Job cuts surge on the "DOGE" impact

The Sandbox Daily (3.6.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

job cuts surge on DOGE actions

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.99% | Russell 2000 -1.63% | S&P 500 -1.78 % | Nasdaq 100 -2.79%

FIXED INCOME: Barclays Agg Bond -0.10% | High Yield -0.38% | 2yr UST 3.965% | 10yr UST 4.280%

COMMODITIES: Brent Crude +0.26% to $69.48/barrel. Gold -0.29% to $2,917.5/oz.

BITCOIN: -4.89% to $85,745

US DOLLAR INDEX: -0.07% to 104.228

CBOE TOTAL PUT/CALL RATIO: 0.76

VIX: +13.41% to 24.87

Quote of the day

“Your talent is God's gift to you. What you do with it is your gift back to God.”

- Leo F. Buscaglia, Ph.D. in Living, Loving, and Learning

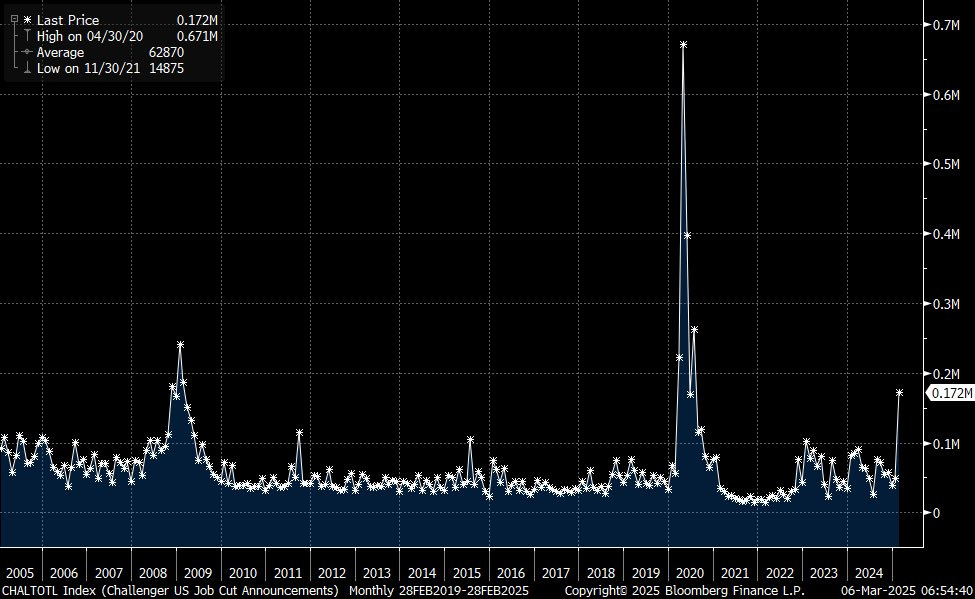

Job cuts surge on DOGE actions

In a sign that policies from the new White House Administration are starting to hit the labor market, Challenger layoff announcements spiked 245% m/m in February to 172,017, more than double what they were a year ago and the highest monthly total since July 2020 (262,649).

The year-to-date total of nearly 222,000 planned job cuts is the highest since 2009, when the economy was still amidst the Great Recession.

The surge was led by the government sector, with 17 different agencies announcing cuts last month.

Challenger said the purging of the federal workforce by DOGE was cited as the main reason for layoffs.

Despite the jump in job cutting plans, initial claims for unemployment insurance have yet to show a meaningful increase.

They actually fell by 21,000 last week to a lower-than-expected 221,000, basically reversing the rise in the previous week.

Initial claims have been range-bound since late 2021, close to their pre-pandemic level and are low by historical norms.

Continuing unemployment claims in the prior week rose 42,000 to 1.897 million, but are also contained longer-term, while the insured jobless rate was unchanged at 1.2%. This is consistent with a continued low unemployment rate in the very near term.

These reports, however, suggest that there is a disruption brewing in the labor market.

Given that the jobs market started 2025 from a near-balanced supply/demand position, weakening economic growth and more layoffs in the months ahead could put upward pressure on the unemployment rate and downward pressure on economic growth.

Such weakness is unlikely to show up in the BLS monthly jobs tomorrow, but is a risk for subsequent months. A significant risk that must be watched closely.

Sources: Challenger, Gray, & Christmas Inc, Bloomberg, Ned Davis Research

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website: