Jim Cramer 2007 vintage, plus bond market struggles, market jitters, portfolio insurance, and rules-based investing

The Sandbox Daily (8.3.2023)

Welcome, Sandbox friends.

Today’s Daily discusses:

bond investors mired in historical drawdown

market jitters return

portfolio insurance is dirt cheap

rules-based investing

Every August 3rd, we celebrate Jim Cramer’s 2007 “they know nothing” meltdown rant. Bear Stearns ($BSC) was trading at $109 that day. Wow.

30-second YouTube clip below:

Let’s dig in.

Markets in review

EQUITIES: Nasdaq 100 -0.11% | Dow -0.19% | S&P 500 -0.25% | Russell 2000 -0.28%

FIXED INCOME: Barclays Agg Bond -0.67% | High Yield -0.32% | 2yr UST 4.883% | 10yr UST 4.179%

COMMODITIES: Brent Crude +2.46% to $85.25/barrel. Gold -0.29% to $1,969.3/oz.

BITCOIN: +0.52% to $29,288

US DOLLAR INDEX: -0.12% to 102.472

CBOE EQUITY PUT/CALL RATIO: 0.62

VIX: -1.06% to 15.92

Quote of the day

“Investors should use more simplified thinking. Markets are endlessly complicated, investors are endlessly emotional, and there are no points awarded for difficulty.”

- Morgan Housel, How to Win by Doing Less

Bond investors taking it on the chin

U.S. bond investors are mired amidst a historical drawdown. The asset class is down -13% over the trailing 3-year period, their worst 3-year return in history.

Last year’s interest rate hikes and surging inflation caused steep losses in the bond market, resulting in the U.S. Aggregate Bond Index to endure its worst year on record since the 1976 inception of the index: -13.04%. Ouch !!

The current drawdown is the longest in bond market history.

Some investors might be thinking: “Who cares? I don’t invest in the bond market.”

Well, as the largest global marketplace in the world, $133 trillion dollars definitely care. $51 trillion of that resides here in the United States.

Source: Charlie Bilello, Bianco Research, All Star Charts

Market anxiety returns

The S&P 500 closed 1.4% lower on Wednesday, its worst day since April, amid investor anxiety that strong private sector job creation figures raised the risk of a further rate hike from the Federal Reserve. Compounding the selling pressure, investors are digesting the implications of the decision by credit rating agency Fitch to downgrade the U.S. government’s sovereign credit rating. Today we saw downside follow through, despite a fairly significant intra-day reversal.

The return of market anxiety after three consecutive weekly gains in the S&P 500 was also reflected in the VIX index of implied stock volatility, which rose to its highest level since May.

The deterioration this week’s trading derailed the 21 consecutive day streak in which the S&P 500 moved without a 1% or more swing on the index, as well as 18 consecutive days in which we had more new highs than new lows.

Taking a breather here makes sense, given stretched technicals across the market as well as weak seasonality and a swift rise in bullish investor sentiment.

Source: Hi Mount Research

Portfolio insurance is dirt cheap

Per Bloomberg’s reporting:

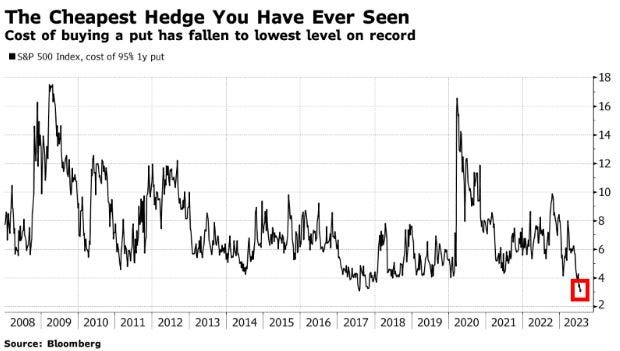

U.S. stock bulls have grown so confident in the market that the cost of buying protection against a 5% dip in the next YEAR has fallen to what Bank of America strategist Ben Bowler is calling the cheapest you likely have ever seen.

The chart above shows the cost of protecting yourself against a downside move in the S&P 500 over the coming 12 months was the cheapest it had been since at least 2008.

The cost of hedging right now is truly historic. High interest rates and low equity volatility are driving down the price of put protection.

Remember, if you are looking to mitigate downside risk in your portfolio, it’s always prudent to buy hurricane insurance before the storm hits, not after.

Source: Barchart

Rules-based investing

Dollar-cost averaging over long time horizons effectively makes market timing irrelevant.

As they often say, “time in the market” is more important than “timing the market.”

Dollar-cost averaging prevents procrastination, minimizes regret (by using a rules-based investing philosophy), avoids market timing, and removes emotion from your financial plan. While it may be tempting to try waiting for the perfect time to invest – especially in a volatile market – remember the low probability of finding the right entry point and the (high) cost of waiting prevents you from even beginning your financial journey.

As Nick Maggiulli eloquently said, Just Keep Buying.

Source: Brian Feroldi

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily.