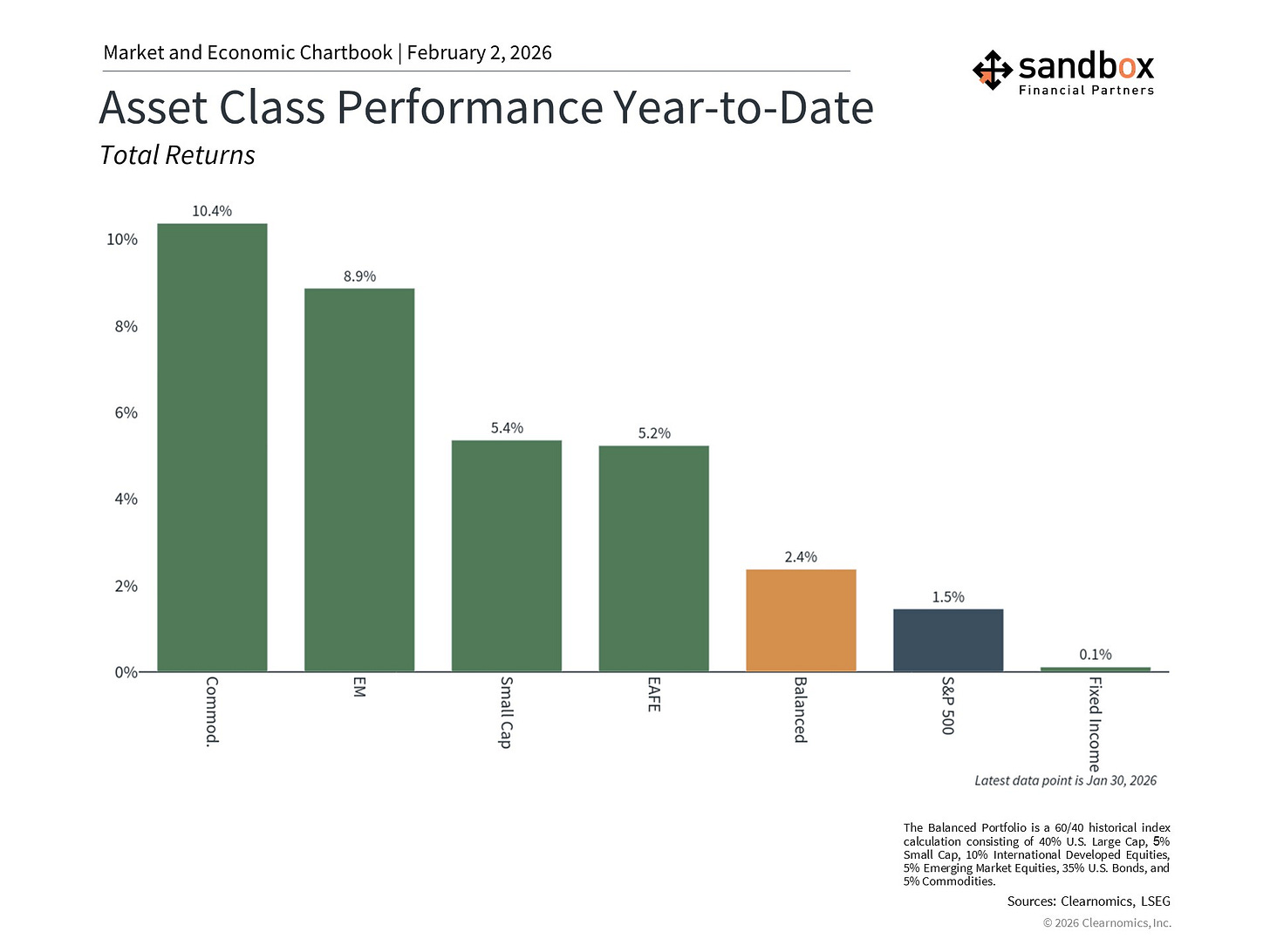

The start of the year was positive for stocks and bonds, continuing the rally from recent years. This might be surprising to some investors since there were several periods of volatility driven by geopolitics and Federal Reserve policy. While headlines created short-term swings, including the S&P 500’s worst day since last October, markets rebounded quickly. Within days, major indices reached new all-time highs, driven also by healthy corporate earnings that have supported portfolios.

For investors, January serves as a valuable reminder that headlines can move markets in unpredictable ways, but fundamentals and long-term goals-based investing are what matter most. While geopolitical events and policy uncertainty will likely create more volatility throughout 2026, the best way to navigate these challenges remains a balanced portfolio.

Key market and economic drivers in January

The S&P 500 gained +1.4% in January and briefly crossed 7,000 for the 1st time on an intra-day basis.

The VIX, a measure of stock market volatility, ended the month at 17.44 after rising above 20 due to geopolitical tensions

The Bloomberg U.S. Aggregate Bond Index climbed+ 0.1% over the month as long-term interest rates rose. The 10-year Treasury yield ended the month at 4.24%, the highest level since last September.

International Developed Markets (DM) jumped +5.2% based on the MSCI EAFE Index, while Emerging Markets (EM) gained +8.8% based on the MSCI EM Index

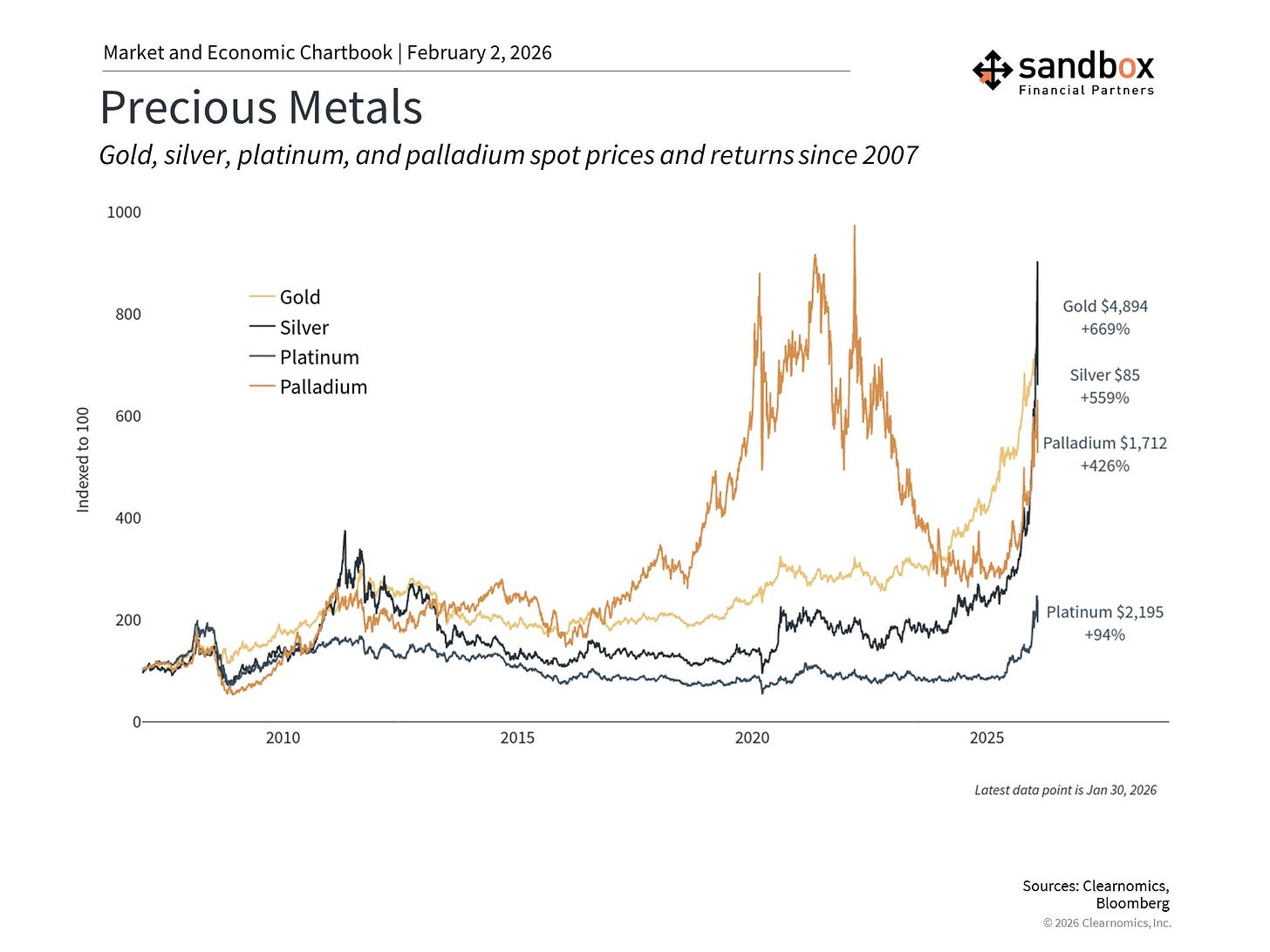

Gold surged to a record close of $5,417 per ounce before plunging nearly -10% on January 30

The U.S. dollar index fell further to about 97.0, reaching its weakest level in nearly four years, before rebounding slightly following the Fed Chair news

The Federal Reserve held its policy rate at 3.50 to 3.75% at its January meeting, following three consecutive quarter-point cuts in the second half of 2025

President Trump announced the nomination of Kevin Warsh as the next Fed Chair. If confirmed by the Senate, he would take office in mid-May.

Consumer Price Index inflation remained at 2.7% year-over-year in December, still above the Fed’s 2% target

Washington ended the month with a partial government shutdown

Severe winter weather across much of the Eastern and Southern United States caused natural gas and electricity prices to spike

Geopolitical tensions edged market volatility higher

Early in the month, a U.S. operation in Venezuela resulted in the capture of President Nicolas Maduro. While the operation centered around narco-terrorism, much of the conversation quickly turned to oil. Venezuela holds the world’s largest proven oil reserves but pumps less than 1% of global crude production due to its poor infrastructure. For investors, the primary channel through which geopolitical events affect financial markets is through commodity prices, and oil remains central to the global economy.

Geopolitical concerns rose further over U.S. statements regarding the purchase of Greenland due to its strategic importance to defense and commodities. This sparked diplomatic disputes with NATO countries involving tariffs that led to the S&P 500’s worst day since last October. However, the situation quickly de-escalated after President Trump met with the NATO secretary general and established a “framework of a future deal,” leading the market to rebound.

Gold, silver, and the dollar took center stage

Precious metals continued to rally until a significant reversal on the final day of January. Gold rose to nearly $5,600 on an intra-day basis while silver’s spot price exceeded $120 per ounce before they both sold off. These moves have been driven by a combination of factors including geopolitical risk, central bank purchases, and concerns about Federal Reserve independence.

The moves driving gold and silver have been referred to as the “debasement trade,” or the idea that fiscal and monetary policies that effectively weaken the dollar, create deficits, and lead to inflation may strengthen precious metals.

At the same time, the U.S. dollar was pushed lower and touched 4-year lows on an intra-day basis. Working heavily against the currency’s appeal is the persistent chatter around the calls to diversify away dollar-denominated assets to circumvent the United States’ financial sphere of influence.

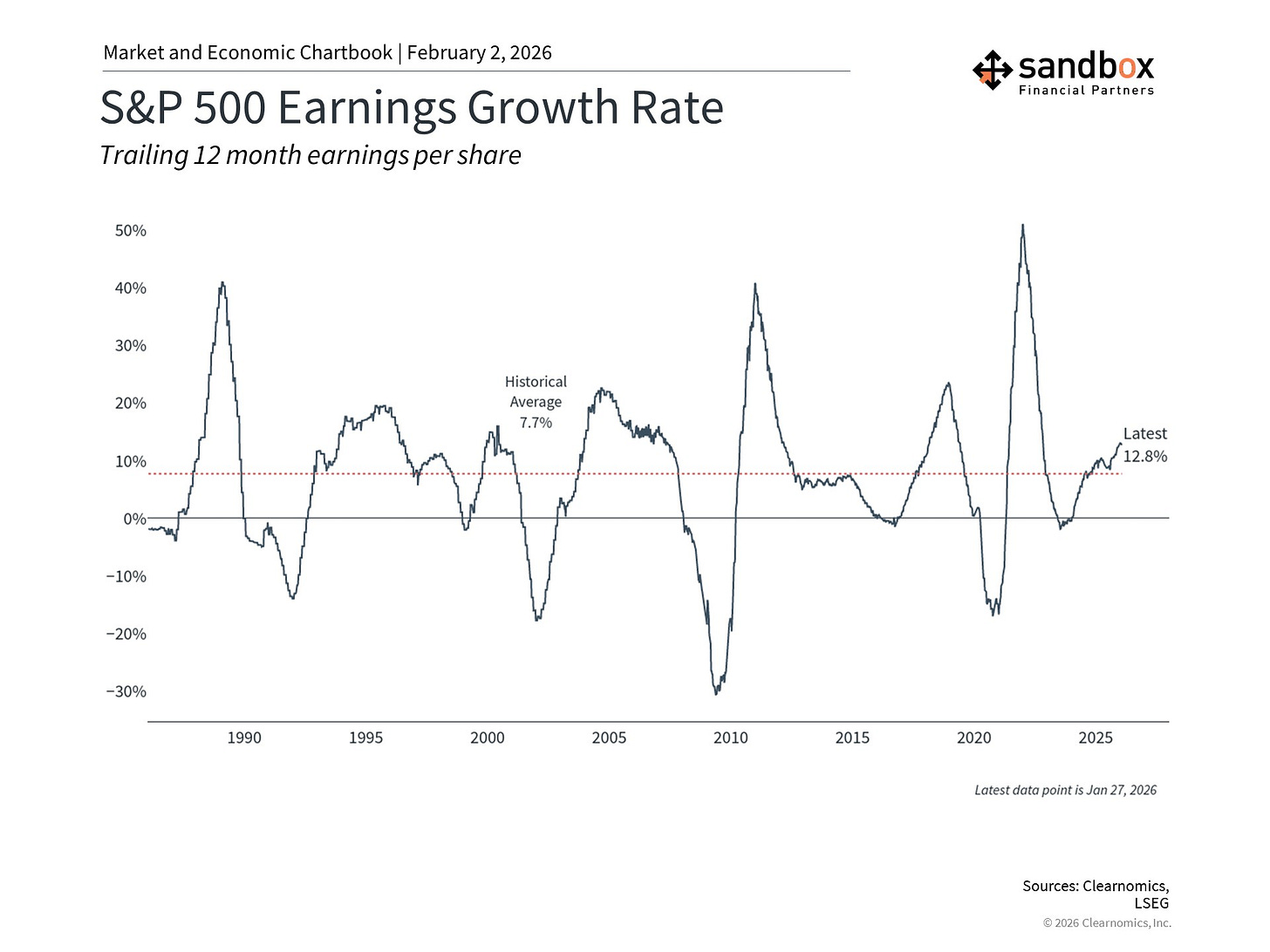

Corporate earnings remained healthy despite uncertainty

4th quarter earnings are showing that companies continue to perform well. Per FactSet data, 33% of S&P 500 companies have reported results and 75% have beaten expectations.

If these trends continue, large public companies could be on track to achieve a growth rate of 11.9% for the quarter, representing the 5th consecutive quarter of double-digit earnings growth. On a trailing 12-month basis, earnings growth has accelerated to 12.8%.

Naturally, many investors are focused on AI and technology earnings since these stocks have contributed to market returns over the past several years. So far, markets have had mixed reactions to the earnings of these companies, even when they beat estimates, due to lofty expectations and questions around the sustainability of this spending.

At the same time, many other sectors have benefited from broad economic growth and have grown their earnings at a faster rate as well.

Bottom line?

January experienced rising cross-asset volatility due to geopolitics, the Fed, and more. However, markets were resilient and healthy corporate earnings have helped major indices reach new all-time highs, even as precious metals stumbled.

Source: Clearnomics

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Hey, great read as always. That 'three choices' quote? Still the best algoritm for life.

Solid monthlyrecap. The gold/silver selloff on the last day of January was brutal but makes sense given how overstretched those positions were getting. The "debasement trade" framing is spot on, its basically a vote of no confidence in dollar stability. Corporate earnings holding up despite all the headline noise is probbly the most bullish signal right now, fundamentals still matter more than geopolitics in the long run.