Key Q1 mutual fund trends on what investors need to know, plus strong breadth, credit demand, and earnings

The Sandbox Daily (5.21.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

mutual fund trends in Q1

breadth evidence supports ongoing bull market

a resilient U.S. economy and cooling inflation have fueled strength in credit

strength in earnings outlook

Let’s dig in.

Markets in review

EQUITIES: S&P 500 +0.25% | Nasdaq 100 +0.21% | Dow +0.17% | Russell 2000 -0.20%

FIXED INCOME: Barclays Agg Bond +0.19% | High Yield -0.08% | 2yr UST 4.831% | 10yr UST 4.412%

COMMODITIES: Brent Crude -1.32% to $82.53/barrel. Gold -0.15% to $2,425.8/oz.

BITCOIN: +0.77% to $70,219

US DOLLAR INDEX: -0.04% to 104.622

CBOE EQUITY PUT/CALL RATIO: 0.53

VIX: -2.39% to 11.86

Quote of the day

“Some things cannot be taught; they must be experienced. You never learn the most valuable lessons in life until you go through your own journey.”

- Roy T. Bennett, Author of The Light in the Heart

Mutual fund trends in Q1

The Goldman Sachs U.S. Portfolio strategy team published their Mutual Fundamentals quarterly report, which analyzed 482 large-cap mutual funds with a combined $3.3 trillion in equity assets under management. The broad takeaways?

No more T-bill and chill: Mutual fund cash balances have continued to decline, signaling managers' optimism about the backdrop for equities. U.S. equity mutual fund cash as a percentage of total assets declined to 1.5%, matching the record low from December 2021.

Stronger performance: After significant underperformance in 2023, mutual funds have posted stronger results year-to-date, led by Growth and Value funds. 45% of large-cap mutual funds are outperforming their benchmarks YTD, compared with the historical average of 38%. 55% of large-cap value managers and 49% of large-cap Growth managers are outperforming their benchmarks.

Mutual Fund outflows persist: Despite solid performance, active mutual funds have continued to experience outflows year-to-date. There have been $139B of outflows from active mutual funds YTD, compared with $121B of inflows to passive ETFs. Notably, "active" ETFs have experienced $23B of inflows.

Sector positioning: The average mutual fund is currently most overweight Financials (+167 bps) and Industrials (+139 bps) and most underweight Information Technology (-341 bps). The current Industrials overweight is near its 10-year high (93rd percentile), while the average mutual fund’s underweight in Utilities is the smallest in 10 years.

Magnificent 7: The average large-cap core mutual fund holds 19% of its portfolio in the Magnificent 7 stocks, while the average large-cap growth mutual fund holds 34% in the Mag 7. The combination of increasing benchmark weights and diversification restrictions means that the average large-cap mutual fund was 660 bps underweight the Magnificent 7 in 1Q24 in aggregate, largely unchanged vs. last quarter.

Source: Goldman Sachs Global Investment Research

Breadth evidence supports ongoing bull market

Participation in this bull market continues to broaden out. New highs are everywhere.

We are witnessing more countries (55%) around the world hitting 52-week new highs than we’ve seen in years.

It’s the same in the United States, too.

Breadth readings held up quite well during the S&P 500’s 5.5% pullback from March 28 through April 19.

In fact, all sectors across the S&P 500 are currently registering golden cross signals – where near-term trends (50-dma) sit above their long-term trends (200-dma).

As you can see in the table hovering over the top pane in the graphic below, markets find themselves in this general situation (8 or more sectors registering golden crosses) roughly half the time, generating a +8.69% annualized gain in this environment. Not bad.

73% of stocks are trading above their 2018 highs. 43% of stocks are trading above their 2021 highs. 62% of stocks are trading above their December 2023 highs.

After a spring malaise thought, just 34% of S&P 500 constituents are trading above their Q1 high. This more limited participation over the near-term makes sense because we know Tech cooled off over the spring.

So, it should come as no surprise that if the indexes climb the next leg higher, Tech and Tech-adjacent areas will have to participate.

New highs are expanding at the country level, at the index level, and at the sector level. Have you noticed?

Source: All Star Charts, Ned Davis Research

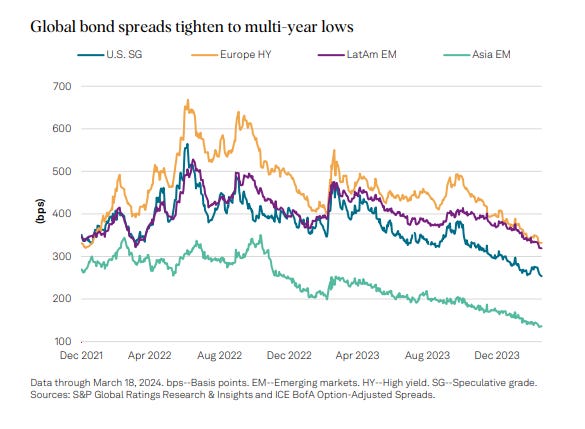

A resilient U.S. economy and cooling inflation have fueled strength in credit

One of the biggest pillars in the markets today remains the appetite for credit.

Spreads on U.S. speculative grade bonds hit an all-time low of 246 bps back in March. But it’s not just the United States, it’s globally as this chart of high yield spreads around the world shows.

Even with tightening spreads, investors continue to pile into leveraged loan funds and give them more money to lend.

Source: John Authers, The Daily Shot

Strength in earnings outlook

S&P 500 forward earnings guidance continues to increase as we move past Q1 earnings season and into their analyst days and shareholder meetings.

The earnings momentum is broadening out: 78.4% of S&P 500 constituents raised forward earnings estimates over the past 3 months.

Common themes? Cost cutting and stock buybacks are driving EPS.

Source: Yardeni Research

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

I have been trading for 35 years, and positioning and sentiment are the pinnacles for my success and longevity. Your work does not go unnoticed. I appreciate all that you do.