Looking for juice🥤? Just add leverage💉!

The Sandbox Daily (8.14.2025)

Welcome, Sandbox friends.

TSD is off tomorrow for the BMW Championship at Caves Valley and will return to your inbox on Monday, August 18. Happy early Friday!

Today’s Daily discusses:

the growing demand for leveraged solutions

Let’s dig in.

Blake

Markets in review

EQUITIES: S&P 500 +0.03% | Dow -0.02% | Nasdaq 100 -0.07% | Russell 2000 -1.24%

FIXED INCOME: Barclays Agg Bond -0.28% | High Yield -0.26% | 2yr UST 3.735% | 10yr UST 4.287%

COMMODITIES: Brent Crude +1.87% to $66.86/barrel. Gold -0.76% to $3,382.5/oz.

BITCOIN: -3.69% to $118,258

US DOLLAR INDEX: +0.36% to 98.197

CBOE TOTAL PUT/CALL RATIO: 0.77

VIX: +2.35% to 14.83

Quote of the day

“We all end up in the same dirt. The only difference is what we planted before we got there.”

- Glenda Palomeque

Want more return? Just add leverage!

The 2025 stock market rally has some everyday investors looking to ratchet up the risk.

Leveraged trading activity is skyrocketing as thrill-seeking investors aren’t satisfied with just ordinary daily returns.

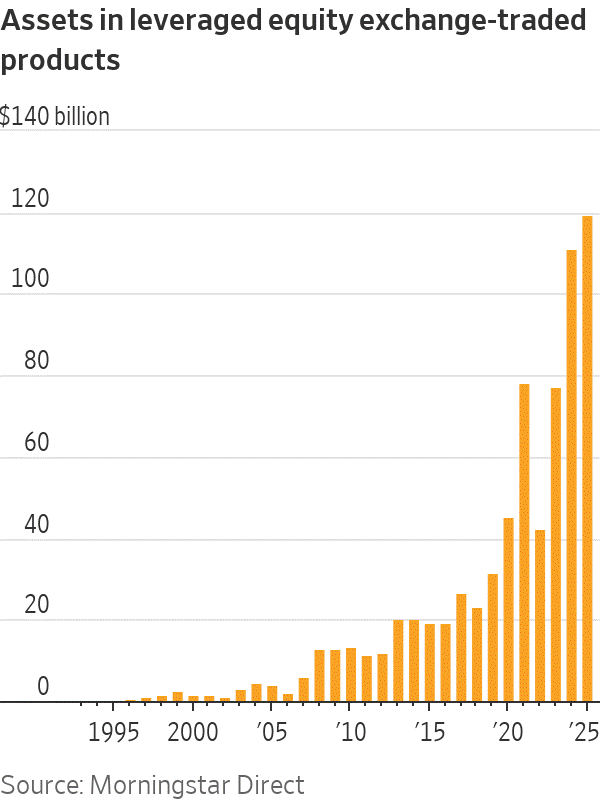

Assets under management (AUM) for leveraged exchange-traded products (ETPs) hit a record $119 billion in July. By comparison, the 2021 peak before the 2022 bear market was ~$78 billion.

Over the last 3 years, assets in ETPs have tripled.

Some is new organic money flow, the rest are new product launches. More than 100 leveraged products have launched in the United States this year, surpassing the previous record of 73 posted in 2024.

The asset managers that offer single-stock funds say they are meant to be used as short-term trading vehicles and aren’t appropriate for investors who don’t plan to actively manage their portfolios.

The funds produce their promised result daily but leverage is reset daily, meaning that compounding effects can lead to very different returns than an investor might expect over the long term.

While the ecosystem of leveraged products deserves a home, investors must understand its higher costs, performance drags over longer time frames, and downside risks should momentum move in the opposite direction.

Source: Gunjan Banerji

That’s all for today.

Blake

Questions about your financial goals or future?

Connect with a Sandbox financial advisor – our team is here to support you every step of the way!

Welcome to The Sandbox Daily, a daily curation of relevant research at the intersection of markets, economics, and lifestyle. We are committed to delivering high-quality and timely content to help investors make sense of capital markets.

Blake Millard is the Director of Investments at Sandbox Financial Partners, a Registered Investment Advisor. All opinions expressed here are solely his opinion and do not express or reflect the opinion of Sandbox Financial Partners. This Substack channel is for informational purposes only and should not be construed as investment advice. The information and opinions provided within should not be taken as specific advice on the merits of any investment decision by the reader. Investors should conduct their own due diligence regarding the prospects of any security discussed herein based on such investors’ own review of publicly available information. Clients of Sandbox Financial Partners may maintain positions in the markets, indexes, corporations, and/or securities discussed within The Sandbox Daily. Any projections, market outlooks, or estimates stated here are forward looking statements and are inherently unreliable; they are based upon certain assumptions and should not be construed to be indicative of the actual events that will occur.

Please see additional disclosures (click here)

Please see our SEC Registered firm brochure (click here)

Please see our SEC Registered Form CRS (click here)

Strictly for short term traders