Let's talk about volatility

The Sandbox Daily (8.13.2025)

Welcome, Sandbox friends.

Today’s Daily discusses:

no fear left in this market

Let’s dig in.

Blake

Markets in review

EQUITIES: Russell 2000 +1.98% | Dow +1.04% | S&P 500 +0.32% | Nasdaq 100 +0.04%

FIXED INCOME: Barclays Agg Bond +0.36% | High Yield +0.26% | 2yr UST 3.683% | 10yr UST 4.238%

COMMODITIES: Brent Crude -0.56% to $65.75/barrel. Gold +0.29% to $3,408.8/oz.

BITCOIN: +2.67% to $122,733

US DOLLAR INDEX: -0.27% to 97.834

CBOE TOTAL PUT/CALL RATIO: 0.95

VIX: -1.63% to 14.49

Quote of the day

“Your life is nothing but a reflection of how you spend your time.”

- Proverb

No fear left in this market

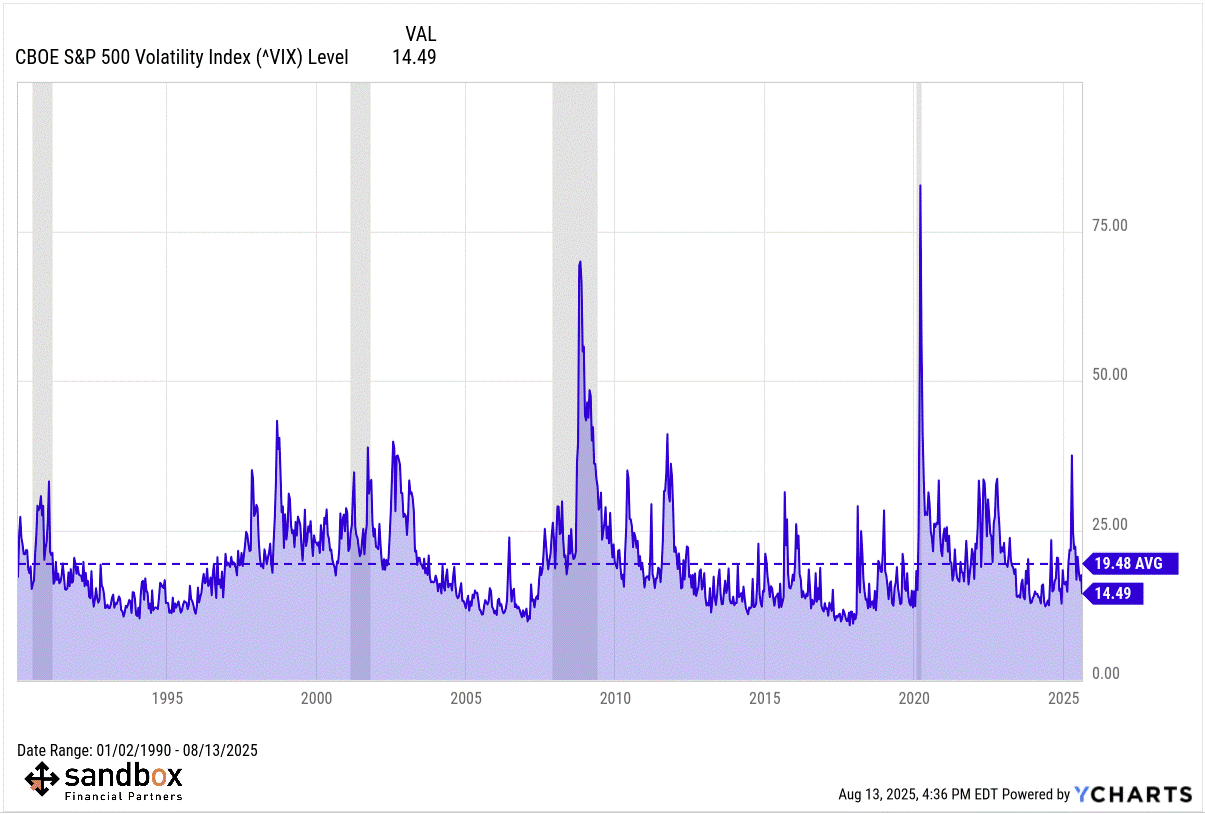

Is anyone old enough to remember the early April VIX spike when we hit the highest levels of volatility since the covid-19 pandemic?

If you suffer from amnesia, then you’re in luck because you have the market commentators – such as those on CNBC and Bloomberg – who obsess over the VIX, or the so-called “Fear Gauge,” especially during times of market declines.

Today?

The stampede of bulls raging off the April lows have flattened the VIX to its lowest level of the year, closing today at 14.49.

The CBOE Volatility Index (VIX) is the annualized implied volatility of 30-day at-the-money options on the S&P 500.

In plain English, it is a market-based measure trying to assess the future movement of U.S. large cap stocks over the next month.

As a helpful rule-of-thumb, a 16 VIX implies a one-day move in the S&P 500 of roughly +/-1%. A 30-ish VIX implies a one-day move of +/-2%.

Another VIX heuristic is applying standard deviations of movement around the modern average of 20 VIX to identify attractive entry points to add risk (ie buy equities).

At 28 VIX, or one standard deviation above average, buying equities is usually in your best interest. This is a key level for identifying sharp downdrafts and subsequent bottoms.

At 36 VIX, or two standard deviations above the mean, you lean heavily into adding risk. At three (44 VIX) and four (52 VIX) standard deviations, you plug your nose and back up the truck into stocks.

But, you can’t wait for an approaching hurricane to buy insurance. You need to purchase that when the weather is calm and the skies are clear.

The same applies to the stock market. Buying insurance when the market is falling is more costly than when conditions are calm. Waiting for the VIX to rise to higher levels is too late.

So, if you are uncomfortable with current valuations, or the administration and its policies, or any other identifiable tail risk, buying insurance when volatility has pancaked is an item that should be rising to the top of your shopping list.

Sources: Mike Zaccardi, YCharts

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Or you can leave your investments alone and since you have been fully invested for years and no cash of consequence stand there and do nothing.

No need for options unless you do have $1 million plus and a killer algorithm to make a few hundred thousand on a very ripe and liquid mistake pwned by others.