Long-term uptrends 📈 remain intact, plus exaggerated concerns 🤫 over U.S. consumer and strong appetite 💪 for credit

The Sandbox Daily (8.20.2024)

Welcome, Sandbox friends.

The S&P 500 snapped an eight-day winning streak as the market rebound rally hit the pause button, activist investor Carl Icahn was ordered by the SEC to pay $2M to settle charges alleging Icahn failed to timely disclose various personal loans he secured by using Icahn Enterprises stock as collateral, and investors ready themselves for the Federal Reserve’s annual Jackson Hole Economic Symposium.

Today’s Daily discusses:

long-term uptrends remain intact

concerns over U.S. consumer appear exaggerated

High Yield investors are rosier than most

Let’s dig in.

Markets in review

EQUITIES: Dow -0.15% | S&P 500 -0.20% | Nasdaq 100 -0.24% | Russell 2000 -1.17%

FIXED INCOME: Barclays Agg Bond +0.30% | High Yield -0.09% | 2yr UST 3.992% | 10yr UST 3.809%

COMMODITIES: Brent Crude -0.66% to $77.15/barrel. Gold +0.52% to $2,554.6/oz.

BITCOIN: +0.54% to $59,351

US DOLLAR INDEX: -0.51% to 101.367

CBOE EQUITY PUT/CALL RATIO: 0.47

VIX: +8.40% to 15.88

Quote of the day

“Markets trend only about 15% of the time; the rest of the time they move sideways.”

- Paul Tudor Jones

Long-term uptrends remain intact

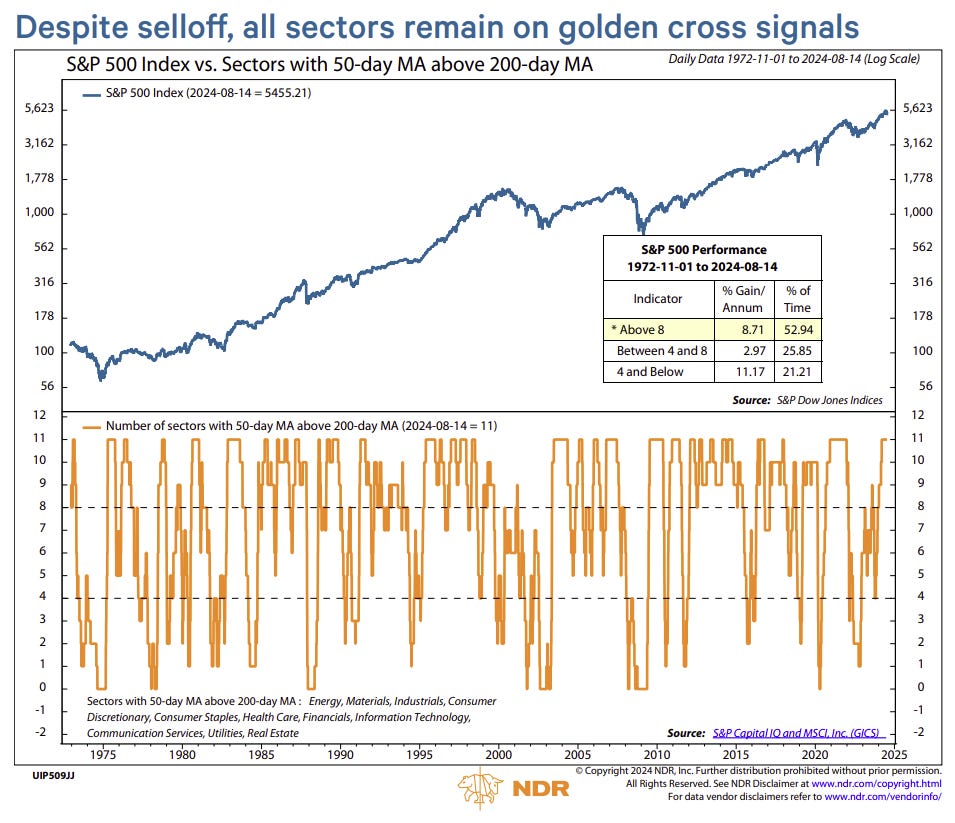

Despite the historic VIX blowout and stocks getting the hammer earlier this month, all sectors across the S&P 500 remain on golden cross signals, where near-term trends (50-dma) sit above their long-term trends (200-dma). Interpretation: breadth readings held up quite well during the corrective phase several weeks ago.

A declining number of sector golden cross signals would suggest a higher risk for a more severe correction.

The ball remains in the bull’s court while long-term uptrends for all sector remain positive on an absolute basis.

As you can see in the table hovering over the top pane in the graphic above, markets find themselves in this general situation (8 or more sectors registering golden crosses) roughly half the time, generating an +8.71% annualized gain in this environment. Not bad.

Source: Ned Davis Research

Concerns over U.S. consumer appear exaggerated

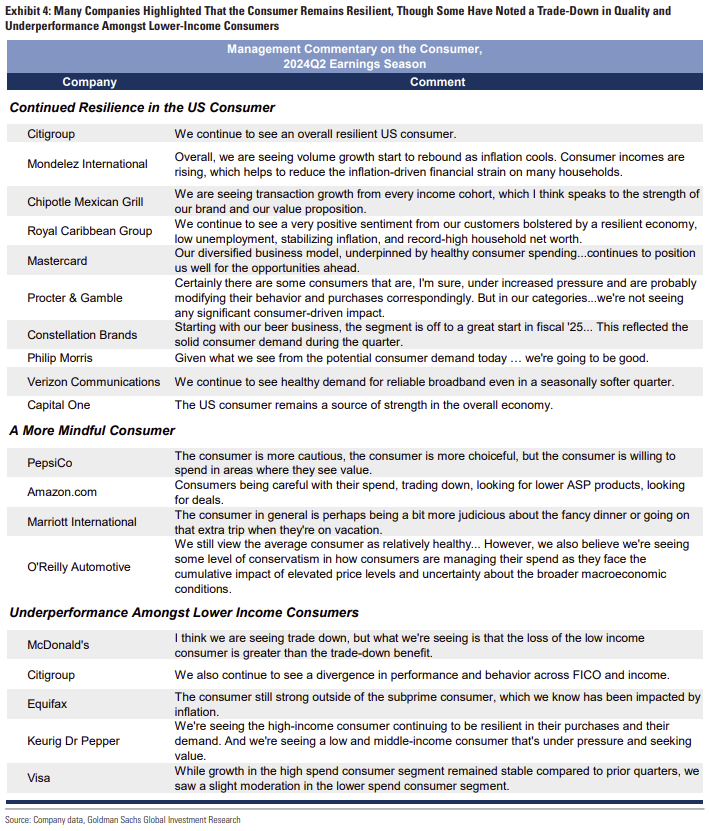

One prominent narrative this earnings season was the fear over a sharp deterioration in the health of the U.S. consumer. Those concerns were soothed somewhat by last week’s strong Retail Sales report and quarterly earnings results for Walmart. Below we look at two main sources of investor concern.

One focal point has been the breadth of downward revisions to sales expectations at consumer-facing companies and the slowdown in realized sales growth.

However, equity returns have historically been more sensitive to changes in the growth rate of sales, not just the absolute level itself. And yet, the growth rate of sales remains healthy, and the rebound in real income growth to a solid pace should help to stabilize real spending growth around current levels.

The second source of concern has been a view that sentiment around the health of the consumer in company commentary has turned more negative, especially around lower-income consumers.

Similar to previous quarters, a review of earnings transcripts shows that several companies have noted that consumers of their products remain under pressure from the macroeconomic environment and that this pressure has led to weaker sales. But that experience is not universal, however, as other companies continue to see resilient consumer spending.

It should also be noted that sentiment around the consumer actually improved sequentially this earnings season and reached its highest level since 2022, suggesting that investor fears appear to rest on overweighting the more negative anecdotes from this earnings season.

Source: Goldman Sachs Global Investment Research

High Yield investors are rosier than most

One of the biggest pillars in the markets today remains the strong appetite for credit.

Yields on U.S. corporate junk bonds are touching their lowest levels in more than two years.

Despite ongoing recession concerns, corporate bond spreads – which tend to widen before and during recessions – are sending no such signal. While the inverted yield curve has all but guaranteed a recession for the last two years, High Yield credit – aka junk bonds – are not pricing in much of one.

Speculative-grade corporate defaults have remained low due to strong refinancing and repricing activity, resilient corporate earnings, and robust consumer spending.

Essentially, weaker companies have more options to fix their balance sheets and survive when yields are at these low levels.

It is difficult to dial up any recession odds with High Yield bonds continuing to new highs.

Source: Lisa Abramowicz

That’s all for today.

Blake

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Great summary