Lessons from Warren Buffett for today’s market

The Sandbox Daily (5.5.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

lessons from Warren Buffett for today’s market

Let’s dig in.

Blake

Markets in review

EQUITIES: Dow -0.24% | S&P 500 -0.64% | Nasdaq 100 -0.67% | Russell 2000 -0.82%

FIXED INCOME: Barclays Agg Bond -0.17% | High Yield -0.04% | 2yr UST 3.838% | 10yr UST 4.345%

COMMODITIES: Brent Crude -1.79% to $60.19/barrel. Gold +2.96% to $3,339.4/oz.

BITCOIN: -1.55% to $94,191

US DOLLAR INDEX: -0.24% to 99.789

CBOE TOTAL PUT/CALL RATIO: 0.84

VIX: +4.23% to 23.64

Quote of the day

“I can calculate the motions of the heavenly bodies, but not the madness of people.”

- Isaac Newton

Lessons from Warren Buffett for today’s market

Key principles of investing are that patience, discipline, and maintaining a long-term perspective can drive financial success. Perhaps no investor captured this wisdom as eloquently as Warren Buffett over his five-decade career as CEO of Berkshire Hathaway.

Buffett’s retirement announcement over the weekend is an opportunity to revisit his investment principles that are not only relevant in today’s market environment but have also stood the test of time.

Tariff volatility has improved valuations

“Whether we're talking about stocks or socks, I like buying quality merchandise when it is marked down.” – Warren Buffett, 2018 Berkshire Hathaway annual letter

An important tenet of Buffett’s approach is investing in companies that are undervalued.

While broad stock market valuations rose to nearly historic highs earlier this year, the recent pullback and steady earnings growth have brought valuations back to more attractive levels.

At just under 20x, the S&P 500's price-to-earnings ratio is now in-line with its average over the past decade. This “valuation reset” is the result of short-term concerns about tariffs and economic uncertainty but might also reflect opportunities.

This is because, over longer time horizons, valuation ratios serve as the best gauge of market attractiveness.

While market moves that occur over days and months are often dominated by news headlines, company-specific events, and geopolitics, these concerns typically settle and fade over time. When looking out over years and decades, what matters more are the overall growth trends and whether investors paid a reasonable price when they made their original investment.

Valuations are one way to gauge whether investors are paying a reasonable price. Rather than focusing on stock prices alone, valuations tell us what you get for that price – in terms of earnings, book value, cash flow, dividends, and more.

Purchasing assets when valuations are attractive typically improves the odds of stronger future returns, while investing when markets appear expensive often leads to more modest long-term results. For this reason, valuations have historically shown a strong correlation with long-term portfolio performance.

It's important to recognize that valuations should not be viewed as market timing instruments for making all-or-nothing investment decisions. Rather, they are an important input into building appropriate portfolios. Understanding current valuation levels can help identify opportunities and set expectations in all phases of the market cycle.

Corporate earnings have grown steadily

“Focus on the future productivity of the asset you are considering. If you don't feel comfortable making a rough estimate of the asset's future earnings, just forget it and move on.” – Warren Buffett, 2013 Berkshire Hathaway annual letter

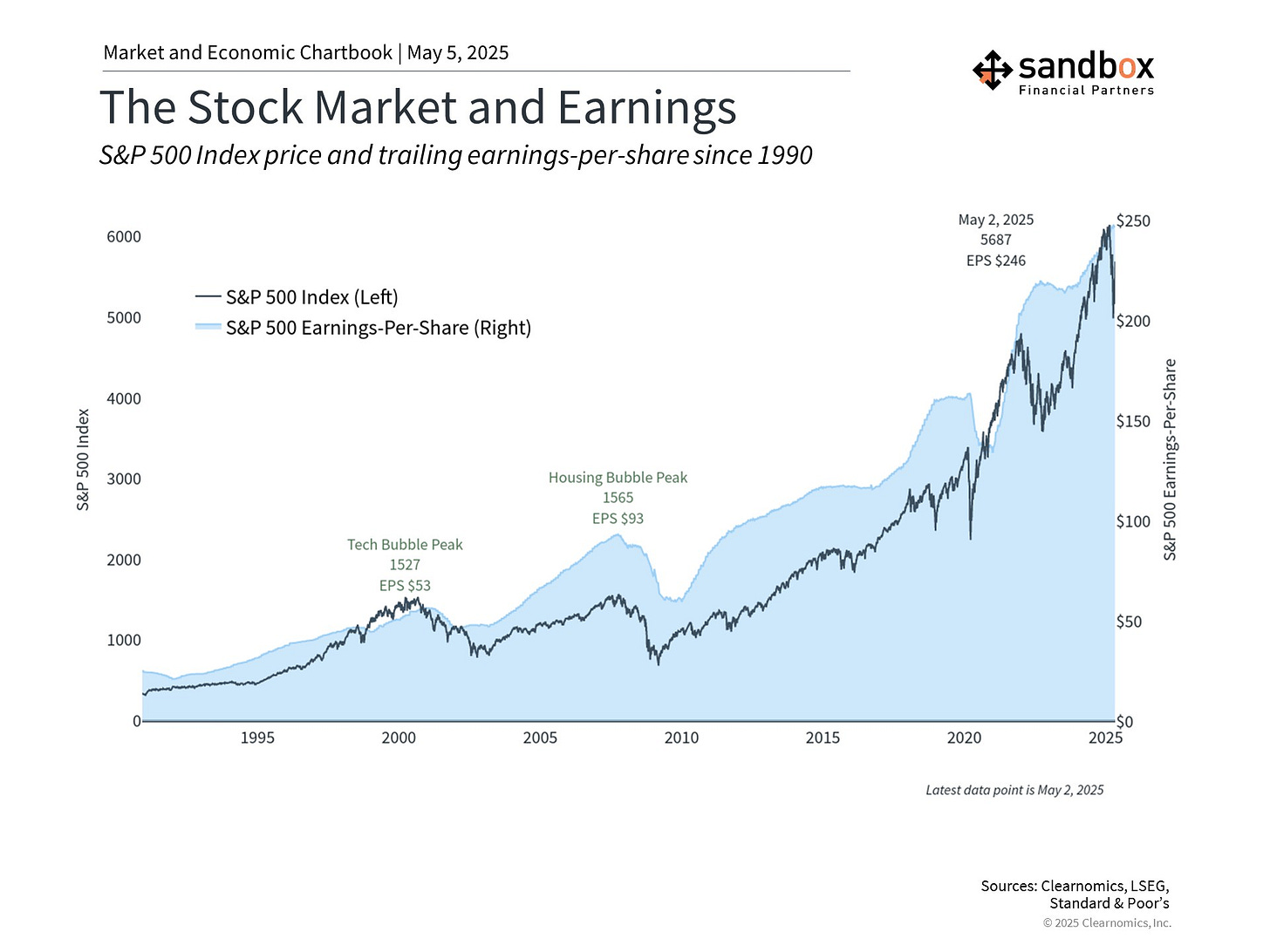

In addition to more attractive prices, another important reason valuations have improved is the steady growth of corporate earnings.

With more than 75% of S&P 500 companies having reported first-quarter results, earnings have grown an impressive 12.8%, according to FactSet. This significantly exceeds the 7.2% growth rate expected at the beginning of earnings season.

Beyond the numbers, earnings calls have provided valuable insights into how companies are navigating the current environment. Two few key themes have emerged.

First, many companies have adopted a "wait-and-see" approach to the tariff situation. Given limited visibility, some have suspended guidance, while others have incorporated preliminary tariff estimates into their forecasts.

Second, despite near-term uncertainty, plans to make capital investments remain strong, particularly in technology sectors. Major technology companies have maintained or increased their capital expenditure plans for 2025, especially in areas related to artificial intelligence infrastructure. This suggests that management teams have continued confidence in long-term growth opportunities.

Dividends continue to support portfolios

“It’s not good news when any company cuts its dividend dramatically” – Warren Buffett, 2023 Berkshire Hathaway annual meeting

Even though Berkshire Hathaway has rarely paid dividends, Buffett has benefited from the dividend-generating ability of his portfolio companies.

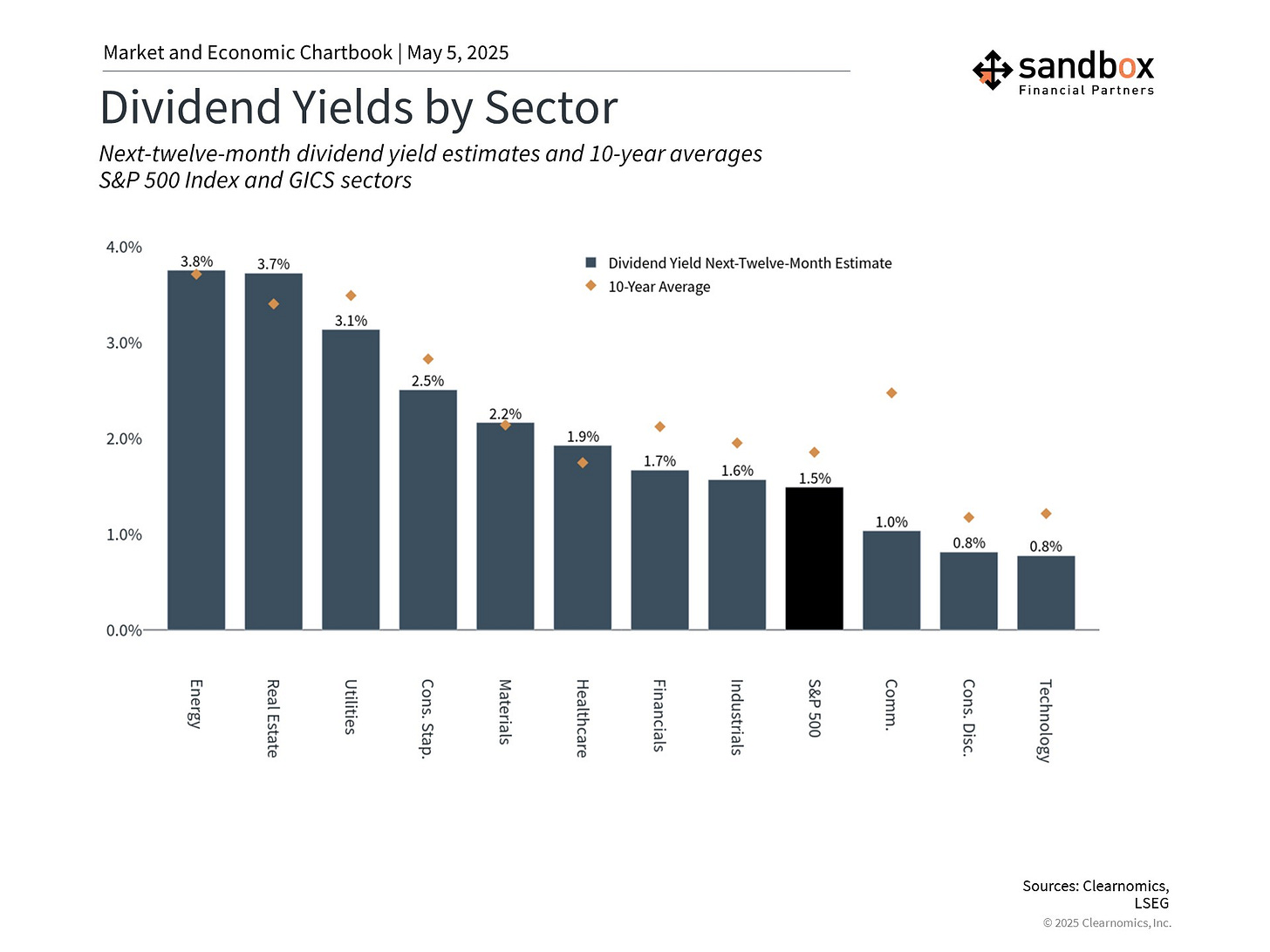

His mentor, Benjamin Graham, focused heavily on the importance of dividends as an indicator of corporate financial health. While investors typically focus on stock prices, dividends have historically been a meaningful contributor to long-run returns.

Despite ongoing market uncertainty, dividends have continued their upward trajectory, adding to stock market total return for investors.

The chart below shows that many sectors have healthy dividend yields, many of which are still around their 10-year averages.

For investors who rely on their portfolios for income, dividends are an important source of yield.

Companies are typically reluctant to cut dividends except during periods of financial stress. Dividends are also an important signal of the underlying financial health of corporations. This is because dividend payments are not just accounting figures but require actual cash outflows. The continued growth in dividends suggests confidence among corporate leaders despite near-term uncertainties.

As Warren Buffett’s career shows, the best way to navigate uncertainty is with a patient, long-term approach to investing.

This remains relevant in today’s market environment, especially as fundamentals for long-term investors remain healthy.

Sources: Clearnomics, FactSet

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures at the Sandbox Financial Partners website:

Warren Buffett is a legendary investor!