Labor market breadth, plus AI infrastructure, market internals, and aligning financial priorities

The Sandbox Daily (3.26.2024)

Welcome, Sandbox friends.

Today’s Daily discusses:

labor market breadth, state-by-state

AI infrastructure

market internals remain sound

aligning your financial priorities

Let’s dig in.

Markets in review

EQUITIES: Dow -0.08% | Russell 2000 -0.19% | S&P 500 -0.28% | Nasdaq 100 -0.36%

FIXED INCOME: Barclays Agg Bond +0.10% | High Yield -0.12% | 2yr UST 4.593% | 10yr UST 4.238%

COMMODITIES: Brent Crude -0.96% to $85.92/barrel. Gold +0.14% to $2,201.3/oz.

BITCOIN: +0.18% to $70,335

US DOLLAR INDEX: +0.06% to 104.297

CBOE EQUITY PUT/CALL RATIO: 0.70

VIX: +0.38% to 13.24

Quote of the day

“The key to money management: it’s making a lot of money when you’re right and minimizing it when you’re wrong.”

- Stanley Druckenmiller, Duquesne Capital

Labor market breadth, state-by-state

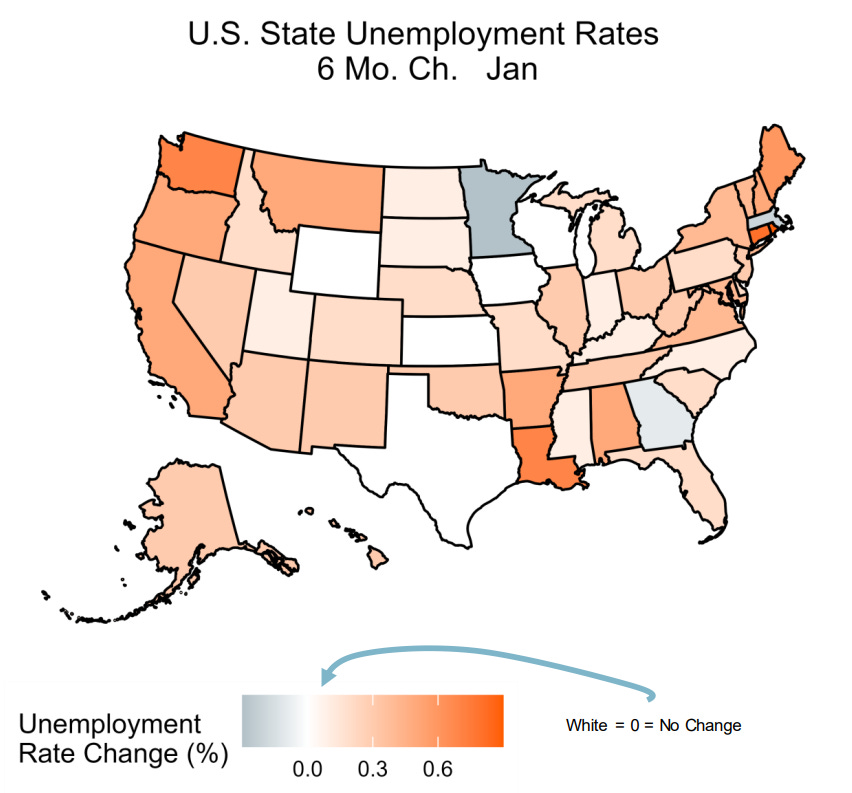

There are now Sahm rule recessions in 21 states that comprise ~45% of national GDP – consistent with the slowdown in rehiring and uneven joblessness.

Robust monthly headline payrolls and a sub-4% national unemployment rate appear to mask the deteriorating health of the labor market at the state level.

The Sahm Rule, indicating a recession when the 3-month average unemployment rate increases by 0.5% within a 12-month period, is showing up across the country but not at the national level itself.

Outside of a post-recession resurgence in 2003, every time this many states have triggered the Sahm Rule, we’ve had a recession.

Over the last 6 months, the unemployment rate is up in 39 states, flat in 8, and down in just 3.

"We actually don't have one labor market; we have a whole collection of labor markets," says Indeed economist Nick Bunker.

Source: Piper Sandler

AI infrastructure

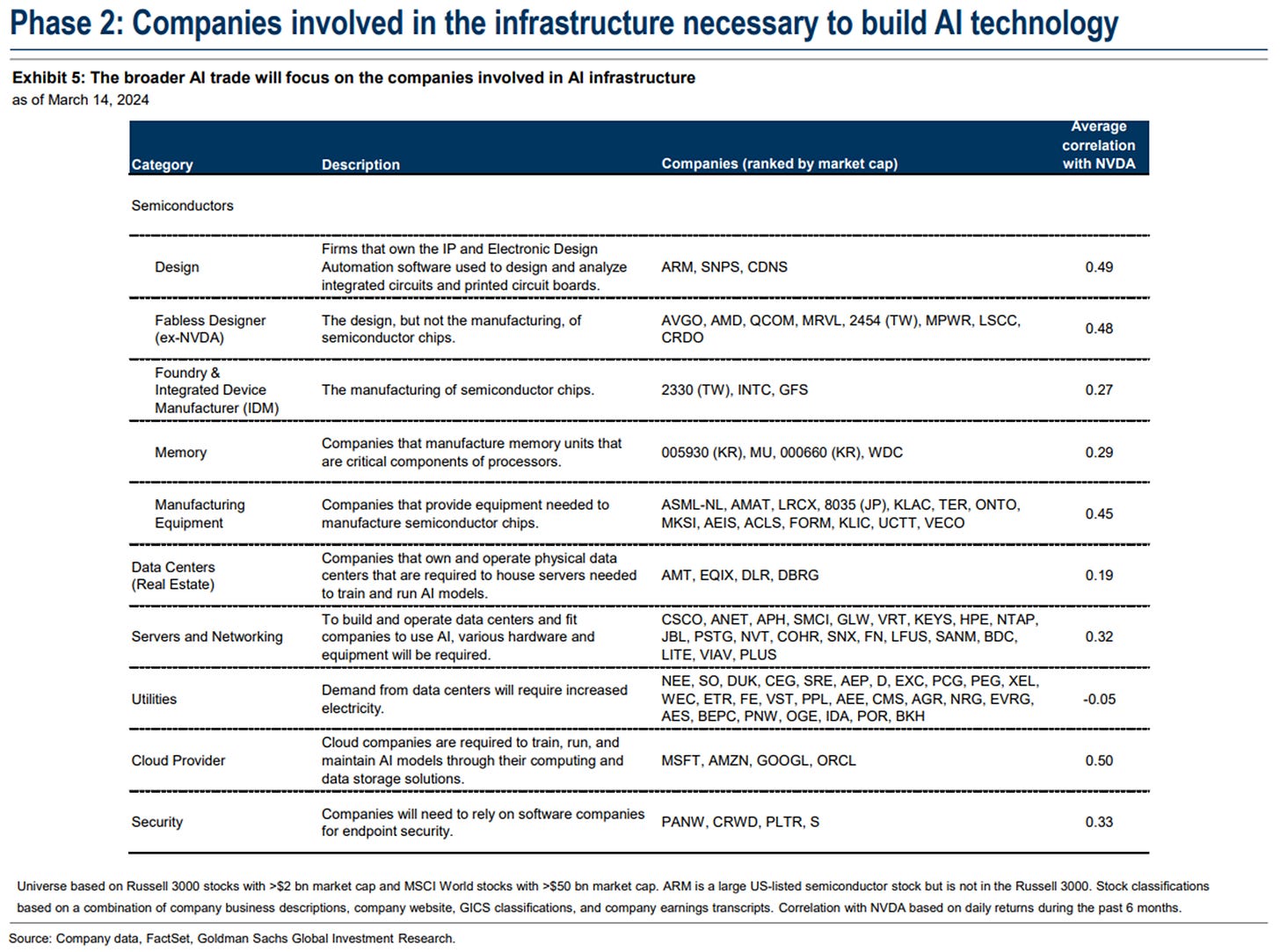

AI has captured investor enthusiasm ever since the moment OpenAI publicly launched ChatGPT to the world on November 30, 2022.

Today, many investor conversations center around the future opportunities within artificial intelligence. With Nvidia having gained 477% over the intervening period, many investors are trying to identify other beneficiaries as the AI trade broadens.

The Equity Portfolio Strategy team from Goldman Sachs has highlighted various ideas on the next phase of the AI trade – the infrastructure companies involved in the development, manufacturing design, and physical production of AI (semiconductors, cloud providers, equipment, data center REITs, utilities, and security).

The companies in each grouping below are based on a combination of GICS classifications as well as company business descriptions, filings, websites, and earnings calls.

This list is not meant to be all-encompassing and it should be acknowledged that most of the companies have diverse business models beyond AI.

Source: Goldman Sachs Global Investment Research

Market internals remain sound

5 months off the October 2023 lows and 17 months off the October 2022 lows, many investors continue to pooh-pooh this market, while others fade upside risks simply stating that stocks “need a breather.”

And yet, the broadening of market participation and rotation to new leadership seems to carry the major indexes higher, one week after another.

The number of stocks trading above their 50-day moving average (DMA) and 200-DMA for the MSCI ACWI index are near their highest levels over the past few years – indicating a broad and healthy participation from stocks around the globe.

The MSCI ACWI is an oft-sighted global benchmark composed roughly 60% United States, 30% Developed Markets, and 10% Emerging Markets.

Looking more locally to the United States, market strength has rotated into more cyclical areas, as Energy, Materials, Industrials, and Financials have all shown relative strength – despite recent weakness from certain areas, namely the Tech sector.

And while it’s often logical to just consider what’s working, there’s also information in reviewing what’s not working. If stocks are going to reverse lower in any meaningful way, market technicians will often see that show up in the New Lows lists.

As you can see below, the New Lows list is a ghost town. Without an expansion in the number of issues making new lows, it’s constructive to remain directionally long for most investors as long as market internals remain supportive.

The table above captures all companies across the S&P 1500 – a composite of the S&P 500 (large-caps), S&P 400 (mid-caps), and S&P 600 (small-caps) – which covers 90% of the market capitalization of U.S. stocks, so it represents a broad swath of the domestic market’s exposure.

While some trimming of profits in extended leadership is likely this spring, we should view modest pullbacks and consolidations within intermediate-term uptrends as healthy buying opportunities.

Source: Ned Davis Research, Grindstone Intelligence, All Star Charts

Aligning your financial priorities

"Make sure you're not geeking out about small-bore investment problems while giving short shrift to the game-changers."

Morningstar’s Christine Benz makes a good point. There are so many facets to personal finance that it can be easy to end up focusing on decisions that, at the end of the day, won't have a significant impact, while simultaneously overlooking topics that carry much more weight.

That's why it’s important to review a pyramid such as the one below to illustrate the relative importance of personal finance topics, with the foundation being of greatest importance.

Perhaps your financial pyramid assumes a different order and that’s ok – prioritize what works best for you because every household and situation is different.

Source: Morningstar

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.